Building Working Capital Infrastructure for the World

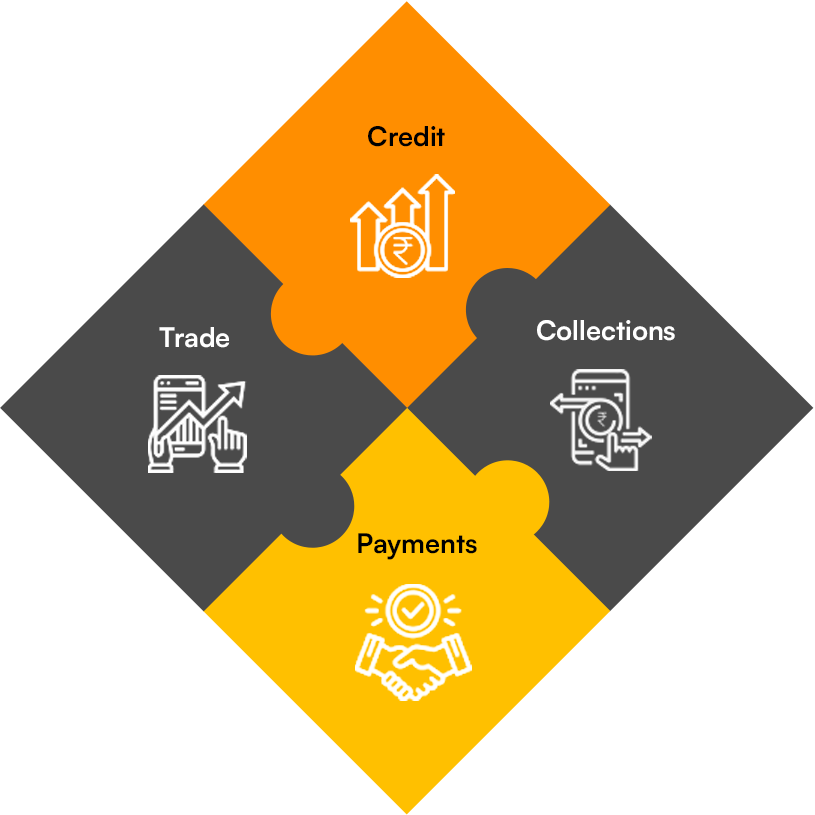

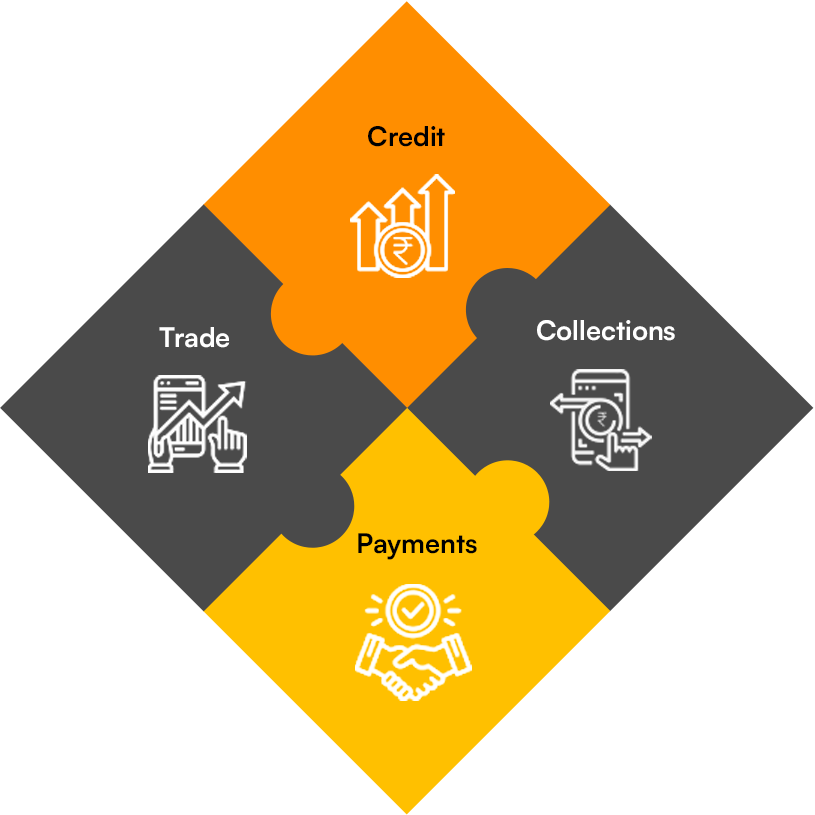

Trade

Structured B2B marketplace for trade facilitation along with supply chain financing and trade intermediation.

Credit

Access to diverse range of lending solutions such as Invoice Discounting, Purchase Order Financing, Pre-invoice Financing.

Payment

Simpler, faster, better B2B payments and automated reconciliation for high impact business processes.

We provide solutions for

Institutions

Enterprise Programs

Providing liquidity programs for enterprise eco-systems using state-of-the-art technology platforms.

Financial Institutions

API based Working Capital platform and embedded credit solutions for Financial Institutions and their Customers.

SMEs

Providing an all-in-one credit, trade and cash management platform for small businesses to manage and grow their business.

Enterprise Programs

Providing liquidity programs for enterprise eco-systems using state-of-the-art technology platforms.

Financial Institutions

API based Working Capital platform and embedded credit solutions for Financial Institutions and their Customers.

SMEs

Providing an all-in-one credit, trade and cash management platform for small businesses to manage and grow their business.

Why choose us?

Full spectrum

of working capital programs catering to payables and receivables cycles of our clients.

Multi-funder

Flexible product structuring

capabilities with off-balance sheet opportunities.

Digital trade finance

with automated transaction documentation and integration with all leading ERPs.

Deep trade finance expertise

in designing built-to-suit working capital financing programs customized to each client.

World-class technology platform

to provide scalability, intuitive UX, robust data security and advanced data analytics.

Seasoned in-house relationship team

to deploy strategies to drive recurring participation by beneficiaries.

Our team

Nirav Choksi

Co-Founder and CEO

Ram Kewalramani

Co-Founder and MD

Ashutosh Taparia

MD & CRO, Corporate Coverage

Satyam Agrawal

MD, International Business

Manu Prakash

MD and Head – Partnerships & FI Coverage

Debashree Lad

Chief People Officer and Head of Corp. Com

Kapil Kapoor

Chief Product & Technology Officer

Ranjit Singh

Executive Vice President & Head of Credit

Ketan Mehta

Chief Financial Officer

Gaurav Dugar

EVP & General Counsel

Our client testimonials

Prior to our introduction to CredAble, we were never doing any bill discounting. This throttled out growth and we hit a ceiling beyond which we couldn't scale. After having availed CredAble's services a few times, we've noticed that our payments process is super smooth and suppliers trust us far more than they did before.

Subhashish Sahoo

Director, Shakti Brands.

CredAble has been instrumental in helping us meet our working capital requirements. I, for one, would definitely recommend all vendors in the textile space who are facing working capital problems to give CredAble a shot.

Akash

Founder, AV Apparels

CredAble has helped us immensely with shortening our working capital cycles. In the past two years, we have grown in terms of how we manage our finances and how we divide our resources amongst all four verticals. We were able to take advantage of several business opportunities that presented themselves during the pandemic, and it’s all thanks to the liquidity that CredAble was able to provide us with.

Apoorva Goel

Director, Panchanan International Private Limited

Latest News

& Media

The Indian Premier League (IPL) has come a long way as a multinational sporting franchise.

Most small businesses experience this hurdle, and under such circumstances, in order to sustain their

What are MSME Business Loans? Micro, Small, and Medium Enterprises (MSMEs) play a pivotal role

The technological waves of disruption have dramatically altered how financial services companies create value for

To thrive in the emerging supply chain ecosystem, it’s time we rethink the traditional value

Effective working capital management is paramount for SMEs in order to maintain their financial stability

We would love to speak with you

Lending Partners

Prior to our introduction to CredAble, we were never doing any bill discounting. This throttled out growth and we hit a ceiling beyond which we couldn't scale. After having availed CredAble's services a few times, we've noticed that our payments process is super smooth and suppliers trust us far more than they did before.

Subhashish Sahoo

Director, Shakti Brands.

CredAble has been instrumental in helping us meet our working capital requirements. I, for one, would definitely recommend all vendors in the textile space who are facing working capital problems to give CredAble a shot.

Akash

Founder, AV Apparels

CredAble has helped us immensely with shortening our working capital cycles. In the past two years, we have grown in terms of how we manage our finances and how we divide our resources amongst all four verticals. We were able to take advantage of several business opportunities that presented themselves during the pandemic, and it’s all thanks to the liquidity that CredAble was able to provide us with.

Apoorva Goel

Director, Panchanan International Private Limited