Reliance Petroleum & its Working Capital Dynamics in a Nutshell

Incorporated in 2005, Reliance Petroleum Limited is a well-known company in India’s oil and gas space. The firm specialises in oil and energy, and operates under the umbrella of Reliance Industries Limited (RIL) which was founded by Dhirubhai Ambani in 1966 and is now led by his elder son, Mukesh Ambani.

In this article, we explore how Reliance Petroleum manages its working capital to enhance business performance and effectively deal with ongoing challenges and market volatilities.

Working capital management in the oil and gas sector: challenges and consequences

WC is vital for companies in the oil and gas sector because it helps support day-to-day operations. These firms generally try to keep WC to a minimum because increases can negatively impact their cashflows.

But even so, WCM does not happen properly or consistently throughout the sector. One reason is that price volatilities and supply chain disruptions draw attention away from WCM. Price increases and supply chain disruptions are highly visible and have serious consequences not only for the industry, but also for national economies. As a result, firms prioritise the optimisation of operational metrics like throughput, day rates, and pricing, instead of focusing on WC aspects like inventory or payables.

When companies don’t focus on cashflow management and process optimisation, they struggle to manage their WC. There are plenty of opportunities in this industry to improve inventory management, demand forecasting, and supply chain planning, and to optimise the processes for billing, collection, and contractor sourcing and management.

For one, they don’t get the visibility and transparency needed effectively to manage assets and cash flows. They also struggle to effectively manage their various – and critical – moving parts, including:

- Accounting

- Close processes

- Contract to cash

- Procure to pay

- Project planning and execution

In addition, firms with poor WC management are unable to capture business and operational efficiencies, improve processes, or lower costs. A lack of focus on WCM also extends their cash-to-cash (C2C) cycles, affecting their ability to repay their current liabilities. Extended C2C cycles also exacerbate cash shortages and create liquidity risk that can prevent the company from delivering value to stakeholders and even endanger its very survival.

Working capital management at Reliance Petroleum in CY’22/FY’23

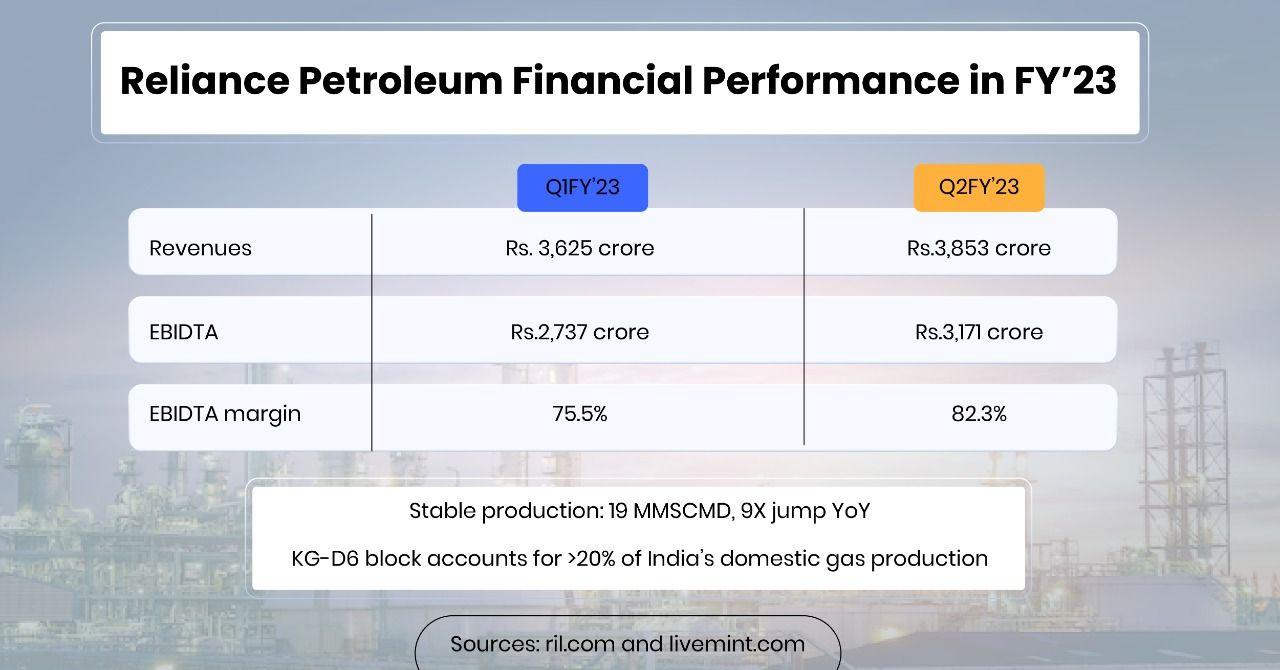

As of 2022, RIL is ranked #104 on the Fortune Global 500 list and #54 on the Forbes Global 2000 list. Reliance Petroleum is performing well in FY’22-23. Its revenue has increased from Rs. 3,625 crore in Q1FY’23 to Rs.3,853 crore in Q2FY’23. Its EBIDTA has also increased from Rs.2,737 crore to Rs.3,171 crore.

In addition, the company’s:

- Revenues are up by 134% YoY

- EBIDTA is up 3X YoY

- EBIDTA margin has increased from 75.5% to 82.3% between Q1FY’23 and Q2FY’23

- Production is stable at 19 MMSCMD, RIL’s KG-D6 block accounts for >20% of India’s domestic gas production

At the 45th AGM in August 2022, RIL Chairman Mukesh Ambani said that the company’s KG-D6 block in the Krishna-Godavari basin of the Bay of Bengal will soon contribute ~30% of India’s gas production. He also congratulated Reliance Petroleum for a “spectacular turnaround” where YoY production jumped 9X and revenues crossed $1 billion.

While these figures indicate a robust balance sheet and show that Reliance Petroleum is well-placed for growth, it must be noted that its parent’s (RIL) gross debt has increased between Q1 and Q2 FY’23. RIL attributes this increase to its higher working capital (WC), which in 2022 stands at INR 7,250 million, compared to INR (507,310) in the previous FY.

In CY’2022 the company has been sanctioned WC limits in excess of Rs. 5 crore from banks on the basis of the security of its current assets. Reliance Petroleum constantly manages and optimises its WC to ensure that operations run smoothly and there are no liquidity challenges to contend with. The next two sections explore the factors affecting Reliance Petroleum’s WC and the WCM strategies used by the company.

Factors affecting Reliance Petroleum’s working capital

Reliance Petroleum’s long-term debt to capital ratio has fallen from 8.07 to 7.25 from the HY ending 30th September ‘21 to the HY ended 30th September 2022. This decrease indicates that its financial leverage has improved and its associated investment risk and risk of insolvency have fallen.

According to a recent (October 2022) announcement by RIL, the increase in WC for the HY ended 30th September 2022 is due to “significant dislocation in energy markets”. These dislocations have caused the prices of crude oil, gasoline, and diesel to hit new multi-year highs and created panic in energy markets around the world. For example, crude prices have varied between $85-$125/bbl while LNG prices have varied between $35-$71/mmbtu.

In addition, macroeconomic and geopolitical uncertainties increased the volatility in global energy markets. One reason for the uncertainty is the continued Russia-Ukraine crisis. Even so, Russian supply remained fairly resilient during the year. Plus, the increased output from Saudi Arabia helped to ease crude prices through Q2FY’23 despite firm demand. At the same time, these volatile conditions affected

Reliance Petroleum’s WC and net debt situation throughout the year.

Reliance Petroleum avails of foreign currency liabilities to fund its WC requirements and capital investments. For this reason, it faces some foreign exchange (FX) risk. In particular, rupee depreciation increases the landed cost of the firm’s foreign currency liabilities. For the HY ending 30th September ’22, the rupee depreciation % has been 3.7%, which while not very high does increase Reliance Petroleum’s loan servicing costs.

Working capital management, volatility management, and liquidity management strategies at Reliance Petroleum

Reliance Petroleum closely monitors its operating cycle to optimise its WC structure and ensure smooth business financing. It also proactively reviews and calibrates (or recalibrates) trade financing solutions to deliver robust WCM.

The company finances its WC requirements by opportunistically using short-term borrowings through Commercial Paper (CP). Given India’s recent low-interest environment, this strategy enables the company to maintain a low cost of its liabilities. It also maintains a diversified investment portfolio with an appropriate mix of steady accrual, tax-efficient and higher-duration assets with lower reinvestment risk, and fixed income instruments invested in sovereign bonds, AAA papers and bank fixed deposits. Such diversification helps the firm to manage cash and cash equivalents and to minimise concentration risk. In addition, risk managers monitor and manage the investment portfolio under a robust risk management framework to protect their capital, maintain enough liquidity to be available at short notice, and to increase the probability of earning optimal risk-adjusted returns.

Future direction of working capital management in the oil and gas sector

In 2020, the COVID-19 pandemic sent massive shockwaves throughout the world, including the oil and gas sector. The global economic recovery started in 2021 but slowed down in 2022 due to the Russia-Ukraine crisis. Since February, this event has caused supply chain disruptions, led to price volatilities, and dislocated global energy markets. To deal with these and other challenges and maintain operational continuity, oil and gas companies must effectively manage their working capital.

According to JP Morgan’s Working Capital Index Report 2022, there are positive signs for the cash conversion cycle in the industry, which has come down from 71.2 days in 2019 (pre-pandemic) to 69.5 days in 2021 (post-pandemic). But at the same time, firms are under increasing pressure to optimise WC due to ongoing supply chain disruptions, higher inflation, and geopolitical tensions. These uncertainties are likely to continue throughout this year and part of the next. In such a scenario, the only way oil and gas companies can continue to grow is by maintaining healthy working capital and practicing effective WCM strategies.

Optimising working capital will unlock significant value in the industry and also free up cash for strategic investments such as ESG and capital expenditures. Here’s where FinTech innovators like CredAble will play a key role. Credable’s state-of-the-art technology platform enables over $6 billion worth of working capital deals annually. All kinds of companies in India’s oil and gas space turn to Credable to access working capital and drive greater value.

Think Working Capital… Think CredAble!