Building Supply Chain Resilience with Deep-Tier Financing

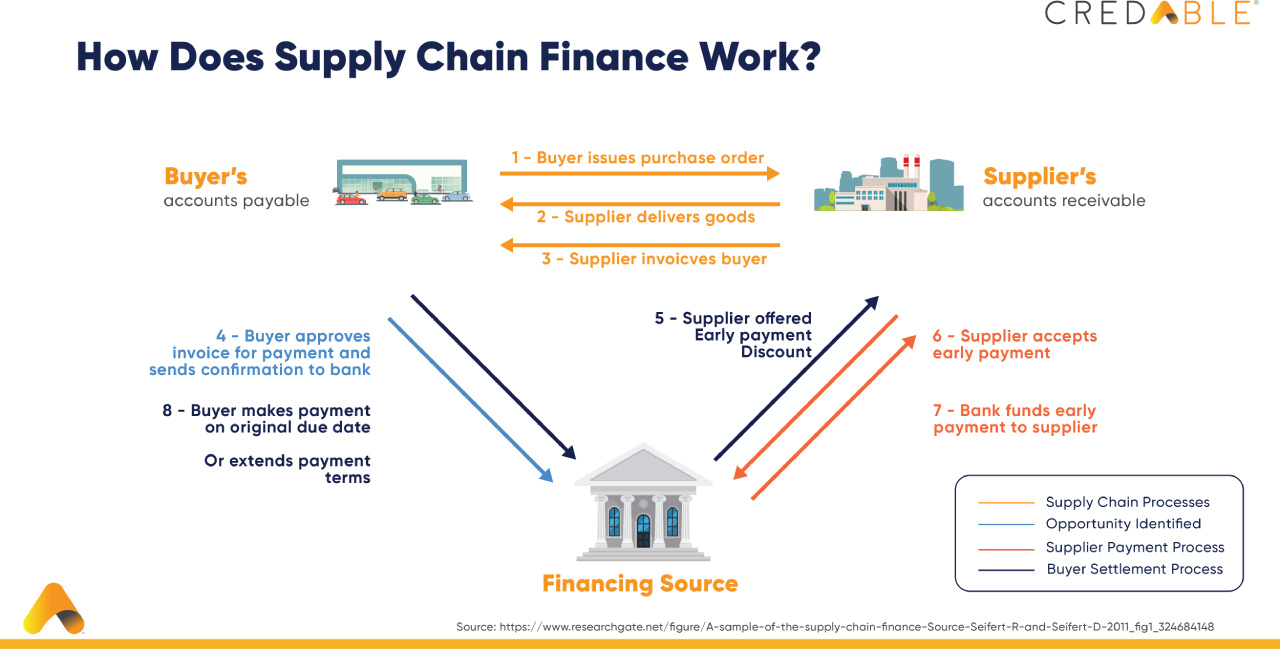

With finance playing an important role in facilitating trade flow, supply chain finance (SCF) helps in ensuring that businesses are always adequately equipped with the working capital necessary to keep the operations running. Supply chain finance has evolved to become the lifeline of today’s globalised economy.

While trade finance supports 80% of global trade, the trade finance gap is persistently large with recent reports stating that the gap has risen to $2 trillion owing to risk aversion and inflation hampering lending limits. As trade gets more complicated and competitive, the supply chain financing model is struggling to fill the credit gap of suppliers in a cost-effective and efficient manner.

Legacy supply chain finance solutions and its limitations

Supply chain finance has been a part of the larger discussion but never the centerpiece of innovation drives initiated by financial institutions and FinTechs. One of the primary reasons for this is the sheer number of moving parts in the mechanism of supply chain finance. The outdated supply chain finance systems have created bottlenecks and liquidity traps for all entities involved.

The limitations and complexities of legacy systems tend to cause significant operational challenges in today’s global and domestic supply chain ecosystems.

- Siloed Data: Banks and corporates today work on separate operating systems that handle different functionalities. These stand-alone systems have minimal interaction with each other which creates major inefficiencies when it comes to leveraging the most relevant data across systems. This directly impacts data-based decision-making.

- Manual error-prone processes:The archaic way of creating spreadsheets and reconciling the records is prone to human error, increased risk of fraud, and revenue loss.

- No built-in transparency:Compliance checks from internal and external stakeholders are essential to maintain transparency in supply chain financing. With disjointed systems, it can become a daunting task to ensure adherence to necessary compliance checks.

With legacy supply chain finance systems—the more the levels of suppliers, the harder it is to cover the entire supply chain through a single financing plan. Owing to a lack of transparency and complexity, trade financing options are typically available only to larger corporations and their first tier of suppliers. Due to a lack of visibility, lenders are unwilling to enroll the wider network of several small suppliers in financing programs, though they play an equally important part in the supply chain ecosystems. Shoring up the stability and resilience of supply chains requires improving the financial position of Micro, Small, and Medium Enterprises (MSMEs) that primarily operate in the lower tiers of supply chains. Deep-tier financing has been making waves as an ideal solution to unlock the value of business relationships and push financing across the supply chain ecosystem.

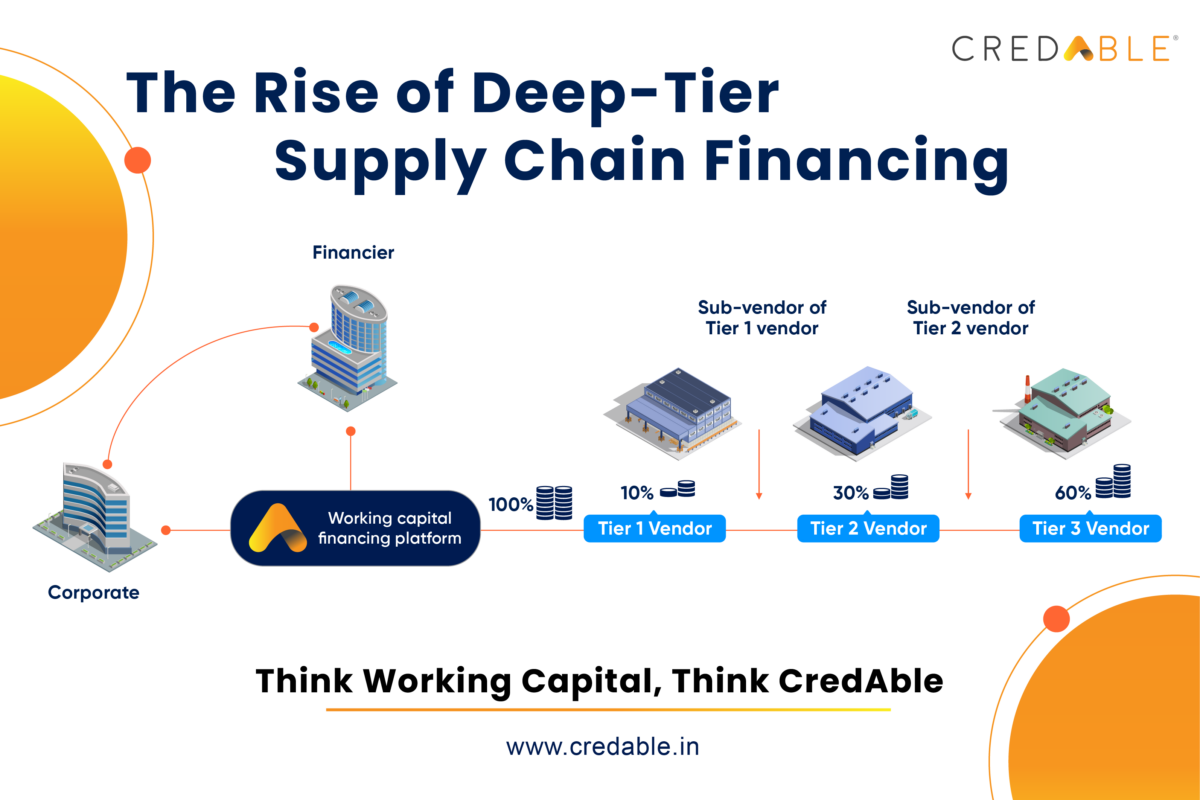

Rise of deep-tier supply chain financing-

Technological interventions in recent times are helping to revolutionise the supply chain financing landscape by digitising the interaction between entities and making the lending process more seamless and transparent. Deep-tier or multi-tier finance, an innovative financing solution has made its way to the top as a game-changer that has helped in unlocking affordable capital for every supplier in the supply chain ecosystem.

Supply chain ecosystems consist of large anchor corporates that have strong credit ratings and its deeper-tier of MSME suppliers. Typically, only the upper tier of suppliers can benefit from a relationship with the anchor corporate and access financing easily.

The innovative deep-tier financing solution brings forth a paradigm shift as it unlocks working capital and makes financing accessible not just for the tier 1 suppliers but for all the suppliers throughout the ecosystem. Deep-tier financing is essentially ecosystem financing where it leverages business relationships to make lucrative financing options available for the entire network of suppliers.

How does deep-tier supply chain financing help?

Currently, supply chain financing is only capable of setting up a payment solution for an anchor and their suppliers up to one or two levels. Going any further causes major time consumption and disruptions due to the numerous paperwork and terms to be considered while dealing with a higher number of suppliers.

Deep-tier financing helps in establishing mutually-beneficial ecosystems. While tier 2 and tier 3 suppliers are given an equal opportunity to access timely funding, banks can expand their reach, access a wider network of clients and tap into new revenue streams by offering financing options to the last-mile suppliers.

The deep-tier financing model keeps a check on sustainable development as well. With MSME suppliers down the entire supply chain having access to sufficient working capital, it makes them financially stable to pursue strategic investments and further enhances their linkages to global supply chains.

Small businesses are going to be the driving force behind adopting a sustainability-first approach for the entire nation. Supportive government initiatives that are encouraging sustainable approaches for small businesses coupled with advancements in FinTech such as Deep-tier financing solutions are promoting sustainability throughout the supply chain ecosystems.

Building resilience into global supply chains

Deep-tier financing presents a massive untapped opportunity to power the MSME sector by

removing many of the structural hurdles that hamper their growth today. CredAble’s deep-tier supply chain financing solution is enabling key banking players to expand their anchor client proposition by providing lucrative supply chain financing options across multi-tiers of suppliers. One such methodology that CredAble is focused on, is the process of tokenization. Tokenization can help in freeing up liquidity from non-liquid assets such as purchase orders and unpaid invoices. The eventual goal of deep-tier supply chain financing is to reach the bottom of the supply chain and serve those underserved. Our alternative web-based model and multilevel penetration approach will enable the buyer/anchor, their tier 1 suppliers, and subsequent suppliers in a common framework at a lower cost. CredAble is closely working on facilitating the supply chain evolution with its globally accepted Supply Chain Finance solution integrated with the factoring segment. In addition, our focus on disruptive concepts such as the deep-tier supply chain financing model can help customers across the entire lifecycle leverage the benefits of technology—irrespective of scale and financial strength.

Think Working Capital… Think CredAble!