Elevating Transaction Banking: Unleashing Embedded Finance and Technology’s Power

Collaborating with FinTechs emerges as a pivotal strategy for guiding banks through the evolving digital realm. However, the influx of FinTech entrants into the cash and trade sector introduces intricacies in selecting the right partner and discerning impactful innovations.

In this article, we look at how technology has accelerated the evolution of transaction banking and the new revenue opportunities that are emerging.

Navigating the Digital Frontier of Transaction Banking

The realm of transaction banking, encompassing diverse services like payments, cash management, and trade finance, is undergoing a seismic digital shift. Traditional transaction methods, such as manual checks and wire transfers, are being eclipsed by automated processes, yielding benefits like swifter payments, reduced costs, and heightened financial transparency.

This transformation, while promising enhanced efficiency, presents novel challenges, particularly the demand for an elevated user experience that remains seamless across the digital spectrum.

Transformative Technology: Paving the Way for Transaction Excellence

Revolutionizing the transaction banking user experience through cutting-edge technology unfolds across multiple dimensions:

1. Automating Efficiency: The integration of technology enables banks to automate labor-intensive tasks like payment processing and account reconciliation, driving operational efficiency and reducing error margins.

2. Informed Decision-Making: By furnishing real-time data and insights, banks empower businesses with the tools to make astute financial decisions, thus refining financial management strategies.

3. Personalization for Impact: Tailored offerings, customized to businesses' distinct needs, foster deeper engagement and stronger customer relationships.

4. A Seamless Business Ecosystem: Secure and reliable payment platforms pave the way for frictionless B2B transactions, bolstering collaborative business endeavors.

Embedded Finance: Catalyst for a Paradigm Shift

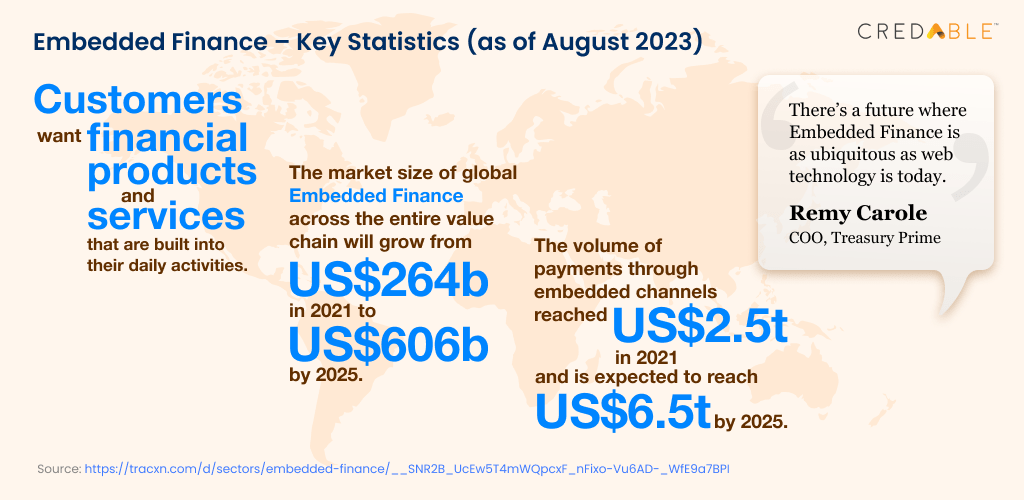

Embedded Finance, a revolutionary innovation, allows banks to seamlessly offer financial services within their digital channels. This paradigm shift holds transformative potential for transaction banking experiences:

1. Streamlined Accessibility: Embedded Finance simplifies access to financial services, allowing businesses to seamlessly explore and apply for offerings within the bank's digital domain.

2. Tailored Engagements: Businesses are poised to experience personalized financial interactions, tailored precisely to their specific needs.

3. Effortless Financial Management: By reducing the time and effort required for financial management, Embedded Finance enhances operational efficiency.

4. Enhanced Security: Embedded Finance bolsters the security framework surrounding financial transactions, fostering trust and reliability.

Revenue Augmentation through Embedded Finance

Embedded Finance's impact transcends user experience enhancement, extending its reach to bolstering banks' revenue streams:

1. Fee-Driven Opportunities: Banks can monetize embedded financial products and services by implementing user fees, fostering revenue diversification.

2. Cross-Sell Advantages: Embedded Finance opens avenues for cross-selling supplementary financial services to businesses embracing this innovative platform.

3. Insights-Driven Innovation: Transaction data generated through Embedded Finance transactions serves as a wellspring of insights to inform the creation of novel products and services, amplifying revenue avenues.

Selecting the Right Technology Ally

The triumphant integration of Embedded Finance hinges on the selection of a technology partner boasting critical attributes:

1. Industry Expertise: The chosen partner must exhibit a profound comprehension of the intricacies of the banking sector.

2. Proven Track Record: A demonstrable history of delivering effective Embedded Finance solutions is imperative.

3. Scalability and Security: A robust technology infrastructure, characterized by scalability and security features, is non-negotiable.

4. User-Centric Focus: A strong commitment to delivering unparalleled user experiences is vital.

Forging the Future with Embedded Finance and Tech Transformation

The trajectory of transaction banking is undergoing a monumental shift, powered by technology and Embedded Finance.

Collaborating with FinTechs has emerged as a pivotal strategy for guiding banks through the evolving digital terrain. Yet, the influx of FinTechs venturing into the cash and trade sector can render the process of selecting an appropriate partner and identifying truly valuable innovations a multifaceted challenge.

At CredAble, we have built the right platforms for banks to offer Embedded Financial solutions to their Corporate and SME customers. If you’re curious about our solutions and want to know how we can help, get in touch with us from here.

Think Working Capital… Think CredAble!