Credit for the Underserved: Addressing The Massive $530 Billion MSME Credit Gap

Micro, Small, and Medium Enterprises (MSMEs), play a central role throughout the global economy and represent a massive untapped source of growth opportunities.

In India, MSMEs are expected to grow from 6.3 crore to 7.5 crore in the coming years.

Having said that, due to a climate of economic turbulence, the MSME sector in the country has been battling the odds to survive and remain competitive in diverse marketplaces.

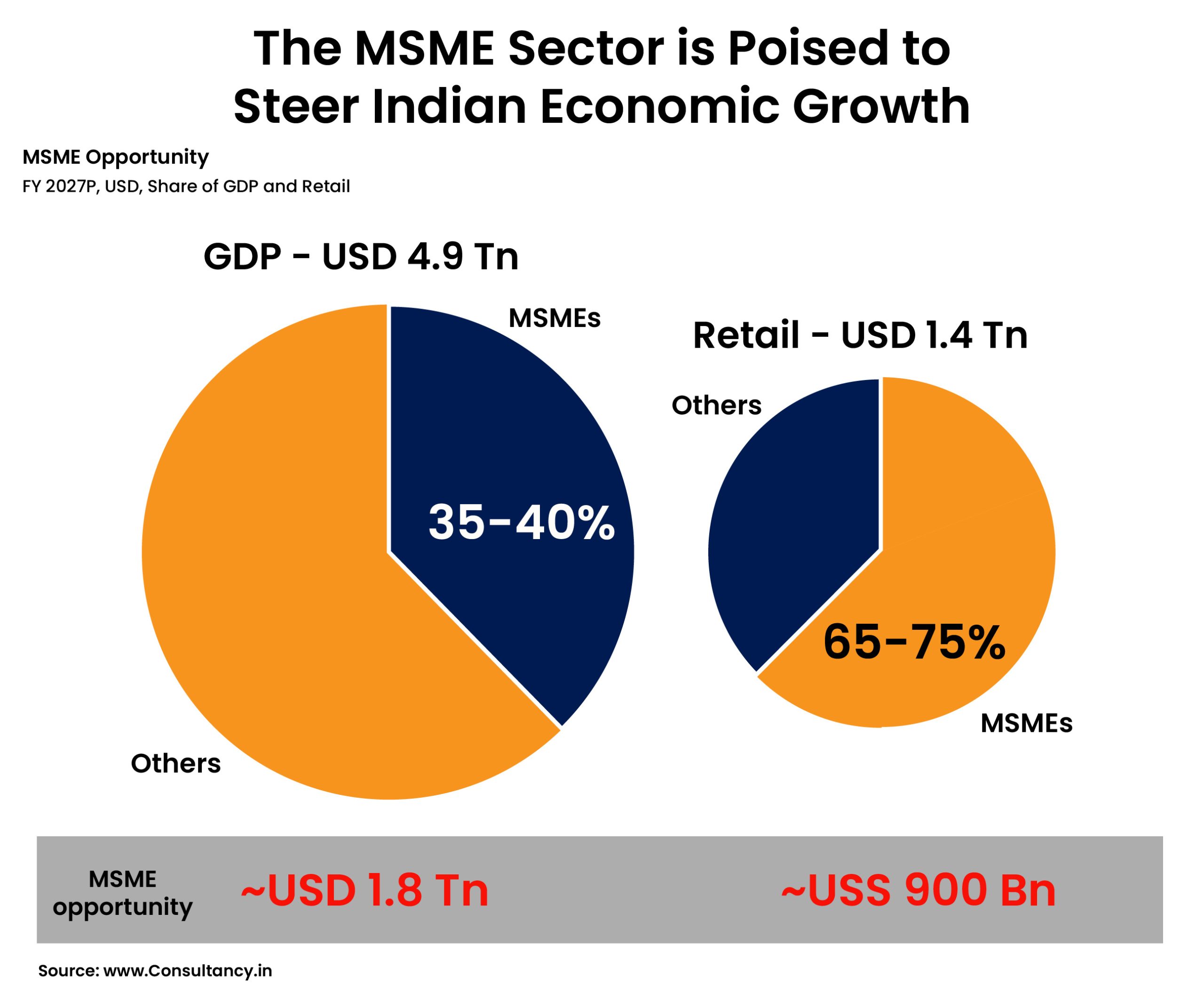

On the cusp of becoming the world's third-largest economy, India has demonstrated an impressive growth trajectory. The MSME sector is a leading contributor to the nation’s employment and Gross Domestic Product (GDP). Other than the agriculture segment, MSMEs in the country employ more Indians than any other sector. They have contributed roughly one-third of India’s GDP in the last decade.

While the MSMEs in India have grown exponentially, almost doubling in strength, the sector’s contribution to the country’s economy remains below its potential. Without a doubt, a significant barrier to growth has been the lack of access to formal credit.

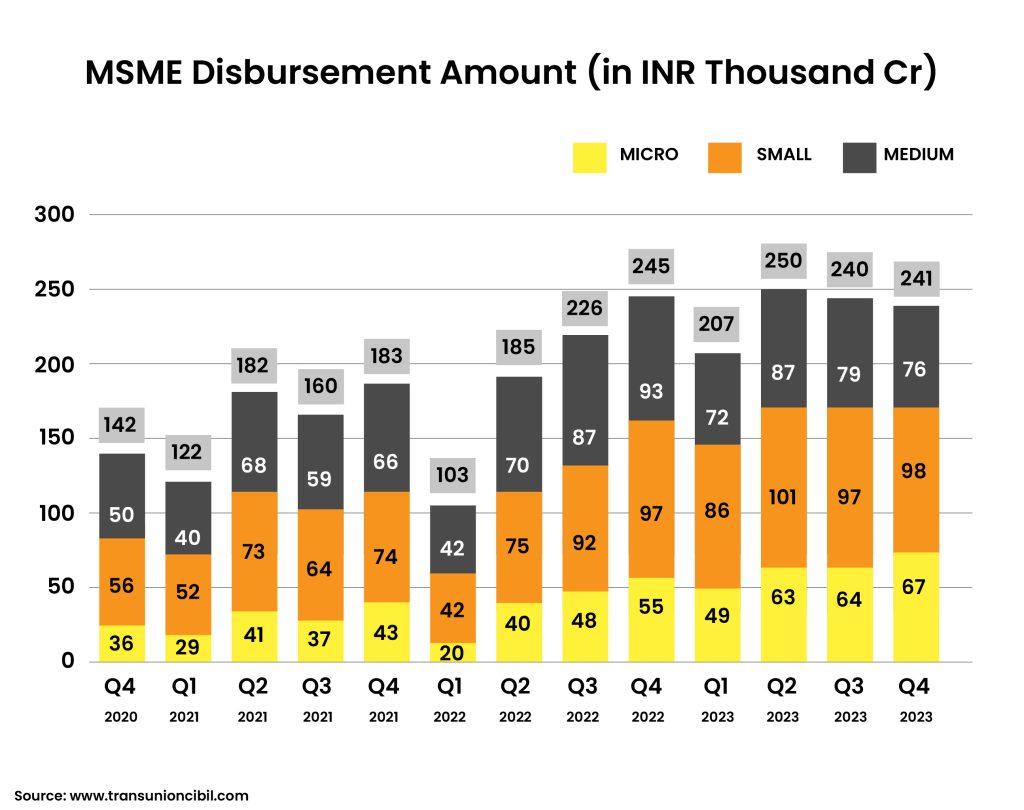

Analysing the MSME credit landscape in India

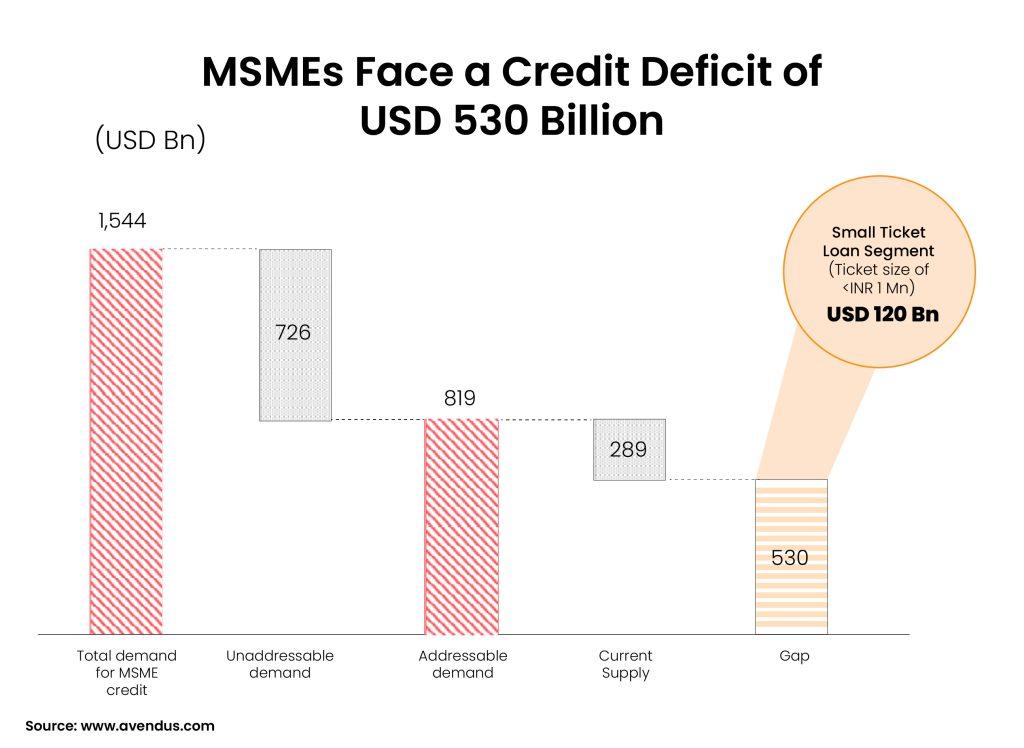

According to a recent report by EY, compared to global averages—the MSME sector in India lags behind when it comes to formal credit penetration. To put things in perspective, MSMEs are currently battling monumental challenges with a credit gap of $530 Bn.

Among the 64 million MSMEs in the country, only 14% have access to credit. The overall finance demand in the MSME market is around $1,955 billion witha 3.8x debt-to-equity ratio. The demand for debt-based finance was pegged at $1,544 billion.

Nearly 47% of the debt demand from MSMEs was estimated to be unaddressable. This is primarily because many of these businesses are not financially viable or they prefer being funded by non-transparent informal sources that end up charging high rates of interest.

This leaves a debt demand of $819 billion, of which $289 billion demand is currently fulfilled by formal credit lenders like private banks. The remaining unfulfilled demand of $530 billion makes up a huge addressable market for FinTechs and NBFCs like CredAble.

Given the pivotal role of MSMEs in fostering wealth creation at a grassroots level and advancing India's trajectory towards global prominence, there is a dire need for the financial services sector, in collaboration with governmental and regulatory entities, to expedite efforts addressing MSME funding challenges.

The digitisation imperative for MSMEs

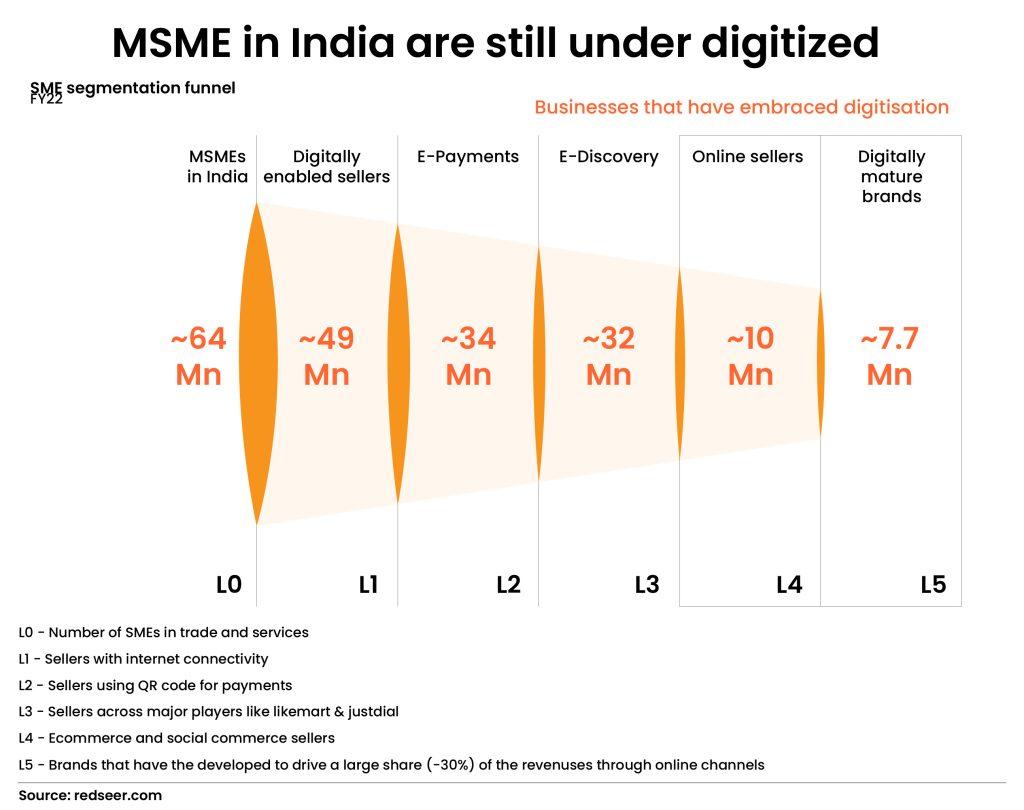

As per findings from a RedSeer report, out of the total of 64 million MSMEs in India, approximately 12%, or around 7.7 million, are considered digitally mature brands, while the remainder is at varying stages of digitisation.

Owing to concerted efforts by the government of India and the regulatory bodies, a paradigm shift in digitising MSMEs is unfolding. With the launch of the digital infrastructure known as the India Stack, there has been a widening of access to financial services in an economy where day-to-day transactions were heavily cash-based. The maturing India Stack, coupled with the prevalence of API-based data availability, has played a critical role in fundamentally transforming the MSME credit value chain. The launch of the Unified Payments Interface (UPI) and Goods and Services Tax (GST), have each positively impacted MSME formalisation and digitisation. As a result, digital payments are now evolving, with the pandemic having spurred the shift more drastically.

Additionally, platforms like Open Credit Enablement Network (OCEN), by connecting a wide range of stakeholders in the lending ecosystem are instrumental in streamlining the process of lending and borrowing for MSMEs.

Digital lending paves a promising future for MSMEs in India

Today, we are witnessing an increased receptivity towards digital lending from the MSME sector. Consequently, end-to-end digital MSME lending has become a reality.

With the lending industry in India, moving towards a more digitally-focused approach, there has been a 12X surge in digital loan disbursements between the years 2017 and 2020.

Digital lending has not only significantly enabled progress towards creating a cashless and paperless ecosystem but has also facilitated transparency and ease of credit availability for MSMEs.

Providing MSMEs digital lending and alternative need-based financing options such as supply chain financing, invoice discounting, securitization of MSME credit, and cash flow-based lending are some of the key ways of improving access to working capital for this sector.

The rapid adoption of technological advancements among FinTech lending companies has led to the emergence of new-age digital lending platforms, revolutionising how MSMEs access credit today.

From a digital payments standpoint, the industry is consistently refining its offerings to cater to the last-mile consumers in the digital ecosystem. These progressive advancements have significantly altered the way MSMEs perceive and manage payments. In recent years, the MSME sector has experienced systemic transformations that have redefined its daily operations, streamlined payment reconciliations, and revolutionised its approach to monitoring cash flow.

Unlocking a new era in digital lending

In India, digital lending is said to surpass traditional lending on unsecured loans by 2030.

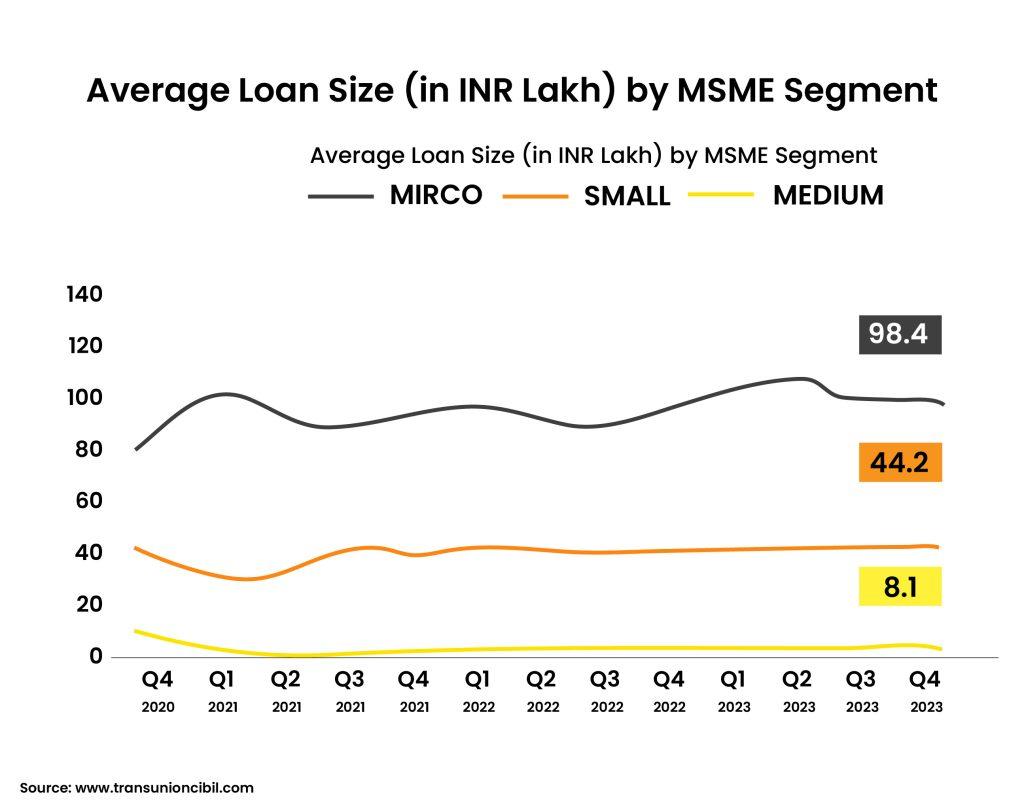

It’s also interesting to note that an increasing number of MSME borrowers are availing loans of lower ticket sizes. Recent reports reveal that the loan ticket size at public sector and private banks have reduced by 21% and 7% respectively.

Backed by RBI’s digital lending guidelines, companies like CredAble are using data-backed underwriting tools and cash flow-based assessments to offer need-based financing solutions to meet the MSMEs’ growing demand for working capital.

Think Working Capital… Think CredAble!