Top 5 Reasons Why Banks Need an Effective Operating System to Reimagine Working Capital Financing

“Act now to thrive tomorrow.”

For nearly a decade, digitalisation has been a top-of-mind topic in the boardrooms of financial institutions.

As enterprise clients are demanding unprecedented digitisation, the time has come for banks to look past their long-standing foundations. To thrive in the current economic and financial climate, banks need to chart new frontiers and reposition their offerings for a brighter future.

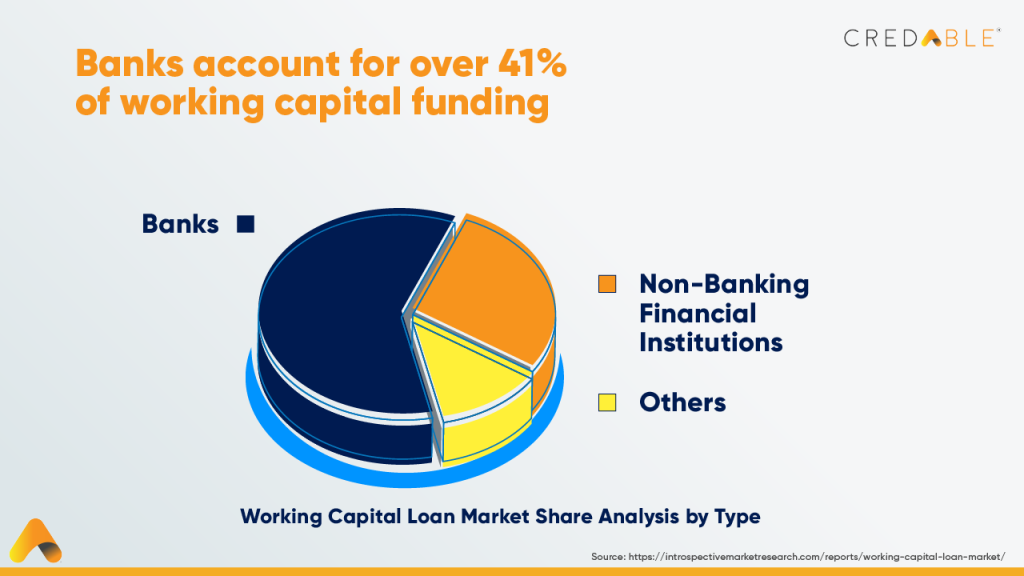

This holds true across the working capital financing space as well. The working capital loan market share is currently dominated by banks, as they account for more than 41% of working capital funding. One thing is certain—banks need to think beyond their linear, monolithic, and vertically integrated operating models to stay competitive.

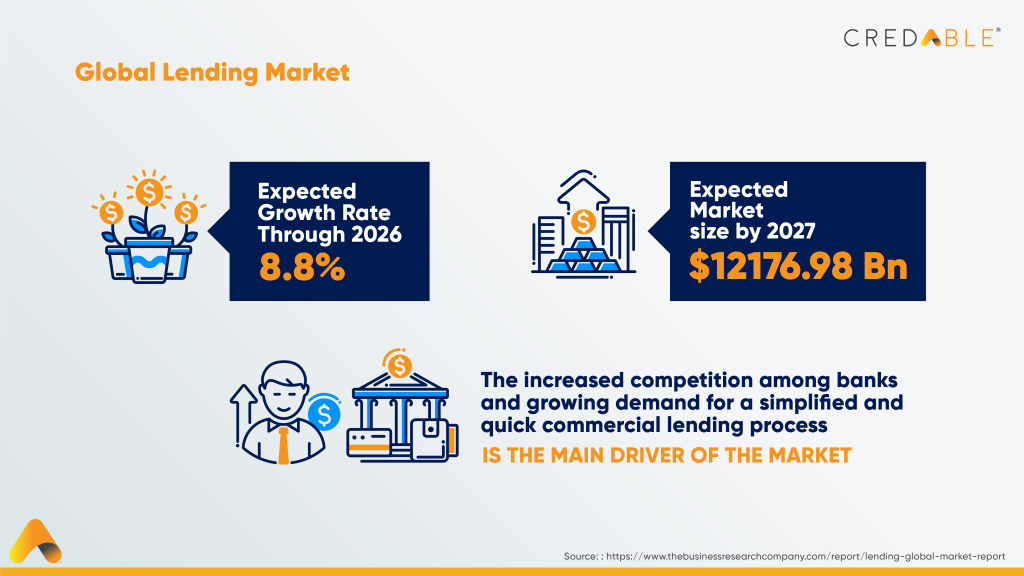

According to McKinsey, the addressable working capital financing market size globally amounts to a staggering $17 trillion. The opportunity is undeniably exponential. The downside? Banks are struggling to outperform their digital-only counterparts who have been quick to respond to market disruptions.

Be it established global titans or neobanks, financial institutions today are sitting on a massive untapped opportunity in the working capital space. What’s holding them back? We’ll run by the challenges banks face and then understand how a comprehensive working capital operating system will help banks win in the digital economy.

Legacy limitations: 5 key challenges faced by banks

Owing to siloed and complex operations, banks are struggling to meet the working capital needs of their digitally forward clients. With a rising league of digital-only players fragmenting the banking value chain, new entrants are increasingly capturing a sizeable revenue of the incumbents in financial services.

Among the multitude of legacy limitations, here are 5 primary challenges that banks face in delivering configurable working capital financing solutions:

1. Monolithic legacy applications:

Financial institutions operate on legacy systems that cannot be easily integrated with newer technologies and efficient operating systems. The lack of synergy and disconnect in the mapping of client data results in several service inconsistencies.

2. Cumbersome manual processes:

Most banks depend on labour-intensive processes that are time-consuming and prone to errors. Owing to this, there are delays in processing loan applications and hassles in assessing creditworthiness accurately. For instance, the absence of a digital onboarding experience will not only slow down the processes but the customer experience also takes a big hit.

3. Disparate banking departments:

Processes such as onboarding and disbursement are all operating in silos. The lack of cohesion between different banking departments can lead to lost cross-sell opportunities.

4. Significant risks:

As legacy systems lack the security protocols of innovative digital platforms, they fail to identify early warning signals during collections, which can severely cost financial institutions.

5. Perils of the one-size-fits-all approach:

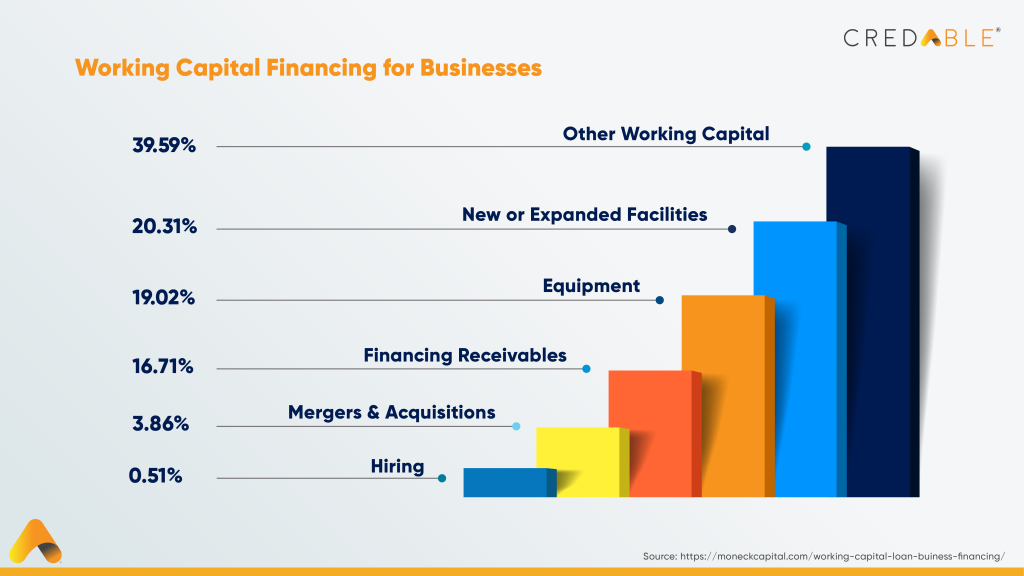

Given how legacy systems are inflexible, banks often take a standard approach to meeting the client’s working capital needs. Businesses require capital for a wide range of reasons. Banks lose out to new-age players who are able to configure innovative working capital financing solutions quickly, at scale, and at a lower cost.

The game-changer: A comprehensive working capital tech suite

Today, banking is at a tipping point. Considering the strong correlation between revenue growth and tech adoption, financial institutions need to prioritize tech enablement to succeed in the fast-changing landscape.

Implementing customisable tech solutions right from the point of onboarding and underwriting to disbursement and repayment is crucial to future-proof the entire working capital financing spectrum.

CredAble is pushing the frontiers of innovation and empowering leading financial institutions to build transformative working capital financing solutions. With a modular, customisable, and scalable Banking as a Service (BaaS) tech suite, we are helping banks transcend incremental improvements to their digital capabilities.

A comprehensive solution suite, CredAble’s BaaS tech stack helps banks overcome the challenges they face in enabling working capital financing for enterprise and SME ecosystems. The solutions suite comes packed with a host of 12 front-end and back-end capabilities such as anchor-led supply chain financing, receivables financing, early warning signals, and loan management systems. The BaaS tech stack is not only compliance-friendly, adhering to the individual policies of financial institutions but also highly customisable to cater to provider and end-customer requirements.

Offer next-level customisation in working capital financing

To stand out in a hyper-competitive world, banks need to offer unique value propositions that are tailor-made to cater to clients’ growing capital requirements. With CredAble, financial institutions can unlock new revenue streams, build resilience, and quickly evolve toward a future-ready state. If an enterprise client is looking for a purchase order financing solution, banks now have the option to augment their offering by leveraging back-end capabilities such as digital underwriting and early warning signals.

CredAble’s path-breaking plug-and-play offerings across the lending value chain enable banks to offer working capital financing solutions that are precision-engineered to meet client needs.