Working Capital Financing

That's Simply Better

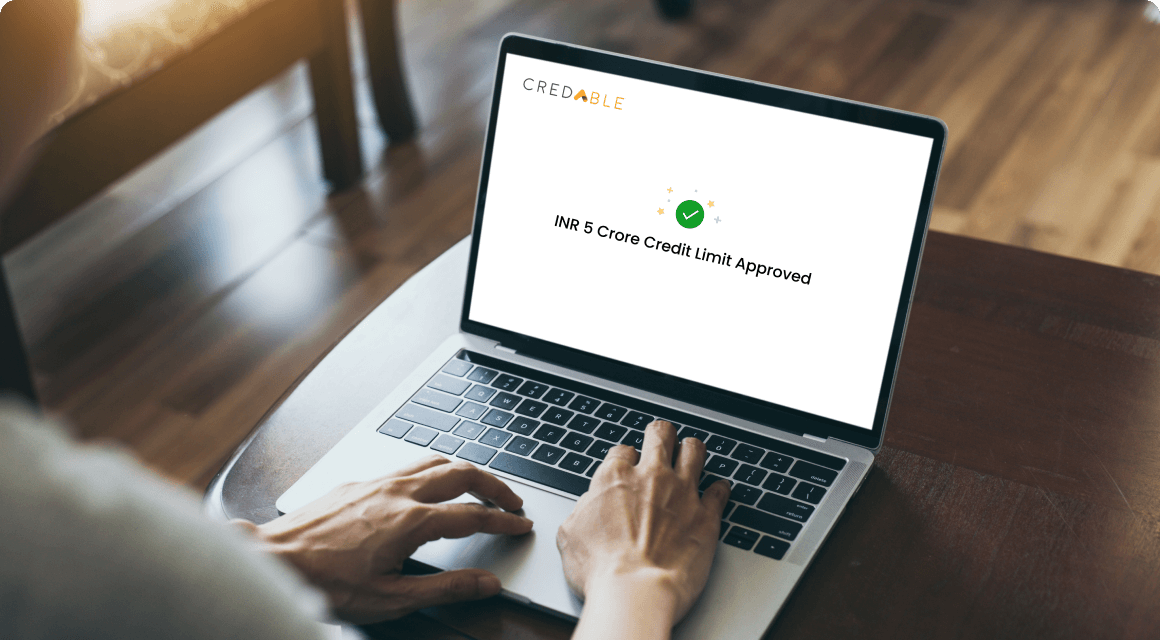

Our RBI-approved NBFC offers quick & customized working capital financing solutions as and when you need it.

Businesses On The Platform

Loans Disbursed

Financial Institution Partners

Corporate Partners

CredAble's Working Capital Advantage

- Collateral-free Working Capital

- Easy Onboarding Process

- Zero Hidden Costs

- Complete Transparency

- Dedicated Relationship Manager

- Quick Disbursement

- Off Balance-sheet Financing Solutions

Customised Credit Options For Your

Unique Working Capital RequirementsRevolving Short-Term Loans

Revolving Short-Term Loans is a pay-as-you-use working capital credit line where you pay interest only on the limit you use. Regardless of credit history, this flexible financing solution enables quick access to credit for small ticket sizes, boosting business at every stage of the growth journey. Read More

Sales Invoice Discounting

Unlock immediate access to collateral-free working capital with our Invoice Financing solution. By leveraging the funds trapped in unpaid invoices, you can maintain a healthy cash-flow balance and ensure ample liquidity for the growth of your business. Read More

Unsecured Business Loan

Unlock the funds you require without the need for collateral, empowering you to expand your business. Take advantage of our Unsecured Business Loan offering with competitive interest rates to fuel your growth. Apply Now

Pre-Shipment Financing

Our Pre-Shipment Financing solution offers a convenient way for suppliers, regardless of their size, to access collateral-free borrowing by leveraging purchase orders issued by large corporates. Apply Now

Purchase Invoice Discounting

Our Purchase Invoice Discounting solution provides you with the opportunity to finance your short-term business-related purchases. With this solution, you can enjoy the benefit of instant payment by availing discounts from your suppliers. Apply Now

Demand Loan

Our unique Demand Loan solution enables liquidity for your business by providing instant short-term credit loans. You are charged interest solely on the amount you utilize from the assigned credit limit, ensuring cost-effectiveness and flexibility. Read More

Export Finance

With our off-balance sheet financing solution, you can benefit from unsecured post-shipment financing for your exports. This unique offering empowers you to confidently take on more export orders without adding any burden to your balance sheet. Apply Now

Customised Credit Options For Your

Unique Working Capital Requirements

-

Revolving Short-Term Loans

-

Sales Invoice Discounting

-

Unsecured Business Loan

-

Pre-Shipment Financing

-

Purchase Invoice Discounting

-

Demand Loan

-

Export Finance

Revolving Short-Term Loans is a pay-as-you-use working capital credit line where you pay interest only on the limit you use. Regardless of credit history, this flexible financing solution enables quick access to credit for small ticket sizes, boosting business at every stage of the growth journey.

Unlock immediate access to collateral-free working capital with our Invoice Financing solution. By leveraging the funds trapped in unpaid invoices, you can maintain a healthy cash-flow balance and ensure ample liquidity for the growth of your business.

Unlock the funds you require without the need for collateral, empowering you to expand your business. Take advantage of our Unsecured Business Loan offering with competitive interest rates to fuel your growth.

Our Pre-Shipment Financing solution offers a convenient way for suppliers, regardless of their size, to access collateral-free borrowing by leveraging purchase orders issued by large corporates.

Our Purchase Invoice Discounting solution provides you with the opportunity to finance your short-term business-related purchases. With this solution, you can enjoy the benefit of instant payment by availing discounts from your suppliers.

Our unique Demand Loan solution enables liquidity for your business by providing instant short-term credit loans. You are charged interest solely on the amount you utilize from the assigned credit limit, ensuring cost-effectiveness and flexibility.

With our off-balance sheet financing solution, you can benefit from unsecured post-shipment financing for your exports. This unique offering empowers you to confidently take on more export orders without adding any burden to your balance sheet.

How We Helped Our Clients Fill Their

Working Capital Gap

Since the inception of our partnership, CredAble has consistently proven to be an invaluable and trusted financing partner. As India's largest managed workspace platform, serving 500+ diverse clients, including Fortune 500 companies, reliable financing solutions were essential for optimizing working capital for us. Our strong partnership continues to grow as CredAble consistently provides timely, reliable, and efficient financing options. Their tailored solutions, like flexibly structured working capital products and vendor financing solutions, have been vital in expanding our operations. CredAble's ability to provide funds in record time has enabled us to seize growth opportunities without disrupting cash flow. They have played an integral role in helping us meet our financing needs on time.

Harsh Binani Co-Founder, Smartworks

CredAble has been a vital partner in our success story over the last 4 years. Their post- shipment invoice discounting solution has been a game-changer, by helping us to manage working capital seamlessly. Their team is extremely supportive because of which we've confidently taken on larger contracts, closed more sales, and expanded our customer base. CredAble's flexible working capital solutions have helped us overcome cash flow challenges and maintain a competitive edge in the industry.

Renuka Aradhya N Managing Director, Pravasi Cabs Pvt Ltd