Decoding India’s Ambitious $15.2 Billion Semiconductor Plans

Today, semiconductors are powering trillions of dollars of goods and processes.

Poised for a decade of growth, the global semiconductor industry is projected to become a trillion-dollar industry by 2030.

Owing to the rising demand for smart devices, automotive, and other products enhanced by chips, India is also climbing up the ranks to become a major global hub for semiconductor manufacturing. The semiconductor industry is now a focal point of geopolitical competition within the country, as the US, Japan, China, and other nations seek to fortify their domestic chip sectors.

Crucial for manufacturing essential components in our technological landscape, the semiconductor sector has captured headlines in recent times.

Under the ‘Development of Semiconductors and Display Manufacturing Ecosystem’ scheme, the Union Government in India has approved allocating up to $15.2 billion (INR 1.26 trillion) for three semiconductor manufacturing and assembly plants. This also includes the country’s first semiconductor fabrication (fab) plant. This fab facility will be established in the Dholera region of Gujarat and will be set up by the salt-to-software conglomerate Tata Group and Taiwan’s Power Chip. It is estimated that the three new units will directly employ 20,000 individuals, while also generating nearly 60,000 indirect jobs.

With this landmark move, India aims to become self-reliant in the field of semiconductors, reducing the dependence on other countries for chips.

The economics behind India’s power play in the semiconductor business

Working capital expenditures in the semiconductor industry are driven by demand and technological innovation.

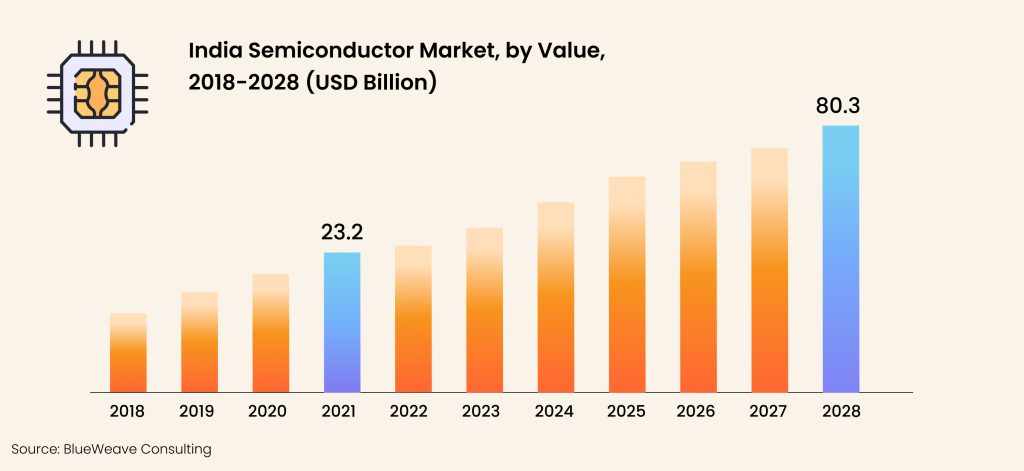

By 2026, the Indian semiconductor market is anticipated to exceed $55 billion, with smartphones & wearables, automotive components, and computing & data storage accounting for over 60% of its growth.

From the perspective of both scale and rising demand for semiconductor components, India is well-positioned to become the second-largest market for semiconductors in the world.

With countries like the U.S., China, and Japan investing heavily in developing domestic capabilities, India too is ramping up its plans and expanding operations to capture the increasing opportunities along the entire semiconductor value chain.

India’s $10 billion chipmaking incentive plan was designed to attract the attention of global chipmakers and display manufacturers. The government wanted to lure international chipmakers into setting up local facilities in the country. The government plans to bear half of the working capital of any approved project. This means that for companies establishing domestic manufacturing projects in India, the government would offer incentives that amount to up to 50% of capital expenditures. These investments from the government highlight the plan to advance the semiconductor industry, increase supply chain resiliency, and promote national security.

The implementation of timely policy reforms and the development of a semiconductor ecosystem within India are poised to reduce dependence on imports in the future.

Chip shortage and the dependence on imports of semiconductors have adversely impacted MSMEs working within the electronic manufacturing industry. With India on its way to ramping up semiconductor manufacturing, the timely incentives and policies will help create a huge ecosystem for ancillary industries and in turn, MSMEs.

The Ministry of Electronics and Information Technology (MeitY) has introduced the Design Linked Incentive (DLI) Scheme to address the challenges faced by the domestic semiconductor design industry. The scheme aims not only to enhance the industry's position in the value chain but also to fortify the semiconductor chip design ecosystem within the nation.

Just a few months back, MeitY disclosed the inclusion of two more MSMEs specialising in semiconductor design under the SemiconIndia Future DESIGN DLI program.

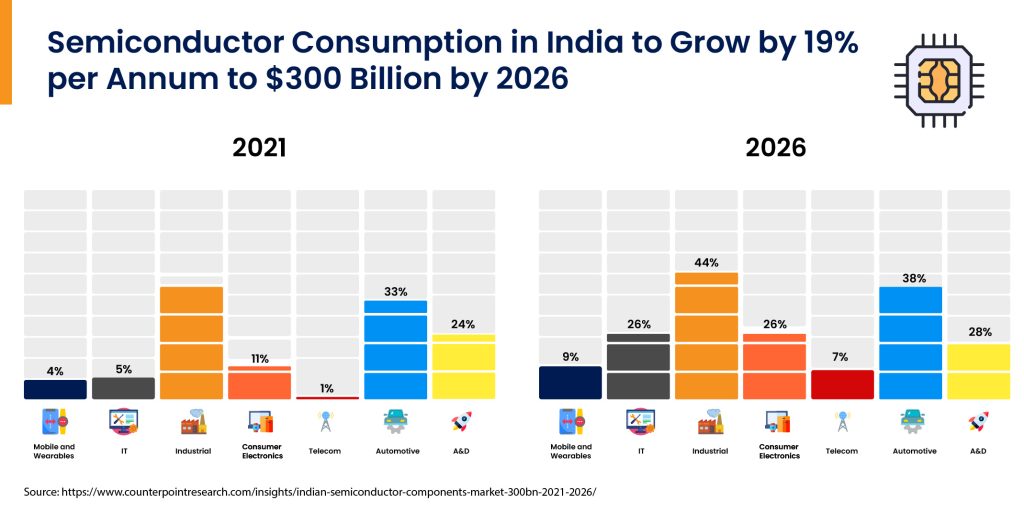

Production Linked Incentive and ‘Make in India’ are some of the key schemes that will further boost the local sourcing of semi-components. According to recent reports, the cumulative revenues of India’s semiconductor component market will climb to $300 billion during 2021-2026. At present—IT, mobile, and wearables, along with industrial segments contribute around 80% of the semiconductor revenues in India.

Industry 4.0 plays an enabling role in the semiconductor value chain

As per recent reports, the Semiconductor Industry Association, representing most of the well-established global chipmakers, is confident that the market is set to bounce back from its 2023 downturn. This will primarily be driven by rising demand for high-priced processors designed for Artificial Intelligence.

Considering how manufacturing is the semiconductor industry’s largest cost driver—it's interesting to see that AI and Machine Learning (ML) use cases will deliver the most value by reducing manufacturing costs, improving yields, and increasing a fab’s overall throughput.

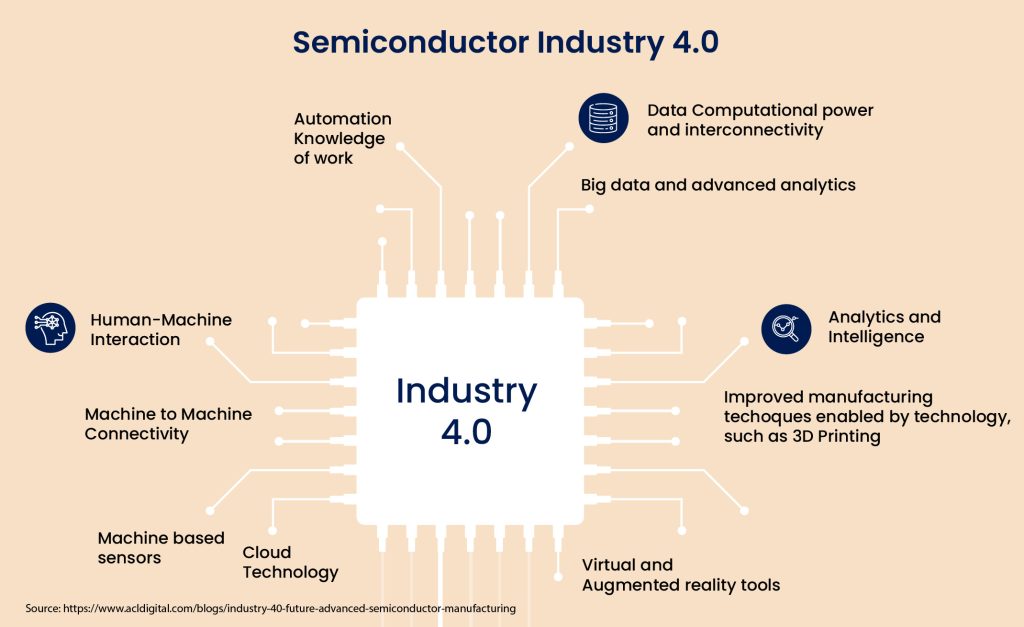

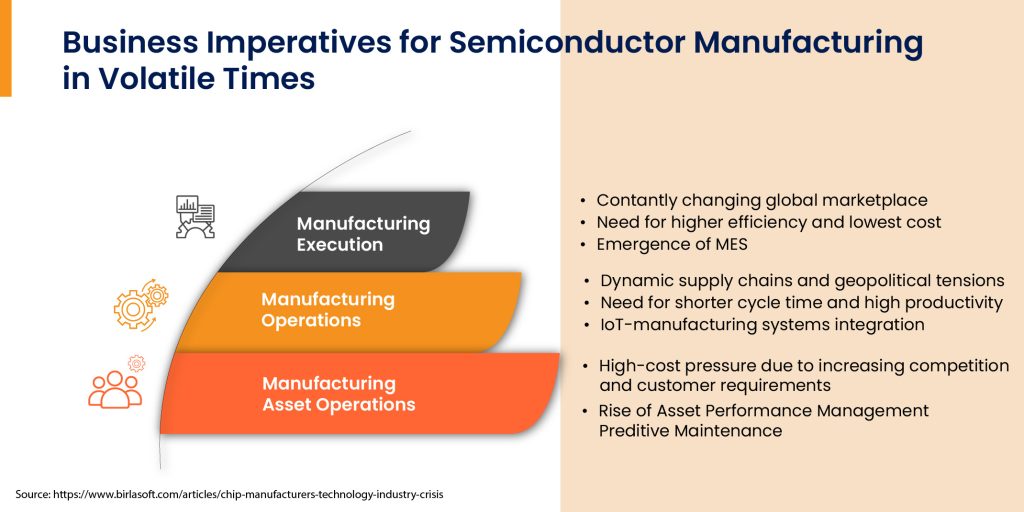

The semiconductor Industry 4.0 is defined by the integration of numerous state-of-the-art technologies, which collaborate to create a unified and interconnected manufacturing environment. Through the utilisation of data-driven decision-making, predictive maintenance strategies, and the adoption of smart factory concepts—semiconductor manufacturers can effectively address rising demand and enhance both customer satisfaction and market penetration.

The promising aspect is that the benefits of Industry 4.0 will extend well beyond the factory floor to the entire supply chain. Through the integration of suppliers, manufacturers, and customers into a unified network, businesses can streamline logistics, minimise lead times, and adapt promptly to fluctuations in demand and supply chain financing requirements. Such enhanced agility is essential in today's fast-paced business landscape.

Discover Solutions for Building Resilient Supply ChainsLooking ahead

Despite past setbacks, including the collapse of high-profile partnerships, India remains steadfast in its journey to achieving semiconductor self-sufficiency.

This involves establishing a reliant and robust supply chain that will not get disrupted.

India’s goal to establish itself as a semiconductor manufacturing hub includes drawing the attention of overseas chipmakers’ investments, in turn saving on high import costs while also bolstering the local smartphone manufacturing industry.

Ensuring a continued focus on growth drivers in the emerging technology space is imperative to empower semiconductor companies to create a more resilient future.

Similarly, with sufficient working capital financing, firms can invest in research and development, expand their manufacturing capabilities, and strengthen their supply chains. This financial support will enable companies in India to pursue their ambitions of semiconductor self-sufficiency with greater confidence and agility, ultimately contributing to the growth and resilience of the industry as a whole.

Think Working Capital… Think CredAble!