Infusing Technology for Convenience in Banking

The Evolution of Banking

1472, the First of the currently operational banks opened in the Tuscan City of Siena. This pioneering institution was tasked with two foundational capabilities: the custodianship of patrons' most cherished possessions, notably their trust, and the navigation of relationships with members necessitating financial support.

The change came with the institutionalization of banking. Banks were now focused on operational efficiency, within themselves. To leverage a broad range of information that maximized their returns and mitigated risks across investments, be it equity, lending, or arbitrage. Subsequent changes manifested in the evolution of lending structures and the expansion of capabilities beyond traditional lending, concurrently accompanied by ongoing enhancements in banking efficiency.

While the bedrock of the Banking Industry remains the same – funds, relationships and information, the global capitalist revolution has witnessed a transformative Cambrian explosion of traditional funding use cases. The landscape has evolved, with a shift from merely the quantum of funding provided to an emphasis on the customer experience accompanying financial services. The proliferation of digital assets, the advent of Banking as a Service (BaaS) facilitated by fintech innovators, and the disaggregation of the financial services value chain into specialized providers have collectively unveiled an aspiration for banking experiences that are seamless, uninterrupted, and effortlessly initiated.

What is Invisible Banking

Invisible Banking, as the name suggests, denotes the strategic use of technology to seamlessly integrate financial processes into routine actions, thereby obviating the necessity for manual inputs.

The overarching objective is to transcend the paradigm of a beautiful user interface to no user interface whatsoever.

That said the sanctity of banking being a play of trust and responsibility must be maintained. The essence of invisible banking lies in the identification of actions that lie in the natural course of a person’s activity but simultaneously also clearly indicate the need for banking, in the form of either transactions or funding. It leverages an array of technological nuances programed to capture the said actions aptly and develop a network that allows them to speak to each other as required to facilitate the transaction.

Breaking it Down

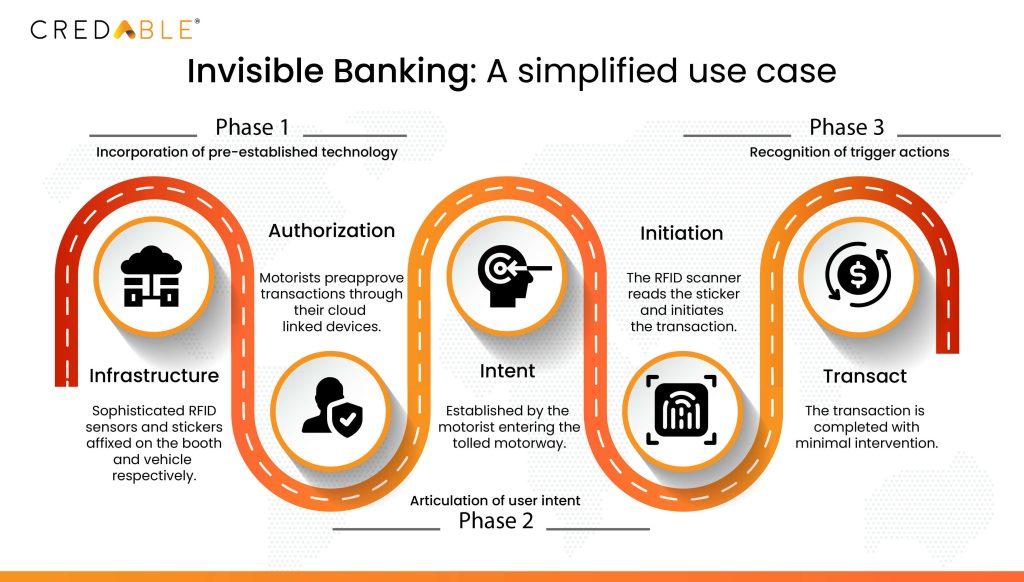

A noteworthy illustration of the concept of Invisible Banking can be found in the ubiquitous yet often overlooked implementation of 'FastTag,' (an initiative for automated toll collection on chargeable highways in India) epitomizing a harmonious integration of technology and user experience for a seamless banking encounter. Let’s delineate this process further:

Cloud-Backed RFID Infrastructure: Positioned at the toll booth, a sophisticated RFID sensor, complemented by a straightforward sticker affixed to the vehicle, constitutes the foundational technology.

Transaction Pre-Authorization: Motorists proactively authorize transactions for a predetermined period through a dedicated application seamlessly interfacing with the aforementioned cloud software.

Intention Establishment: The traveler's intent is effortlessly established as they approach the entry point of the tolled motorway.

RFID Scanning and Transaction Initiation: The RFID scanner adeptly scans the affixed sticker, instigating the transaction process.

Frictionless Transaction Execution: Subject to approval, the entire transaction unfolds seamlessly, necessitating no user intervention apart from the routine application of the vehicle's brakes—an aspect that could potentially be refined further through advanced technological iterations.

In essence, this process can be deconstructed into three key phases: the incorporation of pre-established technology, the articulation of user intent, and the recognition of trigger actions that seamlessly propel transactional interactions.

Invisible Banking in Supply Chain Finance:

The evolution of supply chain financing is converging towards the realm of Invisible Banking, where the facilitation of fund flows aligns seamlessly with the movement of goods and the value creation process along the supply chain. This innovative financial approach relies on intricate financial structures, harnessing current assets and leveraging extensive data analysis to extend financing to stakeholders traditionally considered unbankable within the value chain.

Traditionally, the supply chain financing process involved a series of physical movements, document filings, and segmentation, often taking several days. This extended timeline contradicted the core of supply chain financing, which necessitates swift access to working capital. However, by embracing API technology and leveraging Digital Public Infrastructure – DPI (DPI are blocks or platforms hosting information such as identity, transactions, data exchange and so on – that are generally developed and maintained by governments as digital infrastructure), this cumbersome process can be drastically reduced by over 90%. This transformative potential has been actively explored by lenders, particularly through the emergence of Fintech entities.

Looking ahead, the focus is shifting towards minimizing human intervention and manual inputs in this streamlined process.

While data creation, collection, and transfer can already be digitized, the future trajectory involves the replication and seamless integration of physical information into the digital realm. The requisite technology is in existence; what requires further development is the precise use case that optimally exploits this potential.

A Rudimentary Use-case:

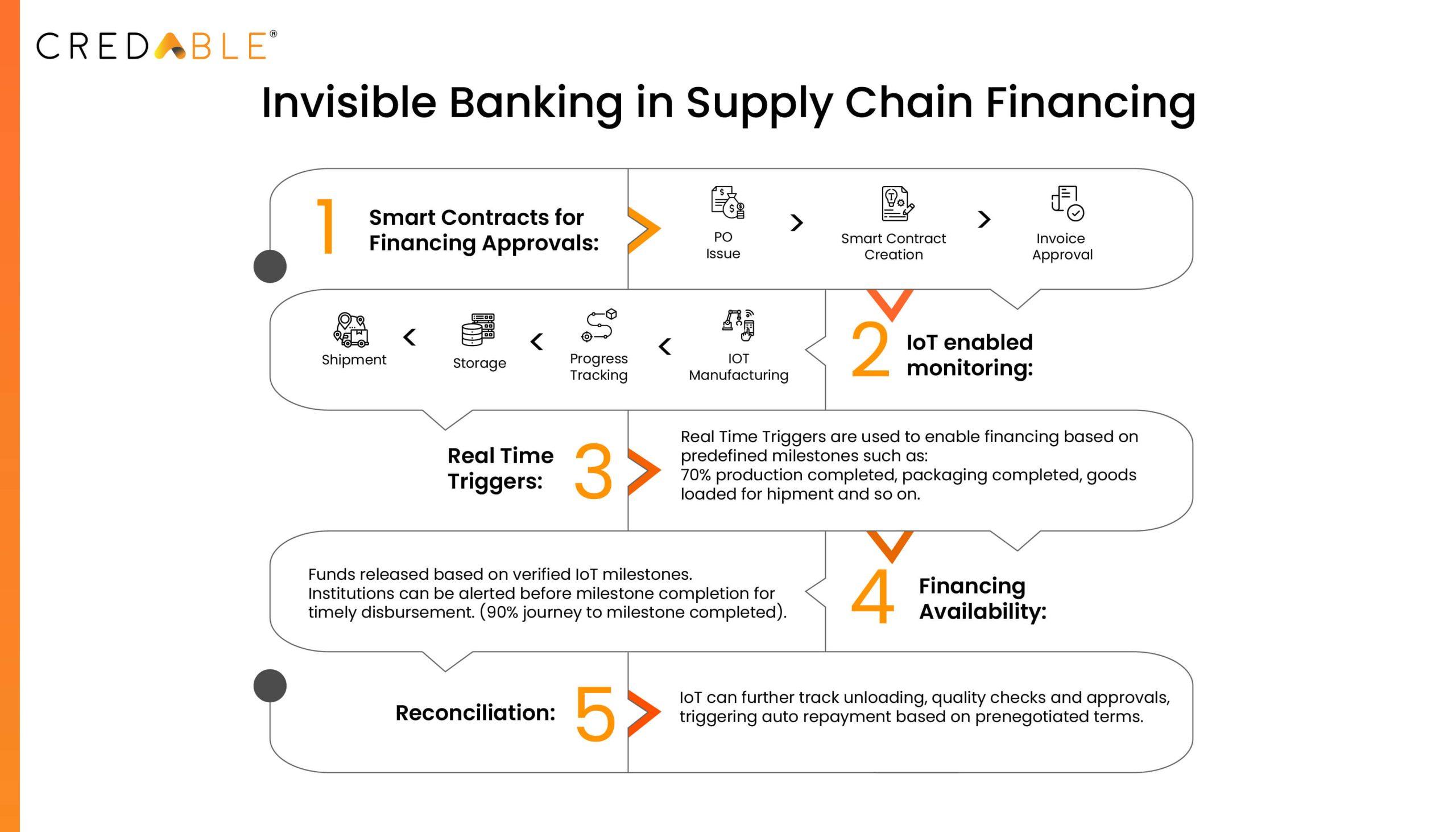

Let’s develop a simple use case for invisible banking in Supply Chain Financing. Our assumption is that the stakeholders involved are well equipped with current supply chain financing platforms and have a program up and running for the same. Further we shall use two additional tech pieces – Smart Contracts and the IoT.

Let’s assume you are a global electronics manufacturer, sourcing components from a network of suppliers around the world. You have a stable range of transaction types leaving aside a few outliers and have a defined set of parameters to accept or reject transactions, based of which you want to automate and optimize supply chain financing practices.

1. Smart Contracts for Financing Approvals: Once the PO is issued a smart contract is automatically generated based on pre-defined rules. The contract is edited and approved on receipt of an invoice.

2. IoT enabled monitoring: IoT sensors are embedded across the value chain, including manufacturing and shipment equipment. These are equipped to track manufacturing progress, storage conditions and shipment locations, this enables milestone based financing and fractional financing based on manufacturing position.

3. Real Time Triggers: As the process progresses the IoT data is fed into the smart contract and pre-defined milestones are triggered (70% production completed, packaging completed, goods loaded onto carriers and so on).

4. Financing Availability: Milestones are verified through the IOT enabled data, triggering the release of funds. Institutions can be looped in to keep disbursements ready when milestones are nearly complete.

5. Reconciliation: The IoT can tract the unloading and final quality checks and trigger payments to financiers as negotiated to complete the cycle.

Through the discussed invisible banking use case, patrons can streamline supply chain financing further and mark a distinct jump in data backed financing. With businesses moving towards automation, SCF platforms are becoming increasingly important. Moreover, as mentioned earlier – with the disaggregation of the financial services value chain, banking concepts such as embedded finance are taking the forefront - corporates and financial institutions can leverage specialized providers to implement effective and forward-looking SCF programs. CredAble, as a global leader in Working Capital Financing technology, is actively engaged in Supply Chain Financing and Embedded Finance, among other propositions.

Think Working Capital… Think CredAble!