CredAble for Tomorrow: Powering the World with Working Capital Technology

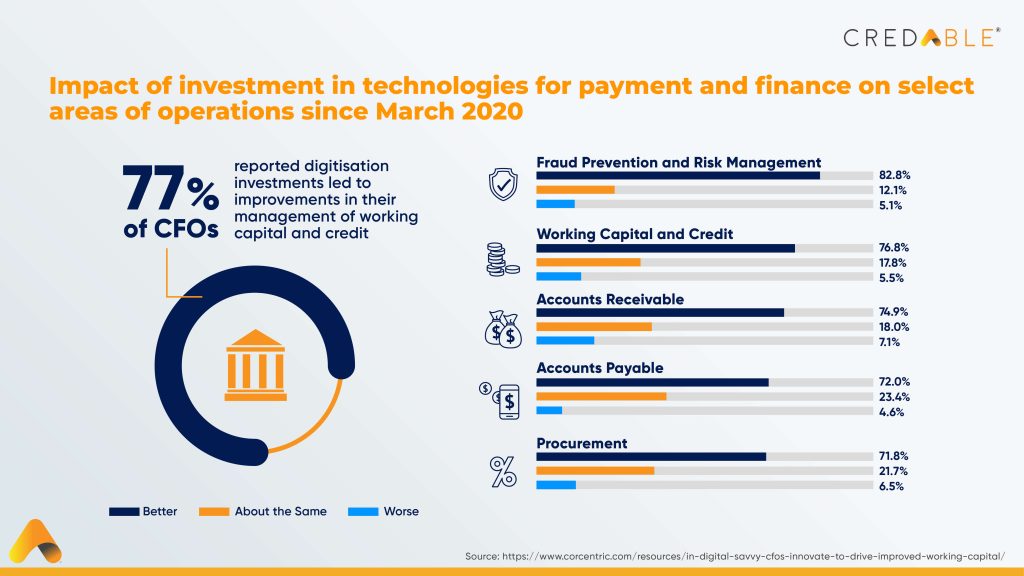

Central to any organisation’s financial and operational health is efficient working capital management. To enable improved working capital performance, businesses need to enhance their processes, operating systems, and technology.

A report by Ernst & Young confirms that optimising working capital performance has a potential cash opportunity of Rs. 5.2 trillion. While businesses in India are looking to fortify their working capital processes and strengthen their cash positions, it’s important to understand the many challenges businesses face in managing working capital. From changing market conditions to regulatory compliance and strained supply chain relations—there are several factors influencing a company’s working capital.

Managing working capital effectively is pivotal to ensure that the company has enough flexibility to fund its short-term expenses and ensure all excess cash is invested strategically. With supply chain instability disrupting operations and increasing the pressure on working capital, we take a look at how CredAble is reviving the business ecosystem and accelerating the shift towards digital solutions.

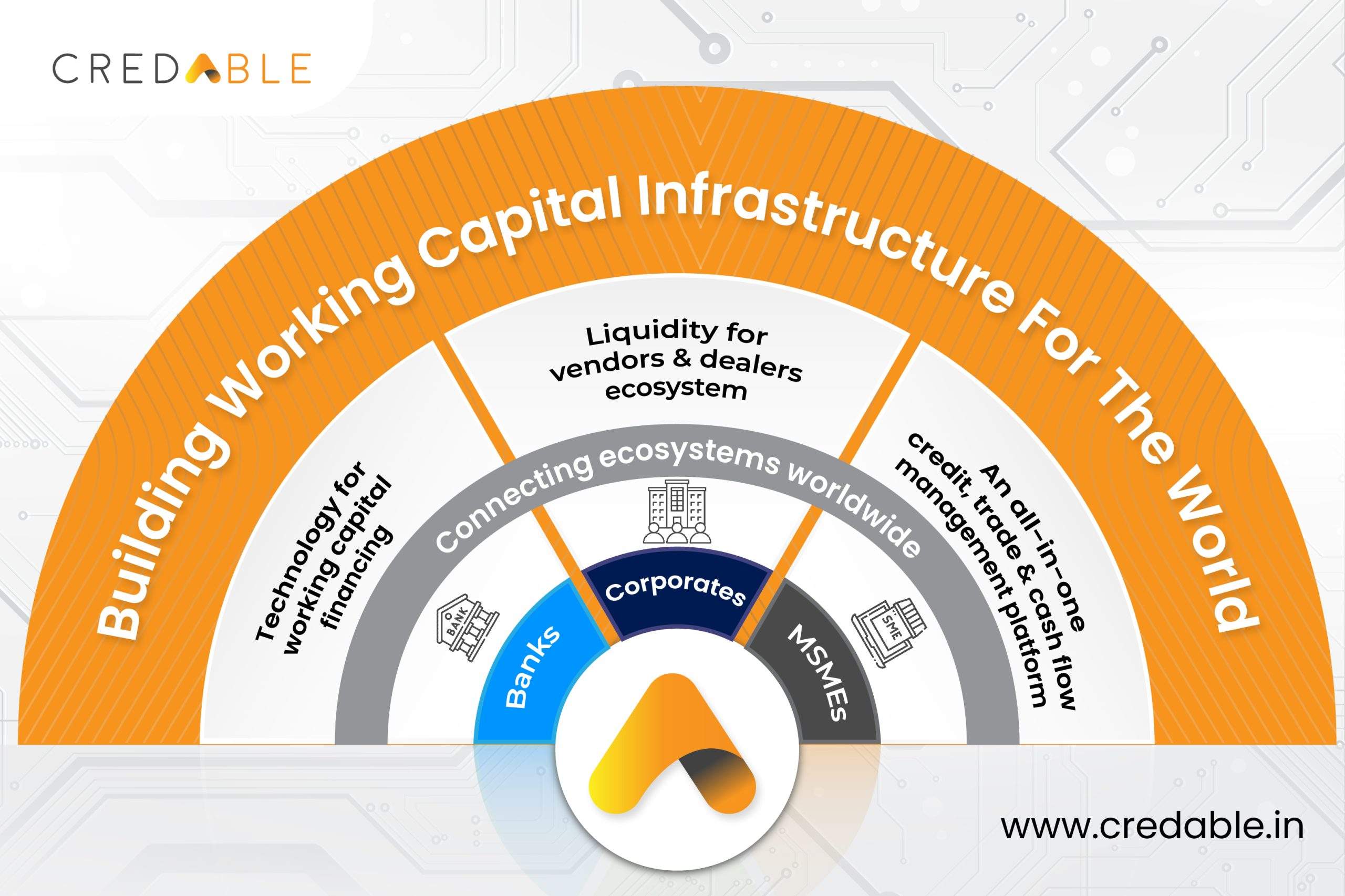

CredAble’s futuristic working capital tech infrastructure

As India’s largest working capital tech platform, CredAble has been instrumental in solving working capital challenges for businesses both big and small.

CredAble’s product proposition is simple—with our integrated platform and 360° tech-enabled solutions suite, we enable liquidity right from the purchase order stage to the post-invoice acceptance stage, catering to every participant in the ecosystem.

With a comprehensive working capital infrastructure that caters to the end-to-end ‘order to cash’ cycle, we help in delivering maximum efficiency and unlocking capital that is locked up for all our stakeholders. Having disbursed more than $5 billion to businesses of all sizes, CredAble adopts a tailored and structured approach to help clients achieve working capital optimisation.

Additionally, businesses in India, especially Micro, Small, and Medium Enterprises (MSMEs), have had to battle with a credit crunch. In recent times, businesses that have made a conscious shift to digital solutions have been able to tackle working capital challenges better and considerably improve their cash-to-cash cycles.

Our award-winning AI-powered technology platform hosts over 100 corporate customers and currently has a borrower base of 2,00,000+ customers. Having built a seamless operating system for working capital where solutions can be leveraged in the form of a plug-and-play mechanism, we are helping businesses actively adopt emerging digital technologies to manage their finances with ease and achieve long-term competitive advantages.

Revolutionising trade operations with disruptive technologies

CredAble’s end-to-end trade finance solutions offer favourable terms of funding regardless of business size or borrowing capacity. With a structured B2B marketplace for trade facilitation and lucrative supply chain financing solutions, we’re helping businesses discover new buyers and suppliers, gain greater visibility of their supply chain capabilities, and reinforce trade relations.

In collaboration with Northern Arc Capital, CredAble recently completed India’s first securitization of a pool of receivable loans under the RBI’s SSA Direction. Furthermore, CredAble’s deep-tier supply chain financing solution helps banks expand their reach and overcome the operational challenges of providing trade finance solutions. Banks can now go beyond serving first-level suppliers and cater to a larger client base.

CredAble’s invoice discounting, export financing, and trade intermediation solutions are helping businesses accelerate their trade operations. Regulatory initiatives like the Account Aggregator (AA) network and the Open Network for Digital Commerce (ONDC) have also been introduced to facilitate trade. CredAble’s market-leading trade finance solutions coupled with these initiatives are helping businesses meet global and domestic trade needs, source vendors, and rise above the competition.

Key FI partnerships

Over the years, we have nurtured strategic FI partnerships that are branched out to over 35 financial institutions. Backed by these marquee partnerships, today, CredAble is at the forefront of shaping the future of working capital management and trade finance.

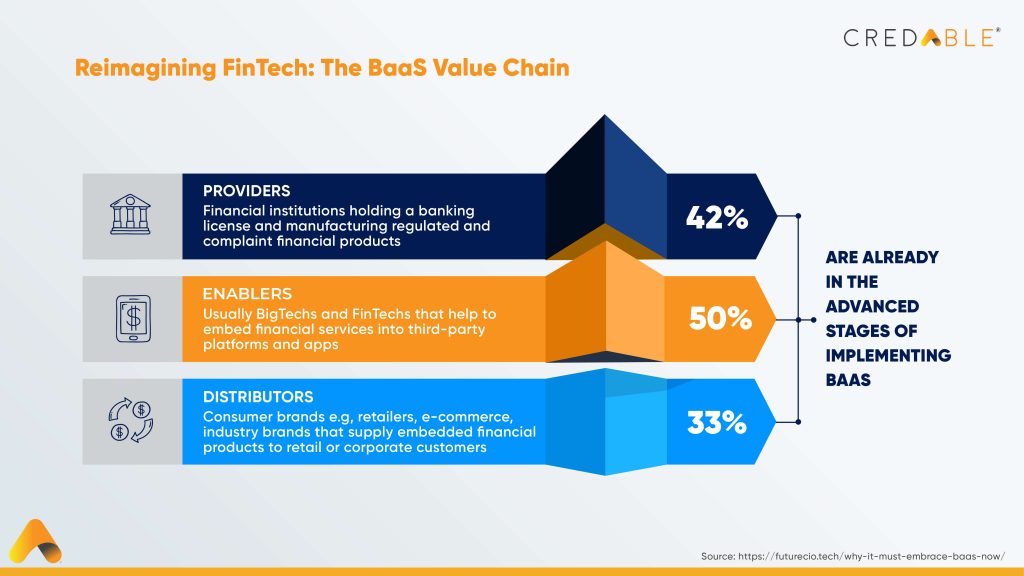

Our comprehensive Banking-as-a-Service (BaaS) tech stack offerings are already powering leading banks, financial institutions, and emerging corporates across the globe. With BaaS transforming the financial services industry, CredAble takes up the role of a technology enabler that is helping embed financial services into third-party platforms and apps.

With embedded financing, CredAble empowers banks to automate the entire loan lifecycle and digitise the banking journey. CredAble’s API-based embedded finance solutions offer multifold benefits, such as:

- Enabling banks that lack the tech prowess to offer next-gen solutions

- Unlocking financing opportunities for merchants on popular digital marketplaces

- Offering delightful experiences to end-customers on the platform of their choice

Enabling last-mile financial inclusion

Despite their prominent role in India’s economy, a large number of MSMEs are yet to be integrated into the formal financial ecosystem. Our partnership with leading financial institutions is helping us fuel greater financial inclusion and offer seamless, secure, and superior digital services to these underserved segments.

By offering an end-to-end digital credit underwriting model and leveraging the Open Credit Enablement Network (OCEN) technology, CredAble is digitising the entire lending process and making affordable credit accessible to a large number of businesses in the country.