How Corporates Can Empower their MSME Suppliers with Anchor-Led Supply Chain Financing

The complexity and cost of trade finance have presented challenges even before the disruptions caused by the pandemic and the more recent geopolitical tensions.

Tighter regulatory compliance and long payment cycles have only added further cost pressures.

For Micro, Small, and Medium Enterprises (MSMEs) in India, the limited access to credit hampers their capacity to expand production and fulfil orders quickly, resulting in delays that disrupt corporate delivery schedules. This inefficiency undermines supply chain performance, affecting corporates' inventory management and overall value chain effectiveness.

Against this backdrop, 70% of businesses in Asia are keen on addressing the payment challenges arising from Business-to-Business (B2B) trade.

Facilitating timely trade finance is pivotal in advancing corporates and their network of MSME suppliers towards achieving 60% of the challenging $2 trillion export target by 2030.

The good news is that a transformation in trade finance is already underway, driven by advanced working capital financing technology and bringing much-needed liquidity to the credit-strapped MSME sector.

Anchor-led supply chain financing, in particular, is a promising solution to plug the working capital gap between corporates and MSMEs. Before we dive into how anchor-led supply chain financing is adding immediate value to global trade networks, let’s first look at the current trade financing landscape.

The current state of affairs

The global supply chain finance market is expected to grow to $8.86 billion by 2027.

Owing to the rising complexity of trade finance transactions, sophisticated tech-enabled working capital financing solutions are coming to the forefront to eliminate much of the manual work and risks that are involved.

MSME suppliers typically have to wait up to 30 to 90 days, and in some cases, even up to 6 months, for corporate buyers to pay for the goods delivered. While the MSME 45-day payment rule is expected to ensure timely payments, small businesses continue to bear the brunt of long cash conversion cycles.

As a result, increasing access to alternative sources of short-term financing for MSMEs is critical. What’s promising is that, as per a survey by Accenture, 90% of businesses are now open to considering innovative trade finance products and services. This will be a boon to the corporates and their ecosystem of MSME suppliers in India.

Anchor-led supply chain financing has emerged as a viable solution to this credit problem, empowering MSME suppliers to finance their production cycle and ensure uninterrupted supply chain operations.

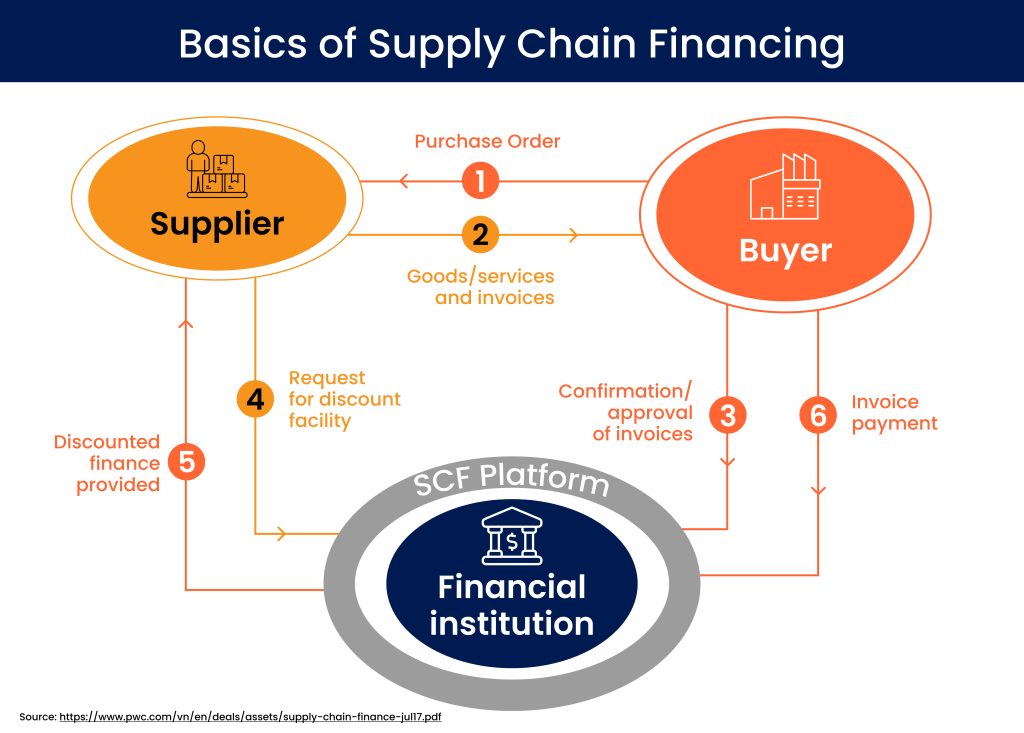

How does anchor-led supply chain financing work?

Anchor-led supply chain financing benefits both the large corporate entity (the anchor) and its network of MSME suppliers simultaneously.

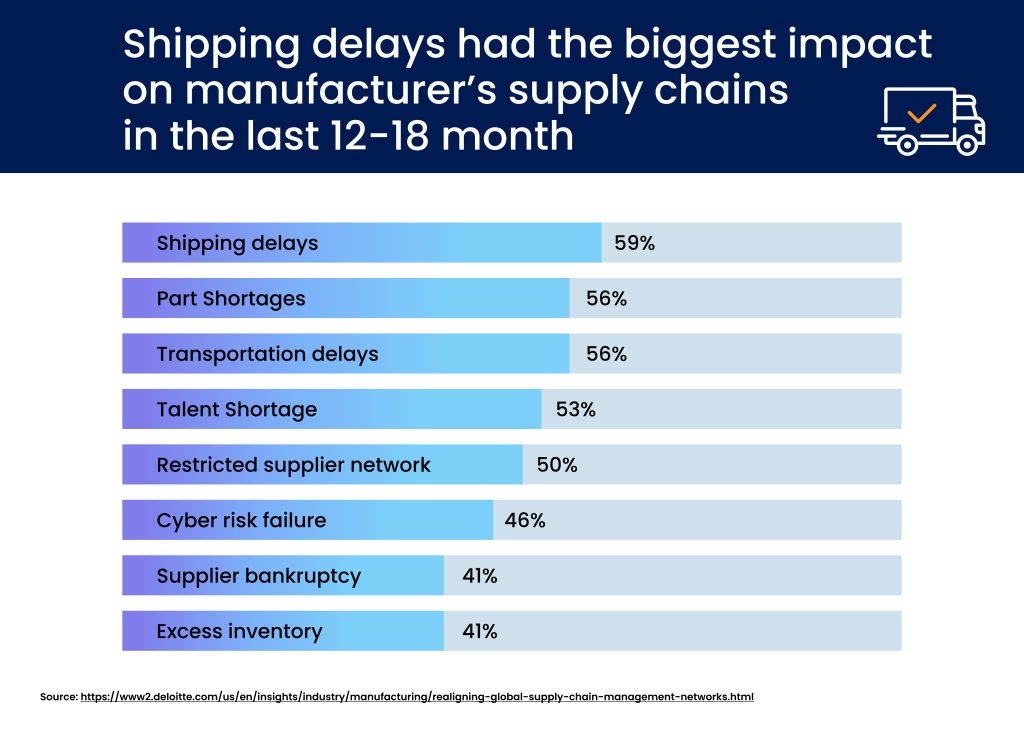

Shipping delays have had the greatest impact on manufacturers’ supply chains in recent years.

With anchor-led supply chain financing, the corporate can facilitate access to financing for its suppliers and mitigate financial constraints that could otherwise disrupt the flow of goods and services along the supply chain.

This allows MSME suppliers to secure financing against the value of their accounts receivables at the cost of a discount.

Under anchor-led supply chain financing, a designated financial intermediary will make early payments to the supplier using the corporate’s approved invoices as security. This way, the buyers (corporates or anchors) can pay later for the goods they purchase, while MSME suppliers get paid faster for the goods supplied.

FinTechs are reimagining the future of trade financing

FinTechs like CredAble are stepping up to reshape the future of banking with advanced tech-enabled solutions in working capital financing, such as the transformative Anchor-Led Supply Chain Finance Platform.

CredAble’s Anchor-Led Supply Chain Finance Platform empowers banks to initiate and manage financing programs for corporate clients and their network of suppliers seamlessly.

This is a holistic solution for comprehensive program setup and transaction management that integrates with corporate ERPs, ensuring a smooth transaction journey. It connects with core banking systems, payment systems, and trade booking systems to create an end-to-end, frictionless experience for all stakeholders involved.

The way forward

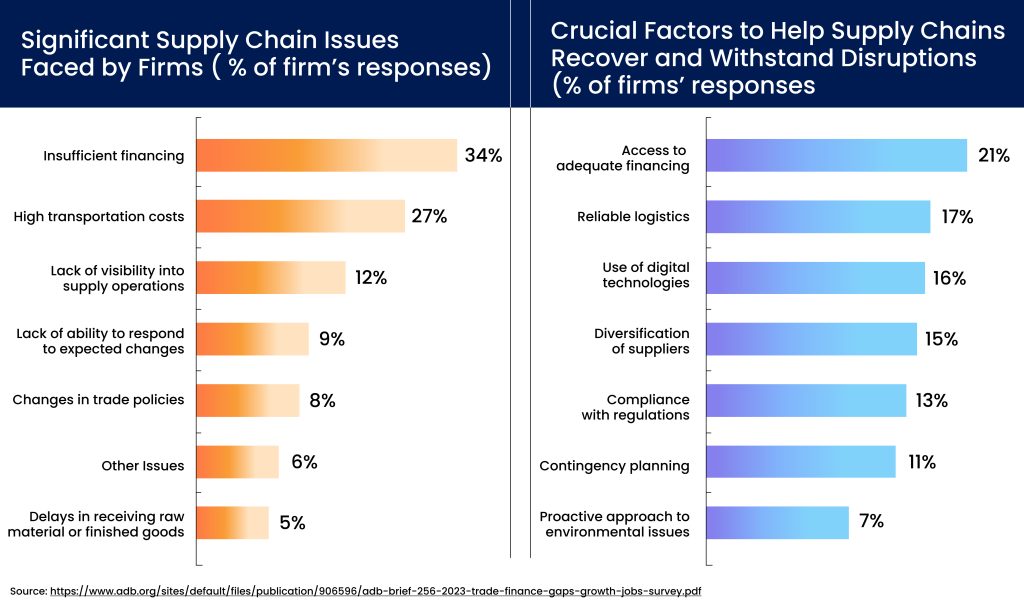

Insufficient financing continues to be ranked as the most critical supply chain financing issue encountered by businesses worldwide.

A significant 70% of the MSME credit gap can be attributed to working capital demands. In response to this challenge, anchor-led supply chain financing

programmes become integral to addressing the cash flow challenges of MSME suppliers.

The expanding global trade volumes, coupled with the evolution of cutting-edge working capital solutions to essentially automate the process of funding invoices, collectively indicate an evolving trade financing landscape ripe with untapped opportunities.

Within this dynamic ecosystem, there exists a significant white space inviting new entrants, including FinTech platform providers and banks, to engage and contribute to the strengthening of the resilience of supply chains globally.

Think Working Capital… Think CredAble!