5 Proven Ways to Shorten the Cash-to-Cash Cycle and Free Up Capital

Sudden changes in the economy and disruptions in the supply chain have resulted in mounting credit constraints, adding to the competitive pressures that businesses are already facing. Boosting the cash flow and increasing financial flexibility has become paramount to tide over the unprecedented times and stay ahead of seemingly volatile market conditions.

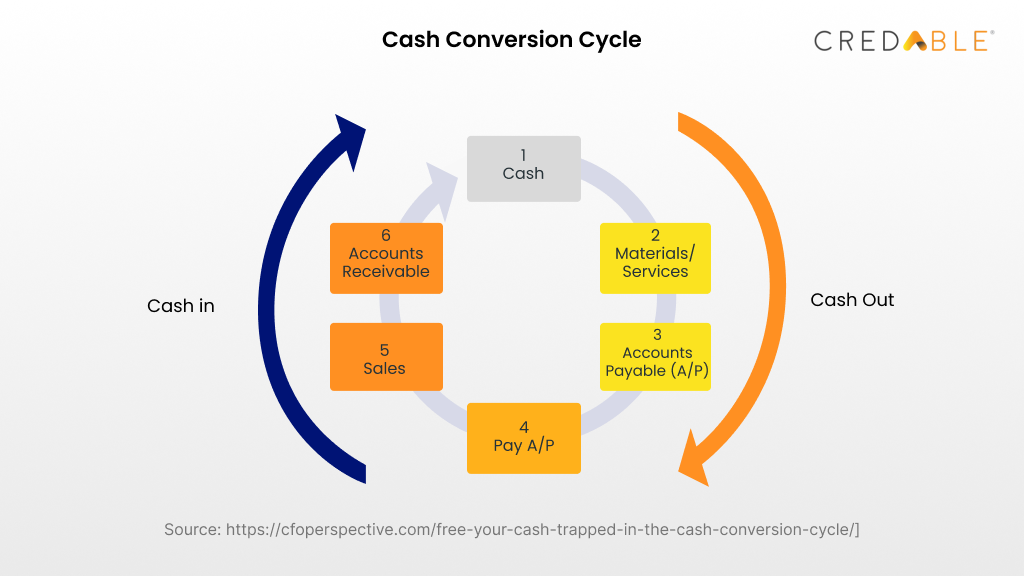

One definitive way to overcome these setbacks is to explore your Cash Conversion Cycle (CCC), also called the cash-to-cash cycle, and look for ways to get paid faster. Simply put, the cash-to-cash cycle is the number of days it takes for a company to convert the cash spent on inventory purchases into cash flows from sales.

How does a cash crunch happen?

Having a clear understanding of the cash conversion cycle will help you know how soon your business is able to turn inventory investments into cash sales. This is key to steering clear of cash crunches and tapping into lucrative opportunities.

A cash crunch takes place when you have exhausted your cash in hand or at the bank but have not yet been compensated for the sale of goods or services. We’ll understand this better with a quick example.

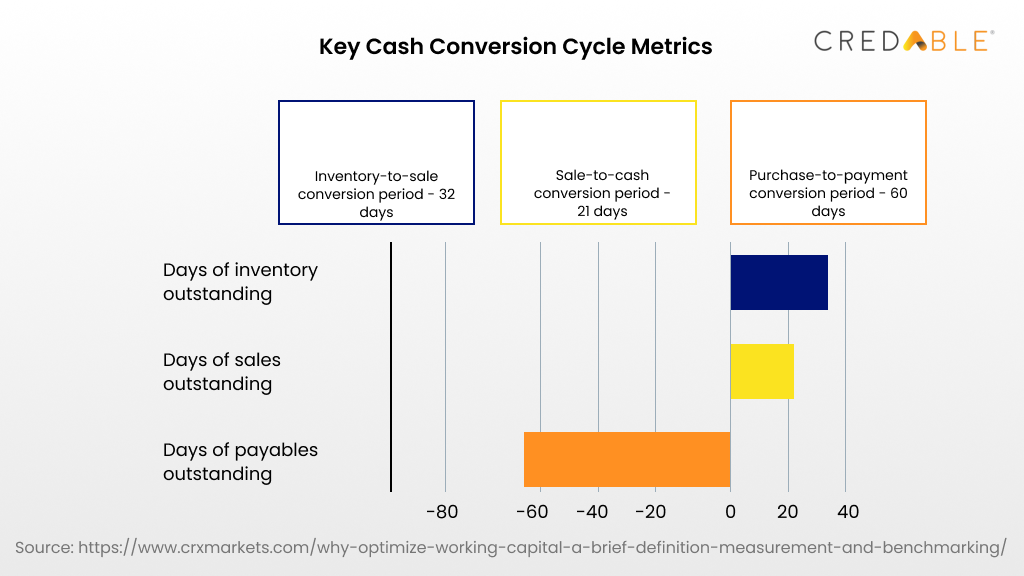

- Let’s say a distributor buys their inventory on June 1st.

- The inventory is then kept in their warehouse until they sell it on July 3rd (32 days).

- The customer then pays them after 21 days on July 24th.

- After having bought the inventories on June 1st, the distributor had to wait 60 days till July 31st to pay back their vendors.

| Cash Conversion Cycle Period | Dates | Days |

| Inventory to sale | June 1 – July 3rd | 32 |

| Sale to cash | July 3rd – July 24th | 21 |

| Purchase to payment | June 1 – July 31st | 60 |

The need to improve the cash-to-cash cycle

The cash conversion cycle is considered to be a standard measure of working capital performance. In 2020, owing to increases in inventories and receivables, the cash conversion cycle deteriorated by 2%.

According to a report by Ernst & Young, businesses in India have experienced an increase of six days in the cash-to-cash cycles. For small enterprises, the cash-to-cash cycle went up by nearly two weeks. To offset the staggering effects of the pandemic on the working capital, nearly 70% of companies ended up stretching their payables.

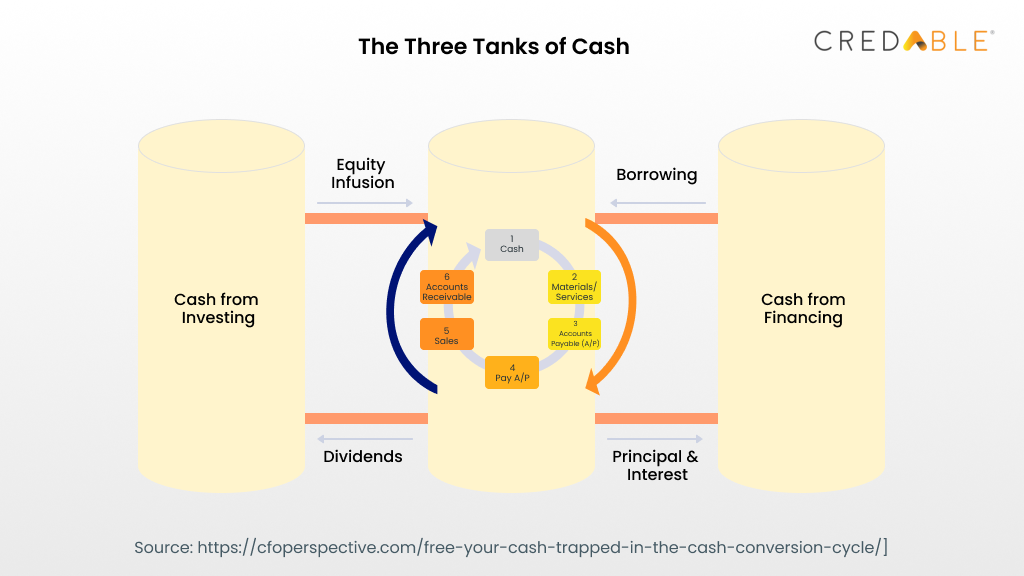

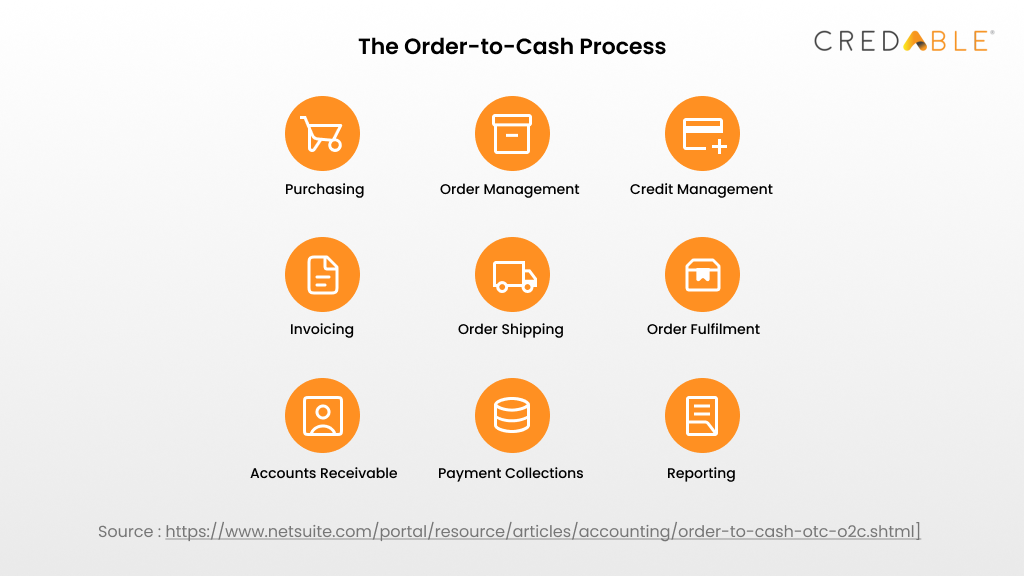

Optimising working capital performance presents a potential cash opportunity of INR 5.2 trillion. A shorter cycle is a clear indication of a company’s ability to maintain a faster inventory-to-sales process and efficiently manage its working capital. To achieve this, businesses need to control inventory chains and ensure that their supply chain (from the point of purchasing the inventory to paying for it) is aligned with their demand chain (Order-to-Cash / OTC / O2C).

The primary focus for businesses must be to reduce the Days Sales Outstanding (DSO) and improve Days Purchases Outstanding (DPO) and the Days Inventory Outstanding (DIO), which together form the cash conversion cycle.

5 Strategies to unlock capital and shorten the cash conversion cycle

Here are five ways to free up trapped capital:

- Maintain clean financial records: Every healthy business stays on top of its numbers. Ensure your customer records are updated with returns and closely monitor the accounts payable and accounts receivable reports.

- Invest in digital solutions: Businesses are now more open to using tech-enabled financing solutions to ensure that their working capital is bound up for as little time as possible. FinTechs like CredAble are using state-of-the-art technology platforms, deep ERP, and multi-bank integrations to enable liquidity for vendor/customer ecosystems of enterprise clients.

- Speed up delivery times: While quick deliveries will ensure that you get paid sooner, they can also lead to stronger trade relations and at times, favourable payment terms.

- Simplify payment processes: Provide your clients with multiple payment options. With CredAble’s receivables financing platform, you can easily receive and manage all your collections in one place.

- Provide early payment discounts: Incentivising your customers to pay early is a great way to close the gap in your cash conversion cycle. Offer your customers a 1 to 2% discount for paying within a 30-day period or lesser. CredAble’s fully digital early payment platform is designed to reduce the risk of cash shortages and ensure the procure-to-payment process remains intact.

Reimagining working capital optimisation

Having a solid digital foundation is crucial for businesses to reap the benefits of efficiency and cost, not to mention liberate trapped capital for profitable deployment. With CredAble’s working capital infrastructure, we are bridging credit gaps and providing flexible access to value-added financing solutions to businesses of all sizes. Our world-class technology platform offers transformative working capital and liquidity solutions for enterprise supply chains and their vendor ecosystems.