A Swing Towards Prosperity: LIV Golf, PGA, and Saudi’s $1.5 Trillion Pursuit

The Saudi Arabian tryst with Sports.

The Saudi Arabian foray into the world of sports unfolded with both glamour and intrigue. It began in 2014 when the WWE flew down the bustling, city of Riyadh, marking a pivotal moment in Saudi Arabia's ambitions to reshape its sports industry. What was initially referred to as a mere 'live event' soon metamorphosed into something far more significant. Fast forward to 2018, and the WWE inked a groundbreaking 10-year agreement with the Kingdom of Saudi Arabia, with a jaw-dropping annual investment of approximately $100 million a year (still a big number at the time).

The stage was set, and it was abundantly clear that Saudi Arabia was ready to play a major role in global sports. The COVID-19 pandemic, which cast a shadow over the world for much of 2020 and 2021, acted as a catalyst for Saudi Arabia's unprecedented investment in and development of sports. The kingdom spread its influence across various domains, from football and motorsport to professional wrestling and, of course, golf.

The pledge to nurture its own sports industry was supercharged. Putting down the required investment, the country accomplished the jaw dropping feat of creating a ready to race FIA certified Grand Prix in under a year whilst heading a campaign to bring in the finest talent of the football world steadily over a period of 3 years. Yet perhaps the crown jewel in sports investment was the birth of the Saudi Golf League, "LIV Golf." In its inaugural year, this groundbreaking league managed to secure close to 10% of the global golf viewership.

LIV and PGA, a rollercoaster of emotions

The world of golf, traditionally dominated by the PGA Tour, witnessed a shift in 2019 with the emergence of a new contender on the green, LIV Golf. Born from the ambitious vision of the Saudi sovereign wealth fund, LIV Golf entered the scene as a formidable rival to the well-established PGA Tour, creating ripples of anticipation in the golfing community.

With its official launch in 2022, the tour wasted no time in flexing its financial muscle, luring top-tier talent away from the PGA Tour's nest. In a bold move, LIV Golf deployed a unprecedented budget, of nearly $790 million in 2022, about $70 million more than the PGA (an organization nearing its 100th year of operation).

In a theatrical change of events, on June 6th the PGA tour announced it was banding with LIV and the European PGA Tour to create a collectively owned for profit entity.

The announced deal introduces a "capital investment" from the Public Investment Fund (PIF), Saudi Arabia's sovereign wealth fund, renowned for its substantial investments domestically and internationally. This financial infusion is intended to facilitate the growth and prosperity of the new business entity.

PGA Tour Commissioner Jay Monahan clarified that the golf calendar for 2023 would remain unaltered, while underscoring the continuity of the team element in LIV Golf's format.

Crucially, the merger brings an end to nearly two years of legal disputes between the organizations and their respective participants, signifying a momentous resolution.

The tentative merger agreement was signed by PGA Tour Commissioner Jay Monahan, DP World Tour CEO Keith Pelley and PIF’s Yasir al-Rumayyan. Meanwhile, key lawmakers initiated a Senate subcommittee hearing, aiming to put the proposed deal under the microscope, analyzing risks of a foreign government investing in American Cultural institutions.

The Impact

The golf industry is poised for substantial growth in the upcoming years, with anticipated increases in the number of players, operational scale, and revenue. According to a recent report by Grand View Research, the global golf equipment market is projected to achieve a noteworthy Compound Annual Growth Rate (CAGR) of 5.0% from 2023 to 2030. Additionally, the global golf tourism market is expected to experience a robust CAGR of 7.6% from 2022 to 2030.

Vision 2030

In the context of the Saudi Arabian economy, the golf sector is set to make a significant economic impact, which can be summarized as follows:

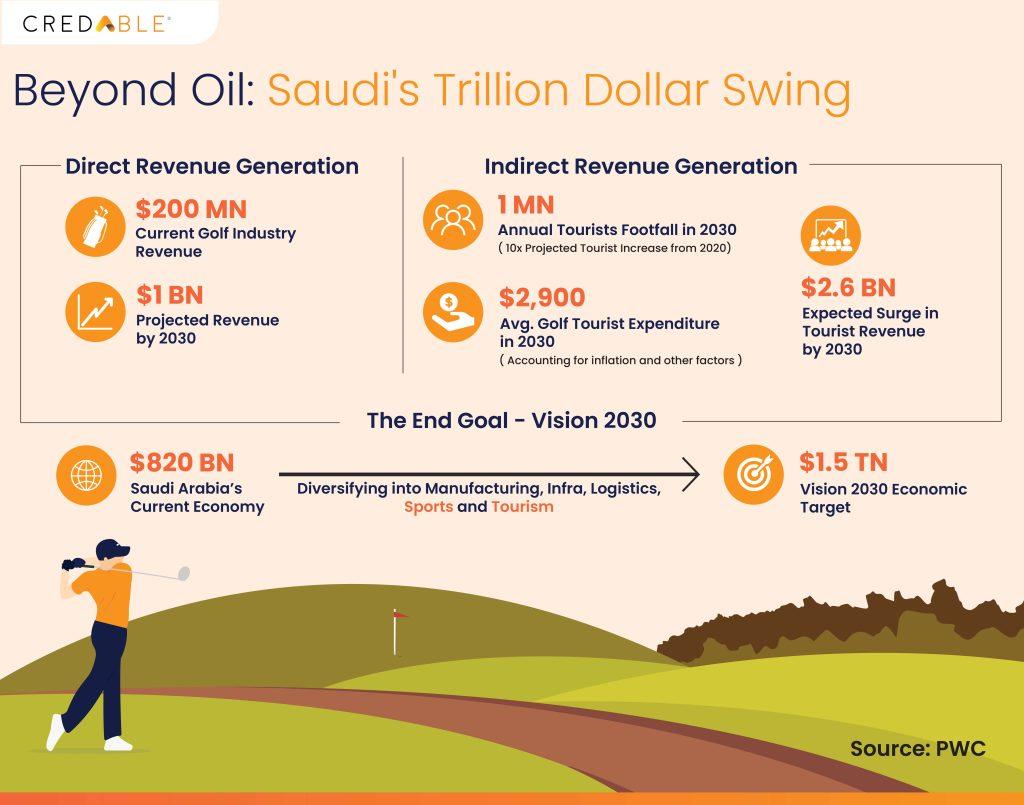

1. Direct Revenue Generation: The golf industry in Saudi Arabia currently yields revenues exceeding $200 million. With the recent deal coming into effect, this figure is anticipated to quintuple, reaching the impressive milestone of $1 billion by 2030.

2. Indirect/Tourist Revenue: The establishment of LIV Golf, which has garnered a substantial presence in the global golf landscape, attracts approximately 100 thousand golf tourists annually. This figure is projected to increase by over tenfold by 2030. Currently, the Saudi Golf Federation reports that the average golf tourist spends an estimated $2,000 per trip, excluding additional excursions. Accounting for inflation, this expenditure is likely to rise to $2,900 by 2030, resulting in a remarkable $2.6 billion surge in tourist revenue.

3. The End Goal: Saudi Arabia's Vision 2030 is a comprehensive economic and social development plan aimed at transforming the nation into a more diversified and sustainable economy. Central to this vision is the diversification of the economy, reducing its dependence on oil. The ultimate goal is to propel the Saudi Arabian economy from its current $820 billion to well over $1.5 trillion by 2030. The government is actively investing in various non-oil sectors, including manufacturing, tourism, and logistics. The Ministry of Economy and Planning, led by Minister Faisal F. Alibrahim, has underscored infrastructure development, industrial growth, and tourism as key focal points in the path towards achieving Vision 2030.

A Necessary Change in the World of Golf

1. Economic Impact on Player Incentives: LIV Golf's remarkable ability to attract talent away from the well-established PGA Tour can be attributed to its distinctive payment structure. LIV Golf concentrates its financial incentives on a select number of events, substantially increasing the payouts for participating players.

2. Contractual Security: LIV Golf has introduced the concept into the world of golf – player contracts. For instance, top-tier golfers like Dustin Johnson were offered multi-year contracts worth substantial sums, ensuring a secure income over an extended period, regardless of any eventuality. This approach stands in contrast to the traditional result-based payment structure in the PGA Tour, which exposes players to significant income volatility due to the unpredictable nature of sports.

3. Innovative Approach to the Game: LIV Golf has ushered in a new era of dynamism in the sport by implementing several incremental changes. Additionally, LIV Golf has restructured the tournament schedule, reducing the number of events to 14, reducing the number of holes to 54 and eliminating "the cut," allowing all participants to compete. Furthermore, the relaxed dress code, permitting players to wear shorts, signifies a departure from golf's traditional norms, making the sport more accessible and appealing.

4. Diversification of Revenue Streams: LIV Golf's innovative approach to revenue generation extends beyond conventional means, such as media rights. A groundbreaking concept introduced by LIV Golf is the team event angle, which offers a plethora of possibilities for both game structure and monetization. Notably, LIV Golf owns all the teams, with future opportunities for brands and sports firms worldwide to buy or lease teams, mirroring the model seen in Formula 1. This innovative revenue model has the potential to revolutionize the financial landscape of golf.

5. Catalyzing Change in Traditional Organizations: While not all of LIV Golf's alterations may be universally adopted, they have undeniably initiated a revolution in the sport. Traditional golf organizations may find themselves compelled to acknowledge and incorporate some of these changes into their existing frameworks.

Geopolitical Hole in One:

The Golf course is perhaps restricted to purely money, but with one proposed golf business deal, MBS, just hit the geopolitical equivalent of a hole-in-one.

The Biden administration's stance toward Saudi Arabia has witnessed a shift, reflecting a thaw in relations. A notable indication of this is Secretary of State Antony Blinken's recent visit to MBS in the Saudi capital. In a statement following the visit, Blinken emphasized that progress on human rights is a strengthening factor in the bilateral relationship, suggesting a pivotal turning point in diplomatic ties.

The Public Investment Fund is poised to inject "billions," according to its governor, Yasir al-Rumayyan, into the new for-profit entity. This commitment grants the fund the exclusive right to further investments in the new entity, including a right of first refusal on any capital injections, which encompasses the PGA Tour, LIV Golf, and DP World Tour. This financial leverage inevitably entails an enhanced role and potentially greater control for Saudi Arabia within men's professional golf.

In summary, the proposed golf business deal carries geopolitical significance, marked by shifting diplomatic dynamics and a notable financial commitment. The convergence of sports and geopolitics underscores the enduring power of finance in influencing the direction of professional golf.

Think Working Capital… Think CredAble!