Financing the Future: How FinTechs Are Accelerating India’s Electric Vehicle Revolution

Governments across the globe are stepping up their fight against climate change and seeking cleaner energy alternatives. Consequently, the seismic transition toward Electric Vehicles (EVs) and associated assets, such as charging stations, has reached a tipping point.

The public acceptance of EVs, though once uncertain, will continue to grow as consumers are more than ever inclined to environmentally-friendly transport options.

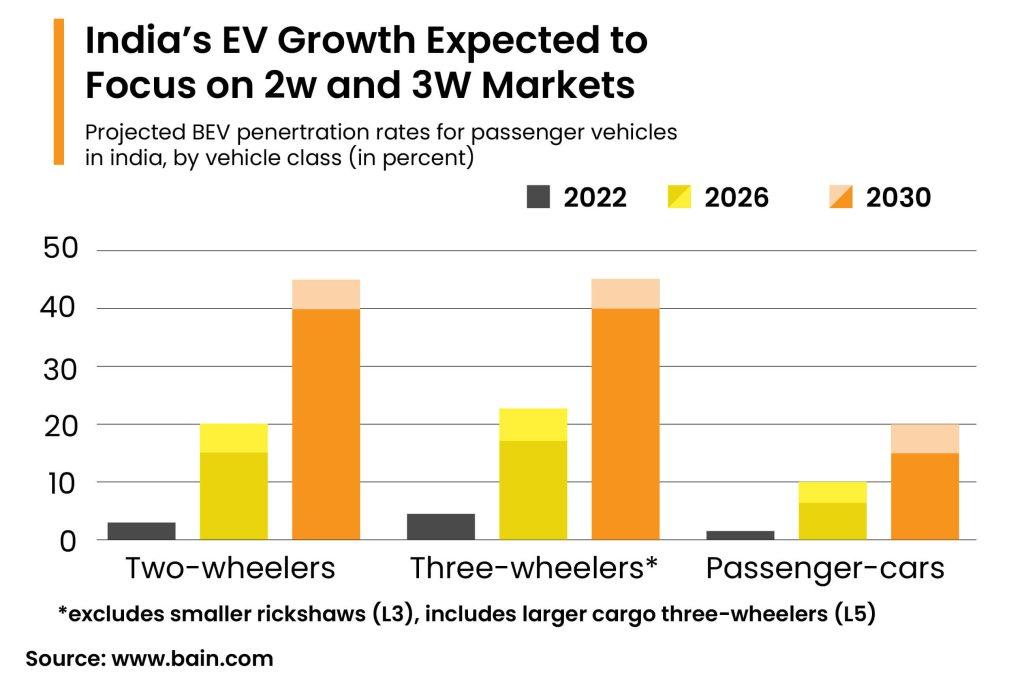

India is at the forefront of embracing the electric vehicle revolution. According to McKinsey, a significant 70% of top-tier Indian car buyers express openness to choosing an electric vehicle for their upcoming purchase, surpassing the current global average of 52%.

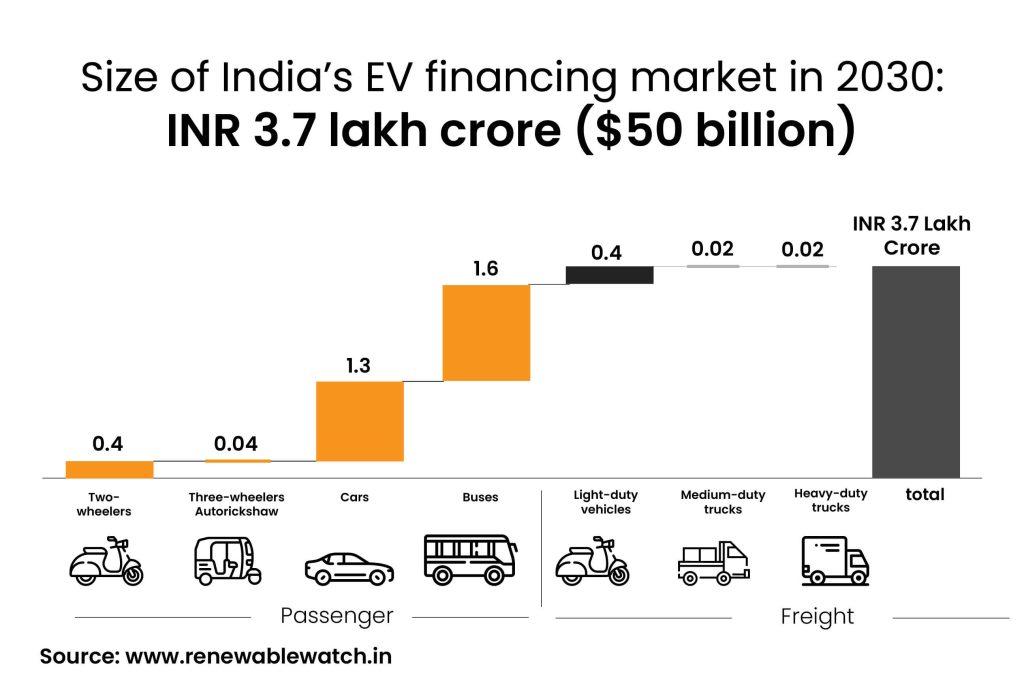

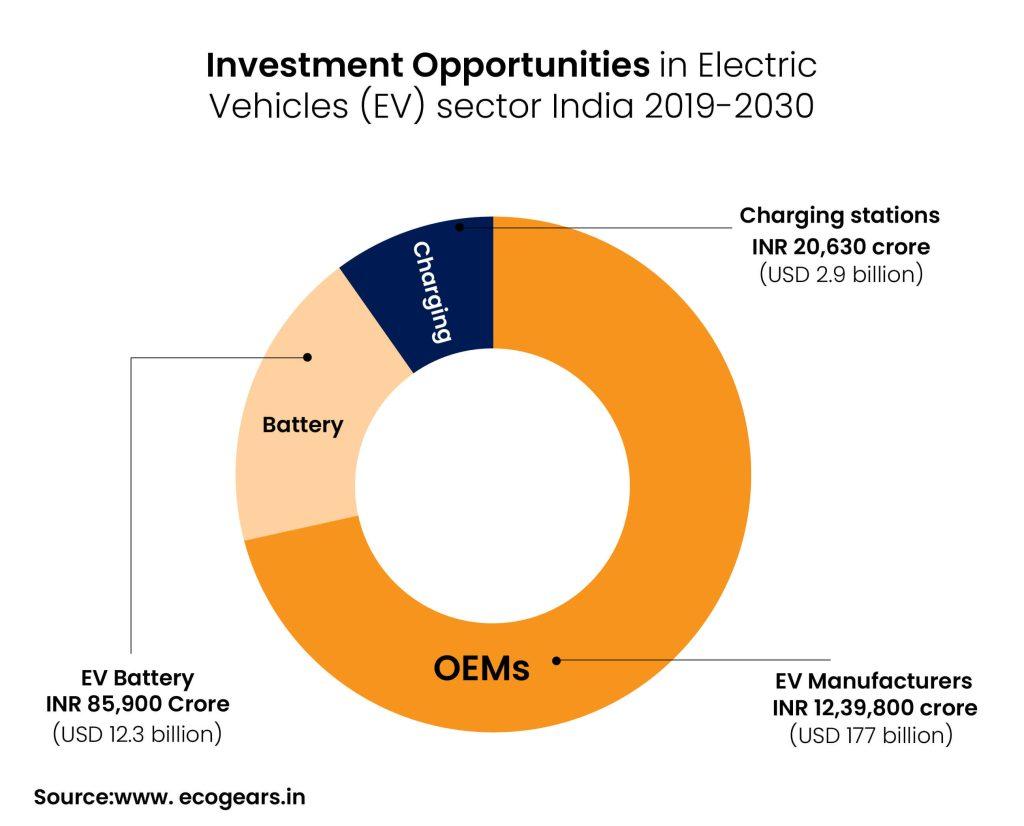

Between 2020 and 2030, India's ambitious electric vehicle transition may demand a substantial cumulative investment, estimated at INR 19.7 lakh crore ($US 266 billion). This simply means that there is a critical need for increased liquidity and a more cost-effective working capital structure to drive the development of EV assets and infrastructure in the country.

It’s interesting to see that even with the ongoing dominance of traditional petrol and diesel vehicles, EVs have topped the charts as a much-needed solution to reduce greenhouse gas emissions and combat air pollution.

The growing appetite for EVs is redefining the automotive retail journey

The EV supply chain grapples with challenges tied to its fragmented structure, numerous small suppliers, and the heightened expenses associated with obtaining critical raw materials. Despite these supply chain hurdles, EV sales in India have clocked a 50% year-on-year (YoY) growth with a record 1.5 million units sold in 2023. Leading car manufacturers are setting the stage with the likes of Volvo, General Motors, Mercedes, Ford, and Jaguar Land Rover publicly committing to introducing an entirely zero-emissions light-duty vehicle fleet by 2035 and 2040 in leading markets.

As the transition to EVs gains momentum, we now see a significant transformation in the dynamics of the car-buying and selling landscape with consumers opting for a digital car-purchasing journey.

Financing options for environmentally friendly vehicles and types of equipment present a lucrative opportunity for lenders capable of meeting this demand.

In response to the widespread acceptance of EVs in the country, Non-Banking Financial Companies (NBFCs) and FinTech firms are venturing into the space of bulk financing options for EV manufacturers and suppliers as well as for equipment financing such as charging infrastructure.

Are banks holding back from venturing into the EV financing space?

Financing for the EV space demands funds on various fronts, beginning with the manufacturing of EV vehicles, extending to batteries, and the establishment of charging infrastructure. The government has taken a strong stand with favourable measures to promote the adoption of EVs such as the introduction of The Faster Adoption and Manufacturing of Hybrid & Electric Vehicles (FAME) scheme. Despite the demand and strong government push for EVs, financial institutions have remained hesitant to take the lead in the EV financing space.

Banks are cautious about financing EVs owing to product risk in addition to the general credit risk. Much of the lenders' apprehensions are driven by the nascent stage of the EV sector and the lack of stability.

The complex nature of EV technology, especially the nuances surrounding batteries, presents another set of challenges for banks in underwriting EV loans. This lack of familiarity acts as a deterrent to financial institutions, impeding their entry into the EV financing domain.

FinTechs take the lead in transforming EV financing

The EV wave has ushered in a new league of green-friendly automotive assets and FinTech startups are latching on to this opportunity. FinTechs are taking a bold leap forward in EV financing by offering solutions that facilitate the easy transition to EVs and support the rising demand.

What FinTechs bring to the EV financing landscape is—speed, ease, and seamless access to working capital financing. Specialised financing options are much needed for the manufacture and supply of EVs as well as the development of adequate EV infrastructure across the country.

Navigating EV supply chain complexities: The FinTech advantagec

According to reports, India requires an annual investment of INR 11 lakh crores (USD 170 billion) of green finance to fulfill its Nationally Determined Contributions—focusing on clean energy, clean transport, and energy efficiency.

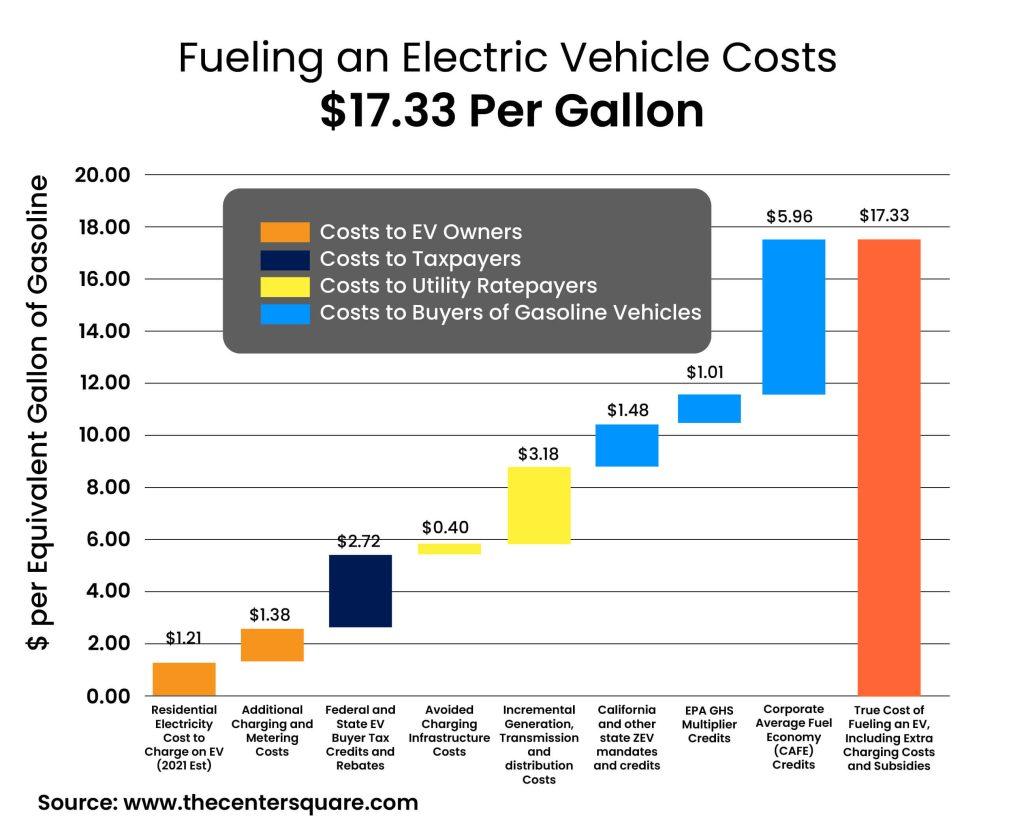

The high manufacturing costs of EVs present a substantial challenge. One of the paramount aspects of the EV supply chains is the procurement of essential components and raw materials, specifically lithium, cobalt, and nickel, all of which are integral to the production of lithium-ion batteries. The surging costs of raw materials, particularly lithium, have led to an increase in the overall expenses of electric vehicles. Given that the battery represents 50% of the total cost of an EV, exploring domestic sources for lithium mining and supply is viewed as a potential strategy to reduce EV production costs by 8-15%.

To combat these challenges, FinTechs are stepping in to offer working capital financing options tailored to the EV sector. With tech-enabled solutions, FinTechs are helping manufacturers overcome financial constraints and facilitate smoother operations within the complex supply chain.

Moreover, the presence of numerous small suppliers contributing diverse components within the EV supply chains further adds to its fragmented nature. Implementing deep-tier supply chain financing solutions can effectively address the needs of underserved suppliers across multiple tiers, fostering a more cohesive and resilient supply chain.

By offering need-based financing solutions, FinTechs are able to streamline transactions, optimise cash flow, and foster collaboration among suppliers, thus mitigating the strains imposed by the fragmented nature of the supply chain.

FinTechs pave the way for a sustainable future

In recent times, we have witnessed the rise of strategic collaborations between EV Original Equipment Manufacturers (OEMs) and digital lenders. FinTechs are developing partnerships with insurance providers and entering into key tie-ups with battery manufacturers to finance replacement batteries.

To align with the government of India's ambitious targets for electric vehicle adoption, an estimated investment of USD 177 billion is anticipated for the production of electric vehicles.

Considering the rising adoption of electric vehicles in India, the financial landscape is gearing up to support this emerging technology. Banks, NBFCs, and FinTechs are now joining forces to provide tailored financing options, in a bid to meet the costs associated with manufacturing EVs.

FinTechs with their tech-driven approaches and tailored financing features are setting new standards in the EV industry. Backed by timely measures from the government and innovative FinTech solutions, we're edging closer to embracing electric mobility widely and creating a cleaner and more sustainable future for India.

Think Working Capital… Think CredAble!