How Working Capital is Fuelling a New Era of Value Creation in Private Equity Firms and Their Portfolio Companies

For private equity (PE) firms and their portfolio companies, the world is arguably more volatile than ever before. Between rising geopolitical tensions, the pandemic, and climate shocks—economic and global disruptions have become commonplace today.

Over the last few months, the traditional investment model of debt-to-equity has been challenged by a rapid rise in the cost of capital. This has significantly altered the investment calculus. The initial half of 2022 saw public market valuations undergo their worst performance in decades, signaling a period of unprecedented market downturn. The need to confront these uncertainties head-on has never been more critical.

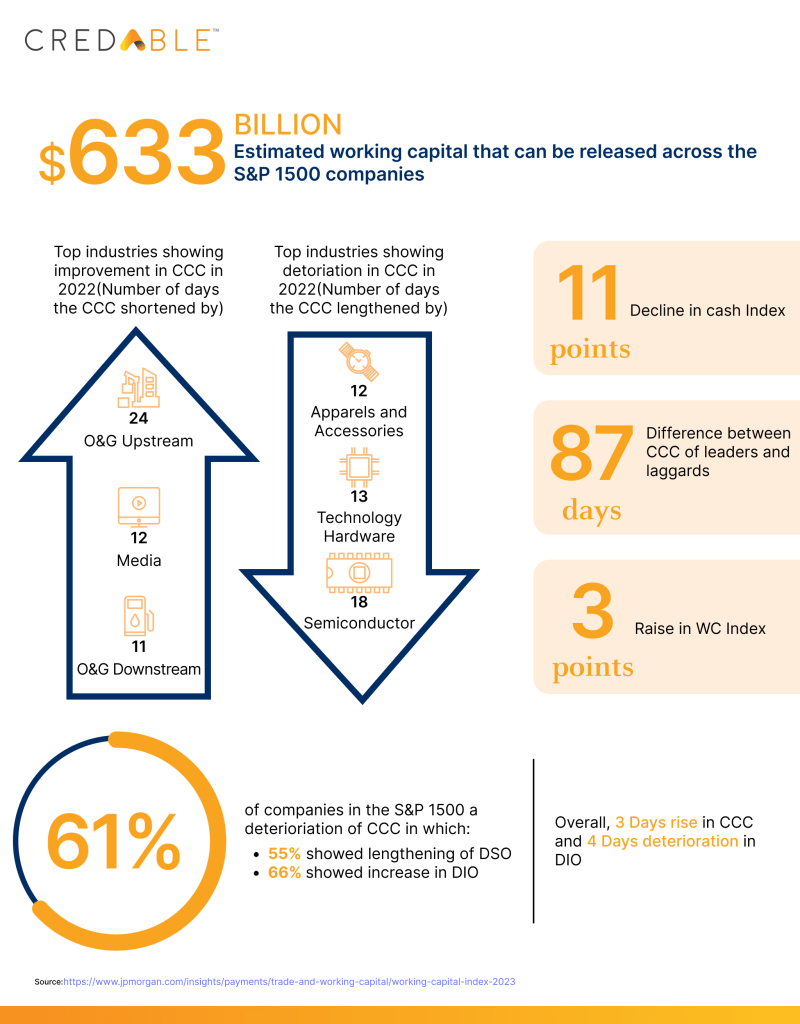

In this complex environment, PE leaders are evaluating existing playbooks and looking for new approaches to deliver outsized returns and improve financial ratios from their portfolio companies. PE firms are forced to reconsider their mix of cash-to-debt in today’s ever-evolving landscape. 80% of private equity professionals, as per EY's survey findings, have heightened their commitment to helping portfolio companies understand and address their cash and liquidity demands. To maintain steady earnings and generate superior cash-on-cash returns, we take a look at how PE firms and portfolio companies are increasingly turning to working capital improvement programs for results.

PE firms utilising working capital finance for their strategic advantage

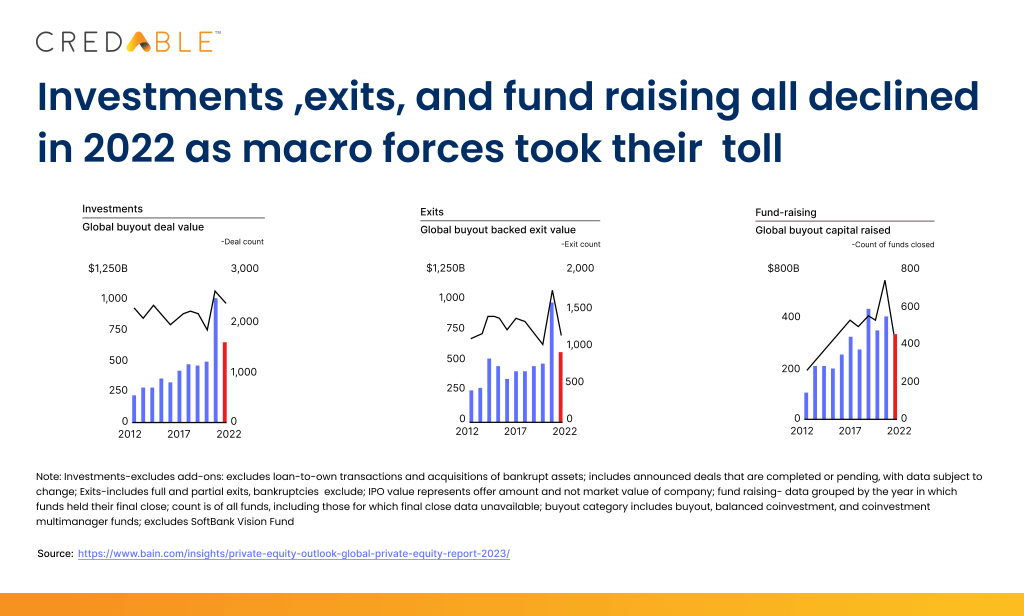

The remarkable upswing in dealmaking post-Covid met a roadblock as inflation and increasing interest rates took center stage in the last two years, ushering in challenging times ahead for the PE firms.

What followed was a sharp decline in deals, exits, and fund-raising activities.

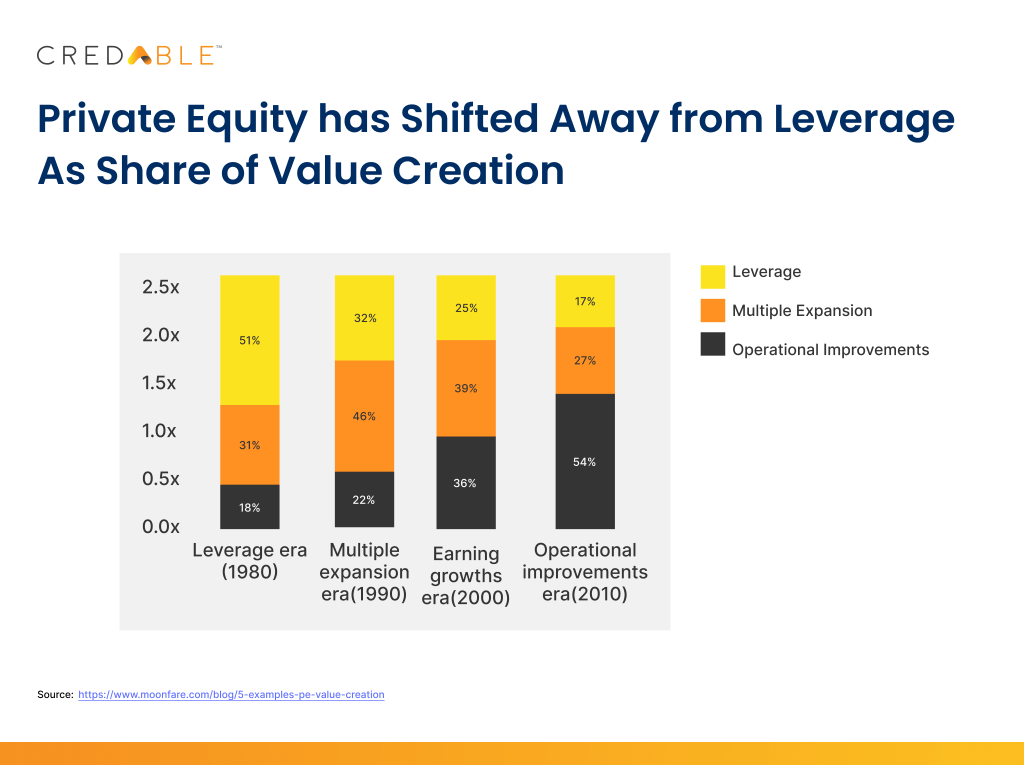

When navigating such economic dislocations, fund managers over the decades have introduced strategic shifts to defend their positions, create value, and seize opportunities that typically emerge in downturns.

From the leverage era in the ‘80s, multiple expansions became the key priority in the ‘90s. We then saw a laser-sharp focus on earnings growth in the 2000s followed by operational improvement gain prominence since 2010.

In the current high-interest rate environment, PE firms are focusing on managing working capital effectively to create value, build cash discipline, and potentially increase returns.

The appetite for working capital solutions has been on the rise, with PE leaders recognising the product not merely as an alternative to traditional borrowings but as a strategic instrument to enhance value across their portfolio companies.

How is this achieved? Working capital optimisation facilitates the release of cash, offering crucial support for expansion through investments, and empowering the execution of acquisitions—all without incurring the burden of additional debt. In essence, it transforms working capital from a financial tool into a strategic enabler for PE firms seeking to maximise value across their diverse portfolios.

50% of PE leaders admit to investments becoming more complex in the last five years. Along with tackling complexities, PE firms are looking to drive scale.

As a result, private equity firms are now placing heightened strategic emphasis on working capital as a part of their due diligence processes. Cash flow transformations are incorporated throughout the transaction lifecycle by private equity firms.

Working capital benefits for portfolio companies

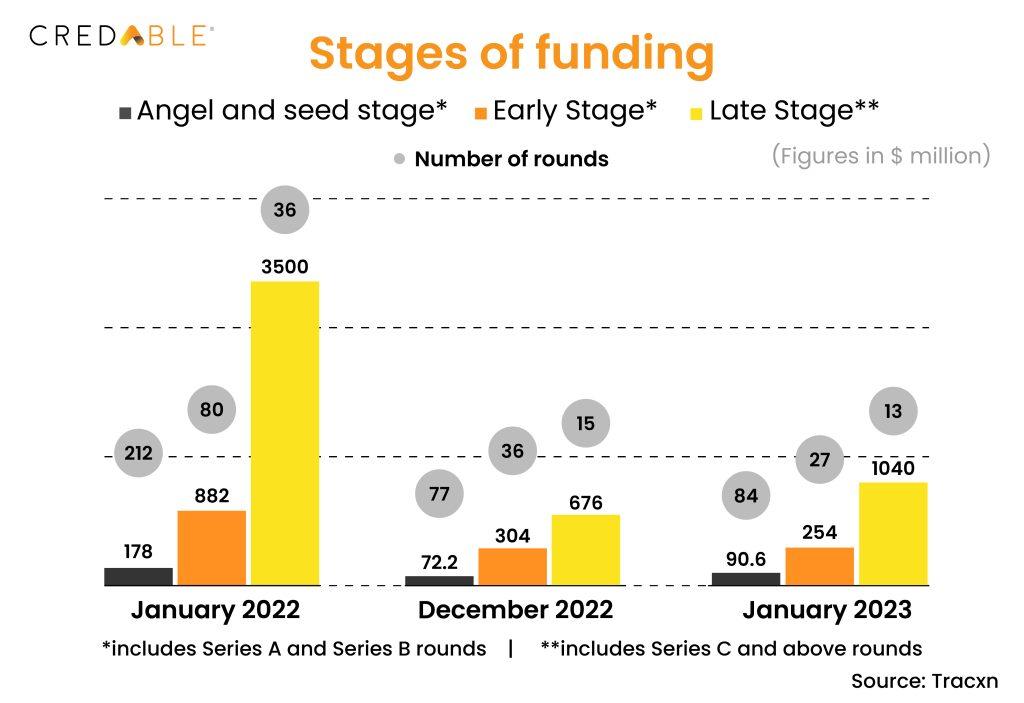

As the recent funding winter has cast shadows over equity flows, portfolio companies are up against financial strains in the midst of unpredictable market conditions. There was a visible slowdown in India’s startup story with the new additions to the unicorn club declining sharply.

2023 was a year of sustenance. As PE firms looked to invest in businesses that have lower burn and higher visibility to profitability, most portfolio companies shifted their focus towards slashing spending and long-term value propositions.

Assessing the cash reserves within portfolio companies takes center stage for private equity firms. Meanwhile, portfolio company leaders are presented with challenging decisions to uphold and protect profit margins. They need to optimise their speed and response to the difficult trade-offs that market volatility demands.

Portfolio companies, traditionally dependent on PE cash for fueling burn and expansion, are now compelled to adopt cohesive working capital strategies due to the current absence of equity flows. A key solution to this challenge involves optimising working capital cycles and strategically extending financial runways to alleviate immediate financial pressures.

Expediting the billing cycle and efficiently managing receivables and payables through need-based financing solutions contribute to the critical mission of optimising working capital. Among these, unsecured business loans, warehouse financing, and sales invoice discounting stand out as indispensable assets in the portfolio companies' strategic toolkit. To survive the funding slump, portfolio companies can approach FinTech leaders such as CredAble and leverage the teams’ expertise to finely calibrate their working capital cycles and extend their financial runways.

Reimagining working capital financing

As PEs focus on value creation, we will continue to see working capital improvement be a prioritised strategy across portfolios in each stage of the transaction lifecycle.

It's imperative to understand that working capital is not solely a financial concern; it is equally an operational challenge intertwined with various processes. Spearheading the revolution in working capital solutions are technology-enabled solutions, providing PE firms and their portfolio companies with game-changing tools and transformative benefits.

Working capital solutions have come to the forefront supporting PEs extensively in the acquisition of companies looking for operational restructuring and portfolio companies in need of additional liquidity.

CredAble is backing corporates globally with an integrated suite of working capital solutions. We are building trust in the capital markets and economies the world over by making working capital financing more seamless and easily accessible in a tech-enabled format.

Think Working Capital… Think CredAble!