How Enterprises Can Intelligently Manage Cash Flow Pressures and Build Supply Chain Resilience

"In the world of business, cash is king."

This explains why unlocking cash trapped in company balance sheets is at the top of the agenda for most CFOs and finance executives today. Businesses are looking to free up cash to make investments, reduce debts, and fund value-creating opportunities.

Working capital management has been a business-school staple for a long time now. According to Ernst & Young, by optimising working capital performance,

businesses in India can tap into a potential cash opportunity of INR 5.2 trillion. Reports also confirm that during the early stages of a market downturn, companies with effective working capital capabilities are seen to outperform weaker cash managers by 21% in total shareholder return. This goes on to show that strong working capital management can position businesses to forestall and steer through challenging times.

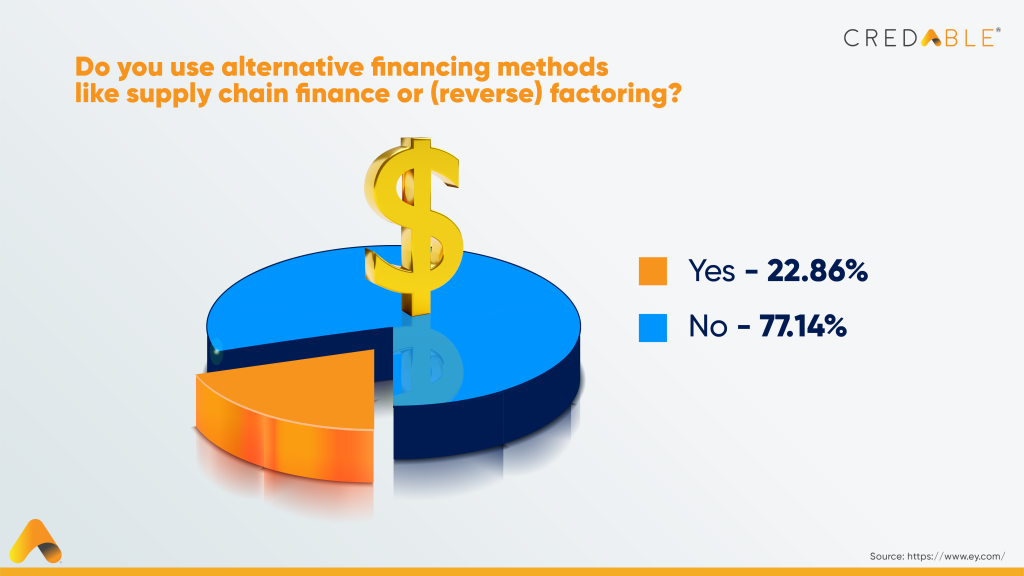

For enterprise supply chains, achieving cash flow freedom has become an urgent priority. In today’s volatile economy, the capacity within the already-strained global supply chains is tightening while demand is on the rise. Considering how all supply chain stakeholders, right from suppliers and shippers to carriers need a faster influx of cash—businesses today need to be more open to alternative financing methods to fund their needs.

With all this in the backdrop, organisations are now realising the strategic value of leveraging technology in automating and streamlining working capital management.

Optimising the order-to-cash cycle

The Order-to-Cash cycle (OTC or O2C) begins with the customer’s order and progresses through credit management, invoicing, and order fulfillment to conclude with the collection of the customer payment.

For organisations to convert inventory into cash quicker, they need to find ways to compress the order-to-cash cycle. This is where working capital solutions come in. Implementing automated working capital solutions between the enterprises and supplier ecosystems will minimise the average number of days taken to collect payments once the sale is completed.

Opting for working capital solutions that accelerate the payment cycle will give businesses the liquidity they need to fund their operations and invest in future growth opportunities. This in turn helps in strengthening the balance sheets, producing strategic cost savings, and improving the financial ratios.

Adopting an intelligent, tech-enabled approach to working capital

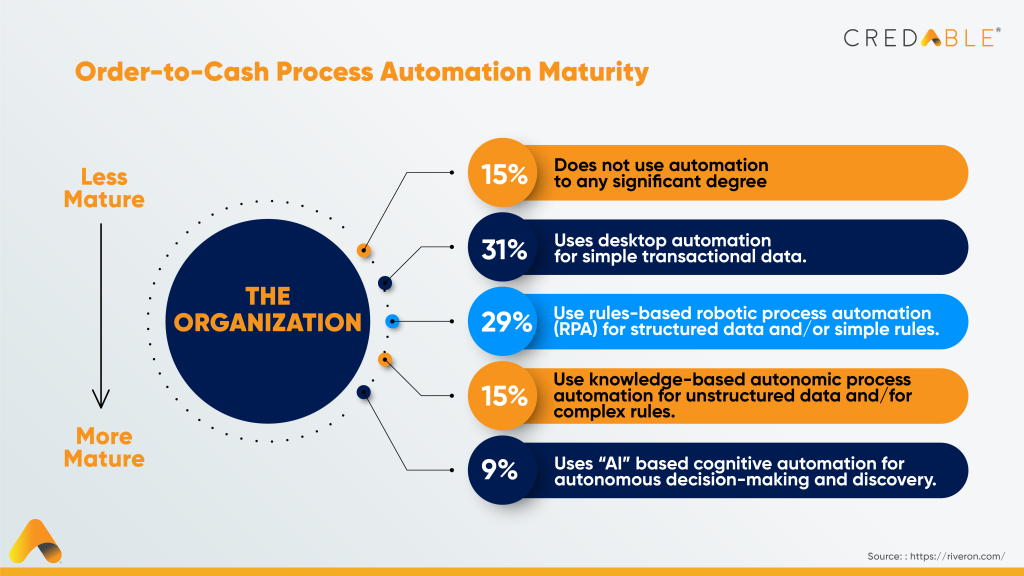

CFOs today are closely following up on the cash position. Only less than 10% of businesses have achieved the highest level of automation in the order-to-cash cycle, whereas 15% have not adopted any process automation strategies.

Gaining access to working capital is a challenge for any business. For small businesses, the ordeal is even worse. They have to deal with working capital cycles that stretch up to 75 to 90 days. Delayed payments and working capital gaps are not only adversely impacting the cash flow of these small businesses but are also adding to the problem of rising Non-Perfroming Assets (NPAs).

Modern businesses face complex challenges that require modern approaches. While organisations understand the importance of working capital management, not many are able to manage it effectively. The goal is to think beyond cash flow and take an integrated technology approach to streamline the working capital cycle. Doing this will help businesses become more resilient in the face of shocks such as supply chain disruptions.

Scalable tech-enabled solutions improve credit accessibility

With tech-enabled working capital solutions, businesses are able to manage credit strategically and have tighter control over their operations. More importantly, they are able to free cash trapped in the balance sheet, deploy it to other profitable activities, and eventually reduce the reliance on external funding.

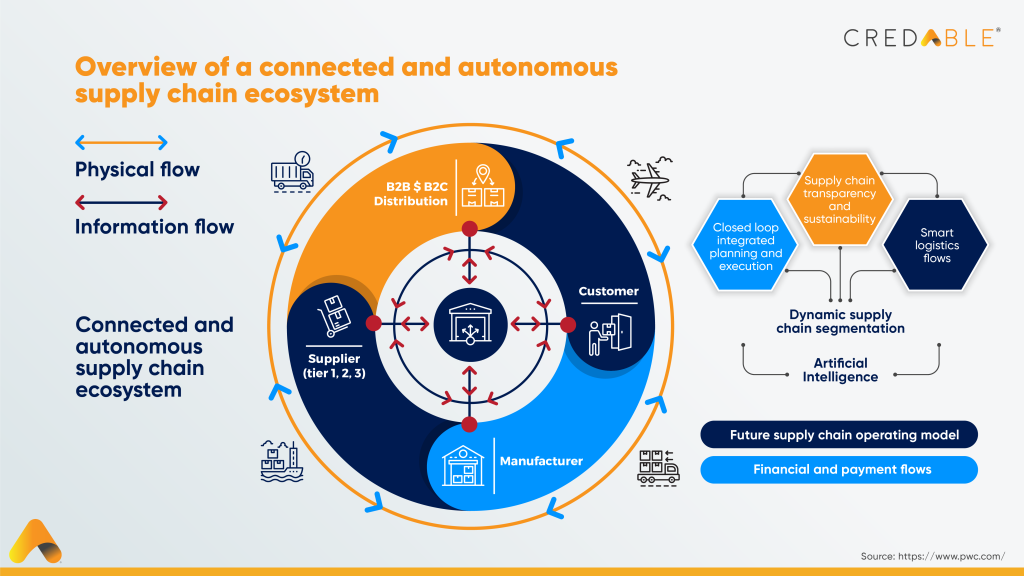

Leveraging technology for working capital management not only automates and speeds up processes but also enables data-backed decision-making and greater transparency. FinTechs like CredAble, offer a comprehensive working capital infrastructure with single-purpose solutions. These end-to-end advanced solutions enable liquidity right from the purchase order stage to the post-invoice acceptance stage, catering to every participant in the ecosystem.

Digitising working capital processes with a combination of advanced technologies offers a host of key benefits, such as:

- Releases trapped cash and speeds up the cash conversion cycle

- Identifies and mitigates risks by leveraging technologies like AI and machine learning models to improve debt recovery and fraud detection

- Manages multiple payment flows from a wide network of sources

- Enables dynamic discounting and auto-processing of invoices

- Automates cash flow forecasting and collections

- Defines operating models, enhances information transparency, and ensures compliance

Business leaders and other financial decision-makers are seeking real-time visibility and control over the order-to-cash process. Automated working capital solutions are enabling greater data transparency across the supply chain ecosystem. With solutions such as CredAble’s Early Payment Program, enterprises now also have the flexibility to establish strong relations with suppliers that require upfront payments. All this has resulted in making global supply chain ecosystems more resilient and connected.

Recover trapped cash and accelerate revenue

In today’s economic climate, businesses need to maintain strong balance sheets and build the flexibility to withstand supply chain disruptions. The focus should be to reduce the cash-conversion cycle and recover cash trapped in balance sheets. Automated working capital solutions are not only closing gaps caused by slow invoicing and not to mention—weak collection and payment processes but are also freeing up cash to make investments and fund strategic growth opportunities.