Fueling MSME Growth: Emerging Lending Models Are Accelerating Credit Flow to the MSME Sector

Despite their prominent role in the economy, the credit gap of Micro, Small, and Medium Enterprises (MSMEs) continues to be an unaddressed challenge globally.

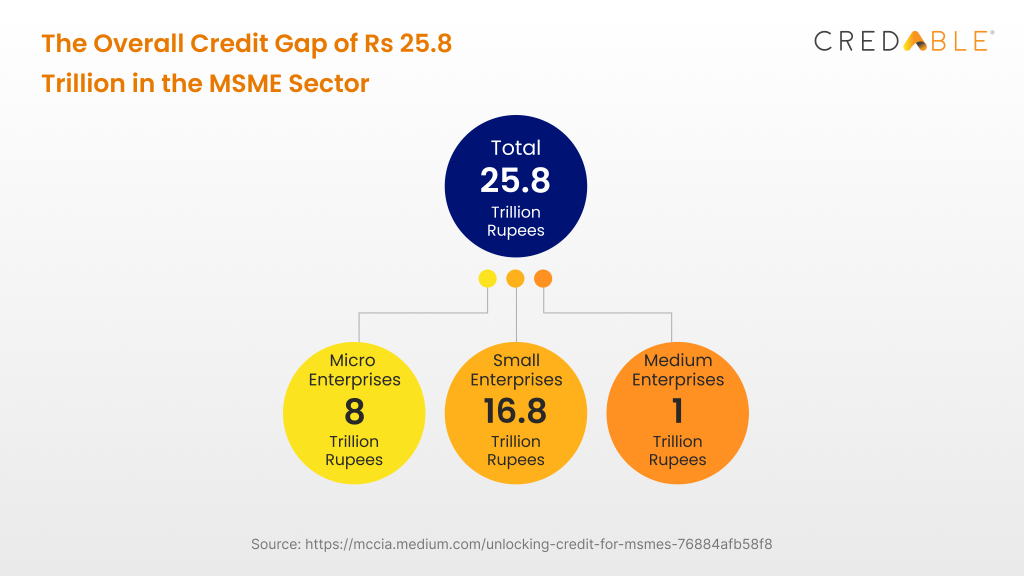

In India, the current business ecosystem is one that is majorly dominated by MSMEs. However, there is an astounding credit gap of INR 25 Trillion in the MSME sector. The perennial capital constraint is limiting the sector from tapping into its full potential.

This report by the World Bank highlights that even with the least financial and regulatory support, MSMEs are the largest employers in most developing countries. Given how 600 million jobs are required by 2030 to absorb the growing workforce across the globe—empowering MSMEs with formal access to credit, has become a key focus for governments worldwide. Promoting the growth of MSMEs will have a ripple effect in boosting job creation, improving income levels, reducing vulnerability, and accelerating economic growth.

MSMEs at the centre of India’s growth story

The backbone of India’s economic structure, the MSME segment, is one of the primary drivers of the country’s industrial sector, accounting for 45% of total industrial production, 40% of total exports, and contributing about 33% to the nation’s GDP. It’s safe to say that MSMEs have grown to have a strong foothold in both the urban and rural areas of the country.

As one of the key drivers of employment, innovation, and economic development—MSMEs have immense potential to ensure an equal distribution of wealth and curb the regional and economic imbalances in the country.

Even with MSMEs playing an instrumental role in India’s economic growth, a large number of them are yet to be integrated into the formal financial ecosystem of the country.

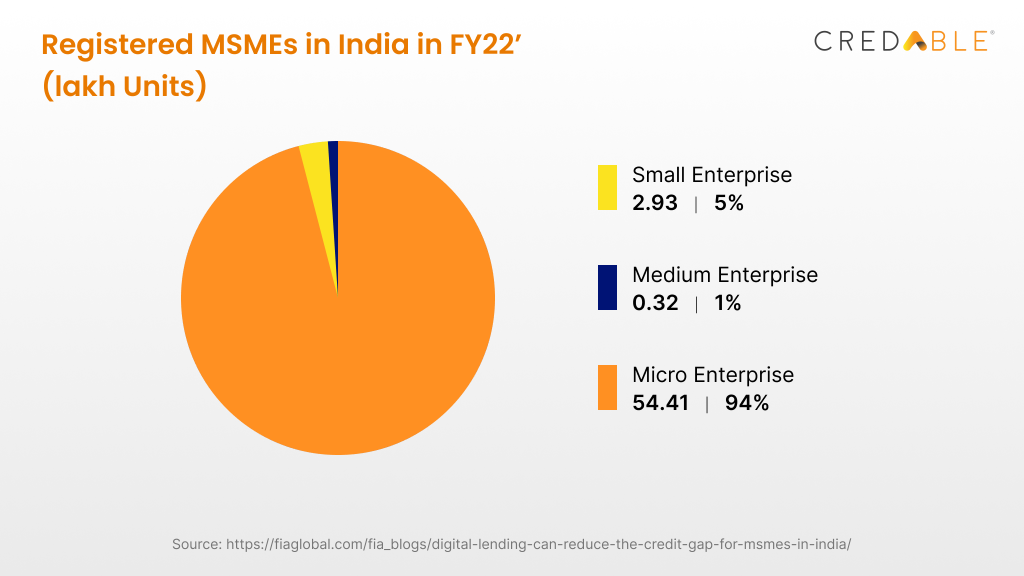

Of the 64 million MSMEs in India, only a meagre 14% have access to credit. To put it simply, the real potential of this sector lies dormant.

Among the MSMEs, medium-sized enterprises are the most well-served by financial institutions considering their stable cash flow, formalized operations, and higher creditworthiness.

With nearly 80% of MSMEs outside the purview of traditional bank credit, these credit-strapped businesses end up accessing financing from private or informal sources at much higher costs.

Plugging the credit gap in the MSME sector

The government’s Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) which facilitates collateral-free credit to MSMEs, recorded a 52% spike in FY22 loan guarantees as the average loan ticket size had increased.

Though the government has introduced many timely measures and regulations to develop credit and liquidity-related policies for MSMEs, the flow of funds to the MSME segment has remained weak. Going by the ‘BLinC Invest MSME Lending Report 2022’, banks and NBFCs currently address less than 15% of the total credit demand of the MSME sector. With many of these businesses heavily relying on cash-driven models, the transition to formal financial services initiatives is yet to experience a significant uptick.

That said, post the pandemic, MSMEs are now more keen on adopting digital solutions. What this has done is open up more avenues for FinTechs like CredAble to step in and cater to the micro-transaction needs of the rapidly expanding sector of MSMEs and in turn, bridge the widening credit gap.

Unlocking credit with digital lending solutions

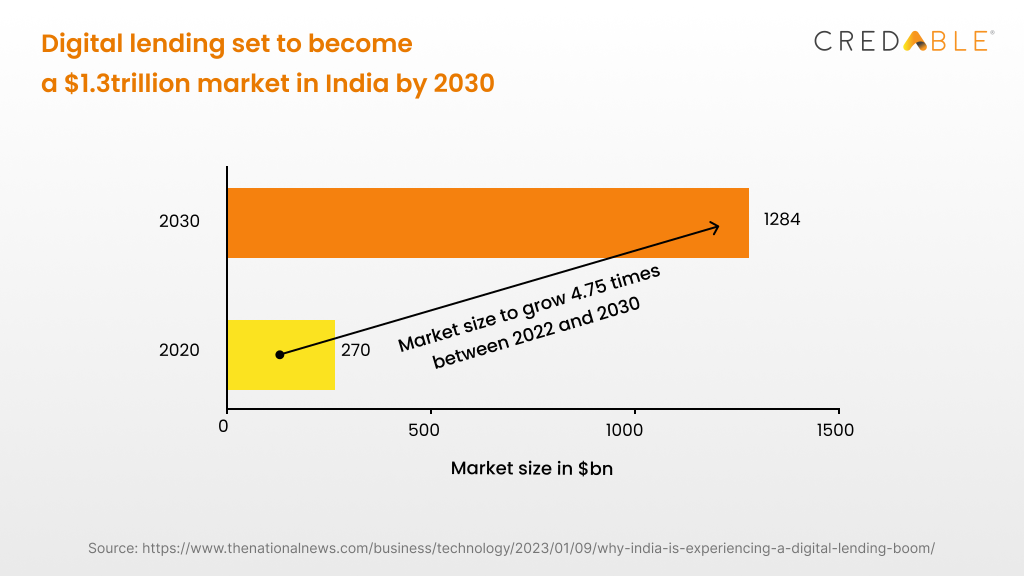

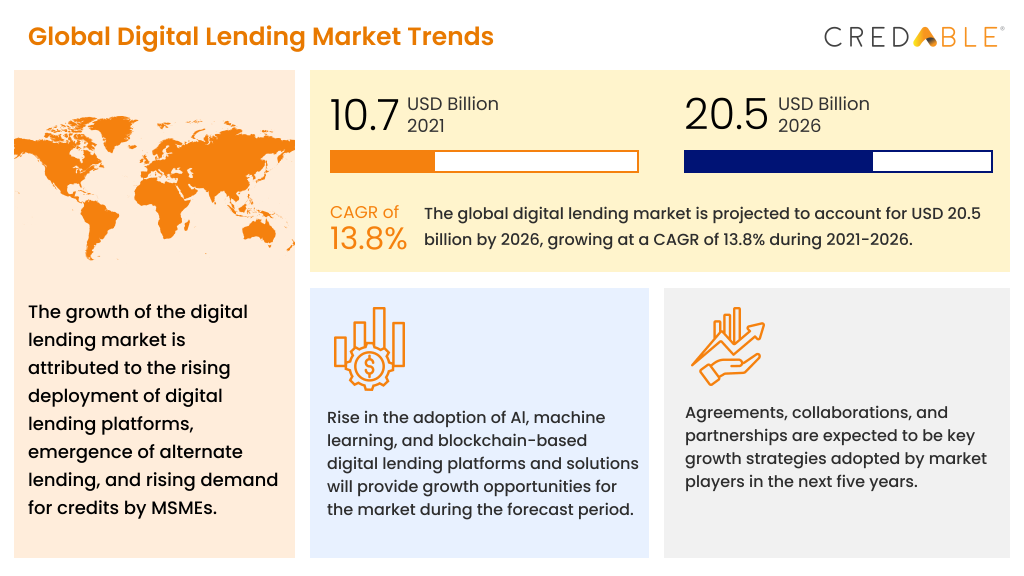

The BLinC Invest report also stated that the advent of emerging lending models using advanced data and technologies such as Artificial Intelligence (AI) and Machine Learning (ML) have the potential to narrow the credit gap in the MSME sector.

There has been a 2x growth in online loan disbursements in recent months. Backed by RBI’s recent digital lending guidelines, FinTech lenders are leveraging alternative credit scoring mechanisms and using data-backed underwriting tools along with cash flow-based assessments to offer sachet-sized loans. FinTech lenders are also meeting the MSMEs’ demand for short-term capital through POS channels. They are now partnering with retailers, leveraging available transactional data, and integrating lending solutions at checkout points.

Emerging models in digital lending

Digital lending has ushered in a new paradigm, enabling MSMEs to access timely and affordable funding.

Apart from digital lending solutions fostering financial inclusion and democratising credit at scale, government-backed digital commerce platforms such as Open Network for Digital Commerce (ONDC) are providing a level-playing field for MSMEs, while Open Credit Enablement Network (OCEN) is reimagining the lending ecosystem by allowing lenders and loan service providers to interact with one another.

CredAble is playing a pivotal role in helping India achieve its vision of transitioning towards a less cash, more diverse, and financially inclusive economy. We utilise advanced AI and ML tools to automate the lending experience for our clients. Our teams make robust credit assessments by leveraging transaction data through external databases and ecosystem partners. This way, we help MSMEs meet their day-to-day operations and cash flow needs by providing access to collateral-free business loans in minutes via a digitised and paperless process. We are also ensuring MSMEs are financially stable with a host of scalable tech-enabled solutions such as embedded credit solutions, anchor-led supply chain financing, and UpScale, CredAble’s super app built to propel small business growth.