What’s fueling the private credit spike in Asia?

Asia’s race to become the world’s leading financial hub is heating up. The Asia-Pacific (APAC) region is solidifying its position as a formidable financial centre demonstrating exceptional growth in recent years.

Moreover, we are also seeing a boom in private credit funds in Asia. The evolution of capital-raising activity in the last 30 years has resulted in the public and private markets working in tandem. They are joining forces to empower businesses across all points of their growth journey—spanning from startups to well-established ventures, and even those experiencing financial distress.

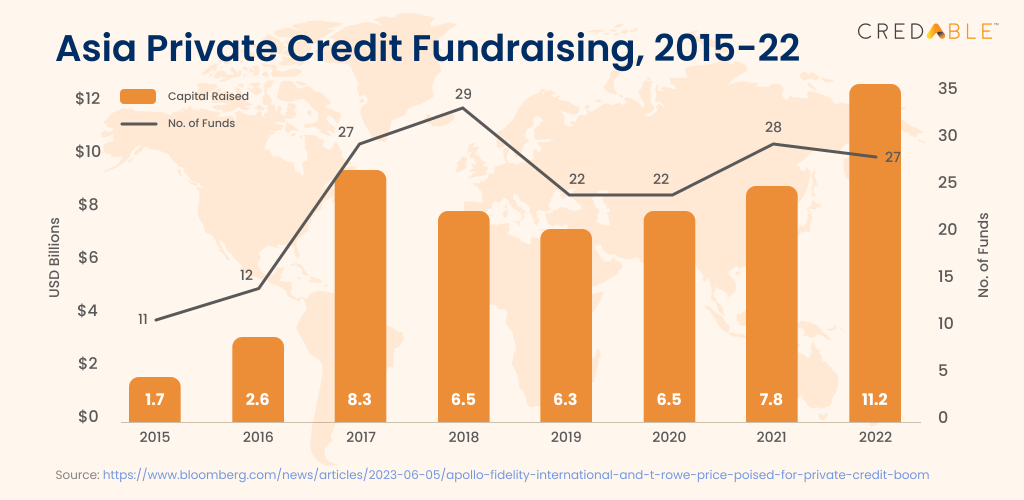

It’s remarkable to see how private credit fundraising has reached new heights in the region. Close to USD11.2 billion was raised across 27 funds in Asia in 2022. This is primarily due to a spike in demand from privately-held firms and startups whose private equity issuance has been hampered by stock market fluctuations and decreasing valuations.

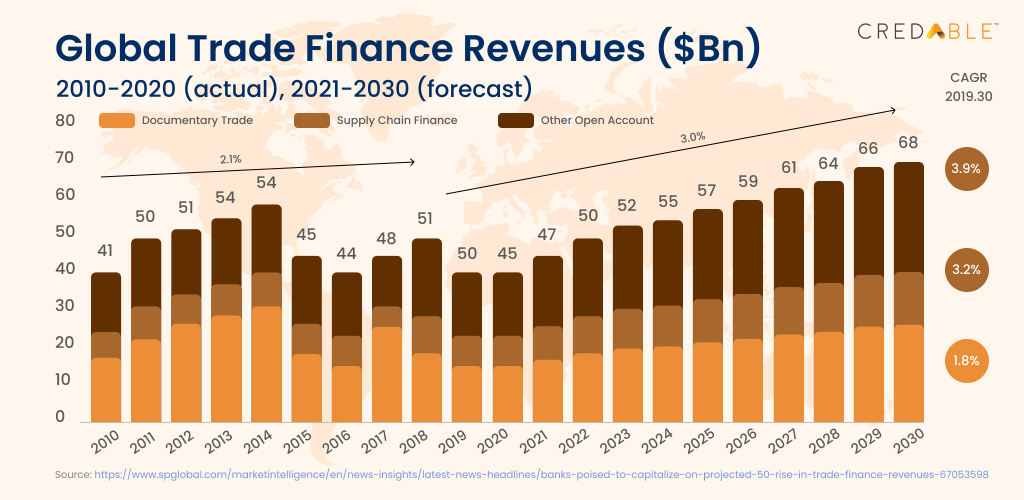

With the APAC region retaining its leading position globally as the largest user of trade finance, we will take a deep dive into how the record-high increase in private credit transactions will have a growing role in Asia’s trade finance market.

State of the market: Private credit in Asia

Private credit refers to the financing provided by non-bank lenders typically to non-investment grade businesses such as middle-market companies or Small and Medium-sized Enterprises (SMEs).

Despite the ongoing economic uncertainties and market volatility, we are expecting to see the continued growth of private credit in Asia's debt financing space.

But this was not always the case.

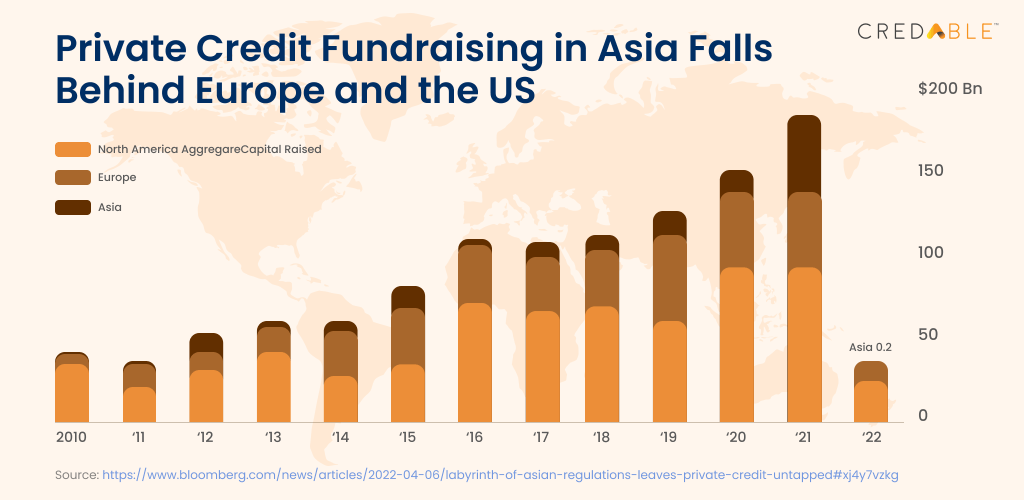

Though Asia is home to some of the largest and most promising economies in the world, historically, the region has accounted for only a fraction of the global private credit market.

During the period spanning from December 2014 to June 2019, Asia's private credit assets under management witnessed more than a two-fold increase.

Typically, the APAC bank lending activity has always exhibited a strong home market bias. The restricted flow of credit between borders creates a window of opportunity for flexible working capital providers with a local presence spanning multiple markets across the region.

These factors signal a shifting dynamic in favor of primary dealmaking in Asia.

What's fueling the private credit spike in Asia?

Let’s get behind the scenes and understand the driving forces behind the rise of private credit in Asia.

The region's private credit markets are attracting larger investments from global sponsors who expect enhanced flexibility in their debt documents. Against the backdrop of increasing yields, credit supply-demand disparities, and attractive deal terms—Asia’s private credit markets are thriving.

The economic tailwinds resulting in growth in private credit markets include:

● Banks’ reduced appetite for riskier transactions and non-blue chip borrowers: Businesses are finding it difficult to access traditional loans owing to tighter lending standards and greater scrutiny of borrowers by risk-averse banks in the APAC region. As a result, FinTechs like CredAble has stepped in to fill the void by providing need-based financing solutions to businesses that are struggling to secure working capital.

● Growing credit demand from SMEs: SMEs play a pivotal role in many Asian economies, representing nearly 96% of all businesses in the region. Traditional banks are conservative in lending to SMEs due to their size and lack of collateral. Private credit providers are filling the gap as they enjoy greater flexibility in their lending criteria and are less constrained by regulatory requirements compared to banks

● Increasing role in trade finance: For decades now, traditional lenders have been the largest providers of trade finance. The increasing awareness of the private credit sector has brought in a seismic shift in trade finance. Besides, the retrenchment of many of the banks from commodity trade finance following the high-profile scandals has left the door open for non-bank lenders to move in and take on much bigger roles in supply chain financing.

The role of private credit in bridging Asia’s trade finance gap

Trade finance plays a crucial role in propelling economic growth and sustainable development. Nearly 80% of global trade relies on finance and going by recent reports, the global trade finance gap has widened and is now at a staggering $2 trillion.

It’s safe to say that non-bank lenders are seeing a wealth of opportunities in the trade finance sector. They are well-positioned to provide smaller and medium-sized traders with much-needed avenues for securing timely access to funds.

Non-bank lenders stand out with their unique advantages, particularly in their flexibility and quick processing capabilities, delivering valuable assistance to commodity producers and trader borrowers.

Even as some private credit managers presently cooperate with trade and commodity banks, there remains substantial room for greater collaboration.

These are some of the key factors driving the rise of private credit funds in Asia’s trade finance scene:

● Compared to other credit opportunities like treasuries and corporate bonds—trade finance transactions are typically short-term in nature, usually under 180 days. This presents private credit providers with greater liquidity and the ability to reprice more frequently, in the event of a change in the credit condition or base rates.

● Businesses value the tailored financing structures, faster execution times, and deeper relationships that private credit managers provide.

● Trade finance offers compelling returns to private capital providers depending on the specific trade finance fund, its source of capital, and its investment approach.

The significance of private credit in shaping Asia’s trade finance

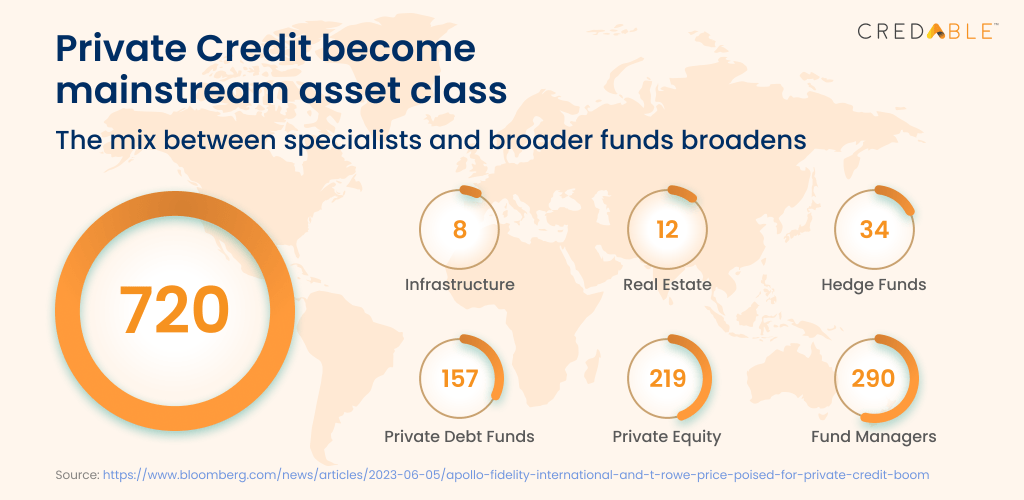

In the last few years, we have seen an increasing awareness about private credit and a growing sophistication on the part of borrowers. Owing to its flexibility and customisation, private credit is now widely recognised as an alternative asset class.

The widening trade finance gap, soaring bank debt costs, and an ongoing retreat of banks from the trade finance sector are rising concerns for borrowers. Private credit offers quick, innovative, and bespoke financing solutions that businesses need to thrive in today’s fast-paced trade finance landscape. As a result, viable trade financing solutions such as pre-shipment financing and early payment programs by CredAble are now becoming lifelines for SMEs who are in the most need of financial support.

How are you navigating this challenging investing environment?

— Pat Michalowski (@PatMichalowski) June 13, 2022

I'll go first..

Preservation of capital is key.

Commodity trade finance #tradefinance provides a private credit yield and is secured by assets that historically appreciate when inflation accelerates.

Think Working Capital… Think CredAble!