Making Supply Chain More Inclusive with Pre-shipment Financing

Global disruptions have highlighted the need for robust and agile supply chains, however, as borrowing cost is on the rise, the financial stability of smaller suppliers is affected. To meet their short-term requirements, it is necessary for them to have better cash flow positions.

MSME portfolios are known to have lower NPA rates (~10.5%) as opposed to the large corporate segments (~17%). The smaller the credit exposure, the lower the NPAs (~8%).

With MSMEs comprising 96% of enterprises, and contributing to 40% of industrial production and 42% of exports, their significance in the economy is paramount. However, the global trade finance gap is narrowing, exceeding the USD 2.5 trillion threshold.

Addressing this gap is crucial, as 80% of trade relies on meeting financial requirements.

MSMEs are contributing to 33.4% of India’s manufacturing output making pre-shipment financing a useful tool to secure the required financing to meet the customers demand and have more cash on hand. This financing methods helps businesses manage cash flows in order to meet their delivery schedules.

Pre-shipment financing has been instrumental in enabling MSMEs to become globally competent. This financing avenue not only optimizes cash flow but also enhances risk management and fosters supplier relationships.

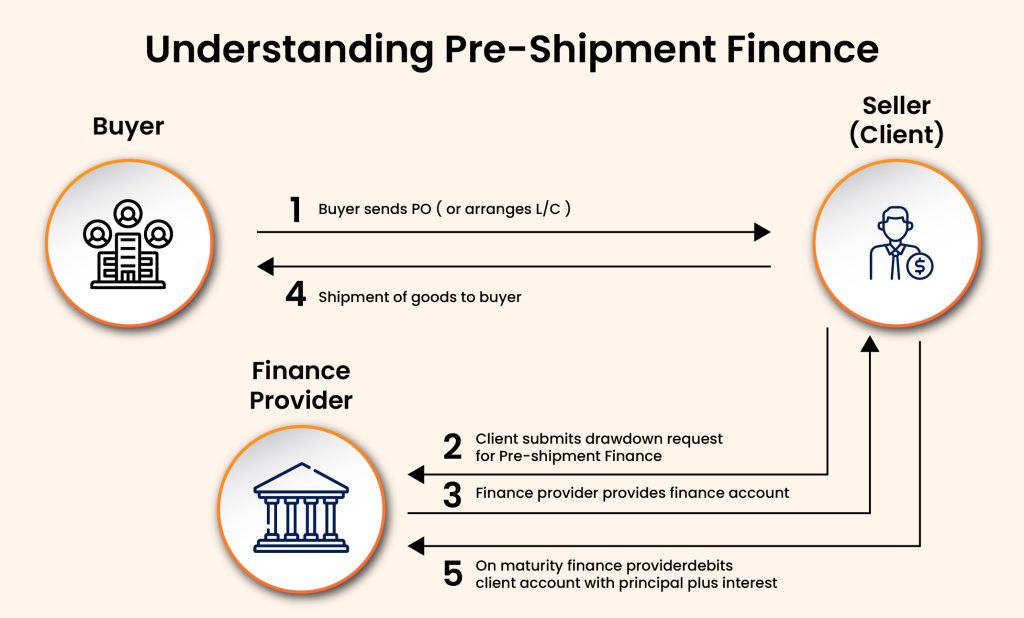

What is Pre-Shipment Financing?

Pre-shipment financing is a structural framework providing flexible financing solutions to MSMEs at various stages in the pre-shipment process.

It is structured for MSMEs to cover their cost of production such as procurement of raw materials, labor, transportation, and other expenses which must be incurred before the goods are ready to be shipped. Pre-shipment finance is a product suite offered to MSMEs by several banks, financial institutions, NBFCs and FinTechs.

The financier leverages supply chain data including historical and real-time milestone information on the movement of goods along the supply chain to boost businesses with a robust end-to-end early capital financing solution. Furthermore, it catalyses MSME production cycles enabling them to take larger orders.

Take on Big Orders Today with Pre-shipment Financing

Pre-Shipment Financing Solutions

Pre-shipment financing gives corporates the ability to bridge the gap between their payment obligations and receivables from their enterprise clients. Pre-shipment financing includes:

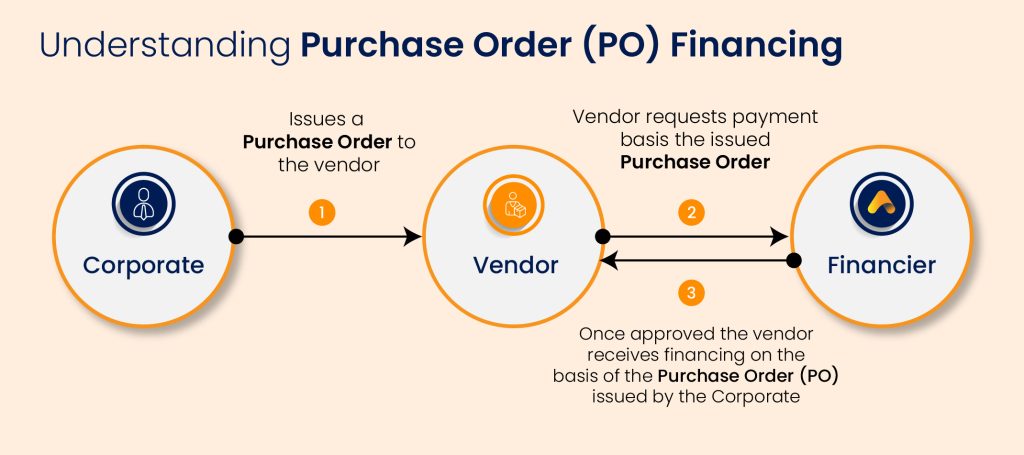

1. Purchase Order Financing: Corporates may avail themselves of Purchase Order Financing as a solution wherein a third party agrees to give a supplier enough money to fund a customer’s purchase order.

This is a financing solution designed to help businesses fulfil their customer’s orders when they lack the necessary funds to purchase the required inventory or raw material. It allows MSMEs to secure financing based on the confirmed purchase orders received by them from their customers.

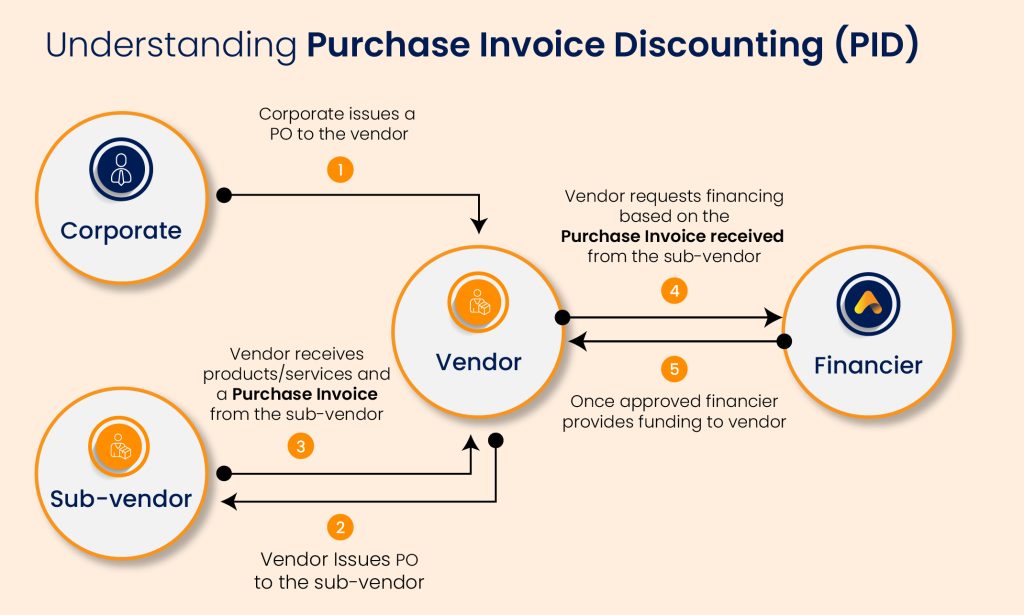

2. Purchase Invoice Discounting (PID): PID gives corporates the opportunity to finance their short-term business-related purchases. This solution allows businesses to access cash which has been tied up using their outstanding invoices before they receive payment from their customers. This solution gives MSMEs a way to bridge the gap between the delivery of goods and the receipt of their payment.

Difference between Purchase Order Financing & Purchase Invoice Discounting

Several factors help in determining whether purchase order financing (PO Financing) or purchase invoice discounting (PID) is a better financing option for businesses. These factors include:

1. Nature of the Business

Purchase Order Financing is ideal for MSMEs to take on large orders, expand their customer base, and build their business.

Purchase Invoice Discounting is suited to MSMEs relying on invoicing clients for delivered goods or services rendered. Here, MSMEs always have access to working capital by unlocking cash tied up in outstanding invoices.

2. Cash Flow Requirements

PO Financing offers a quick inflow of funds to businesses which frequently face a cash flow crunch due to their requirement for raw materials or inventory.

PID bridges the gap between the delivery of goods and the payment stage by allowing prompt access to funds and mitigating the risk of late payments affecting the business’s cash flow.

3. Customer Base and Creditworthiness

A strong credit history proves useful and is an important determinant in securing PO Financing.

PID focuses on the quality of the outstanding invoices and the reliability of the customer base.

4. Frequency of Funding Needs

PO financing provides one-time solutions for MSMEs who receive large, irregular orders which require significant upfront costs.

Purchase Invoice Discounting provides MSMEs with access to funds as invoices are generated to meet their requirements of working capital to cover their ongoing expenses.

5. Cost Considerations

While Purchase order financing gives MSMEs the benefit of avoiding additional debt, it comes at a higher interest rate due to the risk associated with financing specific orders.

Purchase Invoice Discounting involves a discount on the face value of the outstanding invoices, thus reducing the profit margins.

How Pre-Shipment Financing is enabling MSMEs to take large orders

MSMEs are leveraging product suites such as pre-shipment financing to meet their working capital demands.

FinTech companies like CredAble are implementing data-backed underwriting tools, cash flow-based assessments, and alternative credit scoring mechanisms to provide MSMEs with easy access to affordable short-term capital.

From Purchase Order Financing (PO Financing) and Purchase Invoice Discounting (PID) to Warehouse Financing, MSMEs require capital at every step through their journey from production to the delivery of goods.

Pre-shipment financing solutions allows MSMEs to manage their manufacturing costs and maximise their production capabilities, thereby, allowing them to fulfil their orders before time and ensure timely deliveries. This provides them with opportunities to take on larger orders. MSMEs gain significant competitive advantage in the market with access to early financing.

Digital lending solutions such as pre-shipment financing have changed the optics of MSME lending and have made unsecured working capital accessible to small businesses through new age players, banks and other financial institutions.

Unsecured MSME lending in India is expected to reach a valuation of INR 7.5 trillion by FY26 with the MSME merchant base expected to rise to INR 14 million.

Digital penetration in MSME unsecured lending is expected to increase by 20% by FY26 as a result of the rapid adoption of digital technologies.

CredAble’s pre-shipment financing solution provides an automated financing and tracking process based on the occurrence of the corporate’s billable events.

Financing of purchase orders can also be done based on the enterprise client’s approval of the PO. The tech platform enables the mapping of purchase order data against invoice data through an ERP feed or using the FIFO method.

Why MSMEs would benefit from Pre-Shipment Financing

Pre-shipment financing offers small businesses access to finance at various pre-shipment stages and is a beneficial financing method for them:

1. Improved Cash Flow - pre-shipment finance enhances short term cash flow by furnishing the necessary funds for acquiring and transporting export goods, enabling businesses to optimize financial management and mitigate the risk of financial challenges.

2. Increasing Competition – MSMEs become globally competent with necessary funds for better and bigger export opportunities.

3. Flexible Collateral-Free Financing – businesses have greater flexibility in their operations by allowing them to finance the purchase and transportation of goods and services for export as needed.

4. Improved Risk Management - pre-shipment finance minimizes financial risk by supplying funds for exporting goods, aiding businesses in effective risk management and enhancing their prospects for success in international markets.

5. Better Relationships with Suppliers – businesses can secure better relationships with their suppliers by providing the funds required to purchase goods or services on time resulting in more competitiveness and more profitability.

In conclusion, pre-shipment financing emerges as a pivotal tool in bolstering the inclusivity and resilience of supply chains, particularly for MSMEs. As global disruptions underscore the importance of agile financial solutions, pre-shipment financing stands out as a flexible and accessible option for businesses navigating the complexities of international trade. By offering improved cash flow, fostering competition, and nurturing stronger supplier relationships, this financing avenue paves the way for MSMEs to thrive in a competitive marketplace. With the advent of digital lending solutions and the growing embrace of technology, the future of pre-shipment financing looks promising, promising to further empower MSMEs and drive economic growth on a global scale.

Think Working Capital… Think CredAble!