A Deep Dive into Credit Underwriting 2.0

The Evolution of Banking

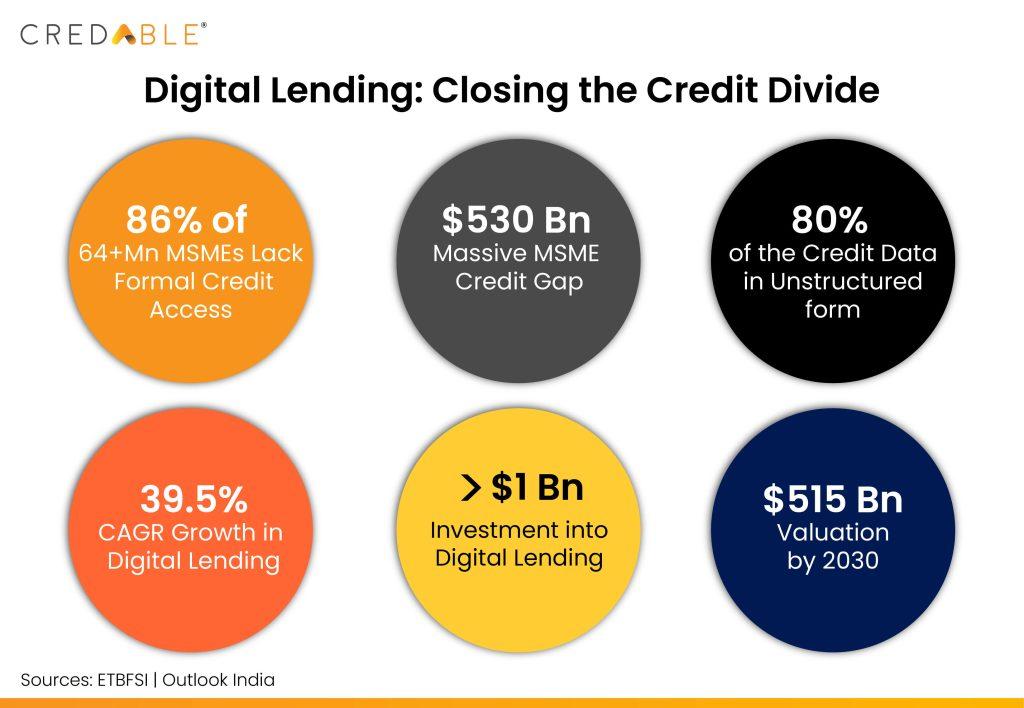

Credit is the most critical component for MSMEs and provision for credit is a critical problem MSMEs face. An effective underwriting and loan approval process is an important predecessor to a favorable portfolio quality. The ever-expanding MSME sector in India consisting of over 64 million MSMEs has witnessed a staggering 2x growth in the last two years, however, there remains a significant credit gap worth approximately $530 billion, which is still untapped. Technological developments and improvement in data analytics have transformed the credit underwriting process for MSME lending, paving the way for a promising future for both MSMEs and lenders.

Smart Borrowing Starts Here: The ABCs of Credit Underwriting

Credit Underwriting is a crucial process employed by financial institutions, NBFCs and FinTechs to evaluate the creditworthiness of borrowers before approving a loan or extending credit to them. It involves assessing the borrower’s income, appraisal, credit score, and assets. A favourable credit score can enable borrowers to obtain loans at lower interest rates. Asset evaluation is also conducted to ascertain whether the borrower’s assets are sufficient to cover the borrowed amount, in case of repayment default.

Traditional Underwriting vs. Alternative Data Underwriting

While traditional underwriting depends on factors such as credit score, income, and limiting access; around 480 million adult Indians under the age of 65 are credit underserved. While traditional underwriting taps into sources such as credit bureau reports, credit scores, and repayment history; alternate data looks into the individual or any business’s ability to repay a loan by looking at their bill payment history, employment history, travel history, e-commerce transactions, government transactions, property records, crowd-sourced fraud databases, to name a few. Fintechs, credit bureaus and financial institutions are using alternative data underwriting to develop scoring models which supplement traditional credit reports and can improve both the credit scoring accuracy and credit access. While traditional ways are reliable, the new approach can help more people and businesses get the financial help they need.

Demystifying Credit Underwriting Engines

FinTechs have been using credit underwriting engines to automate and streamline the credit underwriting process by incorporating alternative data sources. It uses algorithms and risk models to analyse data from a variety of sources, including credit bureaus, bank statements, and even social media profiles. Credit underwriting engines are essentially computer programmes that use data to assess the creditworthiness of loan applicants. The decision-making process used by credit underwriting engines is facilitated through Business Rule Engines (BRE).

Business rule engines (BREs) are automated decision-making software systems which interact with business rules set by the lender and executes them whenever required. A standard BRE offers all the benefits that automation does such as speed, accuracy, cost reduction and heightened performance. BREs must be aligned with the principles of design thinking to be flexible and to allow the lender to be able to define, manage, and deploy business rules and decision logic.

Navigating the Right Credit Underwriting Engine.

To select a good underwriting engine, the key considerations include data source integration capabilities through a single API for efficiency, customization options to align with specific business needs, a user-friendly interface for easy navigation and workflow adjustments, cost evaluation with consideration of expected ROI, and the availability of technical support and training for effective software utilization by the team. These factors collectively contribute to a well-informed decision-making process, ensuring the chosen underwriting engine aligns with business requirements and budget constraints while facilitating accurate and streamlined lending decisions.

How Lenders Can Use Dynamic, Real-Time Underwriting.

80% of the data received by underwriters are in unstructured form, including emails and PDFs, which results in inefficiency and prolonging processing time. Extracting meaningful information thus becomes a challenging task for lenders. The adoption of dynamic real-time underwriting using data analytics and AI streamlines the process, improves efficiency, and enables faster policy decisions.

Multiple benefits may be derived from dynamic, real-time underwriting, including:

Good Customer Product Experience – using a customer’s risk profile, lenders can customise credit products based on customer needs keeping in mind the underlying risk factors. Besides improved customer experience, lenders experience better closure rates.

Improved Risk Assessment – AI-driven underwriting converts unstructured data to structured data, helps in the prevention of any potential losses, automates the data analysis process, and helps reduce manual errors significantly.

Easy and Automated Documentation – AI-driven underwriting has the capability to extract essential information from unstructured documents and even offer document management solutions, enabling lenders to store the customer’s documents for risk assessment.

Why Lenders Should Choose Alternative Data Underwriting.

With emerging digital lending companies in India, the country has seen a growth of CAGR 39.5% in the last decade. The investments pumped into the Indian digital lending space is more than $1 billion and the market is expected to grow to a valuation of $515 billion by 2030. Alternative data underwriting is crucial in India's credit landscape, especially since it helps in tapping the underserved and unserved part of the population.

The benefits to alternative data underwriting include:

1. New Borrower Segments – Alternative data underwriting unlocks untapped borrower potential in India, leveraging non-traditional data like utility payments, online behavior, and social media, expanding access to formal credit facilities.

2. Helps Improve the Gini Coefficient – the Gini Coefficient is an important metric used for assessing an underwriting model’s discriminatory power and predicting future borrower defaults. Enriching underwriting models with alternate data enhances risk differentiation, improving loan repayment predictions. A one-point Gini coefficient boost can save a bank up to USD 10 million per billion in loans.

3. Facilitates Customised Products and Services - Analyzing diverse data, including financial and utility payments, enhances lenders' understanding of borrowers' creditworthiness. Leveraging alternate data in underwriting enables personalized lending, optimizing terms and delivering mutual value.

4. Enables Risk-Based Pricing - Using alternate data, lenders gain a comprehensive risk profile for precise credit assessments, enabling personalized loan pricing. This approach ensures borrowers pay interest rates tailored to their risk, avoiding generic rates.

5. Aids Collections - FinTechs, NBFCs, and banks employ alternative data for automated collections. Leveraging diverse sources like social media and insurance records, a prioritization engine segments borrowers by risk, allowing smart allocation of collection resources and targeted strategies. This approach enhances efficiency, reduces costs, and significantly boosts debt recovery rates, presenting a compelling strategy for lenders globally.

Conclusion

Integrating alternative data sources in lending transforms how credit is assessed, empowering lenders to enhance decision-making. This approach expands customer reach, boosts fairness in lending, customizes products, sets prices based on risk, and improves the efficiency of payment collections. Ultimately, it gives lenders a competitive edge and ensures customers access the most suitable credit facilities.

Think Working Capital… Think CredAble!