How AI & Data Analytics are Revolutionising Supply Chain Financing

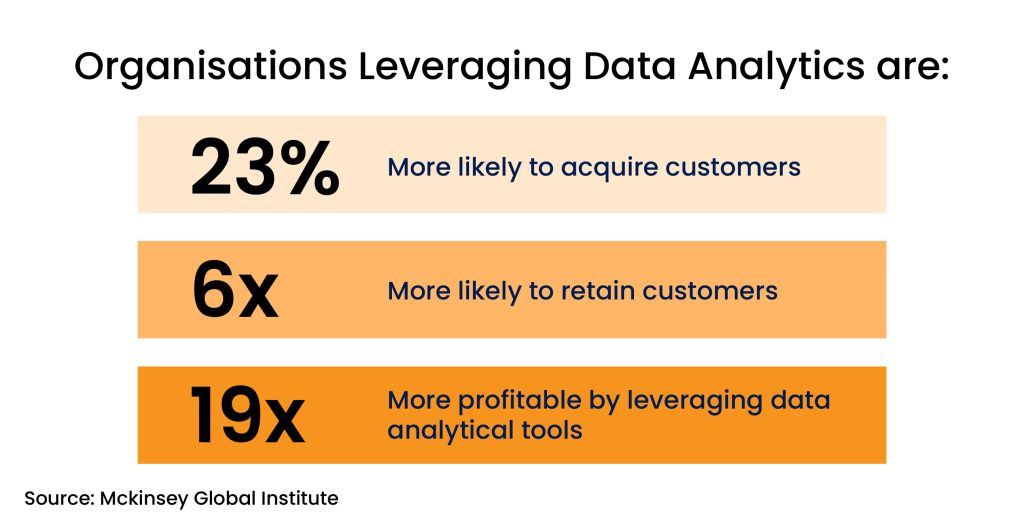

Effective working capital management is paramount for SMEs in order to maintain their financial stability and economic fluctuations. Companies can enhance their valuation and achieve operational flexibility by optimising several aspects of their business such as inventory, accounts receivables, accounts payables, treasury management. The integration of data analytics has empowered financial leaders to make more accurate data-driven decisions to enhance the quality of their deliverables.

Across industries in India, 78% of the organisations have increased their use of data and data analytics, especially in the post-pandemic period. With the infusion of data analytics, enterprises are now able to re-engineer, automate, and leverage artificial intelligence across business functions.

This data-driven transformation has shown approximately 54% increase in revenue performance, 44% faster time-to-market, and has yielded a 62% improvement in customer satisfaction.

Explore Need-Based Working Capital Financing SolutionsThe Working Capital Imperative: Understanding and Addressing Cash Flow Gaps in Businesses

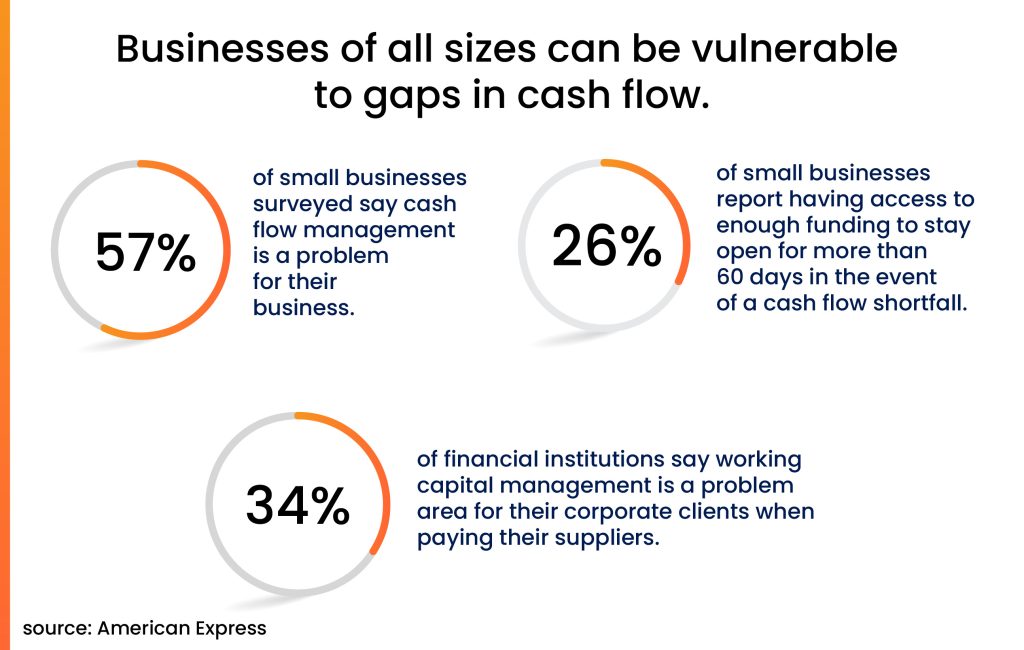

Businesses of all sizes can be vulnerable to gaps in their cash flow with 57% of small businesses claiming that working capital management is a problem faced by them, while only 26% of them claim to have access to enough working capital to remain open for more than a period of 60 days in the unfortunate event of a cash shortfall.

The problem of cash gaps stem from issues faced by them such as late payments, reconciliation, lack of integration with other systems, and longer receipt times.

A Data-Driven Approach towards Improving Cash Flow & Working Capital Management

Strategic management of constituent working capital components is essential for optimizing overall efficiency. Modern analytical solutions offer a variety of techniques to business that strengthen and meet their short-term operational and financial obligations. Analytical tools such as predictive modelling and machine learning algorithms provide businesses with data driven insights of the drivers of working capital, facilitating reliable forecasting, and effective policy formulation.

With advanced analytics, along with enhanced working capital management, these tools are enabling businesses to ensure smooth continuity in their operations and a reduction in risk.

A data-driven approach is optimising working capital management by powering the following functions:

Cash Flow Management:

Organisations can optimise their real-time cash flow management using predictive analytics to identify patterns and correlations which traditional methods may overlook. The adoption of analytical tools in cash flow management is helping businesses to maintain their competitive advantage and identify opportunities for cash flow improvement. Thus, companies using data analytics in cash flow forecasting are achieving an average 7.5% improvement in accuracy, leading to better liquidity and cost savings. Cash flow management also improves working capital for investment in acquisitions, market expansion, innovation, and business transformations.

Inventory Management:

Inventory management leverages predictive demand modelling, powered by analytical and machine learning tools, to optimize procurement and storage decisions while minimizing waste. This approach incorporates seasonality, promotional fluctuations, and external factors to enhance the reliability of output forecasts. Additionally, data analytics facilitates product segmentation, allowing for the identification of fast-moving and slow-moving items. This granularity informs pricing strategies, manufacturing plans, and inventory holding policies.

Inventory management significantly affects every aspect of the business. Several challenges stemmed from traditional methods of inventory management which includes inconsistency in tracking, inaccuracy in data due to manual documentation, and overall supply chain complexities. Studies forecast that implementing analytical tools has led to a 20% reduction in inventory carrying costs and 50% fall in stockouts. Predictive data analytics have enhanced the accuracy of demand forecasting thus enabling companies to anticipate market trends, fluctuations, and customer preferences.

AR/AP Management:

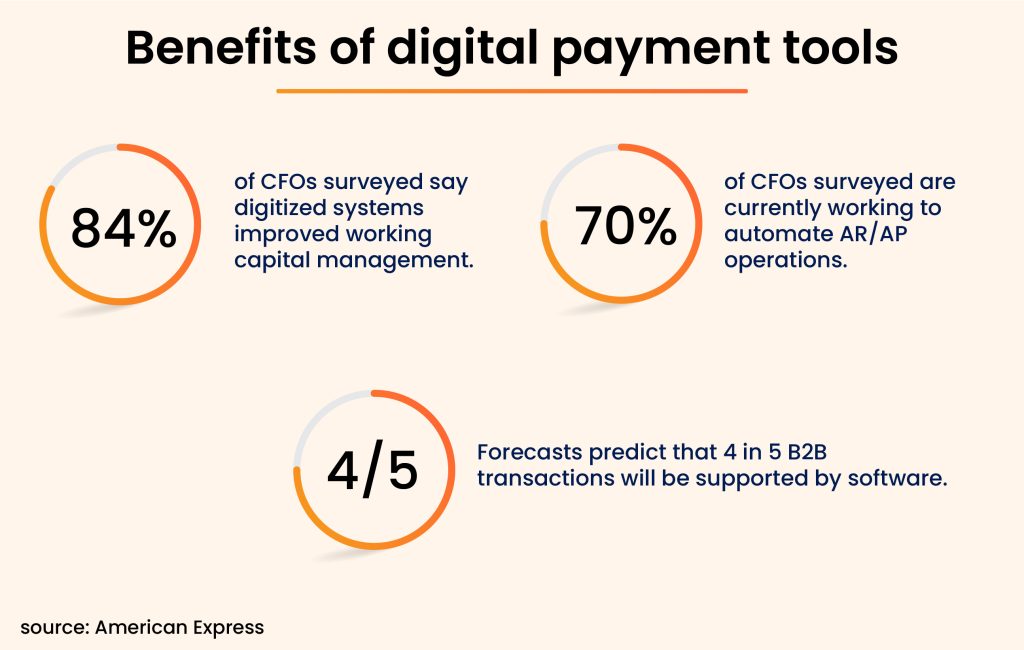

By integrating AI in AR/AP management, companies have seen significant improvement in their cash flow and have reduced their Days Sales Outstanding (DSO). Using AI tools, businesses are getting a better understanding of the customer’s payment patterns on the basis of their historic interactions. Since the use of AI, businesses have recorded a 30% improvement in the Days Sales Outstanding (DSO), thus strengthening their relationship with their suppliers and customers.

Accelerate Your Growth Potential with CredAbleAdvent of Artificial Intelligence in the Supply Chain Financing

Financial institutions and banks can now leverage the power of AI in automating their processes. One of the main applications of AI in supply chain finance is seen to be invoice processing. AI has helped the system to automatically process invoices by analysing large volumes of data, shipping times and several other factors. The integration of AI in supply chain financing platforms has helped businesses identify opportunities within their supply chain networks to improve processes and optimise their costs.

How Suppliers can Utilise Data to Optimise Their Working Capital

With the introduction of data analytics in the finance world suppliers are harnessing AI to optimise their working capital. Using data analytic tools to collate data, it is now possible for suppliers to refine their inventory levels, prevent excessive stockpiling, negotiate favourable payment terms, and preserving their cash flow movements. Through automated AR/AP management, suppliers can identify clients who exceed their payment cycles and tailor credit policies as per their requirements. Overall, AI has facilitated suppliers to optimise their working capital while fostering sustainable growth.

To conclude, effective cash management not only enhances resilience but also enables organizations to fund both organic and inorganic growth, support comprehensive transformation initiatives, and enhance capital-return ratios. To ensure opportunities for future growth, businesses should understand the nuts and bolts of working capital and the potential hurdles that may stand in the way.

With these capabilities and mindsets in place, organizations can quickly implement a transparent, well-coordinated effort to improve net working capital.

Think Working Capital… Think CredAble!