Financial Strategies & Cash Flow Management for MSME Resilience

In recent years, purpose driven MSMEs (Micro, Small, and Medium Enterprises) have emerged as key players in shaping national economies and driving inclusive growth, particularly during challenging times.

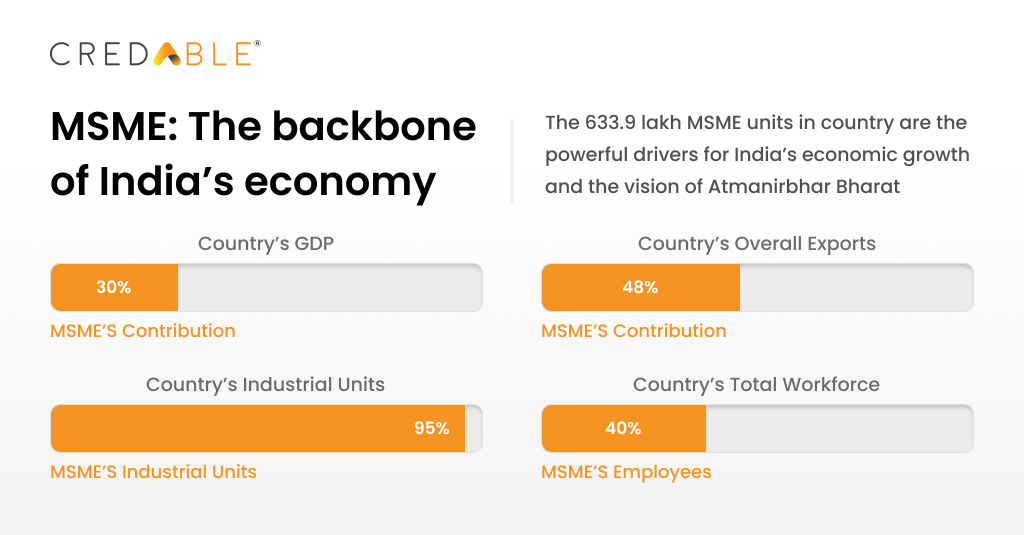

Statistics reveal the significant role played by MSMEs in employment and GDP worldwide, including India.

In the South Asia region, MSMEs employ nearly 85% of all workers in the private sector, while in the East Asia and Pacific region, that number rises to 89%.

Additionally, MSMEs contribute to innovation and sustainability, accounting for 90% of all businesses, over 60% of employment, and 50% of GDP globally.

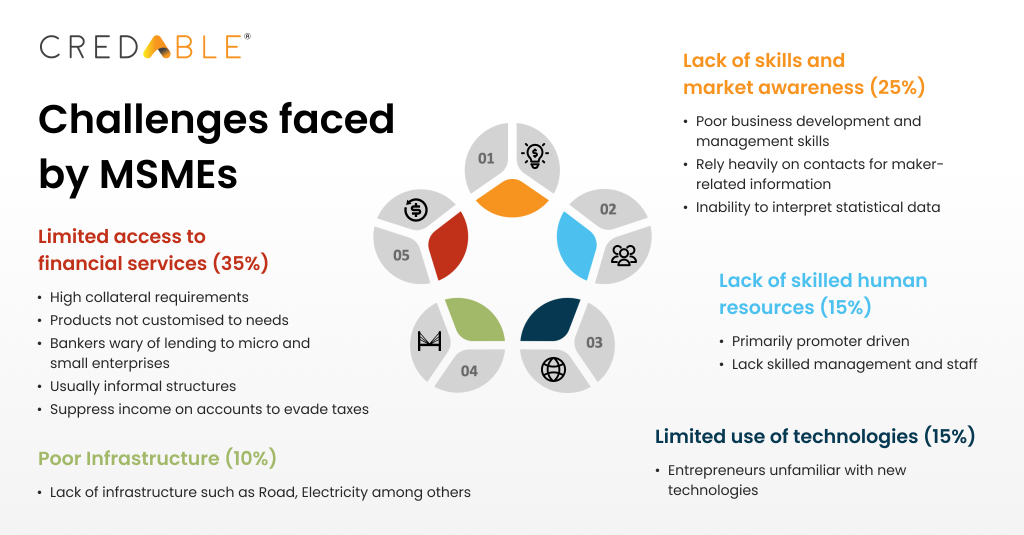

Despite their vital contribution, MSMEs face persistent obstacles, with timely access to finance being a perennial constraint to their growth and expansion. It is considered the second most cited obstacle hampering MSME growth in developing countries and emerging markets. According to the International Finance Corporation (IFC), there is an unmet financing need of $5.2 trillion annually for 65 million MSMEs in developing countries, which is 1.4 times the current level of MSME lending available worldwide.

The informal nature of MSME operations and their lack of proper financial records pose challenges in obtaining formal financing from conventional sources such as banks.

Conversely, banks struggle with credit risk assessments due to the absence of historical cash flow data and financial records for MSMEs. Consequently, MSMEs are unable to explore growth opportunities, contribute to the structural transformation of economies, and address the global employment challenge of creating 600 million jobs by 2030.

One of the key factors for MSME stability and resilience in the face of economic uncertainties lies in effective cash flow management and liquidity forecasting. Shockingly, poor cash flow management is cited as one of the top five challenges faced by small businesses, and 82% of business failures can be attributed to this issue.

Cash flow Optimization: A powerful financial strategy

Therefore, it is crucial to shift the perception of cash flow forecasting from being solely a treasury-specific task or limited to financially struggling companies. Instead, it should be integrated into the larger financial planning and analysis framework of MSMEs, incorporating insights from operational stakeholders to enhance the analytical process.

Studies show that small businesses that monitor cash flow on a monthly basis have an 80% survival rate. By building a strong foundation of liquidity management using cash flow forecasting tools, MSMEs can better understand the impact of different scenarios on their liquidity. This allows for scenario-building, enabling accelerated decision-making and increased confidence in uncertain economic climates.

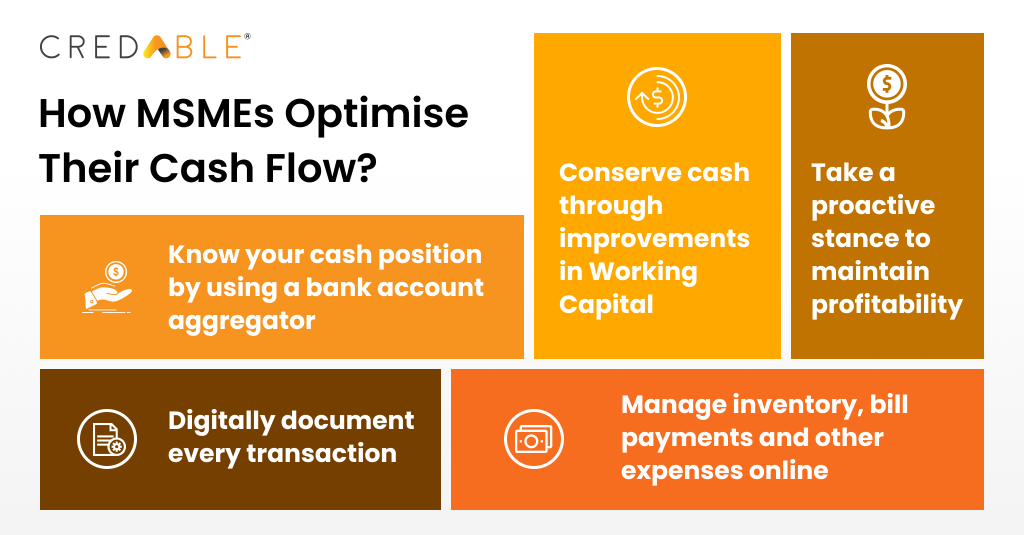

How to optimize cash flow?

Information is key. When you’ve all the information in one single dashboard, it is easier & faster to make an informed decision.

Effective cash flow forecasting requires clear communication of purpose and accountability across functional silos. It is essential to understand the impact of liquidity on both upside and downside scenarios, fine-tune capital allocations to pursue immediate goals while maintaining the long-term vision and determine how operational drivers affect cash flow. By establishing clear goals and a regular cadence, MSMEs can drive purpose and optimize liquidity.

Bridging the credit gap

Today, banks need to go beyond what’s traditionally expected of them to remain relevant and profitable. It’s time for them to rethink their business models.

To address untapped markets, banks need to move away from their product-centric constraints and approach trade finance with a client-centric perspective.

The role of technology

Technological interventions play a pivotal role in helping MSMEs manage their cash flows successfully. Planning ahead and preventing cash crunches are made possible through the adoption of digital tools.

Digital technology has significantly improved the affordability and accessibility of financial services for previously underbanked and unbanked MSMEs. Cash-flow-based lending has become instrumental in meeting the financing needs of MSMEs that do not meet the asset-backed lending criteria.

FinTech partnerships will lead the way

Collaborative strategies between banks and FinTechs (Financial Technology companies) are expected to develop productive ways to serve MSMEs. A combination of traditional credit facilities from banks and NBFCs (Non-Banking Financial Companies) and innovative financing solutions from FinTechs will be critical for MSMEs to access new markets and build their resilience.

Strengthening these strategic alliances will yield positive results, as evidenced by the increased credit penetration and the doubling of quarterly MSME disbursements over the past two years.

How digital lending is strengthening the need for cash flow optimization?

The shift towards digital lending is accelerating, and by 2030, it is projected to become a $1.3 Trillion market, accounting for 60% of the total Indian FinTech sector. FinTech companies like CredAble are implementing data-backed underwriting tools, cash flow-based assessments, and alternative credit scoring mechanisms to provide MSMEs with easy access to affordable short-term capital.

For example, to further empower MSMEs in managing cash flows and meeting their working capital requirements, UpScale by CredAble, a business growth app for MSMEs exclusively, offers an all-in-one credit, trade, and cash flow management app. This AI-powered technological solution provides SMEs with greater visibility and control over their cash flow.

Government policies should also incorporate holistic planning for areas that indirectly impact MSMEs and integrate resilience budgeting to effectively mitigate the impact of future economic shocks.

In conclusion, by adopting transformative approaches to cash flow management, exploring alternative funding sources, leveraging technological advancements, and

fostering collaborative partnerships, MSMEs can enhance their resilience, drive long-term success, and contribute to economic growth and job creation.