Banking in the Tech Age: Unveiling Key Strategies for 2024 with Satyam Agrawal

The pace of change in the financial services industry is not slowing down. Banks are increasingly accelerating their journey to digital to meet customer expectations and make the most of the opportunities coming their way.

From evolution of digital public infrastructure to breakthrough technology, disruptive forces are converging to create an opportunity for banks to strengthen fraying customer relationships. Beneath the hype, new collaborative approach such as Banking as a Service (BaaS) is expected to have enormous potential to help banks increase their relevance and set new performance frontiers.

Forward-thinking banks globally are growing increasingly dissatisfied with their legacy core banking systems and using a partnership model with new age Fintechs and Tech companies as an alternative to upgrade their core technology architecture to remain competitive.

Over the past year, 59% of customers chose to acquire financial products from alternative providers instead of their main bank. With all this in the backdrop, the need for traditional banks to embrace technological advancements and adopt a mindset akin to tech companies has become increasingly apparent. We recently had an insightful conversation with Satyam Agrawal, CredAble’s Managing Director – International Business. Being an Ex-banker for over two decades, Satyam comes with a wealth of experience in the financial services industry. He spoke to us about the key strategies and considerations that can help banks stay competitive in the digital era. Here are excerpts from our conversation.

1. How can traditional banks emulate the tech industry's rapid pace of innovation to stay competitive in the digital era?

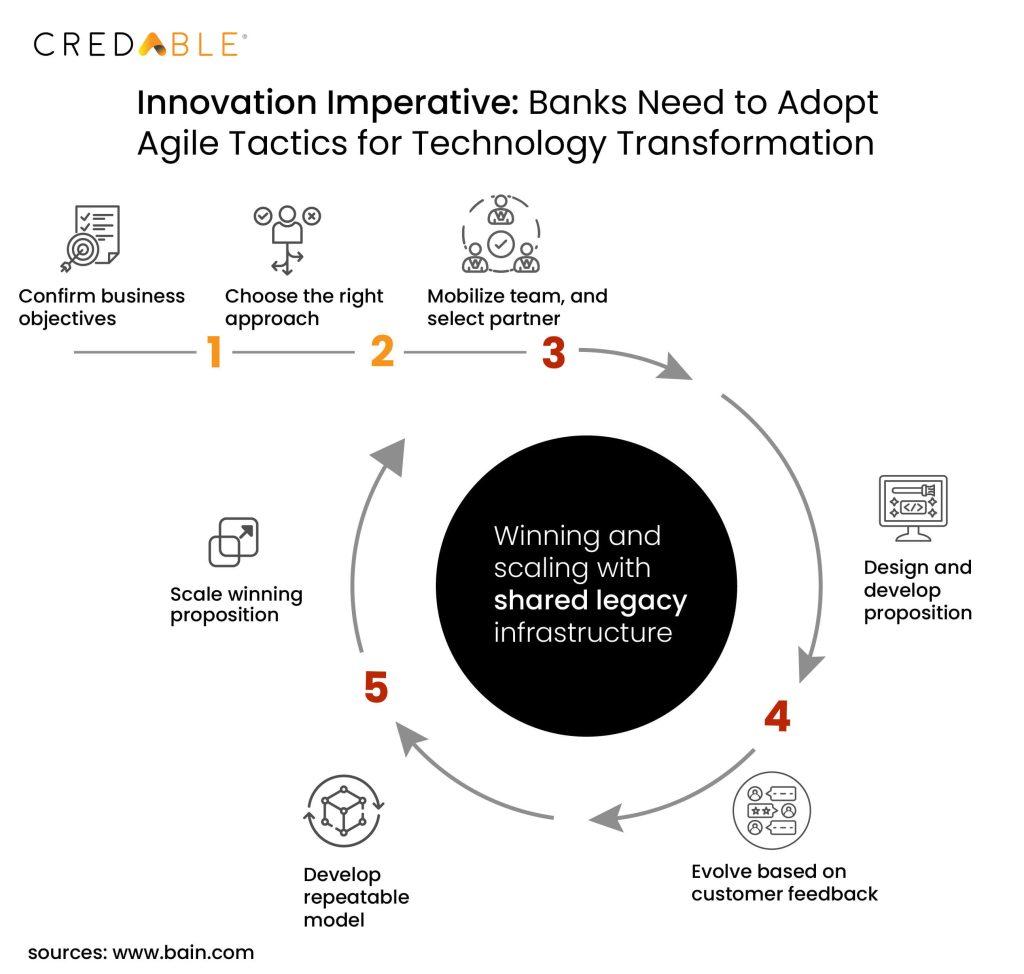

Satyam Agrawal: “Traditional banks can learn from tech start-ups hunger for innovation by fostering a culture of frugality and simplicity. What's important is for banks to become more agile, ensure quick time to test the many opportunities as they arise and scale the ones that are successful. Embracing an agile operating model is not just a recommendation but a necessity for banks seeking to continuously assess new opportunities. The continual commitment to innovation and a forward-thinking approach are pivotal to outperform their peers.

2. In the journey towards thinking like tech companies, what key organisational and cultural shifts should banks prioritise?

Satyam Agrawal: “Drawing from my experience as a former banker, I would like to highlight three critical aspects. Firstly, there exists a culture in banks to be unforgiving towards the individuals who fail embarking on an innovation. I firmly believe that a change is overdue. Banks should embrace a culture to accept failures towards individuals and initiatives who with good intent, made the right decisions to test something new and innovative, and for reasons beyond their control have failed.

Another crucial aspect I would like to highlight is that even today, many banks when engaging with FinTechs, tend to view them not as partners but as vendors. In this mindset, there's a tendency to dictate requirements, expecting the FinTech to merely deliver without collaborative input. Banks that acknowledge the expertise of FinTechs and embrace them as partners rather than vendors find a marked improvement in outcomes.

The third aspect and according to me the most important one is that in most established banks, you still have a team on the side innovating without any eventual P&L ownership. The need of the hour is to marry the two functions from the word go, where the team that's innovating and the team that would eventually own the P&L are actually working together. Ensuring organisational alignment is essential to be on par with the fast-paced nature of the tech industry.”

3. How do you see the role of technology in reshaping the customer experience for banks aiming to think more like tech companies?

Satyam Agrawal: “Most retail banks have excelled in leveraging technology to provide exceptional customer experiences precisely when needed. Delivering a superior customer experience is now table stakes.

Looking at customer experience, from a digital perspective—a significant opportunity arises, especially within the SME and corporate segments. Many banks are currently addressing their backend capabilities in this area. There exists a substantial opportunity for banks to align with the approach of tech companies by intensifying efforts to digitise and enhance Customer Experience. Adopting a tech-driven mindset and achieving progressive levels of digital and operational maturity will empower banks to meet the financial needs of the SME segment, particularly for small-ticket transactions that were historically inaccessible or had high servicing costs. Moving to a frictionless digital customer journey and leveraging digital public infrastructure for business customers can bring enormous rewards for both Banks and their customers.”

4. What strategies can banks adopt to foster a mindset of continuous innovation and experimentation similar to that of tech companies?

Satyam Agrawal: “Banks can foster innovation by emphasising partnerships with FinTechs, adopting a frugal mindset, and learning to keep things simple.

Having worked on both sides, I've noticed a distinctive hunger within FinTechs, a quality often more pronounced than in larger organisational settings.

The adoption of a frugal mindset is crucial, facilitating the swift delivery of solutions within stringent time frames and budgetary constraints—a vital lesson for many banks.

The second noteworthy aspect, a significant learning from my three years in this space, is the emphasis on simplicity within FinTech. In contrast, banks tend to preemptively address complexity, driven by a conditioned mindset inherent in large organisations. The art of simplicity in FinTech is a trait I particularly appreciate. Notably, two broad strategies have emerged among banks—incubating their ventures or supporting external FinTechs. Incubating FinTechs rather than venturing on their own allows banks to benefit from the hunger and agility prevalent in the FinTech space.”

5. From a technology perspective, how can banks balance the need for security and compliance with the agility required to think like tech companies?

Satyam Agrawal: “There’s no undermining the importance of security and compliance for banks, particularly when they're dealing with people's money. Separating core and non-core technology is key to balancing security and agility.

Take, for instance, a core banking platform that incorporates various functionalities, including non-essential aspects like pricing. The key is to segregate these non-core components, allowing banks to concentrate on fortifying security and ensuring compliance with the core technology. This separation opens up avenues for experimenting with innovations in non-core technology, enhancing overall agility.”

6. How do you foresee the competitive landscape shaping up for banks in the era of BaaS, and what strategies can banks adopt to differentiate themselves in this space?

Satyam Agrawal: “The competitive landscape is poised for heightened collaboration between banks and FinTechs within the Banking as a Service (BaaS) model. FinTechs actively seek partnerships with banks, viewing them as collaborators rather than competitors. Recognising their limited reach and financial resources, FinTechs approach banks with a partnership mindset, a sentiment reciprocated by many banks who now see FinTechs as valuable allies rather than threats.

Banks can derive significant benefits by adopting a rapid iteration approach, a hallmark of tech disruptors. A mindset of quick experimentation, learning, and adaptation becomes pivotal for sustained growth. BaaS emerges as a key facilitator, granting banks the flexibility to explore numerous opportunities at a low cost, a notable advantage in achieving swift time-to-market. Banks, adopting suitable models, can still assert control over customer relationships. Partnering with BaaS providers, like CredAble, ensures a cohesive alignment of interests for banks. With entities like CredAble, the benefits extend beyond mere implementation; successful implementations are pivotal.

7. As banks pivot towards a more service-oriented approach through BaaS, how can they ensure a smooth transition without disrupting existing customer relationships and services?

Satyam Agrawal: “The critical first step is choosing the right BaaS partner and recognising that banks not just dealing with a pure technology provider. In the BaaS model, the partner often delivers a managed service extending beyond technology. To stand out, banks must choose partners wisely. The selection should hinge not only on the technology platform but also on the partner's nuanced understanding of the business. A crucial emphasis lies in not solely digitising current services but, more significantly, in delivering innovative products and services to previously untapped customer segments. Clear communication and expectations from the outset will help in maintaining customer relationships during the transition.”

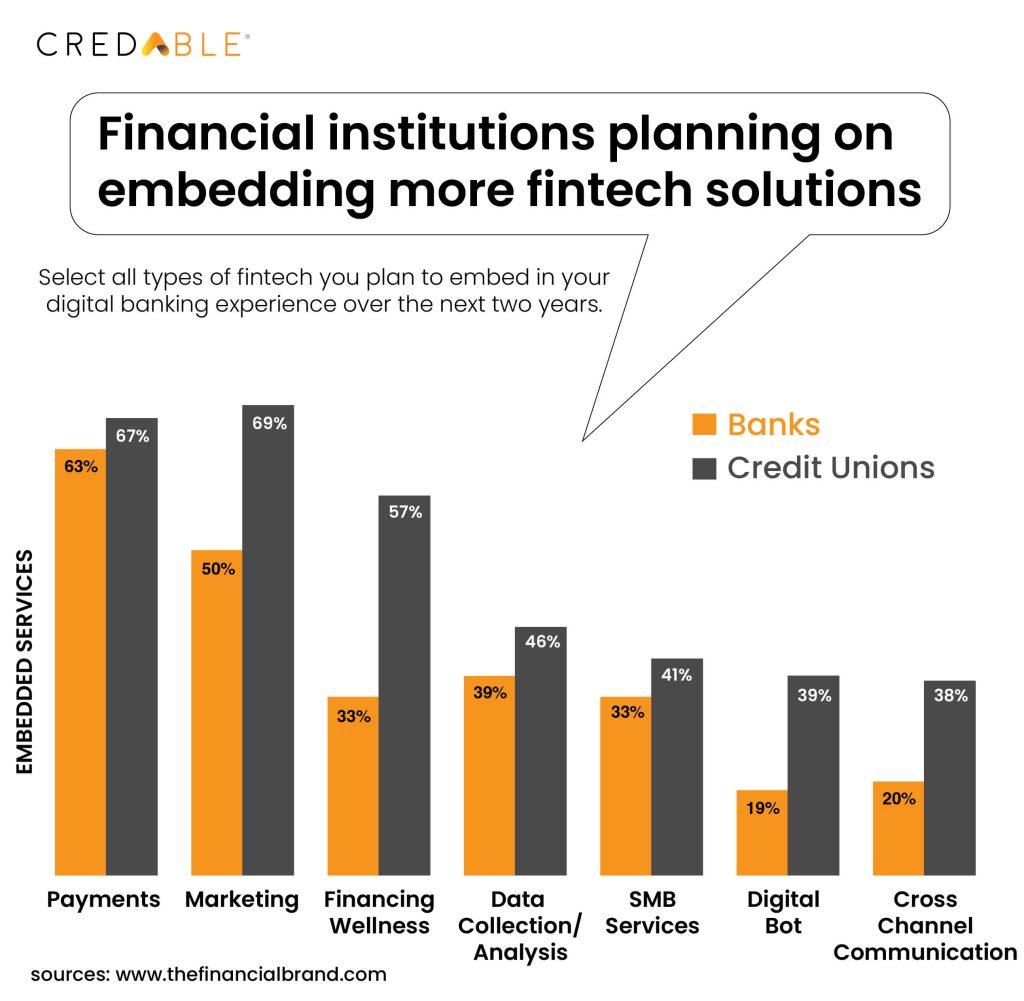

8. In the context of embedded finance, what strategies can banks employ to seamlessly integrate financial services into non-financial platforms?

Satyam Agrawal: “Navigating the embedded finance space poses a significant challenge for banks. Large platforms offer opportunities but often lead to a scenario where a bank is just one among many. Conversely, numerous small platforms present potential, but pinpointing the real opportunities remains uncertain.

Moreover, believing in a one-size-fits-all capability is a flawed approach. Partnering with BaaS providers, such as CredAble allows banks to swiftly engage with multiple platforms, embedding their services and gauging success. The strategy involves building the muscle power to partner with organisations, identifying viable opportunities quickly, and delving deeper into successful partnerships. Lastly, clearly defining expectations from non-financial platforms is crucial for a successful partnership.”

9. In the pursuit of staying competitive with digital-native counterparts, how should banks navigate the decision between building their own core technology and buying new-age tech solutions?

Satyam Agrawal: “From a banking standpoint, the primary focus lies in client origination. The crucial question is: how are clients being originated?

For banks, the pivotal aspect is the commercialisation of financial products and services, with a predominant focus on origination. The evolving paradigm incorporates a combination approach, leveraging third-party and internal channels for client origination. Banks should adopt a combination approach, building core technologies that contribute to their competitive edge while partnering and white-labeling with FinTechs for other solutions. This collaborative model allows banks to be agile, delivering solutions quickly and cost-effectively.”

10. When it comes to thinking like tech companies, what lessons can banks learn from successful tech disruptors in the financial services space?

Satyam Agrawal: “For banks, trying numerous opportunities is crucial. Attempting 10 partnerships or new products might yield two successful ventures, delivering around 80% of the desired growth over the next three to five years. The key is to act swiftly, launching use cases and refining them in real-time, as opposed to prolonged analysis or prediction. Traditional banks typically spend 12 to 24 months on a product or partnership launch. In contrast, newer companies, like ours, achieve launches within three months. The emphasis should be on rapid execution and adaptability, critical for navigating this dynamic landscape.”

11. How does CredAble distinguish itself in the crowded field of cloud-native core technology offerings for traditional banks?

Satyam Agrawal: “In my experience working at CredAble, I take pride not only in our advanced technology platform but also in the exceptional quality of our people. As a technology company crafted for bankers, our team comprises a well-balanced blend of banking and tech experts. Specialising in trade finance, working capital, and supply chain finance—we engage directly with corporates, SMEs, and regulators.

This hands-on experience provides us with a distinctive advantage when offering our technology to other banks. CredAble distinguishes itself through a comprehensive suite of capabilities focused on working capital financing and deeply rooted in understanding the trade and supply chain finance ecosystems.

By seamlessly integrating with the country's digital public infrastructure and essential utility providers, we offer more than just a technology platform. While other platforms possess their advantages, our ecosystem-centric approach serves as our unparalleled strength.”

12. As we have stepped into 2024, what are your key predictions for the financial services industry as a whole?

Satyam Agrawal: "In 2024, the banking industry will maintain its emphasis on agility, digital innovation, and customer-centricity, with success depending on navigating the evolving landscape, embracing technology, and prioritising strategic partnerships. The collaboration mindset between banks and FinTechs, primarily BaaS service providers, is expected to further improve in 2024. This ongoing trend of partnerships is set to become more robust, enhancing the industry's adaptability and responsiveness to technological advancements.

Additionally, as interest rates stabilise and are predicted to decrease, lending is expected to become a crucial machinery for banks seeking faster growth.

Looking ahead, there will likely be an increased focus on Environmental, Social, and Governance (ESG) and sustainability in 2024. Banks are anticipated to seek service providers and platforms supporting their ESG agenda. CredAble is actively engaged in this space, contributing to sustainability initiatives, with upcoming upgrades anticipated in the coming weeks and months.”

Closing thoughts

Today banks worldwide push themselves to evolve towards a future-ready state. Banks have been under immense pressure to modernise their core processing systems. With a goal to reinvent their enterprise, banks are now keen on building a strong digital core to thrive in a future where technology is a primary source of competitive advantage.

This conversation with Satyam Agrawal brought a range of perspectives to the table on the evolving landscape of banking and the imperative for traditional banks to align themselves with the agility and innovation mindset of tech companies.

As the industry marches into 2024, embracing change, fostering partnerships, and prioritising sustainability will be key for banks aiming to thrive in the digital era.

Leveraging transformative technology, a global partner ecosystem, and customisable features—CredAble's cutting-edge BaaS tech suite, boasting advanced architecture offers unparalleled possibilities for banks in building innovative working capital financing solutions.

Think Working Capital… Think CredAble!