Indian Credit Line – An Extended Support for Sri Lanka’s Economic Meltdown.

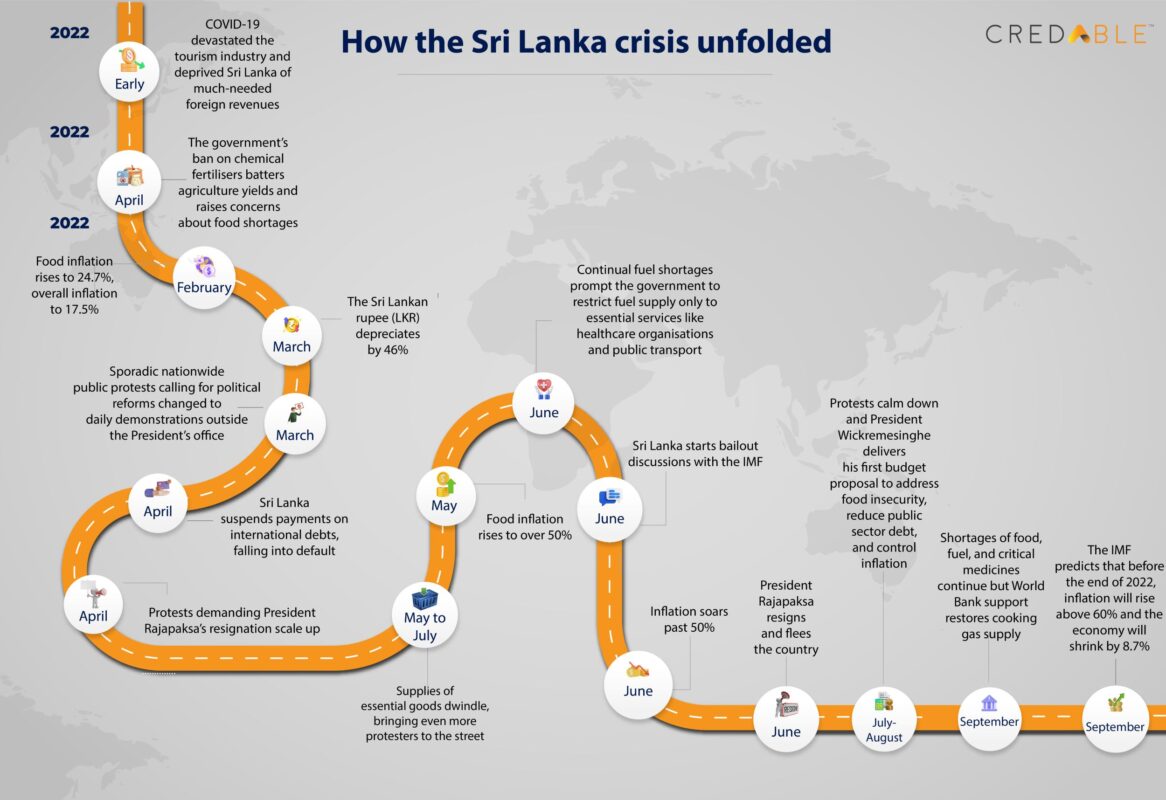

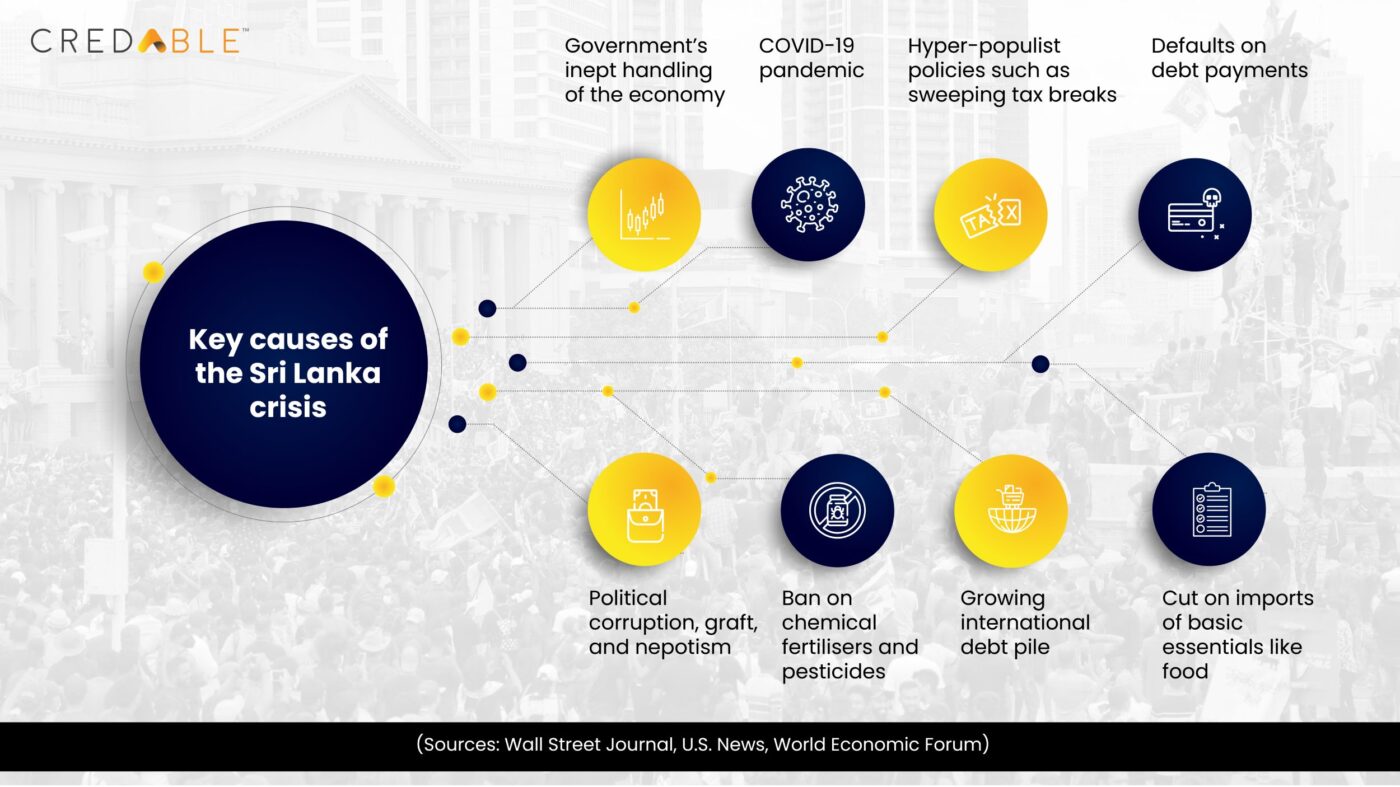

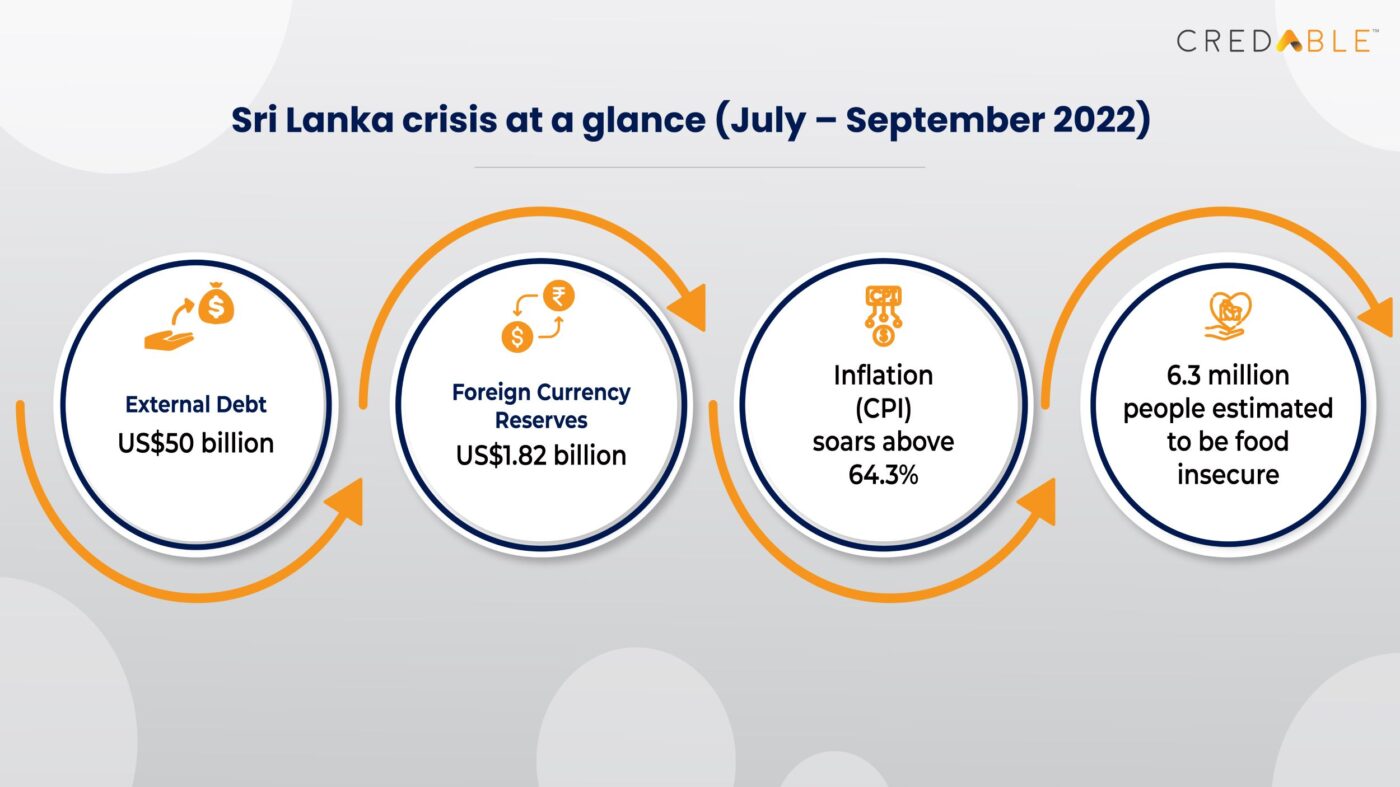

In April 2022, we started noticing increased reports about Sri Lanka’s exacerbating economic crisis. The country’s ballooning foreign debt, spiralling inflation, and severe shortages of essential goods became the talk of newsrooms all over the world.

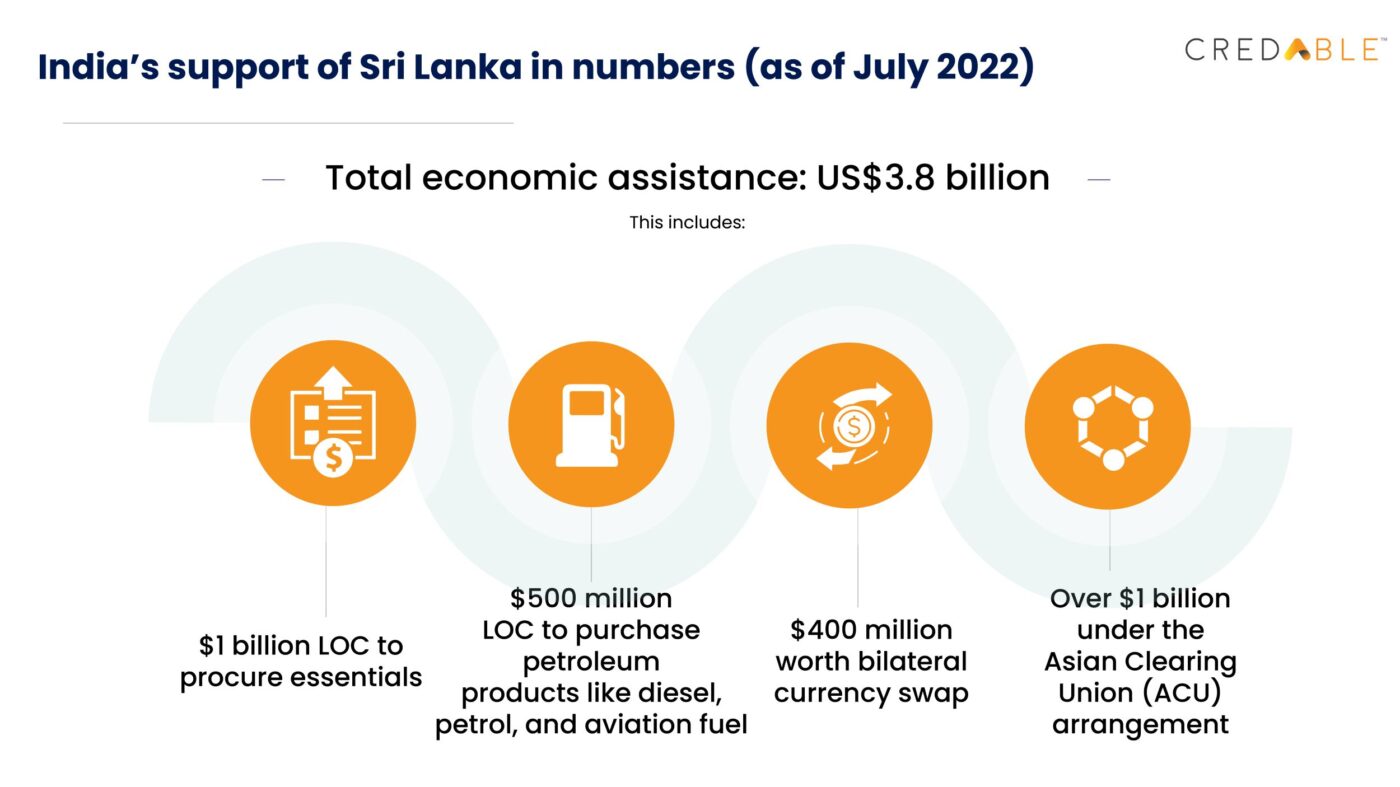

To stave off a complete collapse, the new government reached a preliminary agreement with the International Monetary Fund (IMF) for a $2.9 billion loan. Sri Lanka also turned to other countries for support. It’s the nearest neighbour India is one of the few that has provided tangible and generous help. Let’s look at India’s role in helping Sri Lanka overcome this unprecedented challenge.

The impact of the crisis on Sri Lanka’s supply chain

Sri Lanka’s economic crisis has impacted the supply chains of virtually all its industries. For instance, fuel shortages are interrupting operations at clothing factories. After all, machines cannot work without fuel and people cannot get to work when petrol pumps are running on empty.

Many of these factories supply foreign clothing brands, so their inability to meet production targets is seriously crippling their revenues. If that’s not bad enough, garments are Sri Lanka’s second-largest forex earner, so interrupted production means the country doesn’t earn the foreign exchange it desperately needs. And its producers may end up losing business to manufacturers in other countries.

Other industries’ supply chains are also suffering. Case in point: tourism. Previously popular tourist destinations are now characterized by empty rooms and silent lobbies, and ongoing power cuts and food shortages are depleting hopes of recovery for the sector.

The economic crisis has also impacted Sri Lanka’s maritime activity and slowed down international trade operations. Container transport service providers have drastically reduced their operations and many international shipping lines are skipping Sri Lankan ports. All of this has led to container congestion, further exacerbating shortages of everything from food and beverages to baby powder and cooking gas within the country.

In March, Sri Lanka limited the import of hundreds of non-essential items. Import restrictions on other items were already in place since March 2020, thanks to COVID and the ongoing forex crunch. The idea sounds good in theory to us: import less to reduce pressure on limited forex reserves. But it doesn’t quite work in practice. In anything, importing less creates more market distortions because many of these items are crucial raw materials for other industries, affecting their production capacities, adding to scarcities, and aggravating unemployment – thus making a bad situation even worse.

So, is more imports the answer? It could be – if Sri Lanka can pay for them. To pay for imports, Sri Lanka needs foreign reserves, which as we have already seen, it seriously lacks, further hampering supply chains and exacerbating shortages and inflation.

So how is Sri Lanka dealing with its financial and supply chain situation? By approaching its all-weather friend – India.

India’s helping hand to Sri Lanka

By July, Sri Lanka had approached numerous countries for monetary support, including Japan, China, and even at-war Russia. But some of its allies took advantage of Sri Lanka’s situation to engage in “debt trap diplomacy”. China has also refused Sri Lanka’s appeal to reschedule its massive debt burden of $5 billion.

But it was only India that quickly responded to help debt-ridden, forex-starved Sri Lanka. In 2022 alone, India has committed over US$3 billion in lines of credit (LOCs) and currency swaps to Sri Lanka. To put this figure into perspective, there are 195 countries in the world. Ten have GDPs over 1 trillion. And only one stepped up to really help Sri Lanka at this critical juncture. And that is India. India has also helped to secure the island country’s food, health, and energy security by exporting essential items like food, medicines, and fuel.

How the crisis is affecting Indian businesses

We often see how crises usually create both winners and losers. And Indian businesses in some industries have emerged as the winners of this particular crisis. For example, Sri Lanka’s production of tea – one of its top exports – has fallen sharply in 2022. This has allowed Indian tea manufacturers to boost their own exports and sales. Similarly, Indian apparel manufacturers are fulfilling export orders from Europe, the UK, Latin America, etc., because Sri Lankan manufacturers are no longer able to do so.

And yet, these industries are the outliers because, for the most part, the Sri Lankan crisis is hurting Indian businesses. This includes companies in the automotive, hospitality, FMCG, communications, manufacturing, and banking sectors. Thus, instead of benefiting them, the crisis has adversely affected their exports and foreign direct investments in Sri Lanka. Sri Lanka’s port crisis is also affecting India’s port operations. Congestions at Sri Lankan ports have affected supply chains in India. As more cargo builds up at Indian ports, Indian consumers are vulnerable to increased prices – a situation that no one wants.

The path to Sri Lanka’s recovery

To tackle ongoing shortages and supply chain problems, Sri Lanka will have to import more goods. But to do this, it desperately needs relief from the IMF, the World Bank, and friendly allies like India. But first, the country must also commit to large-scale, long-term economic restructuring, particularly of its bilateral debt. This may be easier said than done, but it is no less vital.

The government should also cut spending. One way: is to reduce the 1.5 million-strong workforce of state employees. Top leaders should also prioritize calming the understandably angry public and amending the constitution to reduce the President’s executive powers.

Currently, Sri Lanka’s political and economic future remains uncertain. However, it can overcome the calamity by tackling the underlying problems that led to it, notably corruption, deep-rooted ethnonationalism, and government mismanagement of forex reserves. We expect that allies like India will continue to help the beleaguered island nation. But ultimately, Sri Lanka will have to develop its own fortitude to get past these challenges.

Practically speaking, Sri Lankan businesses will need substantial financial support in the form of working capital and supply chain finance to pick up the pieces of the crisis. Here’s where innovative FinTechs like CredAble will play a crucial role by bringing in cutting-edge technology, analytics expertise, trade financing, and win-win partnerships with capital providers.

Think Working Capital, Think CredAble!