Cash Flow-Based Lending: Pioneering Financial Inclusion for MSMEs

We have witnessed steady digitisation and growth for over a decade now driven by strong socio-demographic fundamentals. Riding on the back of the digital acceleration wave, India has seen the momentous rise of the startup ecosystem.

Regardless of the recent advancements, a matter of concern for all of us in the industry is that while Micro, Small, and Medium enterprises (MSMEs) are a lucrative and growing market, traditional lending to these businesses continues to be fraught with challenges. Backed by strong consumer demand and initiatives promoting ‘ease of doing business’—reports confirm that 9 out of 10 MSMEs are expecting to make profits this year. On the flipside, the demand for credit is expected to arise in 60% of businesses across all sectors by 2024.

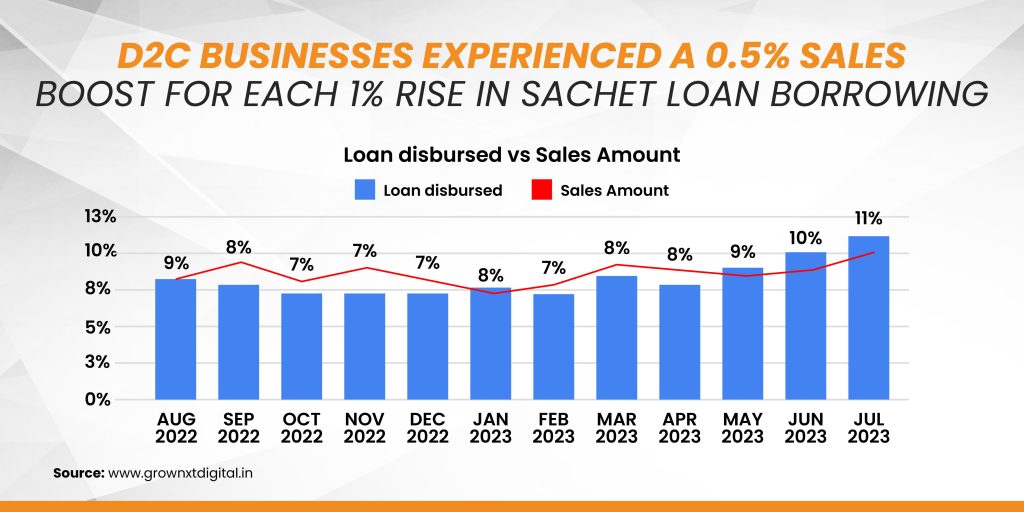

While secured lending requires borrowers to pledge an asset as collateral, unsecured lending does not require collateral but may have higher interest rates and stringent eligibility requirements. These lending options can be challenging for MSMEs to access due to their eligibility criteria, collateral requirements, and the need for a strong balance sheet. In this case, borrowing from traditional financial institutions takes months to complete as it involves the assessment of the liquidation value of assets, collateral, and other determining factors. In recent times, cash flow-based lending has come to the forefront as an ideal solution to meet MSMEs’ growing need for short-term, “sachet loan credit borrowings".

The lending market in India has traversed a remarkable journey

From innovative digital lending models to data-driven risk assessment and embedded financing solutions—there are several options now available for businesses seeking credit.

Most businesses at the growth stage require quick access to short-term finance to meet their daily operational as well as multiple working capital financing needs.

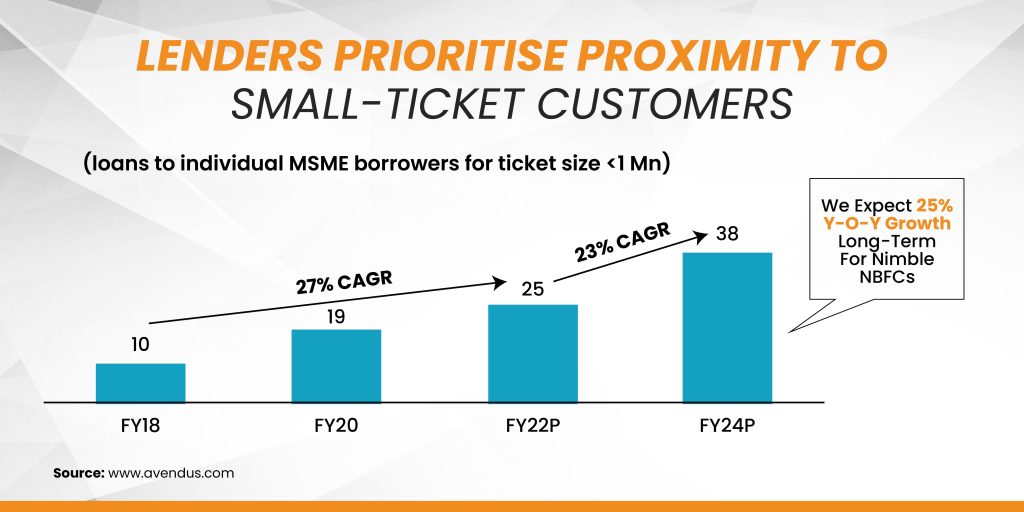

MSME borrowers are increasingly seeking loans of smaller amounts. Recent reports reveal that the loan ticket size at public sector and private banks have reduced by 21% and 7% respectively. That’s not all, over USD 100 Bn of the credit demand among MSMEs exists for the small ticket loan segment. With an increasing demand for small-ticket loans of less than 1 million, we can expect to see small-ticket financing grow at 25% year-on-year.

Cash flow-based lending, a more accessible financing model for MSMEs

Long-term loans are not conducive to meeting the short-term capital requirements of MSMEs—who often prefer immediate financing.

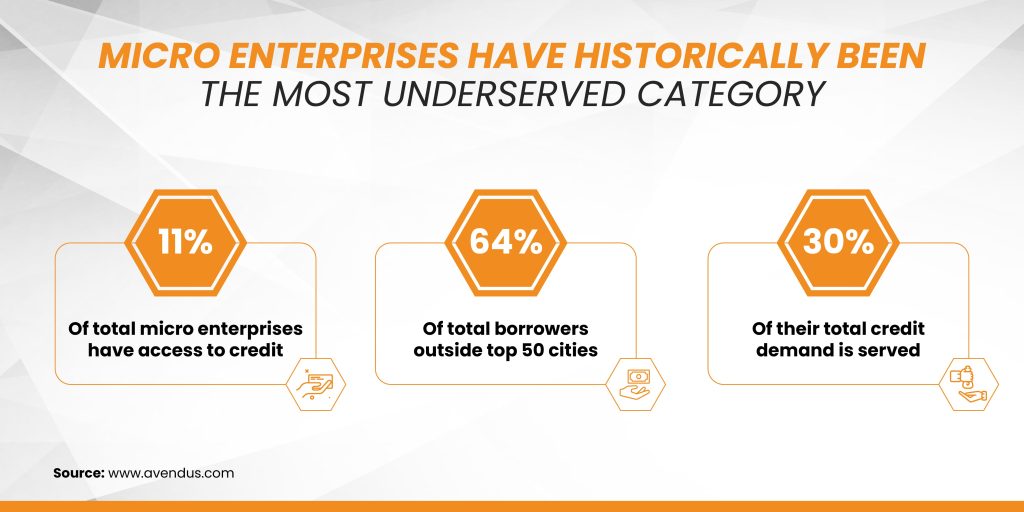

To put things in perspective, the formal credit penetration in the MSME sector stands at a mere 20%. The credit gap is severe for micro-businesses that struggle to access traditional forms of credit.

The primary challenge remains that small businesses often have a limited commercial credit history. Given how most MSMEs are thin-file customers with sparse bureau footprints, it is challenging for traditional financial institutions to evaluate their creditworthiness accurately. Besides, traditional lending methods rely on historical data, which may not provide an accurate depiction of a business's current or future financial position.

This is where cash flow-based lending comes into the picture. As a reliable approach to assessing the creditworthiness of small businesses, cash flow-based lending models address these challenges by offering a more flexible and inclusive financing solution.

Rather than depending on their credit score or locking away collateral to secure funds, MSMEs can access financing based on their real-time cash flow data.

Consequently, even with poor credit histories or limited collateral—MSMEs now have the option to access funds to meet their urgent working capital financing needs.

Unpacking the benefits of cash flow-based lending

The MSMEs’ eligibility to leverage cash flow-based lending is determined mainly by their business’s capacity to generate cash flows.

To put it simply—cash flow-based lending allows MSMEs to secure financing based on the revenues that they are expecting to receive in the future.

By leveraging real-time cash flow data, FinTechs today are redefining the end-to-end digital lending process for MSMEs. Right from the point of onboarding and underwriting to credit product configuration and repayment—MSMEs now have access to affordable and innovative financing solutions.

The real-time visibility of cash flow coupled with a traceable record of digital transactions of MSMEs, equips lending platforms with data-driven decisioning models for credit risk assessments. This removes the dependency on using collateral and credit histories to assess borrowers. In turn, it unlocks access to timely financing solutions that are of small ticket size, have a short tenure, and faster approval turnaround time, not to mention flexible repayment periods.

Moving away from conventional lending practices

New-age FinTech platforms are intertwining data and technology to offer financial access to MSMEs with improved turnaround times and simpler documentation based on their cash flow data.

FinTech lenders like CredAble are using cash flow-based assessments to offer solutions based on transactions between ‘corporates and SMEs’ and ‘SMEs and SMEs’ to meet the urgent demand for short-term capital and supply chain financing. Read our latest white paper to understand more about CredAble's powerful credit underwriting modules and cash flow-centric financing structures.

Explore the SME Whitepaper

We make robust credit assessments by leveraging transaction data through external databases and ecosystem partners. This way, we are uniquely positioned to help businesses meet their day-to-day operational needs by providing access to collateral-free business loans in minutes via a digitised and paperless process.

Think Working Capital… Think CredAble!