Winds of Change: What’s Shaping the Global Fintech Ecosystem?

Fintech is a buzzword that’s taken the financial world by storm. Its popularity has skyrocketed in the last decade and is expected to rise rapidly transforming the financial services industry as we now know it.

The Fintech industry has undergone considerable changes to help businesses become more customer-centric in nature, impacting countless business models be it start-ups, tech firms, or established companies all across the world.

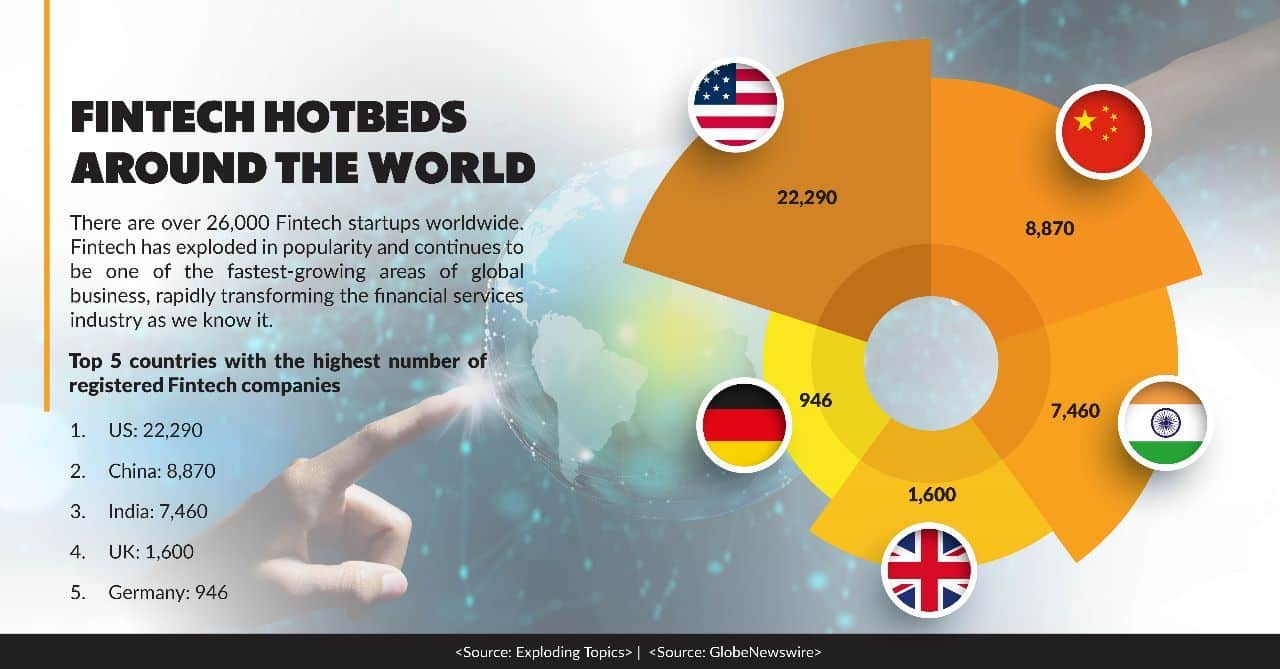

Today there are more than 26,000 Fintech start-ups worldwide. This figure has almost doubled from a modest 12,200 Fintech start-ups in 2019. These numbers go to show that Fintech is a thriving sector with exciting opportunities to explore right now. With the advent of new-age technologies, Fintech is breaking down the silos that exist—in turn, empowering customers to improve their financial lives.

Let’s take a look at the Fintech hotbeds around the world. The USA tops the list with 22,290 registered Fintech companies, followed by China with 8,870 companies. Other countries that make it to the top 5 are India, the UK, and Germany.

Investments in the Fintech sector

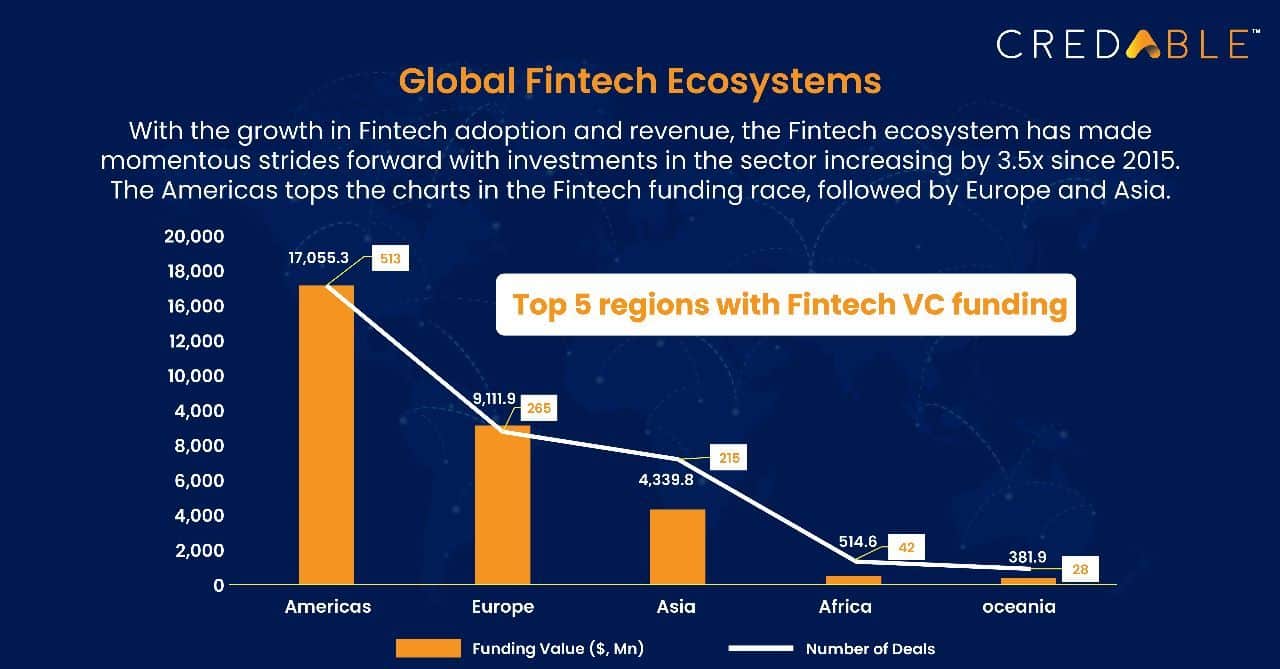

Investments in Fintech companies worldwide have increased significantly in the past decade. In 2020, the sector witnessed a brief lull with the investments dropping from $215.1 billion in the previous year to $127.7 billion. However, in 2021, the investment value rose to $226.5 billion.

The Americas topped the list to become the region receiving nearly 80% of the total investments in the sector, followed by Europe and Asia. Asia is climbing the ranks to become a hotbed for Fintech investments owing to the increased activity and interest of investors in the region.

Venture capital funding in Fintech

Attracting venture capital funding is an uphill task for a lot of Fintech firms. This is because of the concerns that venture investors raise during the due diligence process, to which they seek satisfactory answers. These include:

- The qualification of the Fintech company’s management team

- Whether there is an ample market opportunity as a result of the investment

- Whether the company’s founders are passionate enough

- The regulatory risks involved

- If the company’s financial projections are realistic or not

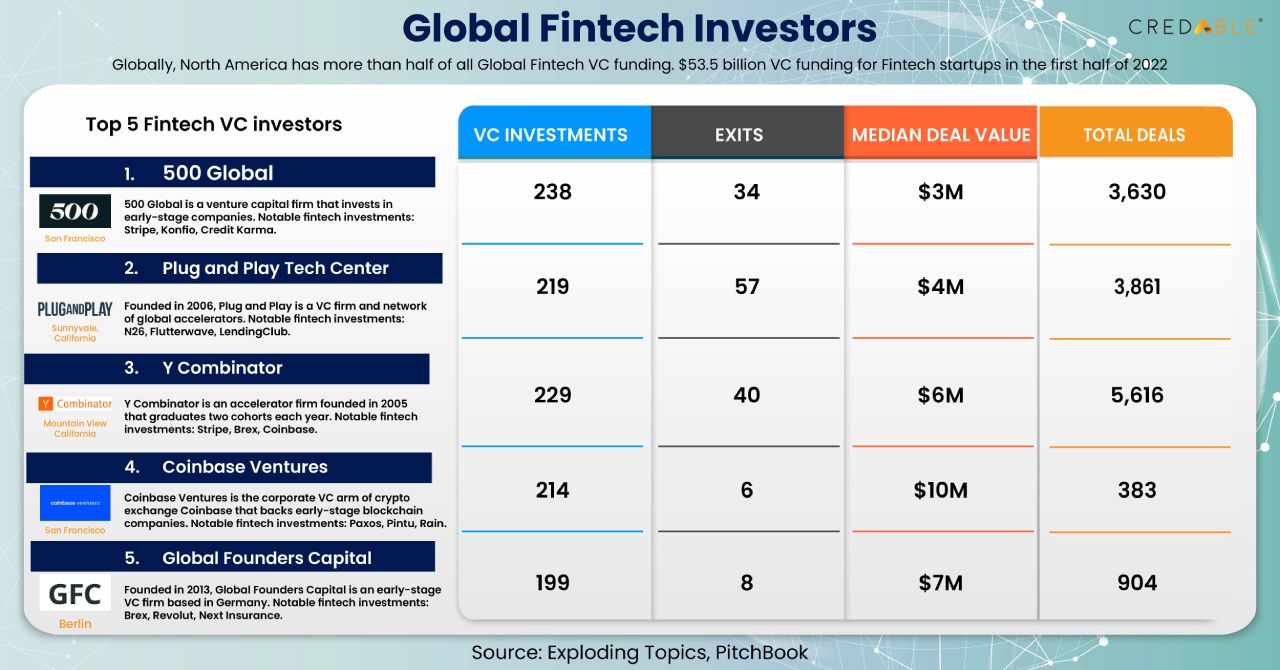

Here is a chart listing the top Fintech VC investors worldwide. They are 500 Global, Plug and Play Tech Center, Y Combinator, Coinbase Ventures, and Global Founders Capital.

What is a Fintech hub?

A Fintech hub is the center point for all the Fintech activity within a region. The infrastructure, companies, people, and how these elements connect with each other make up the Fintech ecosystem. Hubs are usually defined as cities or larger regions like Silicon Valley. The 5 emerging global Fintech hubs are Silicon Valley, London, New York City, Singapore, and Los Angeles accounting for 31% of global Fintech activity.

Here’s a look at the leading Fintech companies in the world—Visa tops the list with a valuation to the tune of half a trillion USD.

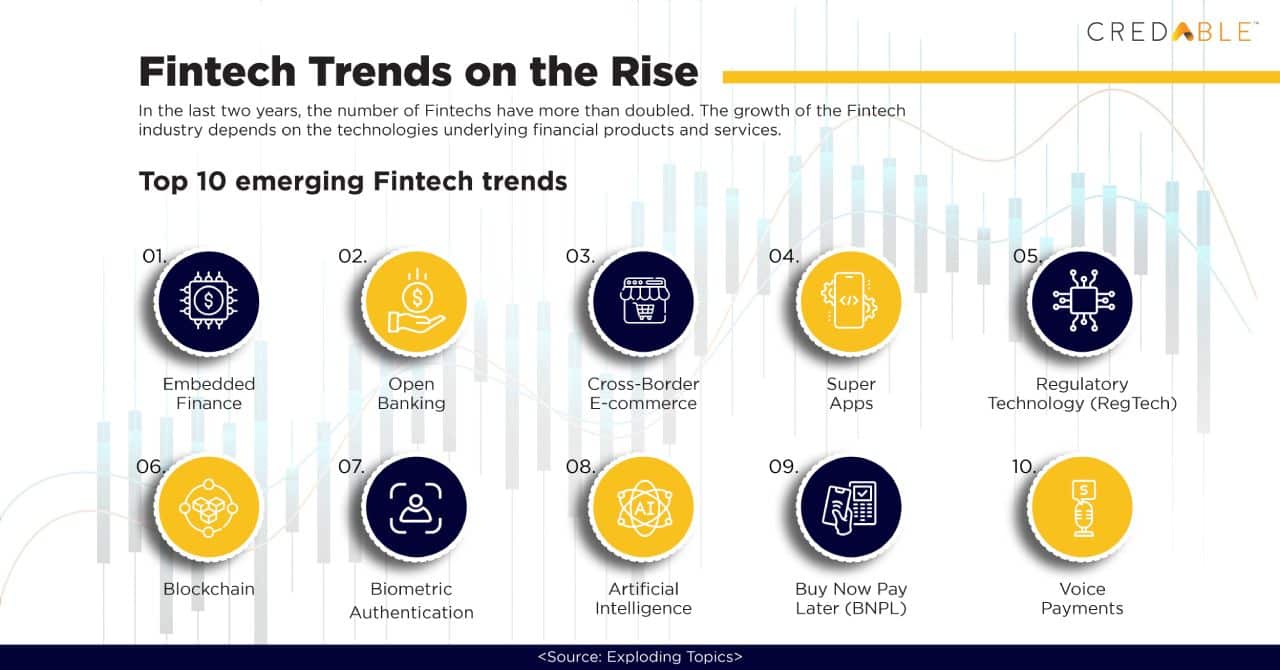

Top 10 emerging Fintech trends

The progress in the Fintech sector depends upon the technologies backing financial products and services.

Here are the top trends to watch out for:

- Embedded finance

With embedded finance in the picture, non-financial companies can offer financial products and services that are typically offered by a bank, to their customers on the platform of their choice. - Open banking

Open Banking is making headway in the financial market allowing customers to pay for products and services online conveniently and obtain loans in minutes. - Cross-border E-commerce

Global E-commerce sales are mounting, giving rise to cross-border transactions. Now more than ever there is a growing need for secure and seamless platforms that facilitate hassle-free cross-border payments. - Super apps

These are apps that aggregate multiple solutions into a unified interface allowing customers to perform most of their activities digitally such as bookings, bill payments, fund transfers, etc. CredAble’s super app, UpScale is used by over 2,00,000+ small businesses to manage their finances and drive their business growth. - Regulatory technology

Given the rise of Fintechs and taking into account the complex legislative frameworks that organizations in the financial services industry have to comply with—we now see a growth in the number of RegTech companies. - Blockchain

Blockchain is slowly but surely transforming global finance and with the underlying blockchain technology addressing the critical issues of increased speed and security in international payments, blockchain is gaining prominence in cross-border payments. - Biometric authentication

The use of biometric authentication to protect financial accounts is considered to be the best way to keep confidential information safe. - Artificial intelligence

AI-backed financial services enable customers to find answers to their problems quickly and get access to personalized financial advice after analyzing their consumer behaviour. - Buy Now Pay Later (BNPL)

This is one of the most talked about Fintech trends of our time. Fintechs today are allowing customers to split up their purchase transactions and pay for them in smaller installments with the help of sachet-sized loans. - Voice payments

Fintech companies are exploring the use of voice assistants and voice biometrics to enable users to pay for goods and services securely and with next-level ease.

Wrapping up

The Fintech industry has witnessed tremendous growth globally in recent years. In all this, India has recorded the highest Fintech adoption rate globally. Having moved from a disruptive threat to an enabling partner, it will be interesting to watch how Fintechs globally make the most of their new phase of evolution.

Think Working Capital… Think CredAble!