A Netflix Original: Free Cash Flow Lessons From Netflix

Back in 1997, Netflix started out as an upstart DVD-by-mail online service. The OTT giant has come a long way from being just a small DVD company to a media juggernaut that is being actively streamed in homes across the globe, even as you read this.

Having redefined how the world watches television, Netflix’s growth in capitalization has been astounding, to say the least. Over the past two decades, Netflix has gone from having television shows available as a pilot, to releasing one episode at a time and finally to having the entire series up for binge-watching.

As a corporate creator of streaming content, not only is Netflix generating a great deal of wealth, but the company also won the bragging rights for Emmys by landing a record of 44 wins in a single year at the 73rd Emmy Awards in 2021 (all thanks to series like ’The Crown’ and ‘The Queen’s Gambit’).

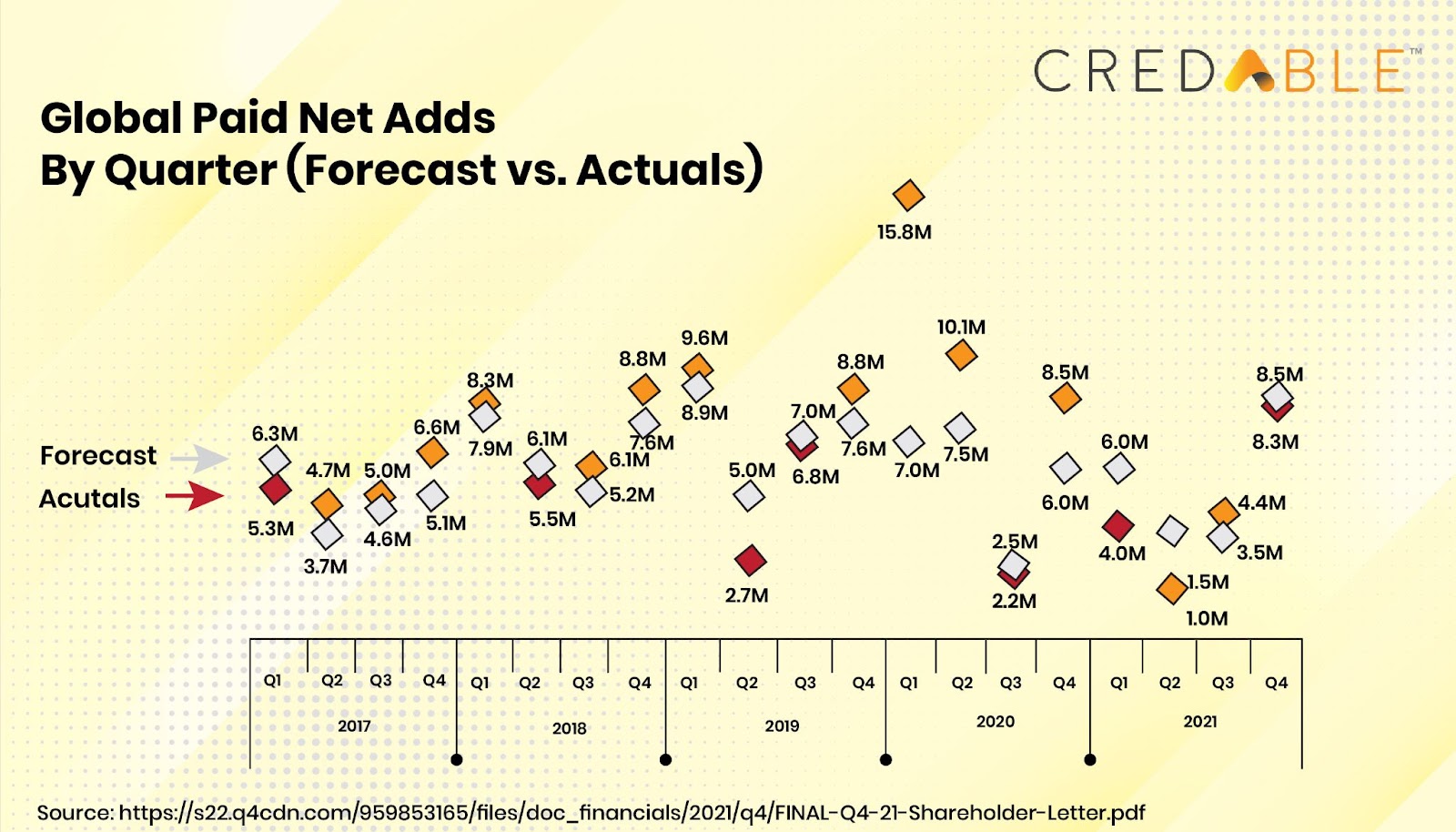

Recently, there have been speculations of a downward trend in growth, owing to the company’s shares plummeting by 20% just hours after the release of its fourth-quarter earnings report, which showcased dipping subscriber figures. What went wrong? With just 2.5 million new subscribers in the last quarter, Netflix was far away from reaching Wall Street’s expectation of 6.9 million.

That said, the company has offered us many lessons right from entrepreneurship wins, a powerful work culture to working capital modelling, especially, in terms of free cash flow.

Let’s understand what free cash flow is and take a closer look at the free cash flow that Netflix has been generating in recent times.

Breaking down free cash flow

Free cash flow is a key metric that tells us the amount of actual cash that is available with a company at any given point in time. Free cash flow boils down to the total cash that is left over after all the working capital and operational payments have been made.

One of the best indicators of a company’s ability to generate cash, free cash flow can be accounted for annually or quarterly.

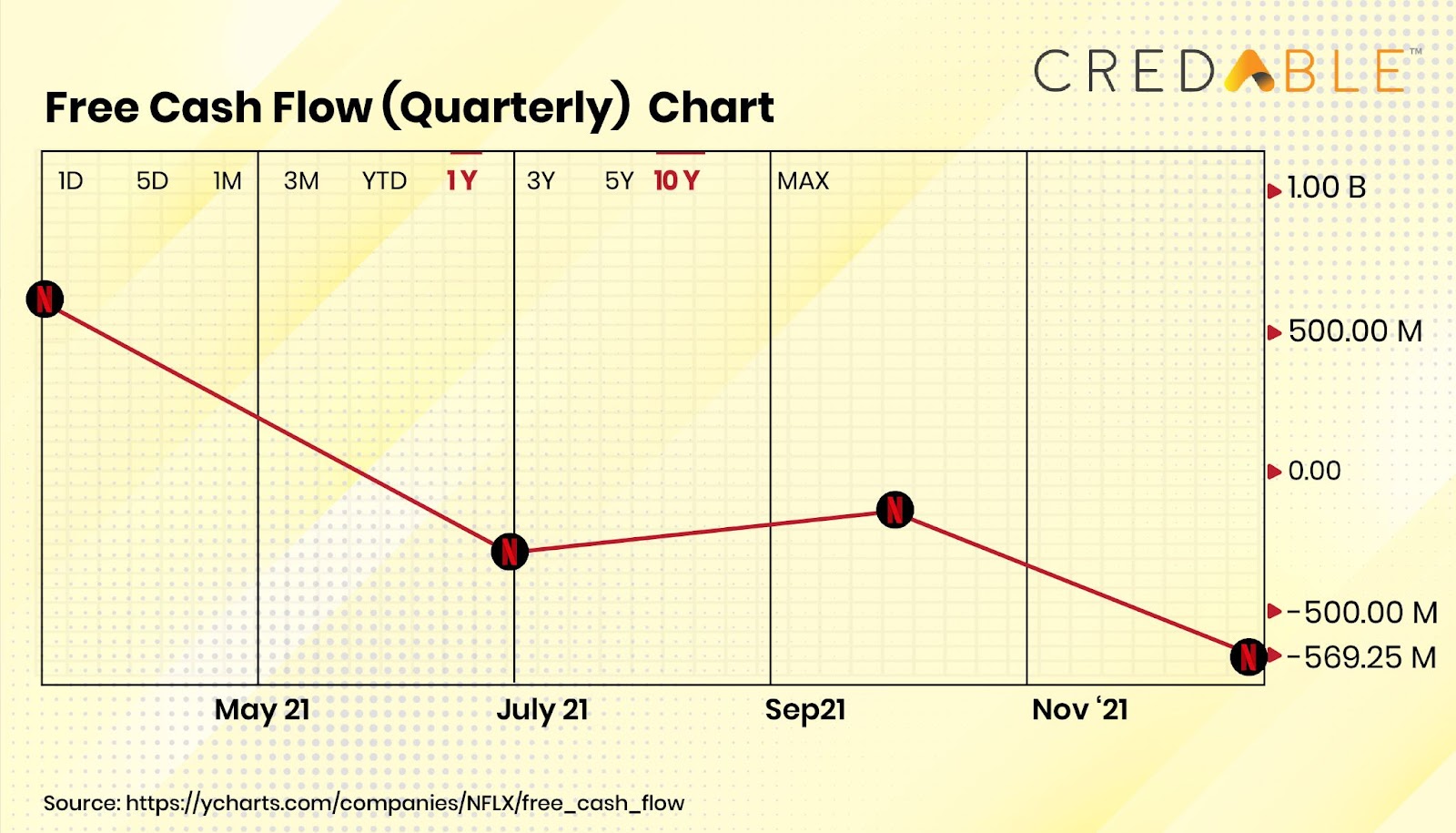

Here’s a snapshot of Netflix’s quarterly free cash flow as of December 31, 2021.

How Netflix reached ‘positive’ free cash flow

Not too long ago, Netflix’s negative cash flows were the talk of the town among investors. What was the reason for deteriorating cash flows? How did Netflix manage to get back on the charts by generating free cash flow? Let’s find out.

All hail original content

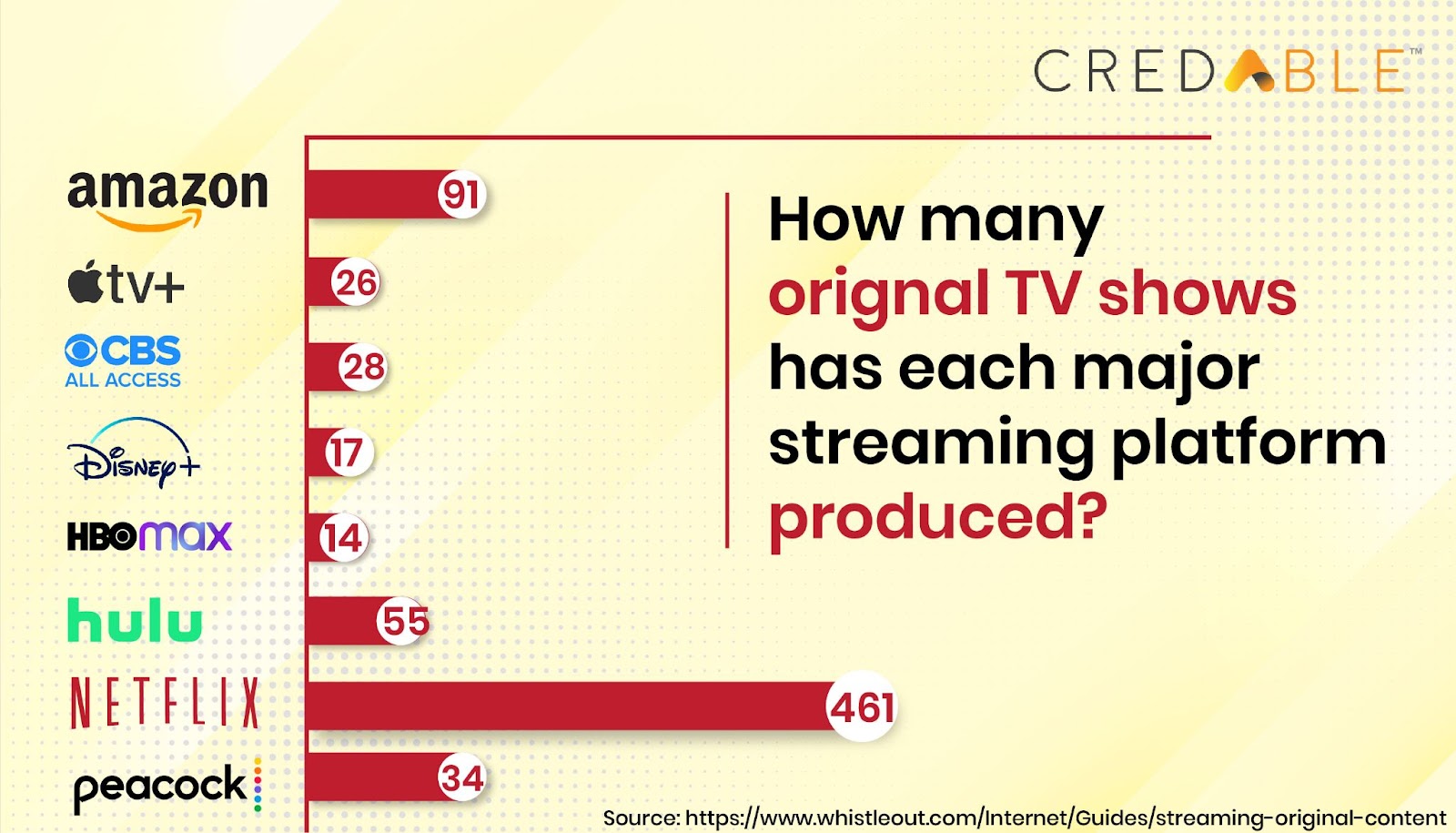

What we need to understand here is that Netflix and other streaming giants are selling content on their platforms. The only way they can remain competitive and stay in the game is if they ensure that their audience is consistently consuming their content. It’s a battle of content consumption and not so much of the viewer’s screen time.

TV series have an upper hand here compared to big-ticket movies. That said, let’s bear in mind that rolling out series after series will not do the job. It’s not all about the amount of content —producing binge-worthy series where episodes end with a gripping cliffhanger, is the way to go about it. Doing this, will retain the viewer’s attention and keep them returning to the platform.

All this is to say that, for these streaming giants to reign supreme — it all comes down to producing unique content. Netflix is winning the battle by producing a significant amount of original content.

Going from cash burn to cash flow positive

Netflix was clear that it need to focus on pushing out more content. With the company doubling down on content investments, the cash flow started to deteriorate and a cash burn was inevitable. What transpired was that the free cash flows dropped down from -$840 million back in 2015 to -$3.3 billion in 2019.

But come 2020, the tables turned — Netflix went from burning billions of dollars to raking in by the billions, generating about $1.9 billion cash.

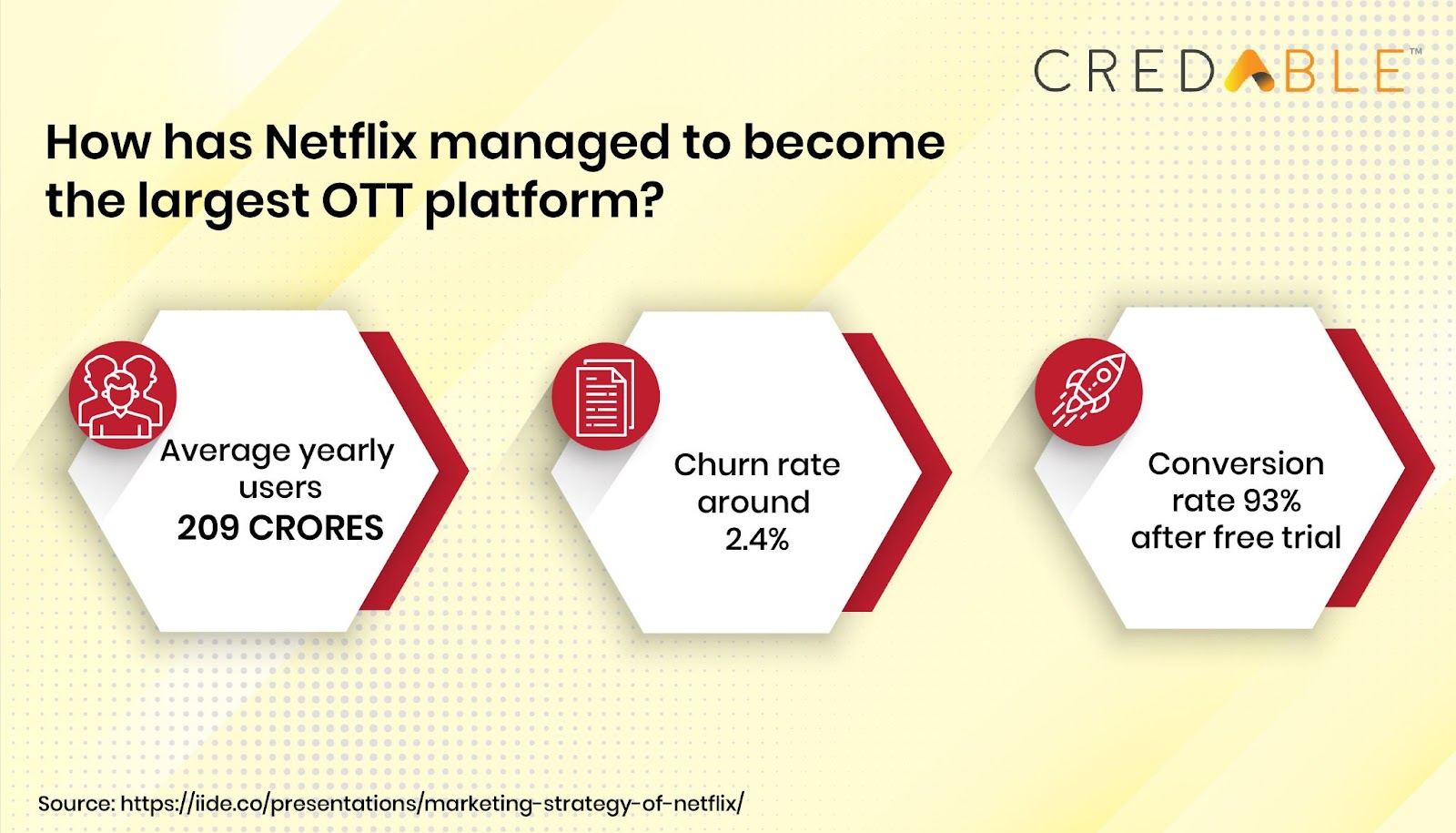

Amidst fierce streaming competition, Netflix pulled in the masses and took up its subscriber count with some stellar content. For the first time in nearly nine years, the company turned cash-flow positive. Another reason was the lesser investments in content — given how the pandemic slowed down production like never before.

That’s not all, with the lockdowns confining people to their homes — the regularity of content consumption went up across homes worldwide. What followed was that the subscriber growth started to pick up. As per the recent Q4 earnings report, Nextflix’s revenues have also started to soar with a 16% year-on-year growth.

The company’s revenue is expected to grow at a higher rate in the coming years with the majority of the income expected from the international markets and not the U.S. market.

With the revenue and gross margin increasing steadily, the operating expenses have declined.

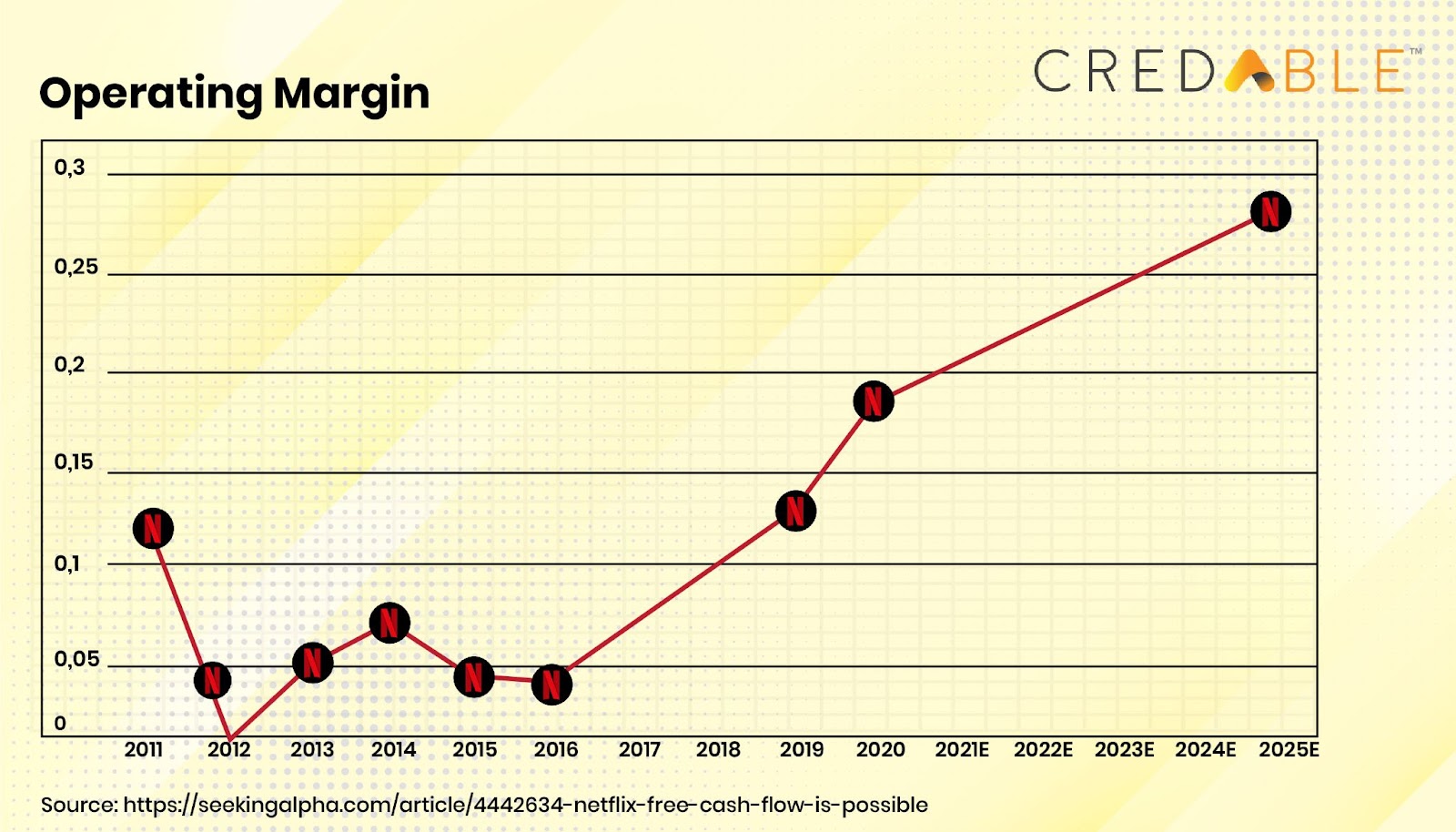

If Netflix can keep up this momentum in the coming years and maintain a growth rate above 15%, the operating margins will have an upward trend as shown here.

In their earnings report, Netflix pointed out that acquisition rates have not reached pre-COVID levels. But they are hopeful for a successful Q1 in 2022, with big releases like ‘The Adam Project’ slated for release in March 2022. The company is looking towards a paid net adds of 2.5m versus 4.0m in Q1 2021.

Scaling up, the Netflix way

Though stiff competition has raised concerns about Netflix’s profitability and ability to generate free cash flow — Netflix has managed to stay ahead by consistently proving that they are a class apart when it comes to working capital allocation. For a company whose capital expenditures are rising ahead of its revenues (courtesy of the content investments), Netflix has demonstrated immense staying power by attracting capital even during slumps.

Netflix’s competitive advantage is the significant amount of original content that they release. In the coming months, it would be interesting to see how they continue to generate free cash flow by smartly allocating their content investments.

Think Working Capital, Think CredAble!