Revolutionising Underwriting Journeys in Urban Co-operative Banks with BaaS Platform

In the last decade, the technology revolution in the financial services sector has incredibly peaked.

What we see today is a radical reimagination of banking business models. With the financial services industry swarming with nimble tech startups, innovative FinTechs have started to venture into banks’ traditional turfs.

What does all this mean for the Urban Cooperative Banks (UCBs)?

The urban cooperative banks are on the cusp of a ground-breaking era. The entry of new agile competitors and evolving regulatory changes call for a shift in strategy.

Four major new policy decisions empowering the Urban Cooperative Banks (UCBs) have been approved:

— Amit Shah (@AmitShah) June 10, 2023

1) The UCBs can now open new branches without the prior approval of the RBI. This will accelerate their growth.

2) The UCBs can now enter into one-time settlements with borrowers,… https://t.co/kiRvNoNQl1

To navigate the rapidly advancing financial services landscape and match up to the heightened demand for tailored customer experiences—UCBs should aim to use tech-enabled solutions. This will further ensure their continued relevance for members of the lower and middle-income strata of society.

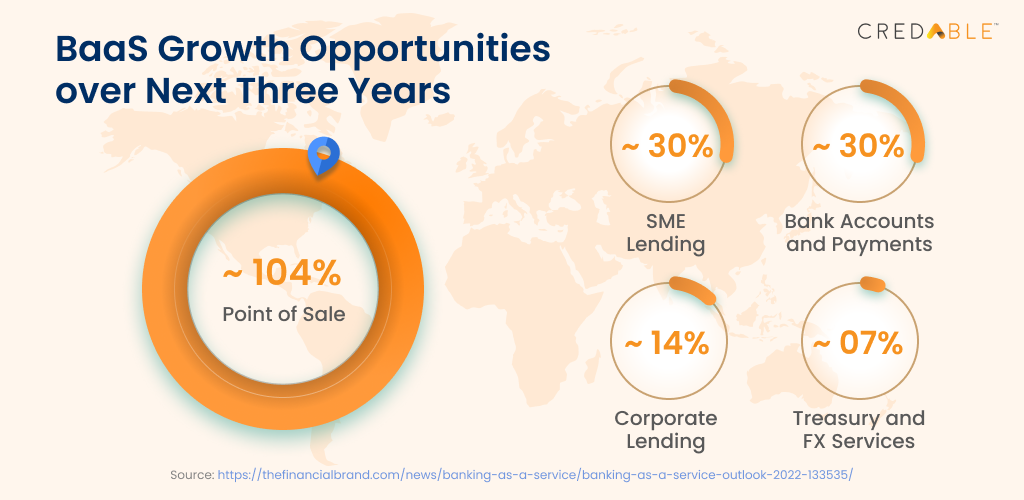

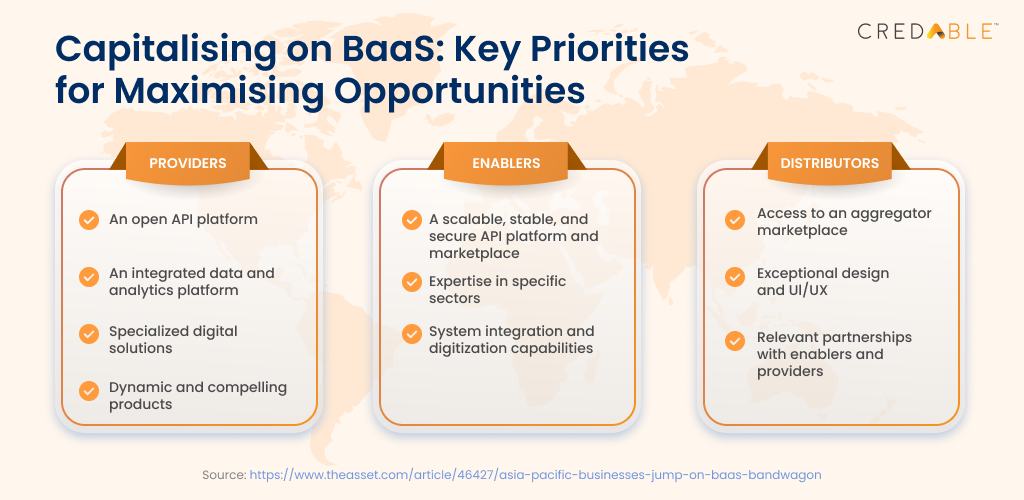

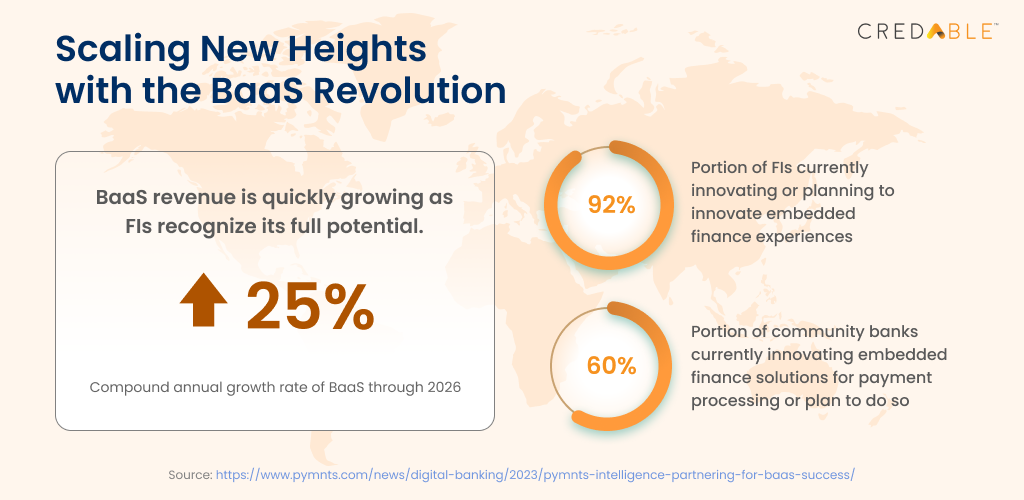

Considering the exponential rise of Banking as a Service (BaaS), UCBs now have the opportunity to deliver personalised experiences that will be vital to retain customers in the face of stiff competition from new-age digital players.

The traditional and conservative nature of urban cooperative banks

In India, UCBs have been holding the fort in urban and semi-urban areas. They play a pivotal role in mobilising savings from low-income urban groups and providing credit to the small-borrower sector.

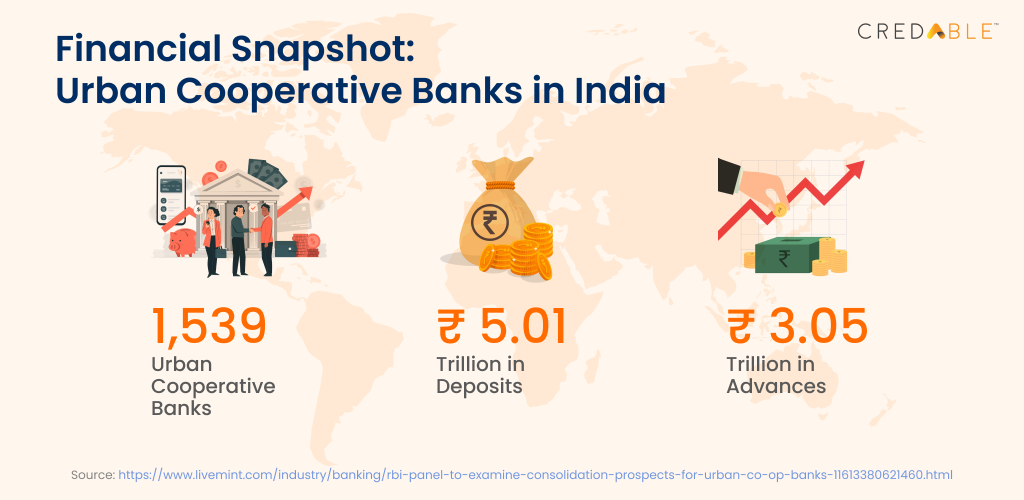

A fundamental pillar of India’s banking ecosystem, urban cooperative banks have registered significant growth in recent years. According to reports, there are 1,539 urban cooperative banks, which include both multi-state and single-state operative banks. Collectively, their deposits account for INR 5.01 trillion, while the cumulative advances total INR 3.05 trillion.

UCBs benefit from a solid banking relationship with their customers. The demographic and geographic reach that UCBs have within the rural and urban populace is truly unrivaled.

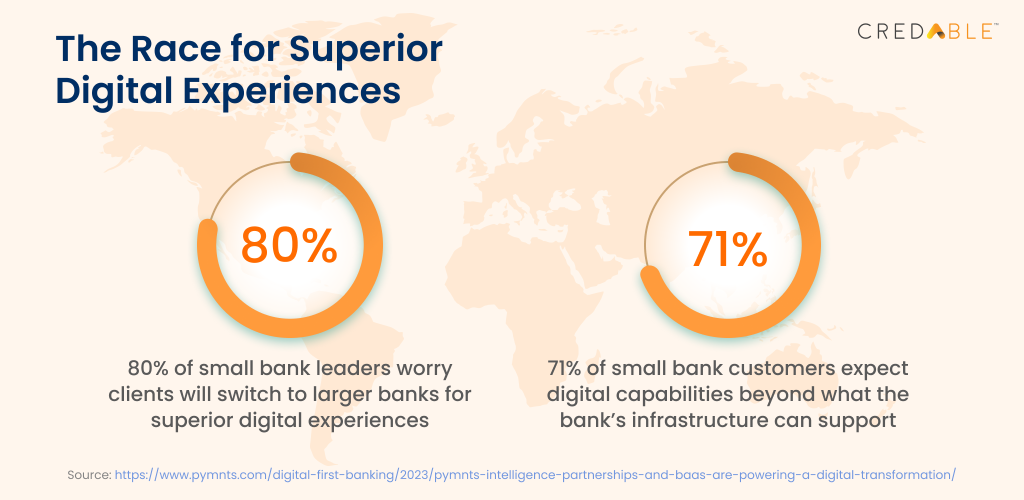

Having said that, the smaller cooperative banks are often hamstrung by a lack of technical expertise and funds. In terms of digital transformation initiatives, they trail far behind their larger counterparts.

For decades now, UCBs have been limited by their resistance to change. Owing to their long-standing practices and established frameworks that are deeply ingrained within their operations, these cooperative banks have been hesitant to adopt new technologies and digital solutions. Their reluctance to embrace innovative ideas has resulted in a slow pace of digital transformation. Furthermore, they are also burdened with manual, time-taking processes impeding their progress in the fast-moving financial services landscape. While manual data entry and paper documentation have hampered their speed and agility, the absence of a robust digital infrastructure has constrained their ability to adapt to changing customer needs and market dynamics.

How can UCBs bolster their digital capabilities with BaaS?

Given how digitalisation is gaining prominence, UCBs are now actively seeking partnerships with FinTechs to modernise their technology infrastructure and gain access to ready-to-use digital solutions.

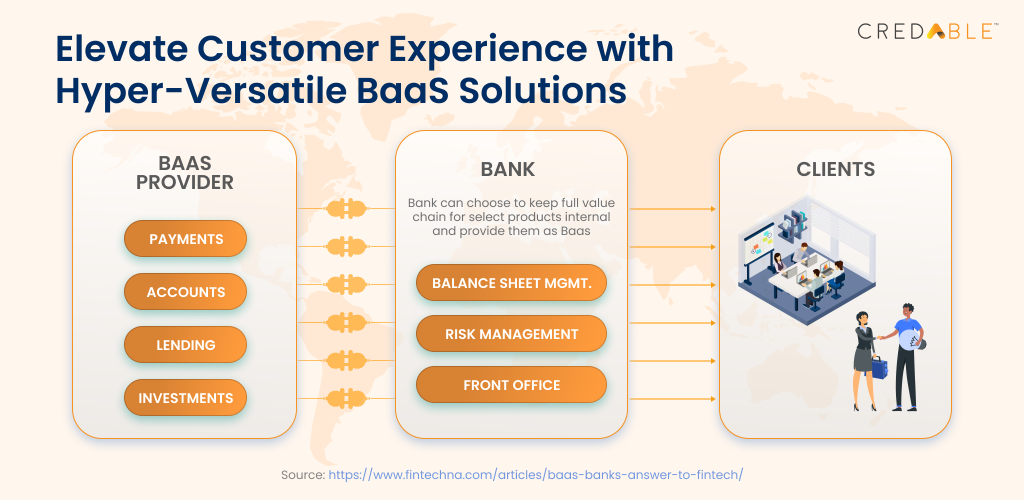

By leveraging BaaS platforms, UCBs can access advanced tech-based solutions, automate processes and enhance operational efficiencies. BaaS platforms will help them upgrade to future-ready operations, powering them to deliver superior customer experiences across multiple fronts.

BaaS platforms also enable UCBs to capitalise on the technology infrastructure that is compliance-friendly and can be precision-engineered to meet the diverse financing needs of their customers.

Revolutionising underwriting and widening financial inclusion

For India to climb up the global economy ranks, there is a dire need to remove structural barriers to last-mile financial inclusion. Urban cooperative banks take on a more proactive approach to achieving financial inclusion. UCBs have been providing institutional credit at an affordable cost for the low-income and disadvantaged sections of society.

A large chunk of the funds is being allotted to Micro, Small, and Medium Enterprises (MSMEs). However, lending to the weaker sections of society has only increased by a meagre 1% in the last few years. While UCBs have played a vital role in providing direct finance to small businesses, they lack the technological backing that will enable their customers to quickly access the funds they need. By embracing BaaS platforms, UCBs can streamline the underwriting process, expedite loan approvals at scale, lower operational costs, and drive greater financial inclusion.

BaaS platforms equip urban cooperative banks with cutting-edge technologies and robust integration capabilities to improve the overall underwriting process and ultimately promote digital financial inclusion in the country.

Expediting underwriting journeys with BaaS Platforms

Here’s a quick look at some of the many ways in which BaaS platforms enhance the underwriting journeys:

● Customisable tech platform

UCBs can digitise the underwriting journeys by leveraging a world-class BaaS platform that is user-friendly, highly configurable, and customisable to meet the high growth needs of customers.

● Automation capabilities

By switching to BaaS platforms, UCBs can automate the entire credit journey—right from the point of document collection and data capturing to loan disbursements. By eliminating much of the manual processes and paperwork, UCBs can ensure quicker verification and credit assessments, resulting in faster underwriting decisions.

● Enhanced risk management

BaaS platforms offer advanced risk management capabilities to improve risk assessment accuracy and reduce fraud. Built-in early warning signals will provide timely alerts in case of any collection issues observed, enabling UCBs to identify potential risks early on and take necessary actions.

● Greater scalability

With a growing demand for credit, urban cooperative banks are now handling larger underwriting volumes. By leveraging BaaS platforms, UCBs can easily scale their underwriting operations to handle high transaction volumes and ensure faster processing times even during peak periods.

● Data integration and analytics

BaaS platforms allow UCBs to access comprehensive customer data, transaction history, credit scores, financial statements, and other relevant information from multiple external databases and ecosystem partners.

● Real-time decision-making

By screening real-time data feeds, leveraging advanced machine learning algorithms, and employing in-built analytics tools, UCBs can make robust credit risk assessments. The ability to make instant approval or rejection decisions will reduce the turnaround time for loan applications and improve the decision-making speed significantly.

Moving forward

In the coming years, we can expect to see a massive transformation of the urban cooperative banking sector as they gear up to achieve greater levels of financial inclusion.

BaaS provides an excellent opportunity for UCBs to reach a larger customer base at a lower cost.

With enough scale to personalise and cross-sell best-in-class financial products, BaaS opens up new revenue streams at attractive margins for urban cooperative banks.

BaaS platforms have produced tangible results by ensuring end customers are able to access timely financial services, even in regions where bank branches may not exist. CredAble’s full-stack BaaS tech suite is built on advanced architecture and designed to help industry-leading financial institutions offer transformative solutions and build a critical base of loyal customers.

Think Working Capital… Think CredAble!