Beyond Valuations: Quasi-Equity and Revenue-Based Financing’s Role in Driving Sustainable Growth for Startups

As of October 2023, India boasts 111 unicorns—with a combined valuation of $349.67 billion. Last year, India’s startup landscape also marked a major milestone of crossing 100,000 registered startups through the Startup India initiative. Currently, home to 1.15 Lakh startups (as per DPIIT) and more than 68K tech startups, India is the third-largest startup ecosystem globally.

Despite witnessing a meteoric rise in startup numbers across the nation, over the past decade, founders continue to seek timely financing solutions that are:

- Tailored to their business requirements

- And conducive to their current growth phase

Traditionally, securing financial backing for a startup involved engaging with venture capital firms or angel investors, typically leading to the dilution of ownership through the issuance of equity shares. In such scenarios, founders frequently ended up in a position of limited negotiation power. However, the startup funding landscape has evolved over the years, introducing a more nuanced framework.

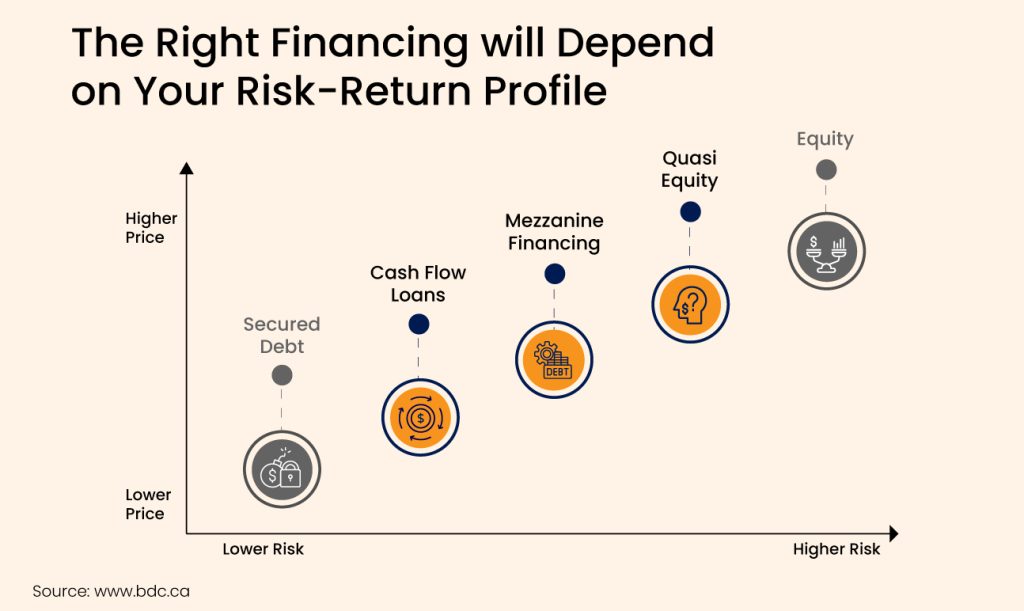

Today, founders and small business owners have the option to choose from a wide range of funding sources that constitute the modern capital stack. While this includes the more traditional avenues like equity funding, private debt, and venture debt, it also has non-dilutive and more performance-based funding options that allow startups to extend their runway with ease.

Navigating unpredictable funding landscape: Alternative financing solutions for startups

In 2023, sectors like FinTech, retail, enterprise applications, and environment and space tech captured the attention of investors. However, owing to the macroeconomic and geopolitical conditions—startups experienced cutbacks in funding across all stages, particularly in late-stage investments. Late-stage financing plummeted by over 73%, reaching a total of $4.2 billion in 2023.

Quasi-equity financing and revenue-based financing are both non-dilutive funding options that have emerged as the most viable choices for startup founders and small to medium-sized business owners

These financing avenues enable entrepreneurs to secure capital without relinquishing equity or ownership in their companies.

Startups that are looking to succeed in a rapidly changing market, must be agile and adaptive to sustain hypergrowth. Consequently, the imperative for non-dilutive funding and a more sophisticated capital stack becomes evident, enabling startups to effectively meet the demands of scalability across various stages of their growth.

Amidst the rising need for short-term, small-value credit among startups, a new breed of ventures is embracing solutions such as cash flow-based financing and revenue-based financing.

● Quasi-equity financing

Combining characteristics of both equity and debt, quasi-equity financing can adopt traits resembling either equity or debt finance, depending on factors like the level of ownership acquired and the risk exposure in case of default. These investments are adaptable, and frequently presented as debt instruments, which could be unsecured and subordinate, like mezzanine debt. Alternatively, they could take the form of convertible instruments or preferred equity, providing diverse channels for injecting capital into the business.

Unlike traditional equity financing, which often requires startups to relinquish a portion of their ownership in exchange for funding, quasi-equity financing allows founders and early investors to retain control over their ventures. This preservation of ownership is crucial for startups looking to maintain autonomy and strategic direction as they navigate the complexities of growth and expansion.

● Revenue-based financing

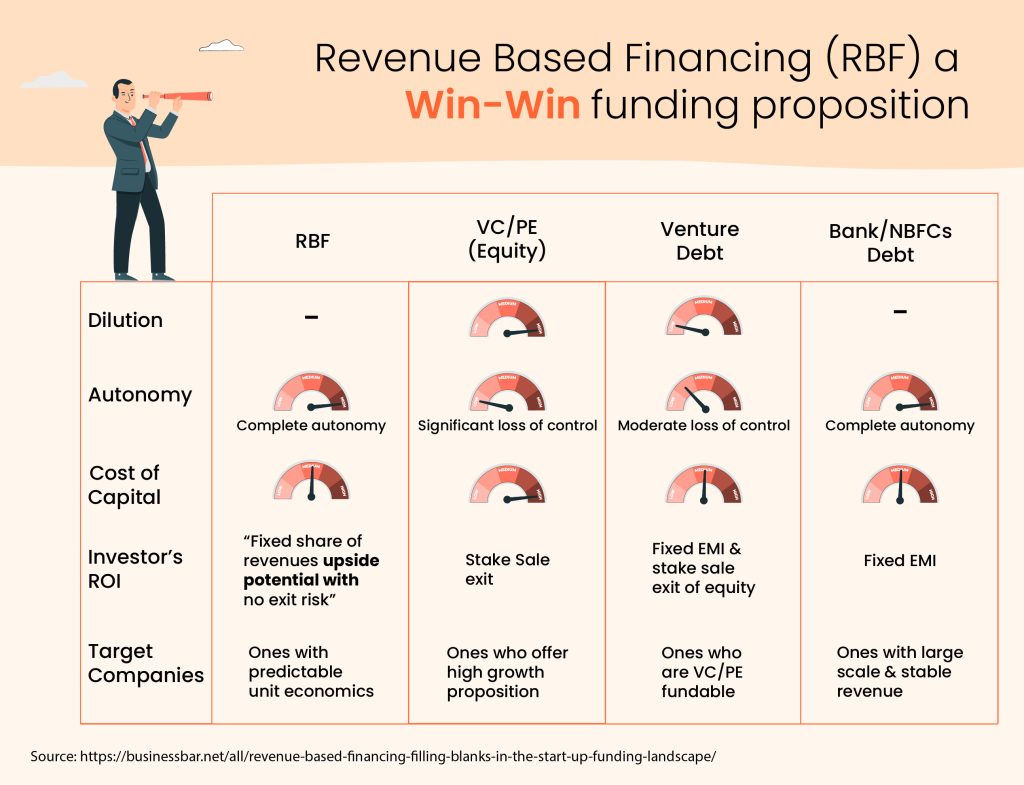

In contrast, Revenue-Based Financing (RBF) provides businesses with funds based on anticipated future revenues. Unlike quasi-equity financing, RBF investors do not typically acquire ownership stakes in the company. Instead, they receive a percentage of the company's revenue until reaching a predetermined repayment threshold.

While quasi-equity financing preserves ownership control, revenue-based financing offers flexibility in repayment terms, aligning with the company's revenue generation.

These startups leverage their current cash flow and projected earnings to access funds efficiently. In our latest white paper, we delve into how startups and small businesses can overcome working capital challenges that small businesses face and shed light on the growing importance of cash flow-centric financing structures.

Navigating startup growth challenges

To be fair, valuations today look a lot more reasonable than what they were a few years ago. While the funding landscape prompts greater operational efficiency, startups should focus on incremental progress, reserving significant strides for the future. For businesses in the growth phase, retaining equity often outweighs chasing valuations, as sustainable growth takes precedence in driving value creation.

Startups in their growth phase, must be adept at dissecting the layers within the modern capital stack to discern the right timing for deploying each funding option.

Quasi-equity financing offers startups the flexibility to structure repayment terms according to their unique circumstances and growth trajectories.

Repayment terms and returns in quasi-equity financing are mainly dictated by the structure of the instrument and the recipient's performance.

This flexibility mitigates the risk of financial strain and empowers startups to manage their working capital efficiently while pursuing growth opportunities.

Furthermore, unlike traditional debt financing, which may require a track record of profitability or tangible assets as collateral—revenue-based and quasi-equity financing evaluates startups based on their growth potential and expected earnings. As a result, alternative financing solutions are now accessible to early-stage startups and high-growth ventures that may not meet the stringent criteria of traditional lenders.

Accelerate Your Growth Potential with CredAbleWhen does quasi-equity and revenue-based financing make sense?

Quasi-equity and revenue-based financing provide strategic alternatives for startups encountering obstacles in accessing traditional capital sources.

Consider a manufacturing startup specialising in eco-friendly packaging solutions. Despite experiencing rapid expansion and heightened demand for its products, the company encounters difficulties in securing conventional bank loans due to its constrained collateral and limited credit track record. However, to capitalise on emerging market opportunities and address the escalating demand for its sustainable packaging solutions, the startup requires additional funding for operational enhancements and marketing endeavours.

In such scenarios, revenue-based financing emerges as an attractive alternative. This innovative financing approach allows the manufacturing startup to leverage its projected future revenue streams as collateral to secure funding. By offering a percentage of its incoming revenue until the loan is repaid, revenue-based financing aligns repayment terms with the company's revenue generation, providing flexibility during periods of fluctuating cash flows.

Looking ahead

The utilisation of revenue-based financing alongside quasi-equity financing highlights the significance of a modern capital stack for startups. This diversified approach to funding enables startups to leverage different financing options tailored to their specific growth objectives, thereby optimising their financial resources and enhancing their ability to navigate dynamic market conditions effectively.

The prospect of India achieving a 7 trillion USD economy size by 2030 remains feasible, provided it sustains its current growth trajectory. There's no denying the important role that startups in India have in generating greater economic returns for the country.

As India positions itself on the global stage, alternative working capital financing solutions like quasi-equity and revenue-based financing will pave the way for startups to achieve sustainable growth.

Think Working Capital… Think CredAble!