How Corporates Are Making the Transition from Embedded Finance to Embedded Treasury

The ever-evolving world of finance has experienced a profound transformation with the rise of embedded finance.

By integrating financial services seamlessly into non-financial platforms, embedded finance has brought convenient and customer-centric offerings to the forefront.

Embedded finance is poised for explosive growth as it empowers customers and businesses to access financial services at their convenience, from any location, and at any time.

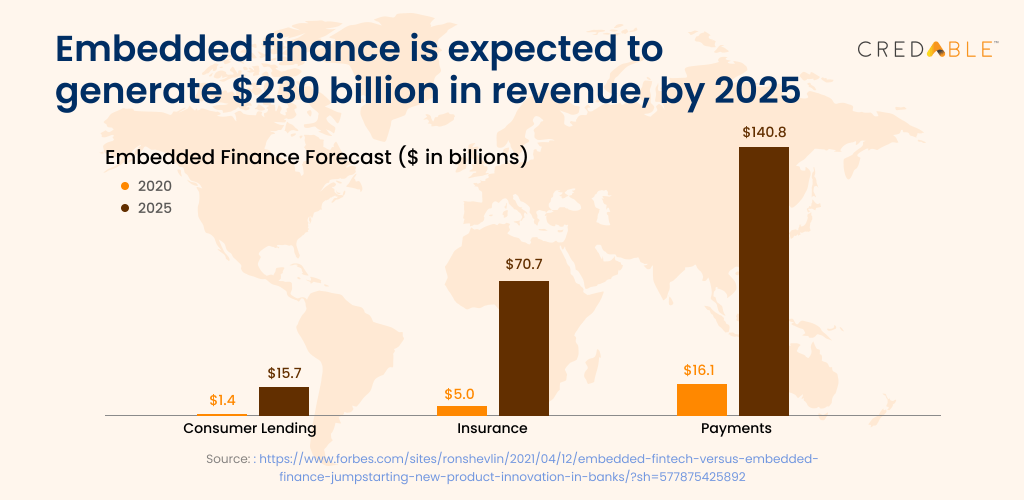

By the year 2025, the remarkable growth of embedded finance is projected to yield a staggering revenue of $230 billion, redefining the way we access and utilise financial services.

As embedded finance continues to make waves, the concept of embedded treasury has risen to prominence as an exciting and transformative development. With a seamless connection between financial processes and business activities—embedded treasury solutions are revolutionising the way corporates handle their financial operations. Embedded treasury offers a holistic approach to financial management. As more companies embrace this integrated approach to financial management, the future of corporate finance looks promising. In this blog post, we will talk about how corporates are now mankind the shift from embedded finance to embedded treasury, and the massive impact it has on corporate financial operations.

The Rise of Tech in Corporate Treasury

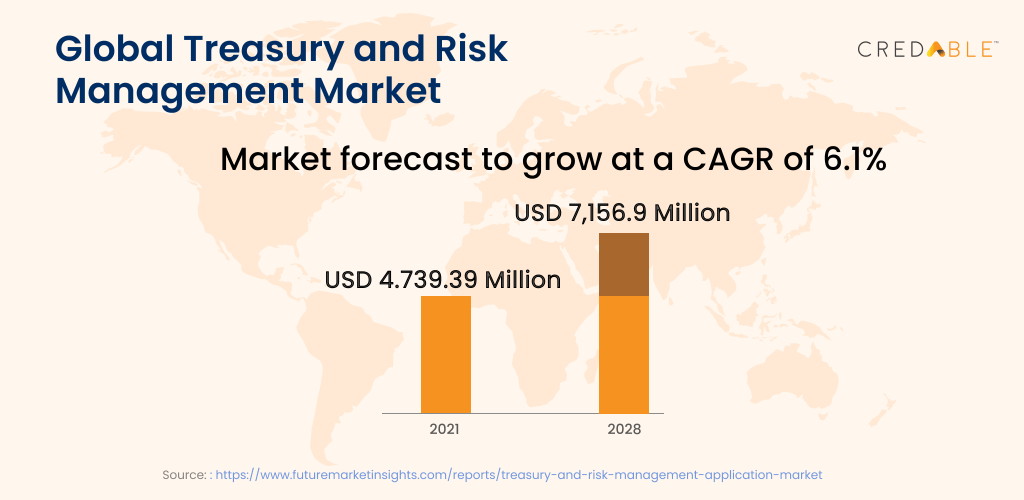

Over the years, the treasury market has held a vital role in corporate operations, overseeing critical functions such as cash management, liquidity, and risk assessment.

For a long time now, corporate treasury has been associated with financial institutions and specialised treasury management systems. With the rise of the digital revolution, corporates now have access to transformative opportunities, enabling them to streamline treasury operations and maximise cash flows like never before.

Technological advancements have been instrumental in transforming corporate treasury practices.

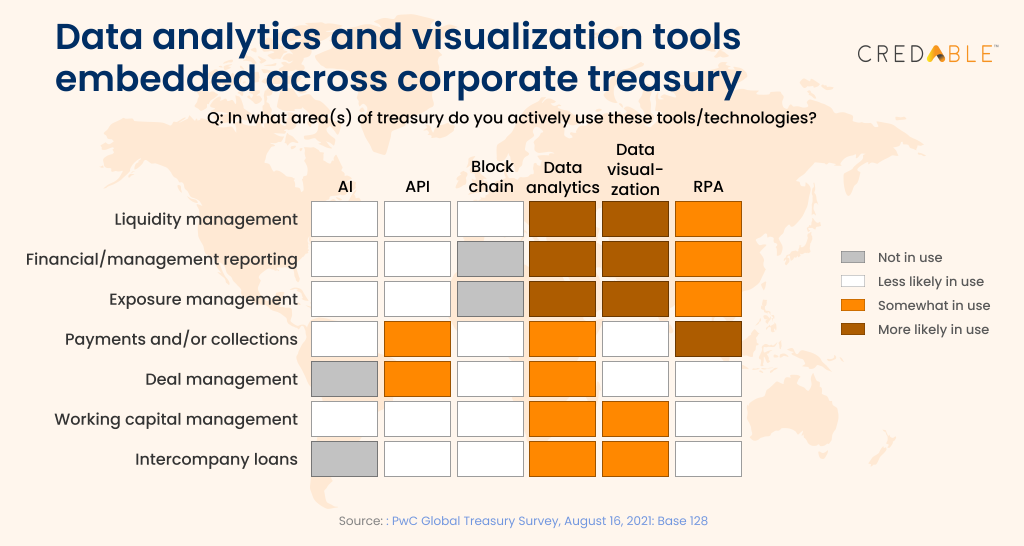

The incorporation of cloud computing, big data analytics, and artificial intelligence has equipped treasurers with vast data and robust tools to make informed decisions.

These state-of-the-art technologies have significantly enhanced cash forecasting, risk management, and working capital optimisation—enabling treasurers to become strategic partners in actively shaping corporate decision-making processes. As technology continues to alter the corporate landscape, treasurers are positioned to play a more influential role in steering financial strategies towards sustainable long-term success.

Empowering Corporate Finances: The Impact of APIs in Embedded Finance and Treasury

Application Programming Interface (APIs) have become pivotal in driving the growth of embedded finance and embedded treasury. Acting as essential bridges, APIs facilitate seamless communication and information exchange between different systems and platforms.

Particularly in treasury, APIs enable the integration of financial services into various business applications, including Enterprise Resource Planning (ERP) systems and accounting software. The automation facilitated by APIs eliminates manual processes, leading to enhanced efficiency and accuracy in treasury operations.

API-driven embedded treasury solutions empower treasurers with real-time access to crucial financial data, transaction capabilities, and valuable insights into cash positions.

Furthermore, the rise of embedded finance and embedded payments is not solely confined to consumer-facing applications but is also gaining traction in the realm of Business-to-Business (B2B) transactions. For instance, by facilitating instantaneous payments upon invoice approval, embedded payments reduce the reliance on extended credit terms. This will help in unlocking working capital faster for suppliers. As corporates increasingly embed financial services into their supply chain and business processes, embedded payments in B2B contexts offer an array of advantages.

These benefits include:

- Faster payment processing

- Improved cash flow management

- Heightened transparency throughout the payment lifecycle

The rise of software enablers utilising the Software-as-a-Service (SaaS) model has played a crucial role in delivering seamless embedded experiences. By leveraging new-age technologies, corporates optimise financial operations, improve cash flow management, and remain at the forefront of the evolving financial landscape.

The journey from embedded finance to embedded treasury

As the corporate world continues to embrace the concept of embedded finance, the natural evolution towards embedded treasury solutions becomes increasingly apparent. These innovative approaches offer a seamless fusion of financial operations with core business activities, presenting a host of compelling benefits.

The progression from embedded finance to embedded treasury holds a plethora of advantages. Imagine having real-time insight into your cash flow, coupled with automated and accurate cash forecasting. This streamlined connection allows for efficient management of liquidity, empowering treasurers with the tools to make well-informed decisions rooted in up-to-the-minute financial data. This, in turn, bolsters their strategies for mitigating risks effectively.

One noteworthy advantage of embedded treasury solutions lies in the enhancement of compliance and governance practices. By centralising control and closely monitoring financial transactions, these solutions ensure that company-wide financial policies are not just in place but actively enforced. This level of oversight guarantees adherence to regulatory requisites, providing a significant boost to overall compliance efforts.

Closing thoughts

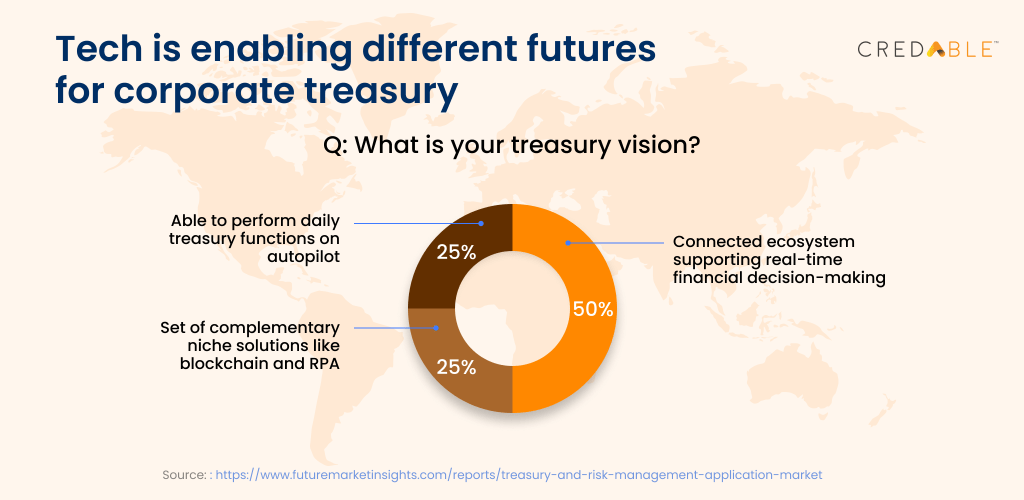

As the embedded treasury revolution gains momentum, corporates that embrace these innovations will undoubtedly gain a competitive advantage in the dynamic global business landscape.

CredAble's embedded treasury solution comes equipped with advanced analytics, allowing treasurers to optimise working capital, mitigate risks, and make informed decisions. With a unified dashboard, treasurers can monitor cash flows, track performance, and forecast cash positions with precision. With CredAble and other innovative FinTechs leading the way, the future of corporate treasury is set to be more agile, efficient, and strategic than ever before.

Think Working Capital… Think CredAble!