Building Working Capital Infrastructure for the World

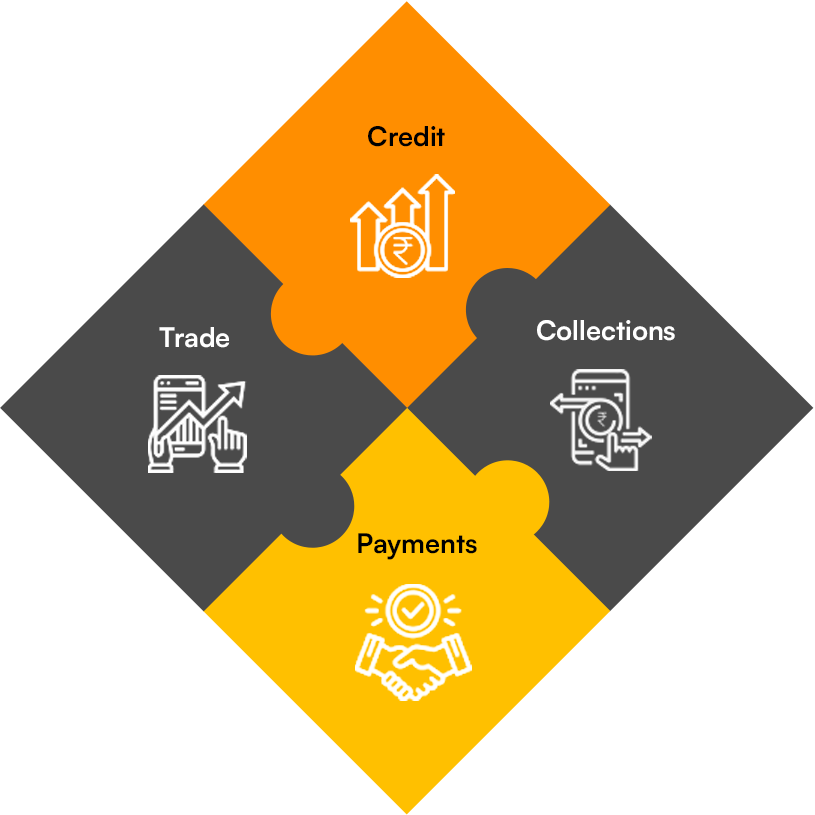

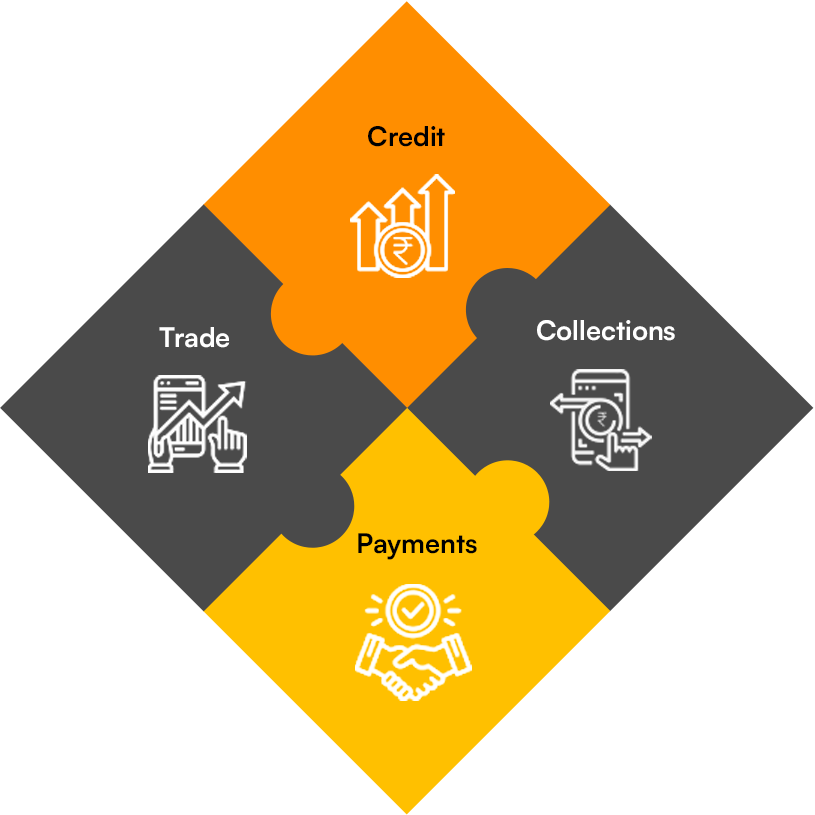

Trade

Structured B2B marketplace for trade facilitation along with supply chain financing and trade intermediation.

Credit

Access to diverse range of lending solutions such as Invoice Discounting, Purchase Order Financing, Pre-invoice Financing.

Payment

Simpler, faster, better B2B payments and automated reconciliation for high impact business processes.

CredAble awards and recognitions

We provide solutions for

Institutions

Enterprise Programs

Providing liquidity programs for enterprise eco-systems using state-of-the-art technology platforms.

Financial Institutions

API based Working Capital platform and embedded credit solutions for Financial Institutions and their Customers.

SMEs

Providing an all-in-one credit, trade and cash management platform for small businesses to manage and grow their business.

Enterprise Programs

Providing liquidity programs for enterprise eco-systems using state-of-the-art technology platforms.

Financial Institutions

API based Working Capital platform and embedded credit solutions for Financial Institutions and their Customers.

SMEs

Providing an all-in-one credit, trade and cash management platform for small businesses to manage and grow their business.

Why choose us?

Full spectrum

of working capital programs catering to payables and receivables cycles of our clients.

Multi-funder

Flexible product structuring

capabilities with off-balance sheet opportunities.

Digital trade finance

with automated transaction documentation and integration with all leading ERPs.

Deep trade finance expertise

in designing built-to-suit working capital financing programs customized to each client.

World-class technology platform

to provide scalability, intuitive UX, robust data security and advanced data analytics.

Seasoned in-house relationship team

to deploy strategies to drive recurring participation by beneficiaries.

Our team

Nirav Choksi

Co-Founder and CEO

Ram Kewalramani

Co-Founder and MD

Ashutosh Taparia

MD & CRO, Corporate Coverage

Satyam Agrawal

MD, International Business

Manu Prakash

MD and Head – Partnerships & FI Coverage

Debashree Lad

Chief People Officer and Head of Corp. Com

Kapil Kapoor

Chief Product & Technology Officer

Ranjit Singh

Executive Vice President & Head of Credit

Ketan Mehta

Chief Financial Officer

CredAble Success Stories

CredAble Success Stories

Latest News

& Media

There is no dearth of data. Automation workflows are in place. Yet, treasury teams grapple

Businesses today are looking to capture time-sensitive opportunities with smarter channel financing solutions. This comes

The retail space has transitioned from a time of turbulence to that of resurgence. The

Trade finance has been around for a long time now and prides itself on its

Sweat. Tears. Glory. The Paris Olympics 2024 have been nothing short of phenomenal, with nations

The race towards real-time is real! In a world where 25% of business bankruptcies occur

We would love to speak with you

Lending Partners