Driving Vertical SaaS Success: The Embedded Finance Opportunity for Banks & Fintechs

Software as a Service (SaaS) business models have evolved at an incredible pace over the last few decades. The changes in end-user behavior coupled with technological advances have paved the way for new and larger opportunities.

In recent years, we have witnessed how technology has the transformative power to solve multiple needs within a single platform. As a result, industry-

specific software, popularly known as vertical SaaS has emerged, offering tailored solutions meticulously crafted for specific industry needs.

Owing to the breathtaking pace at which FinTechs are capturing market share, they are now driving the next phase of evolution in vertical SaaS. Leveraging the advanced technology suite of FinTech companies, SaaS businesses are taking the multi-product route and embedding financial services alongside their core product.

Vertical SaaS companies are winning the 40%+ market share because of their relentless focus on the end-user, while their horizontal software counterparts struggle to get to 20% market share.

The sheer velocity of vertical SaaS growth signals a major shift in the financial services industry, one that forward-thinking banks and FinTechs should not overlook.

In this blog post, we’ll first touch upon how vertical SaaS is addressing Small and Medium-sized Businesses' (SMBs) pain points with customised financial services. We will then delve into how FinTechs and banks can make the most of this opportunity.

Vertical SaaS and SMBs: Poised for embedded financial services

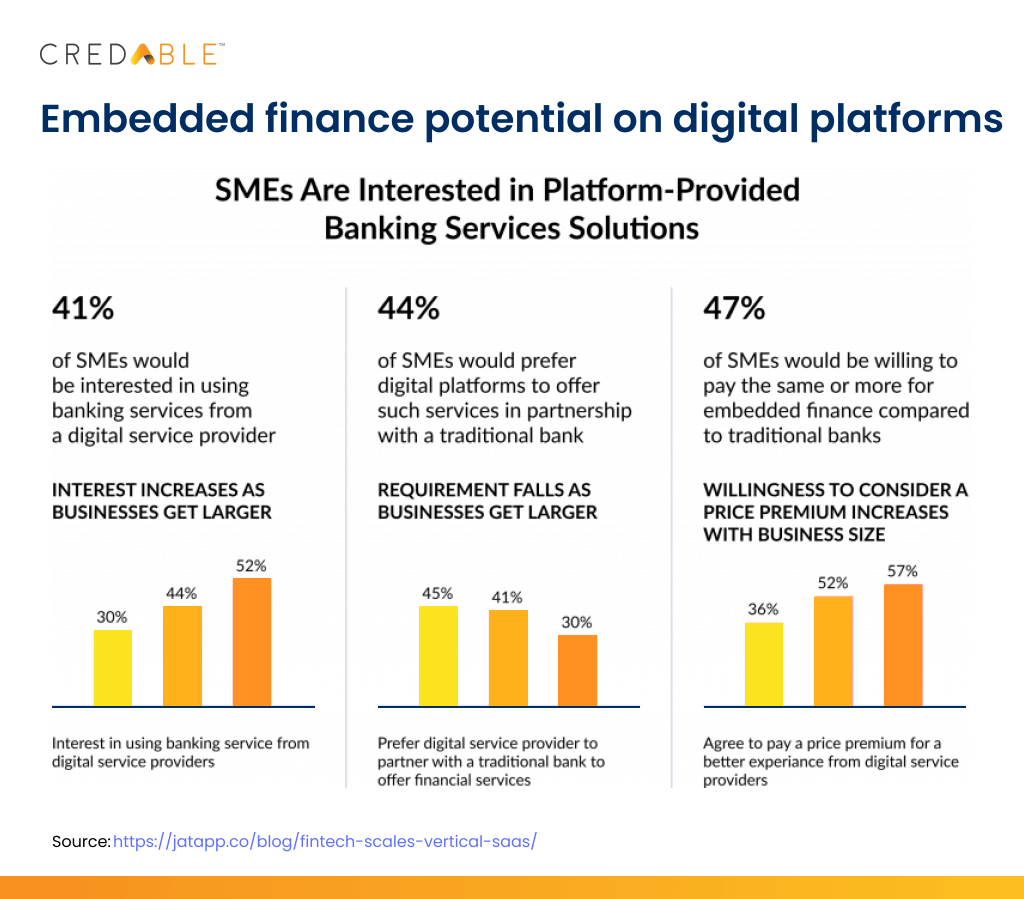

Next-generation vertical SaaS players are developing deep expertise in niches such as financial services, real estate, and healthcare. These software companies are hyper-focused on addressing the pain points of underserved segments such as SMBs.

Small businesses with limited resources, often find it hard to keep up with changing regulations, complex sales processes, and business operations. By offering native industry-specific integrations that don’t need engineering effort, vertical SaaS companies are helping SMBs digitise their workflows and improve operational efficiencies significantly.

SMBs extensively integrate with vertical SaaS platforms to streamline operations. This deep integration combined with the digitisation of workflows becomes a rich source of data, facilitating the delivery of tailored financial solutions such as payments, credit score checks, loans, and payroll services.

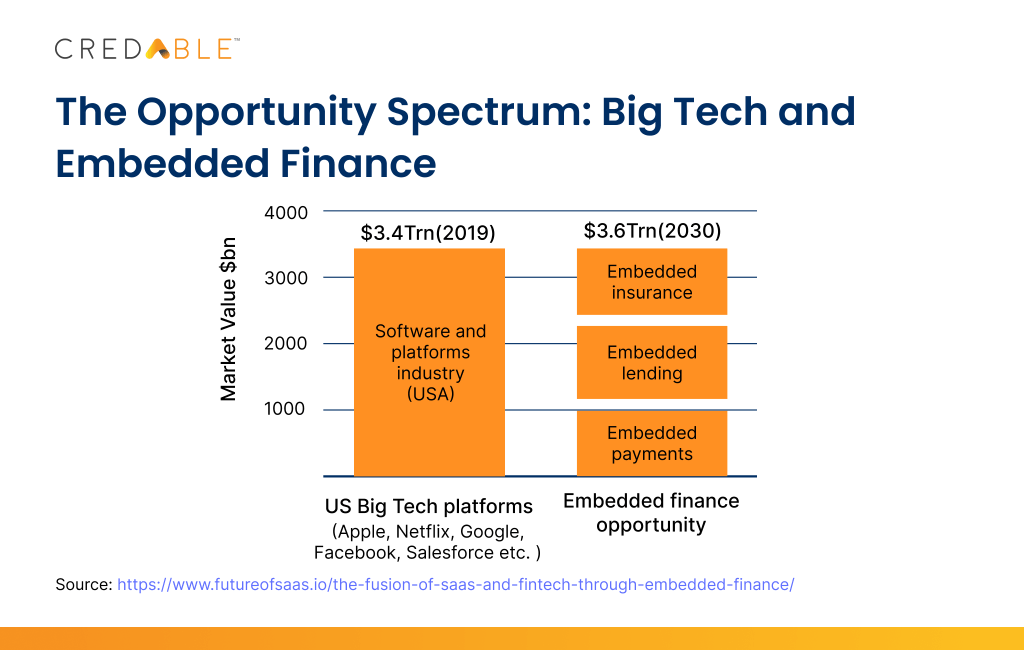

Embedded finance has paved the path for software companies to integrate financial products into their ecosystems. Ranging from payments to lending, insurance, and cards—the embedded finance market by 2030, will exceed the market size of the big tech platforms.

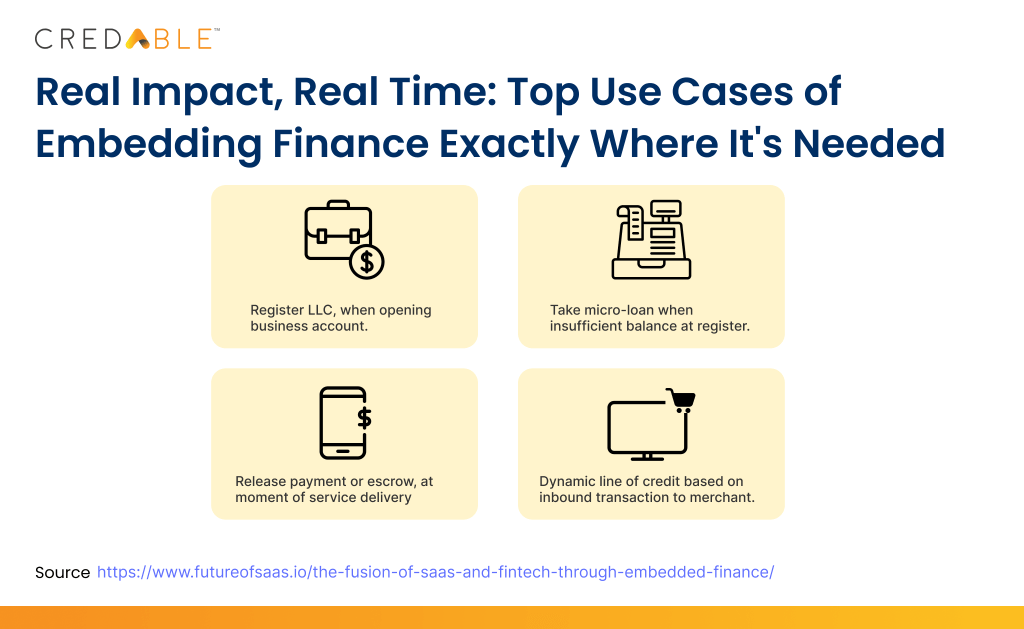

With embedded finance coming into the picture, vertical SaaS platforms not only have an extra app functionality, but they can back their SMB clients with contextual financial services in the day-to-day flow of work.

FinTech's role in amplifying vertical SaaS growth

Embedded finance presents a holy grail for FinTechs to unlock ecosystem opportunities. Many FinTech players have risen to the occasion. They are looking to embed financial journeys at the points of need on SaaS platforms and other marketplaces. By building and distributing need-based digital financial solutions, FinTechs are democratizing financial services and addressing credit gaps in a more cohesive, integrated, and user-centric way.

How does this benefit the SMBs?

Vertical SaaS players that embed financial products at the point of need, offer greater convenience for the SMB segment. SMBs can now accept payments on the same platform they use to run their business, without ever interacting with a bank or third-party PayFac.

How does this benefit the vertical SaaS companies?

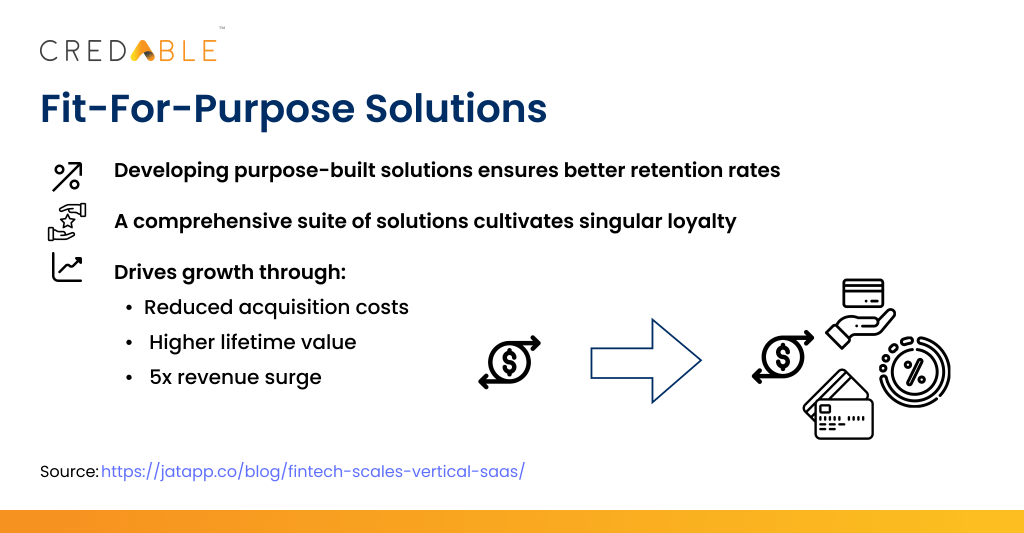

SMBs rely on SaaS companies to streamline, automate, and speed up their end-to-end operations. Embedding out-of-the-box financial services empowers SMBs to easily process payments, apply for loans, or pay taxes without ever leaving the SaaS ecosystem. Moreover, offering financial solutions such as payments to SMBs has become a monetization channel for vertical SaaS players. For SaaS companies, the revenue from processing payments is a plus, especially since acquiring a user who pays a monthly subscription takes time. Vertical SaaS players also end up reducing churn with customers starting to rely more on their “all-in-one” solution.

How banks can thrive with BaaS

Banks are no longer limited by their traditional distribution models. To make the most of the vertical SaaS opportunity, we now see banks embracing the Banking as a Service model (BaaS) which allows them to embed banking solutions into the value chain of ecosystem partners, tap into micro-segments, and increase the share of new-to-bank customers.

FinTechs like CredAble offer BaaS solutions that help banks unlock new financing opportunities by tapping into SaaS platforms and other digital marketplaces—in turn, making highly regulated banking products easily and securely accessible to a growing base of end-users through APIs.

Think Working Capital… Think CredAble!