Rolling Economics of Casinos and its Working Capital Dynamics

In the rolling gamut of economy, many people are obsessed with making money. A few others also enjoy playing with money. These hardy souls are the risk-takers, bettors, and gamblers who frequent casinos and often bet enormous sums on the turn of a dice or the flip of a card.

And it is this human tendency to take risks with money that casinos capitalize on. Ironically, successful casinos try not to take risks with their own money. If anything, they are very competent at managing their money and in particular, their working capital.

What is Working Capital Management for Casinos?

Working capital (WC) is the difference between a casino’s current assets like cash or accounts receivables, and its current liabilities like debts and accounts payable. For casino businesses, working capital management is crucial to maintain their short-term financial health and operational efficiency, and successfully clear their debts within a year.

Casinos’ WC strength is often assessed in terms of their working capital ratio. Also known as the current ratio or liquidity ratio, it indicates a casino’s total current assets to total current liabilities. A positive current ratio indicates that the casino has more assets and fewer liabilities, meaning it can pay off its short-term liabilities and has enough working capital for day-to-day operations. Casinos with a continually negative ratio are at a very high risk of financial insolvency, forced asset liquidation, and ultimately, bankruptcy.

Poor WC management impairs casinos’ ability to fund their current operations and make investments for future growth. They could also face serious liquidity challenges and struggle to repay their debt. Furthermore, they may have to incur additional debt to pay their bills and other liabilities such as salaries and accounts payables. In the worse cases, an inability to properly manage and maintain working capital could result in casino bankruptcy and permanent closures.

India’s Casino State: Goa

Goa is one of only two Indian states (the other is Sikkim) that allows legal gambling and betting, subject to certain legal and financial regulations. It boasts some 15 legal casinos, some of which are onshore (land-based) and located within the premises of large hotels and resorts. Other popular casinos are offshore, that is, located on ships in the Mandovi river close to the capital Panaji.

The Constitution of India grants each state the power to enact its own laws for gambling and betting. At the same time, the IT Act, 2000 regulates online gambling and gives the Government the power to block foreign betting games and sites. The nationwide Public Gambling Act,1867 does not contain any laws regarding online gambling or betting, which creates financing and money laundering problems in the country. To address the issue, the RBI is authorised under the Payment and Settlement Systems Act, 2007 to regulate electronic payment mechanisms and restrict online gambling in India.

Goa regulates casinos under the Goa, Daman and Diu Public Gambling Act, 1976 (Goa Act) which allows five-star hotels to offer casino games under a licensing regime and offshore vessels to offer table games after procuring a state-approved license. This law has helped to create a thriving gambling industry in Goa that drives the state’s tourism industry, supports its economic development, and creates more jobs. Let’s explore this next.

Economic impact of Goa’s casinos

Since they first emerged about three decades ago, Panaji’s river casinos have received several six-month or one-year extensions from the state government to continue operating, despite ongoing opposition from locals. The government is willing to override people’s complaints because casinos bring in big money for Goa.

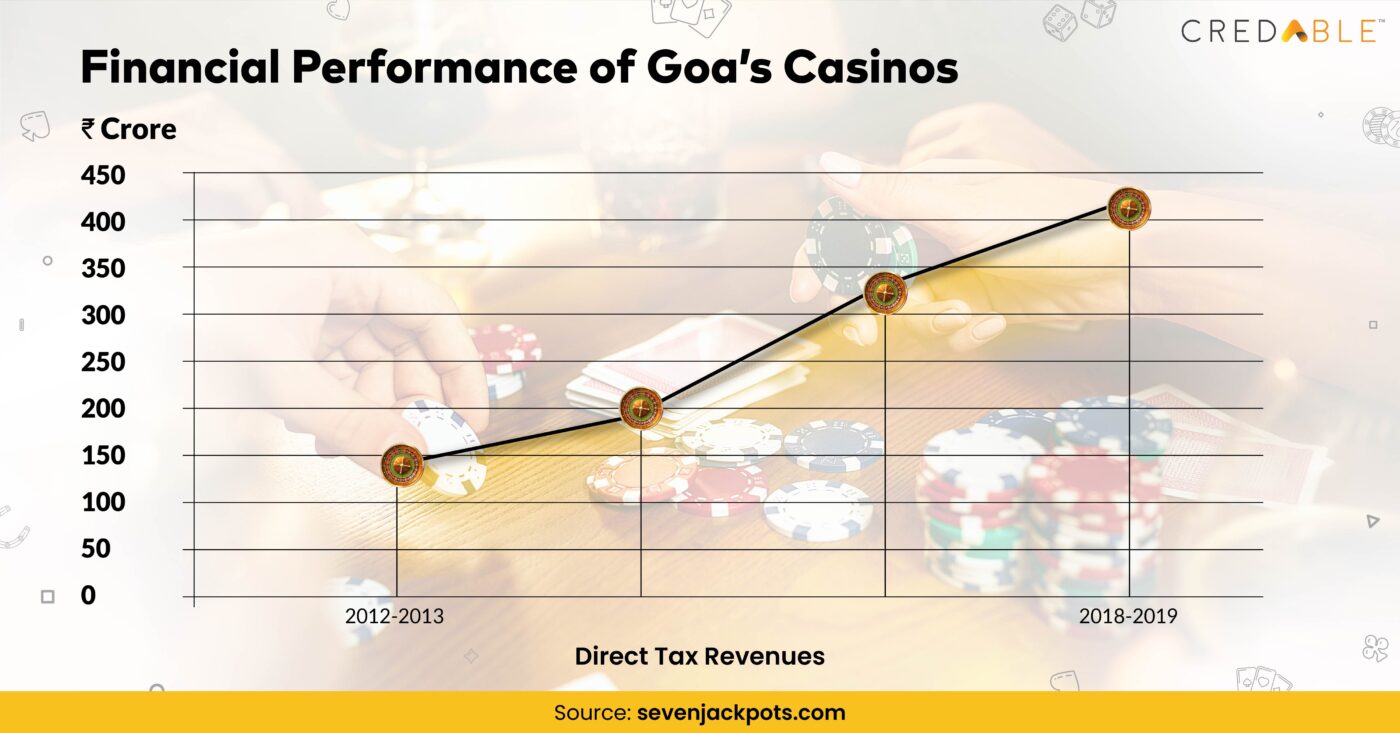

Tourism accounts for 30% of Goa’s GDP, and a big part of tourism revenue comes from casinos. Goa’s offshore and onshore casinos attract three million tourists annually and 15,000 gamblers daily during peak season. In FY 2012-2013, Goan casinos brought in about Rs. 135.45 crores in direct taxes, entry fees, port charges, and liquor licences. The state also earned annual revenues of Rs 6.5 crores and Rs 2.5 crores from each offshore and onshore casino, respectively. By FY 2019, Goa’s direct tax revenue earnings from casinos had increased to Rs. 411 crores.

In early 2021, some reports suggested that casinos brought in Rs. 320 crores annually in license fees alone. The onshore casinos also pay entry fees and local taxes to the city corporation, plus Rs. 25 lakhs to the excise department. The government also earns taxes to the tune of Rs. 1,000 crores from allied businesses, such as restaurants and hotels.

Like many other leisure businesses, Goa’s casinos were also affected by COVID-19 and the imposition of government measures to curb the spread of the virus. These measures have affected their footfall and their revenues, but most of them have managed to survive. One reason is that they have effectively managed their working capital. Delta Corp is a good example.

Financial performance at Goa’s Delta Corp casinos

In 2022, the global casino market is expected to be worth US$129.2 billion. By 2026, it will reach US$153.2 billion, registering a CAGR of 3.7%. In India, Delta Corp Limited has managed to weather the COVID storm a little better than many other casino businesses because they have managed their working capital and kept their debt low.

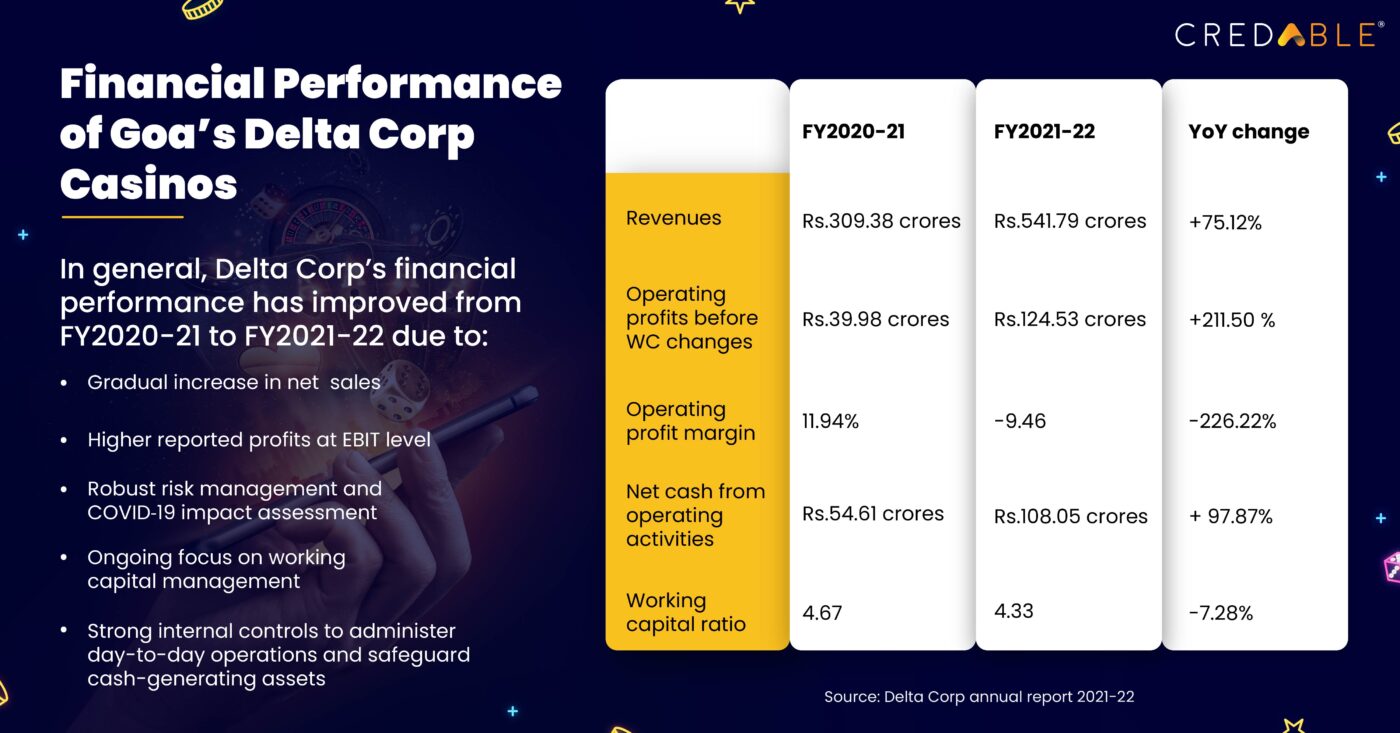

Delta Corp Limited is the only listed company engaged in India’s gaming industry. Like other businesses in the industry, Delta Corp’s Goa casinos were also shut down for several months in 2020 and 2021. They restarted operations in September 2021 with 50% capacity and then scaled up to 100% capacity in March 2022. The capacity pickup – which mostly stems from the lifting of restrictions and the progressive reopening of India’s economy – explains why the company’s revenues increased from its casino gaming business. From Rs.309.38 crores in FY2020-21, revenues increased by 75.12% YoY to Rs.541.79 crores in FY2021-22.

In the same period, the company’s operating profit before WC changes increased from Rs.39.98 crores to Rs.124.53 crores. It also generated more net cash from operating activities: from Rs.54.61 crores to Rs.108.05 crores. All these numbers indicate that the company’s financial position has improved.

Working capital management at Delta Corp casinos

At the end of FY2021-22, Delta Corp was debt-free. In addition, the company also held current assets (cash and cash equivalents) of Rs. 96.19 crores. Their current ratio (WC ratio) has fallen slightly from 4.67 in FY2020-21 to 4.33 to in FY2021-22. This indicates that the company’s ability to service its short-term debt has fallen to a small extent.

That said, the fall doesn’t appear to be a cause for concern, considering that it remains much higher than the average current ratio for the global casino industry. Furthermore, the industry average has fallen from 1.72 in Q3 CY2021 to 1.04 in Q3 CY2022. In comparison, Delta Corp is enjoying robust WC health. Additionally, Delta Corp themselves believe that they have adequate liquidity to honour their liabilities and obligations.

To ensure that there is no material or adverse impact on their WC, the company’s management will continue to monitor changes to their COVID-19 impact assessment. In addition, they will implement strategies to mitigate several risks that may impact their WC and day-to-day operations, such as:

- Carefully administer the statutory compliance management system to ensure compliance with all laws and prevent costly fines

- Add new content and services to improve customer engagement, deliver better user experiences, and mitigate peer risk

- Follow stringent evaluation standards to mitigate acquisition-related risk and ensure that there is minimal negative impact on the company’s cashflows, operating performance, and financial position

- Mitigate profit and cashflow risk by reducing geographic concentration and expand its principal gaming portfolio

- Ensure pay cost visibility and minimize inflation risk by entering into long-term labor contracts and implementing employee-friendly policies

To minimize the various risks to its WC and cashflow, Delta Corp has implemented multiple internal controls. These rules and procedures are in place to improve operational efficiency, safeguard business-critical assets, and ensure the optimal use of cash-generating resources.

The results of poor working capital management in casinos worldwide

Goa’s casinos like Delta Corp have managed to hold on and avoid obsolescence despite the economic challenges created by COVID-19. However, many casinos in other locations have not been as lucky. For example, several casinos in Chinese-ruled Macau earned zero revenues when the latest outbreak began in mid-2022. The industry had already seen revenues tumbling by 70% to $10.8 billion in 2021 compared with 2019. And even though there are no signs of debt repayment problems in Macau’s casinos, liquidity and cash reserves are at an all-time low for many of them. To stay afloat and support their working capital requirements, many are desperately in need of funds.

No casino owner or manager could have predicted a catastrophe like COVID or expected its wide-ranging impact on their revenues and sustainability. However, it stands to reason that if they had managed their working capital better and set aside a greater chunk of it for a rainy day, they might not have found themselves in hot water as they currently do.

Recently, Sydney’s Star Casino lost its operating license after an inquest found that it did not implement proper AML checks over vast sums of cash. The casino is also accused of frequently underpaying taxes to the tune of almost AUD 9 million (as of August 2022). This failure is also symptomatic of poor working capital management, just like the casinos in Macau, in addition to a flagrant disregard of the laws and ethics of Australia.

Casino financing: From the old to the new

All casinos need robust working capital management processes and controls to maintain liquidity and meet their debt obligations. They also need financing to continue operations. In the past, many casinos relied on bank loans to meet their financing needs. Some international banks like Wells Fargo even have separate divisions for casino financing.

In India, some casinos have turned to PE funding in the past. For example, in 2009, Daman Hospitality Pvt. Ltd raised Rs. 35 crores from a PE investor to cover part of its expected costs of Rs. 375 crores. International casinos in places like Macau frequently rely on their parent company for ongoing funding and working capital support. Some of the world’s largest casino companies are in the USA, and many are publicly-listed on the NYSE, which means their funding needs are usually met via equity.

But despite these available financing avenues, many casinos still struggle to maintain healthy working capital.

Think Working Capital… Think CredAble!