Transforming Global Banking and Supply Chain Finance with Customised Technology

In the ever-evolving landscape of banking and finance, a new paradigm is emerging – composable Banking as a Service (BaaS).

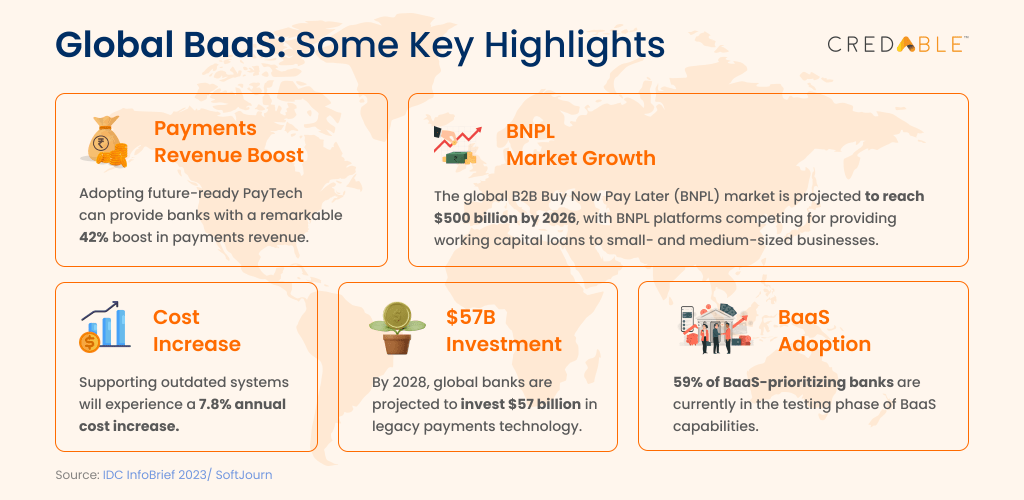

Embracing a digital approach requires incumbents to modernize their core systems and transform legacy infrastructure. McKinsey warns that failure to migrate could result in a significant profit decline of up to 60% by 2025.

Why are legacy banks keen to partner with FinTechs to develop new technologies?

Investing in new technology involves substantial costs, resource allocation, and time for implementation. The rapidly evolving tech industry poses the challenge of potential obsolescence. To navigate these obstacles, incumbents must conduct thorough research, collaborate with experts, and make strategic decisions for a smoother implementation process.

Composable BaaS: A more cost-effective solution?

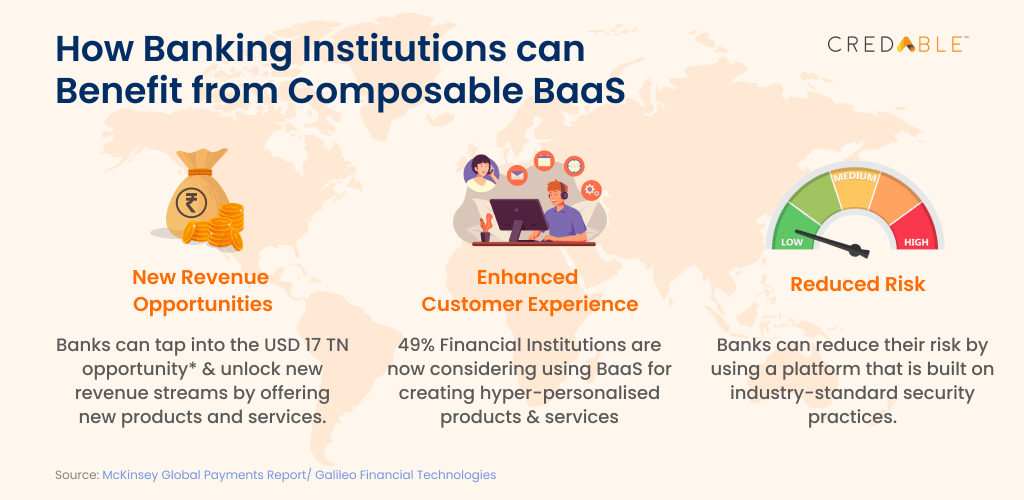

Composable platforms are transforming traditional banking systems by offering a modular approach, empowering financial institutions to tailor their services with ease and agility. In the realm of supply chain finance, this innovative approach is changing the global narrative, revolutionizing how businesses interact and creating new opportunities for growth.

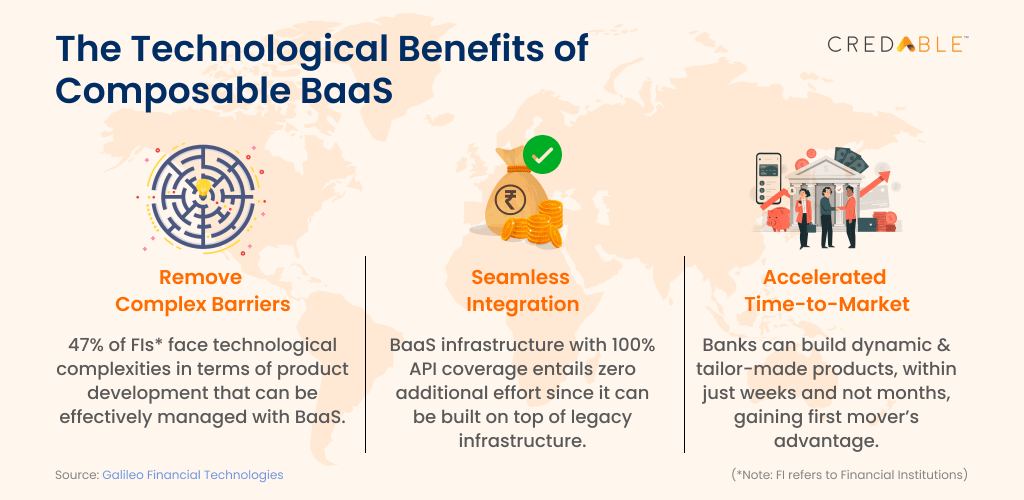

How composable BaaS gives financial institutions a technological advantage?

At the heart of composable BaaS lies its technological prowess. Composable platforms are built with a set of modular and interconnected components, enabling banks to create customized solutions that fit their specific needs. By leveraging Application Programming Interfaces (APIs), banks can seamlessly integrate diverse third-party services and build scalable, efficient, and secure ecosystems. This adaptability allows banks to quickly respond to market demands, introduce new services, and innovate at a faster pace.

How composable BaaS is slowly emerging as the solution to untap previously under-served customers?

The world is more interconnected than ever before, and businesses seek faster and smoother cross-border transactions. Composable BaaS opens up new horizons in global trade by streamlining processes, reducing friction, and minimizing costs. Through API integrations, banks can collaborate with fintech companies to provide real-time foreign exchange, international payments, and trade financing solutions. This fosters international business growth and strengthens economic ties between nations.

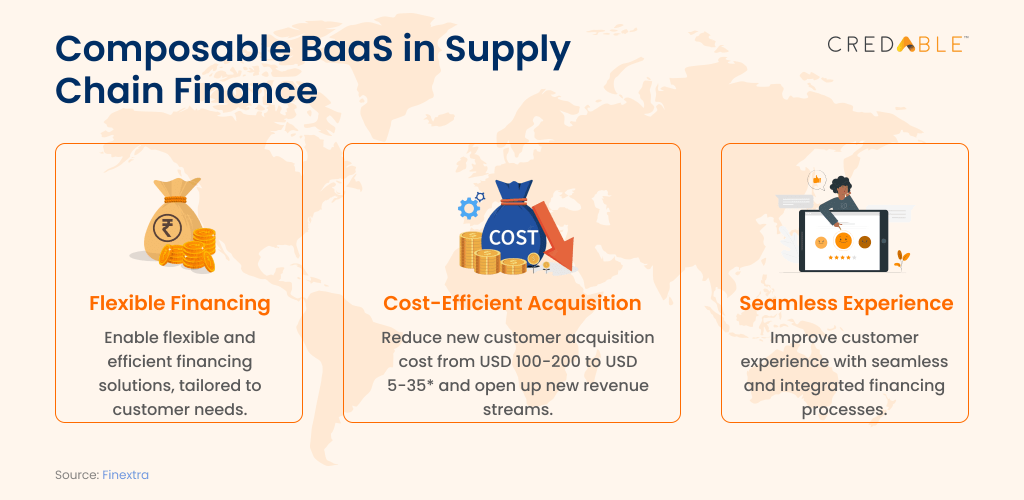

Empowering Supply Chain Finance

Supply chain finance is at the core of efficient trade operations. Composable BaaS platforms facilitate the seamless flow of funds along the supply chain, ensuring timely payments to suppliers and optimizing working capital for buyers. By combining multiple services, such as invoice financing, inventory management, and logistics tracking, banks can offer holistic supply chain finance solutions that address the unique needs of various industries. This empowers businesses to unlock trapped capital, improve cash flow, and enhance overall supply chain efficiency.

The Rise of Embedded Finance

Composable BaaS not only revolutionizes traditional banking but also leads to the emergence of embedded finance. By integrating financial services into non-financial platforms, businesses can offer a seamless user experience, enhancing customer loyalty and satisfaction. Whether it's offering point-of-sale financing at e-commerce checkout or providing credit options within enterprise resource planning (ERP) systems, embedded finance drives financial inclusion and convenience for end consumers and businesses alike.

Composable Banking and its Impact on Supply Chain Finance

Supply chain finance is a critical element of modern-day trade. Yet, it faces challenges like complexity, information asymmetry, and inadequate access to finance for small and medium-sized enterprises (SMEs). Composable BaaS addresses these pain points, fostering transparency and efficiency in the supply chain finance ecosystem.

Through API-driven connectivity, banks can connect to trade platforms, logistics providers, and credit assessment services. This enables real-time data sharing, facilitating quicker credit decisions and unlocking access to finance for SMEs. Improved visibility of the supply chain enhances risk management, reducing the credit risk associated with supply chain financing.

Composable BaaS empowers banks to offer tailored financing solutions, including dynamic discounting, invoice factoring, and supply chain financing programs. By leveraging modular components, banks can efficiently manage credit risk, optimize capital deployment, and provide competitive rates to suppliers and buyers.

Additionally, composable BaaS fosters financial inclusion by catering to the financing needs of underserved and unbanked SMEs. The ease of integration with fintechs and alternative data sources enables banks to assess creditworthiness beyond traditional credit scores. This opens doors for previously untapped customer segments, driving economic growth and prosperity.

CredAble's BaaS Offering: Enabling banks to empower Corporate & SME customers

CredAble, a leading player in the BaaS arena, is revolutionizing supply chain finance. Through its composable platform, CredAble empowers banks to serve a diverse customer base, including large corporates and SMEs. The modular approach allows banks to offer innovative solutions, ranging from early payment programs for suppliers to working capital optimization for buyers.

CredAble's robust API integration seamlessly connects banks with trade platforms and credit assessment agencies, ensuring timely and efficient decision-making.

The bottom line: Composable BaaS: A Game-Changer for Banking and Supply Chain Finance

Composable BaaS is ushering in a new era of banking, driven by innovation, agility, and customer-centricity. By leveraging the power of APIs and modular components, financial institutions can tailor their services, maximize efficiency, and stay ahead of the competition. In the realm of supply chain finance, composable BaaS is breaking barriers, empowering businesses, and fostering economic growth on a global scale. As the world embraces this transformative approach, composable BaaS is set to become the cornerstone of modern banking, shaping a future that is efficient, inclusive, and dynamic.

Think Working Capital… Think CredAble!