Working Capital Financing – Understanding Cash Flow Solutions for Business Growth

Most small businesses experience this hurdle, and under such circumstances, in order to sustain their business, they are left with little to no options but to avail themselves of a loan.

Companies across industries require working capital financing to either maintain their business, in the case of small business, or in order to scale their businesses, as in the case of larger businesses.

To avoid being burdened with long-term liabilities in the form of fixed term loans, MSMEs prefer to meet their short-term financing requirements for their business to continue operations.

What is Working Capital?

Companies require working capital at all times to carry out their daily operations. A constant source of working capital is necessary for businesses to pay timely wages, meet their expenses, maintain adequate inventory at all times, and to sustain other operational aspects of their business.

In 2019, the RBI set up an expert committee which revealed that the credit gap in the MSME sector in India was close to INR 25 crores. As of September 2023, the total loans reported in India stood at USD 1,828 Bn.

What is Working Capital Financing?

Working capital financing refers to the short-term liquidity facility extended to a business enabling them to run their day-to-day operations and covers expenses including inventory, cash, accounts payable, accounts receivable, and short-term debt.

Businesses with inconsistent cash flow generally use working capital financing to borrow money to cover their day-to-day operations and payrolls instead of purchasing equipment or making any large investments. It is typically used to provide finance to companies who receive a promissory note from their clients for the delivery of a certain amount of their goods.

Working capital financing are short-term loans, eliminating any concerns that the borrower may be unable to repay the loan.

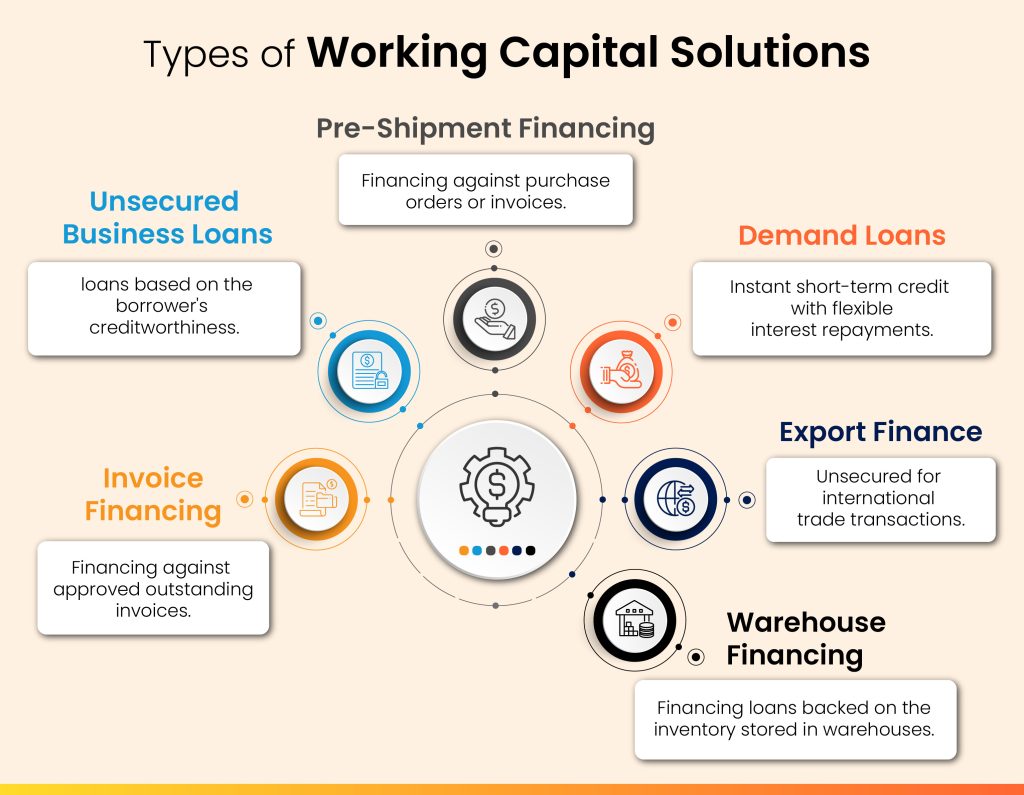

Types of Working Capital Financing Solutions

Working capital financing solutions vary to accommodate diverse business needs. Short-term loans provide funds quickly, while lines of credit offer flexible access. Trade credit allows delayed payment for received goods or services. Invoice financing unlocks unpaid invoice value, improving cash flow. Asset-based lending leverages assets like inventory or accounts receivable for financing. Each option addresses specific requirements, offering businesses flexibility in managing cash flow, seizing opportunities, and mitigating risks, ensuring efficient operation.

1. Invoice Discounting

Invoice Discounting is an invoice financing solution offered by financial institutions based on the unpaid invoices issued to the buyer.

Businesses sell their unpaid invoices to lending institutions to leverage the funds trapped in them. This solution allows businesses to maintain a healthy cash flow balance and ensure liquidity for the growth of the business.

The most popular types of invoice discounting include sales invoice discounting and purchase invoice discounting.

· Sales Invoice Discounting is a short-term loan in which individuals and business owners need to borrow money from financial institutions as a result of late payments from their customers. It is a useful tool for companies to manage and increase their working capital.

· Purchase Invoice Discounting allows MSMEs to fulfill their new purchase orders through early payments on their approved invoices.

This invoice discounting method is useful for MSMEs when they receive new orders at a time when not enough funds are available to them. Purchase Invoice Discounting aids business owners with their immediate cash requirements to ensure that their supply chain continues to run smoothly.

As opposed to the confidentiality maintained in the process of invoice discounting, invoice factoring is a type of invoice financing wherein a business can sell some or all of the company’s outstanding invoices to any third party in order to improve cash flow and stabilize the inflow of revenue. As a part of invoice factoring, the factoring company pays the company most of the amount invoiced immediately and collects payment for the same directly from the company’s customers.

Is Invoice Discounting or Invoice Factoring better for your Business.

Invoice Discounting and Invoice Factoring are both working capital solutions businesses can leverage from financial institutions to gain working capital against unpaid invoices.

| Invoice Discounting | Invoice Factoring | |

| How it works. | Invoice Discounting is the process wherein businesses secure loans against their outstanding invoices. | Invoice Factoring is done when factoring companies purchase outstanding invoices from the businesses seeking loans. |

| Leveraged by | Businesses with steady and reliable customer bases generally leverage invoice discounting. | It has been observed that smaller companies generally leverage invoice factoring as a result of accessibility rather than by choice. |

Ultimately, small businesses must choose the more appropriate financing solution on the basis of the needs and working capital requirements of the company at the time of the loan requirement.

2. Unsecured Business Loan

Small businesses usually do not have collateral to offer while applying for a loan. In such cases, lenders issue unsecured business loans to borrowers based on their creditworthiness rather than on any type of collateral.

Since the lender relies on credit information of the borrower, the loan terms reflect the risk they are taking such as higher interest rates, shorter repayment terms, or even smaller loan amounts.

The advantage of securing unsecured business loans is that since there is no collateral involved in the transaction, the business would not have the risk of losing any. For several business institutions, it is easier for them to borrow small amounts of money for short periods of time as per their requirements. Credit cards, student loans and signature loans are some of the most common and popular unsecured business loans provided by financial institutions.

3. Pre-Shipment Financing

Businesses use pre-shipment financing as a working capital financing solution when they require working capital before the goods or products have been sent or shipped to the customer. This type of financing is done by banks and other financial institutions and is secured by the goods produced or a letter of credit provided by the customer.

Generally, this covers the costs of production and transportation for the business and is intended to help businesses with their working capital requirements between the time the goods are produced, and the customers pay them.

Pre-Shipment Financing is beneficial to businesses in several ways as it helps MSMEs improve their cash flow by providing funds required by them to purchase and transport goods and services. This method of financing enables businesses to enhance their competitive advantage in the market and allows them greater flexibility in their operations.

4. Demand Loans

Demand loans are loans wherein lenders and borrowers do not sign this type of loan for a particular period of time; however, the lender can ask the borrower for repayment either partially or in full depending on the requirement of the lender at the time.

Businesses prefer to obtain working capital demand loans from financial institutions to clear their short-term financial obligations without the burden of repayment penalties.

On the other hand, term loans are long-term debts raised by companies for immediate working capital which comes with a schedule for repayment and installments for interest paid at either fixed or floating rates. These loans are typically only granted to businesses with stable and sound financial statements and a reassuring credit history.

Difference between Demand Loans and Term Loans

| Demand Loans | Term Loans | |

| Definition | Demand loans are short-term loans for which the repayment must be done by the borrowers as per the lenders demands. | Term Loans are long term loans with fixed repayment periods and fixed tenures on the basis of the terms of the loans. |

| Duration | Generally, the duration for demand loans is from a minimum of one week to a maximum duration of a few months. | The duration period for these can be anywhere between 1 year and 20 years. |

| Disbursement Time | Being short-term loans, demand loans are sanctioned and disbursed quickly. | The sanction and disbursement of these loans takes a longer time since these are long-term loans. |

| Repayment Schedule | Lenders can ask their borrowers for repayment of loans as per their discretion. | Term loans have a predefined repayment structure on the basis of the terms of the agreement of the loan. |

| Collateral | In order to receive demand loans, borrowers must pledge collateral. | Since this is a long-term loan, borrowers do not need collateral. |

5. Export Finance

Export finance is a working capital solution catering to the production and other transaction requirements of exporters. Buyers often make payments within an agreed payment term due to which sellers face cash flow issues.

This working capital solution solves the cash flow crunch faced by businesses before clients make payments for the goods purchased.

Export finance allows exporters to sell their goods and services internationally while enabling them with access to working capital before the importer makes the payment for the purchased goods. Besides meeting the exporter’s working capital requirements, export finance allows them to establish new export businesses and with the financial requirements to expand their services in the global market.

6. Warehouse Financing

Small businesses generally require external support to ensure steady cash flow and obtain adequate working capital to facilitate seamless company functions.

Warehouse financing presents small enterprises with a secure, cost-effective, and valuable credit option.

This type of financing proves particularly advantageous for businesses operating in the retail and wholesale sectors, where the maintenance of substantial inventory is crucial.

Being a secure method of lending, warehouse financing is generally not as expensive as other types of financing methods. Lenders have leverage over the borrowers as they have a hold of the borrower’s commodity in the warehouse as collateral in case there is a payment default at the borrower’s end.

Explore More Working Capital Solutions for your Business NeedsBenefits of Working Capital Financing

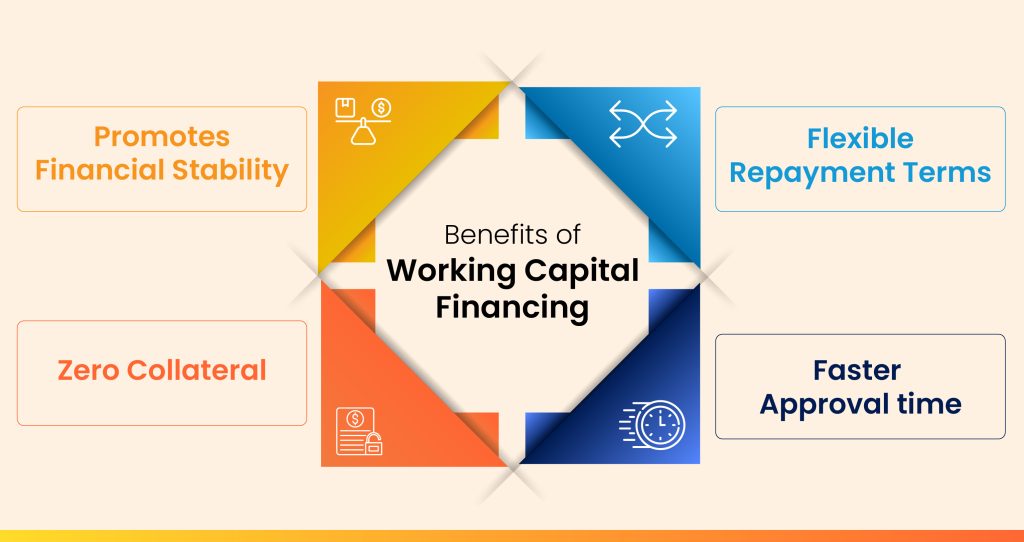

Different businesses derive different benefits from working capital financing based on the type of loan they are using and the purpose for which it is being used:

1. Promote Financial Stability

Working capital financing helps businesses by financing their payment gaps and meeting their working capital requirements. Small businesses can use these financing solutions to fund their day-to-day operations without the need for any equity transactions.

2. Zero Collateral

Businesses are granted easy access to unsecured working capital financing if they have a good credit rating. They are not required to put any of their assets up for collateral in the event of default.

3. Faster Approval Time and Flexible Repayment Terms

Lending institutions provide working capital financing with faster approval time due to the immediate requirement of cash for businesses. The lenders provide their clients with flexible repayment terms and the interest rates levied are dependent on the risk associated with the industry and the business model.

In conclusion, working capital financing serves as a lifeline for businesses, especially small and medium enterprises (SMEs), to navigate their daily operations. Through various solutions like invoice discounting, unsecured business loans, pre-shipment financing, demand loans, export finance, and warehouse financing, businesses can bridge the gap between their current assets and liabilities, ensuring continuity and growth. These financing options not only promote financial stability but also offer flexibility, faster approval times, and in many cases, require no collateral. As the backbone of economic activity, working capital financing propels businesses forward, enabling them to face challenges and seize opportunities for expansion. With tailored financial solutions at their disposal, businesses can confidently navigate the complexities of the market, driving innovation, and contributing to sustainable economic development.

Think Working Capital… Think CredAble!