The Malt Whisky Trail: Unravelling the Working Capital Dynamics Behind Whisky Distilleries in India – CredAble

It’s safe to say that Indian whisky has made a mark in the world of spirits.

We have got data to back this up — Paul John, a renowned brand of Indian single malt whisky, had their limited edition whisky named Mithuna recently recognised as the third finest in the world by Jim Murray’s Whisky Bible 2021.

This was not the first time for an Indian whisky to receive global fame. Way back in 2010, Bengaluru-based Amrut was rated No. 3 in global Murray’s rankings.

According to IWSR Drinks Market Analysis, India happens to be the ninth-largest consumer of all alcohol and the second-largest consumer of spirits in the world. What’s even more interesting is that India is the largest consumer of whisky in the world, almost 3 times higher than the United States. If you do the math, one in every two bottles of whisky sold around the world is bought in India.

India’s taste for whisky

With the likes of Paul John and Amrut taking over the market, today, Indian single malts have garnered international acclaim.

Indian whisky is much closer to rum than traditional whisky. This is because there is a reluctance in using grain in alcohol production, which makes a majority of Indian whisky molasses-based. While the molasses-based spirit has come to be the favoured type of whisky among the masses, consumers in India are not restricted and have the option to go for Scottish brands of whisky like another mass favorite, Johnnie Walker.

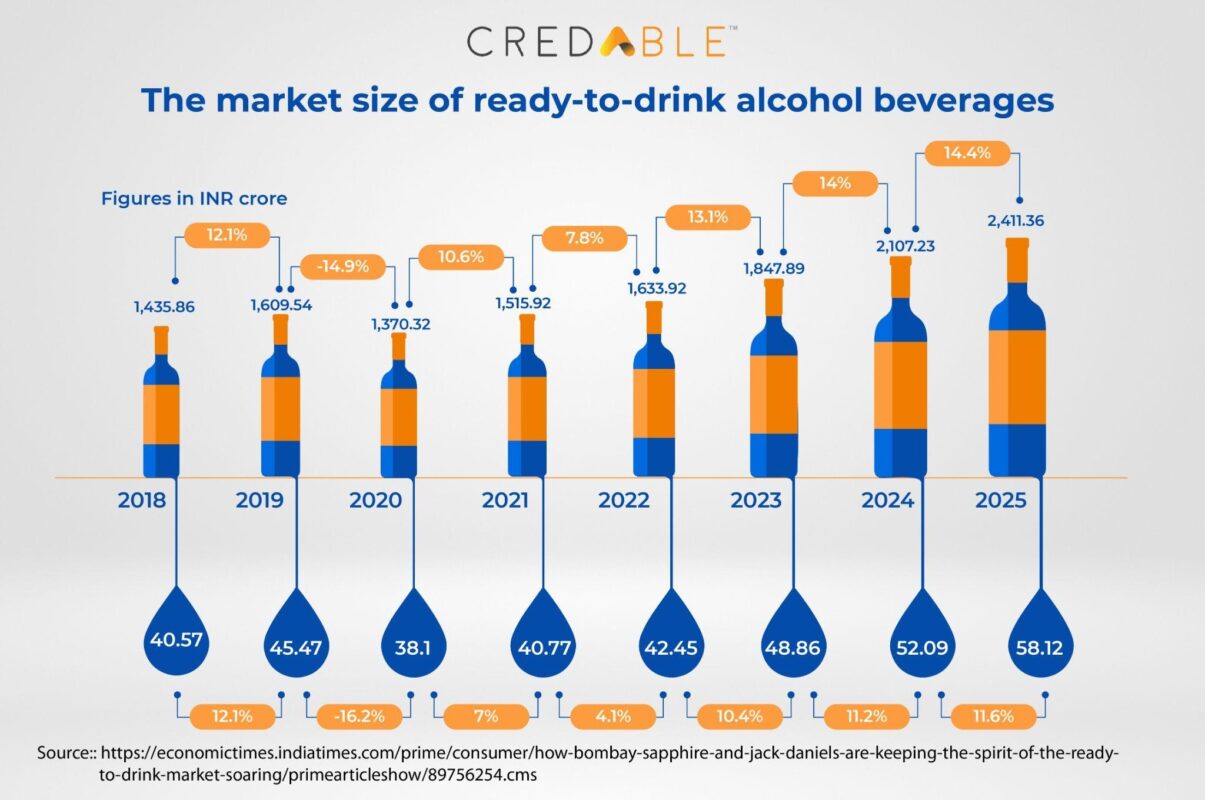

According to reports, two years ago, the Indian whisky market reached a volume of 1.35 billion litres. The market is expected to witness continued growth in the coming years with a forecast that the market will reach 2.82 billion litres by 2026 at a CAGR of 17%. That said, the ready-to-drink segment is expected to boom with reports from Euromonitor International stating that the total RTD market in India is worth nearly INR 1,516 crore. This is primarily owing to factors like convenience, affordability and a huge spike in at-home consumption.

Whisky factories in India: The role of economics in producing whisky

Amrut is one of the most well-known distilleries producing whisky in India. Having started to produce whisky specifically in 1982— Amrut also happens to be one of the first producers of whisky in the country.

Talking about production, the climate in India is not as favourable as that in Scotland. The ‘Angel’s Share’, which is the amount of distilled spirit that is lost to evaporation as the whisky is being aged in the barrels — is much higher (3-4 times more) in India. While distilleries in Scotland Isles are blessed with a slow maturation phase, distilleries like Amrut have managed to find a way around it. Their Greedy Angels limited-edition spirit covers nearly 30 years of maturity after only 10 years of aging.

Distilleries such as Amrut have helped in taking Indian whisky to the world stage. With meticulous methods of production and locally grown ingredients, the reputation of spirits from top distilleries in India has gone from strength to strength. With distilleries in India producing single malt that is now exported to different corners of the world, 7 out of 10 whisky brands sold globally are from India. Even though Indian whiskies have received international fame, American and Irish whiskies are considered to be the popular whiskies in the Indian market.

This could primarily be due to the preference for Scotch considering the age and Scottish heritage that it has. Another reason is that Indian whisky brands have only been in the business for a couple of decades whereas Scottish malt dates back to 400-500 years.

This could explain why Indian brands are lagging behind in their ability to invest and get a good return on capital. A careful study of economics is what will help Indian whisky brands plan their working capital requirements and investment strategies better. To be able to match the pricing expectation in the marketplace, it is crucial to work out the economics behind production and sale before heading to launch a single malt in India.

Another matter of concern is that the excise duty in some states almost comes up to 3-5 times the value of the product. This ends up choking the working capital of most companies. To overcome this challenge, bond to bond transfer of stocks must be allowed in all states where the first buyer or stock point would be the state corporations or the company stock depots. Doing this will help products to be moved from the bonded warehouse of the distillery directly to the bonded warehouses of the State corporations or company-owned warehouses, removing the need to pay excise duty.

Market preference and opportunity analysis

While the whisky market in India is expected to grow, there are many reasons that could hamper the growth.

Owing to the rise in drink and drive cases, stringent government rules and regulations have been introduced to curb the excessive consumption of alcohol.

Nevertheless, the whisky market is on a steady climb. Comparatively beer consumption in India is yet to reach global standards. While the consumption has been on the rise — the per capita consumption of 2 litres continues to be below par with the global average of 30 litres.

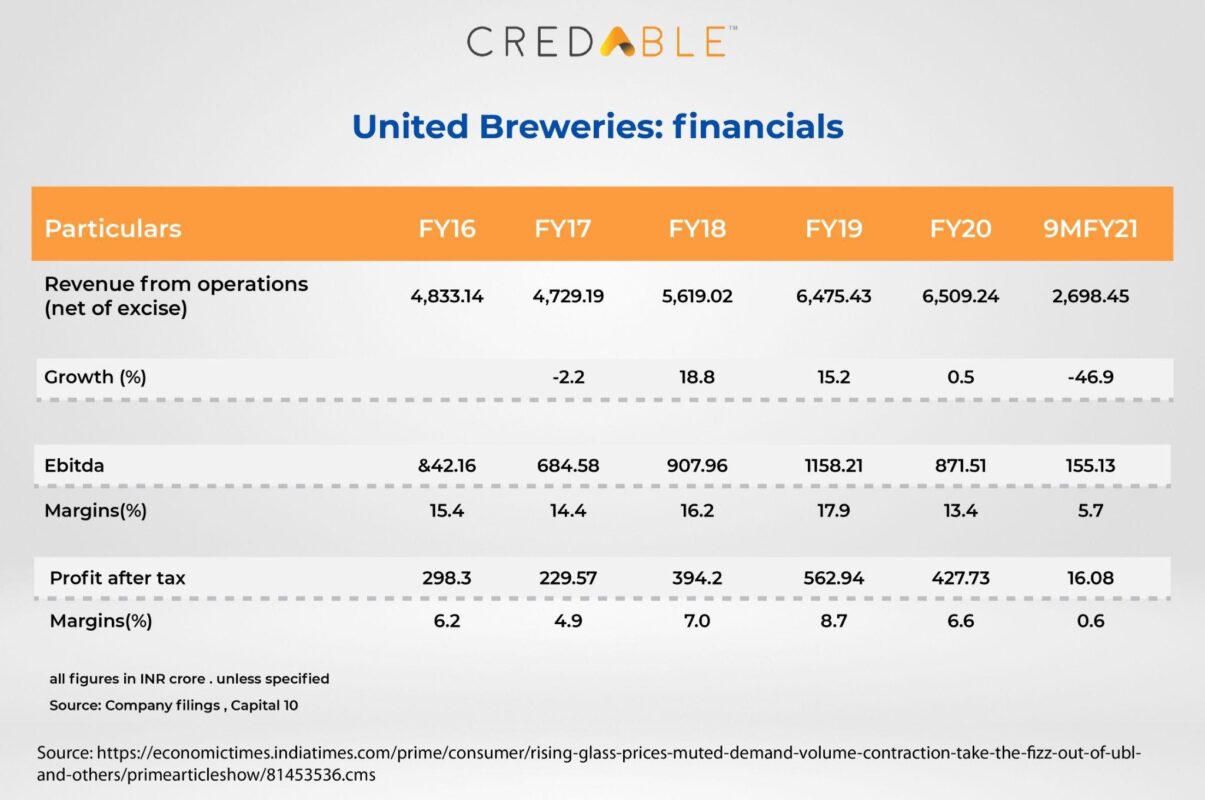

The financials of United Breweries in the last five years show no substantial growth.

Coming back to the whisky market in India — given the changing lifestyles and preferences of people in India, there has been a considerable increase in whisky consumption in the country.

Wrapping it up

A primary reason why the whisky market in India has been booming over the years — is because of the increasing purchasing power of people. With the nation undergoing massive globalisation in recent years, people today have more disposable income and a certain lifestyle that they would like to maintain. All this has led to people spending more on alcohol consumption, especially whisky.

The pandemic has played a part in this by bringing about a trend of drinking better, than drinking more. Two years into the pandemic — though there has been no major increase in consumption, there has been a drastic shift to premium and better quality alcohol. This explains why premium whisky brands have been moving faster off the shelves and some of the Indian premium brands in the whisky market are even priced higher than the legacy brands.

All this is to say that with an overall economic analysis and careful allocation of working capital, the future of whisky brands sure looks promising!

Think Working Capital, Think CredAble!