Elevating Business Performance & Supplier Relations Management with Early Payment Solutions

In today's fast-paced business environment, controlling the cash flow of your business is an essential ongoing responsibility. Businesses can do several things to improve their cash flow generation and maintenance. Nevertheless, utilizing early payments is a somewhat counterintuitive yet successful method of managing your financial flow.

Paying your vendors and wholesalers ahead of schedule will help you manage your cash flow, reduce the cost of products sold, and improve your working relationship with them. It's a win-win situation that might provide welcome stability in an unstable world.

What is an early payment program?

Late payments on invoices can impede a company's ability to meet operational costs and invest in development possibilities, even if it has a healthy cash cushion and beneficial sales. According to a recent survey, 39% of suppliers receive late payments from their buyers, and 62% of those suppliers want to be paid early.

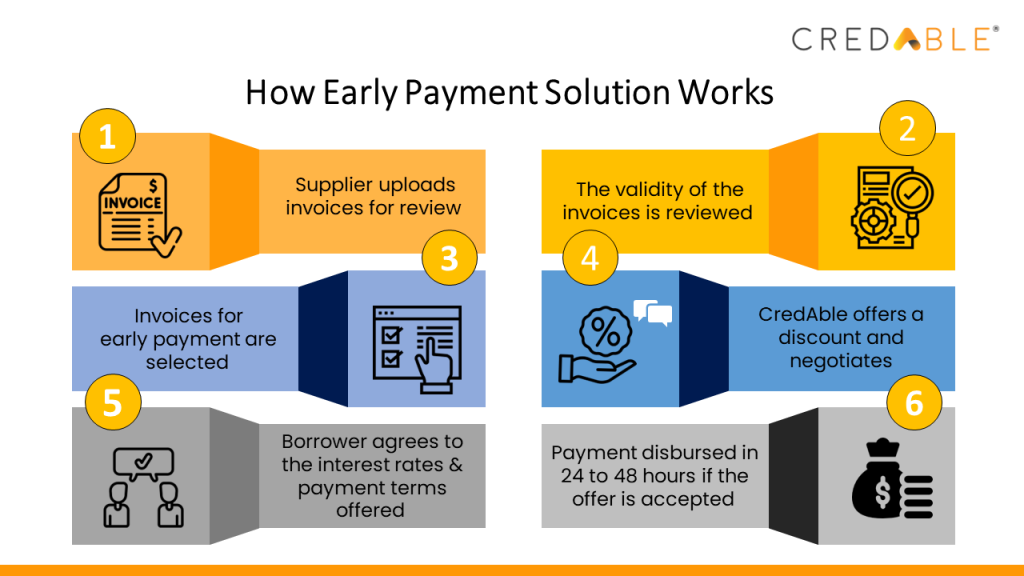

The early payment program enables suppliers to get paid faster by accelerating invoices at a favourable discount rate. It is a quick and easy way to improve cash flow without taking on new debts. Moreover, they are more cost-effective than loans, lines of credit, or invoice factoring.

How buyers can benefit from an early payment solution

By participating in an early payment program, buyers can save money on their purchases by receiving a large discount from their suppliers.

This discount typically ranges between 1.5 and 2%, but depending on the circumstances, the discount can be more or less. The savings would be a big deal if the invoice amount is large. By saving on this front, you can lower the cost of your goods and increase your profit margin.

Additionally, early payment programs can strengthen a buyer’s connection with its suppliers, which can result in better future pricing and terms. In addition, early payment programs can release capital for purchases, allowing for more discretionary spending, investments, or debt reduction.

How suppliers can benefit from an early payment solution

One of the most obvious benefits for suppliers is that they get paid early. Even though the suppliers don’t get the full amount of their invoices, they get the maximum amount of their cash much before the expected date. Early access to cash improves cash flow, reduces days sales outstanding, and enables them to pay suppliers with their own cash flow.

CredAble’s Early Payment Platform offers substantial benefits to suppliers. It helps suppliers accelerate payments, regulate outstanding invoices, reduce accounts receivable payment cycles, increase cash flow, and optimize working capital. The platform streamlines the process of offering early payment discounts to customers who qualify.

By using the platform of CredAble, buyers can propose early payment with a corresponding discount, while giving you the power to determine both the discount rate and an ideal payment timeframe based on your current cash flow requirements.

Moreover, early payment solutions can help drive growth for both buyers and suppliers. Suppliers who have better cash flow can invest in their business operations, expand their product lines, and enter new markets. This can result in increased production, better-quality products, and higher revenues.

Early payment solutions can also help reduce risks for buyers. Late payments can result in suppliers delaying or stopping their services, which can cause disruption to the buyer's operations. Early payment solutions can help mitigate this risk by ensuring timely payments to suppliers, thereby improving the continuity of services and reducing the risk of disruptions.

How does CredAble support supplier relationship management?

CredAble has extensive experience when it comes to optimizing buyer and supplier relationships. As the leading player in the industry, we understand that liquidity in supply chains is the need of the hour for both you and your suppliers. It is also a little challenging to make sure all the players in your ecosystem have the financing to grow equally.

Setting up a team to implement an early payment solution can be a costly affair. CredAble has a dedicated team of supplier relationship managers who bring your suppliers on board and help you run your early payment program. Our supplier relationship managers provide value by analysing industry trends and developing customized programs to benefit both you and your suppliers.

In conclusion

CredAble’s Early Payment Program is a boon for both buyers and suppliers, and as one delves deeper, the point gets clearer. If you want to maintain regular cash flow without affecting your existing terms and conditions, taking advantage of an Early Payment Program is the best solution. Through this program, you can cover your costs on time or invest in future growth without having to take on debt. So, if you like to gain control over cash flow by offering timely access to working capital, trying CredAble’s Early Payment Program will be a smart move.