The FinTech Low-Code Revolution Ushers in a New Wave of Innovation in the Bank’s Underwriting Value Chain

The technological waves of disruption have dramatically altered how financial services companies create value for customers, employees, and other stakeholders.

As Artificial Intelligence (AI) becomes more pervasive, there's an undeniable shift underway towards democratised technology.

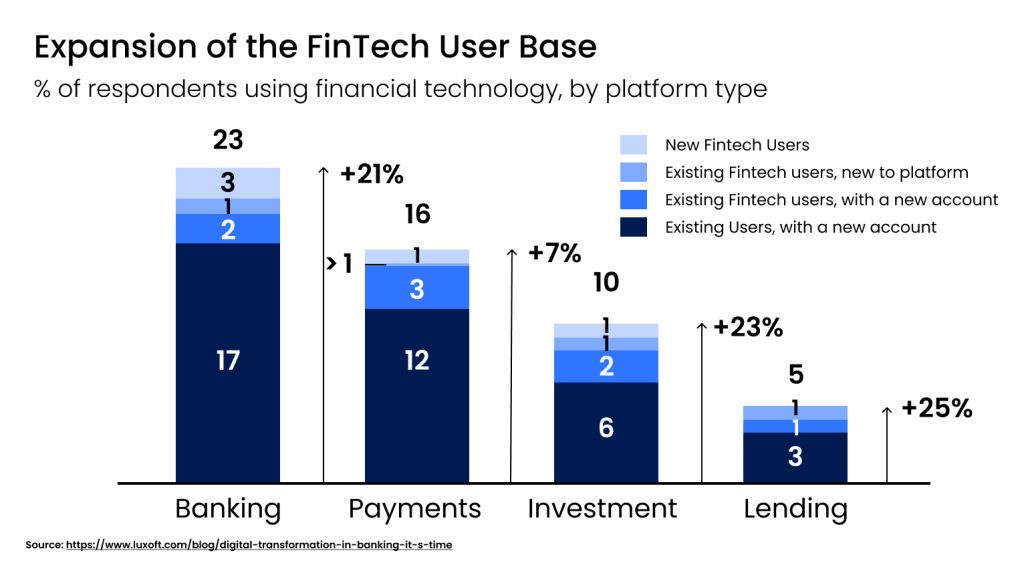

Most of us today have at least one or more financial services apps on our mobile. According to McKinsey, this is just one of the many signs that we are on the cusp of a new chapter in financial services. In the current decoupled era, where payments and financial services may be increasingly disconnected from accounts and other fixed repositories of value—FinTech players have risen to the occasion to provide faster, easier, and more affordable solutions. FinTechs are not only driving transaction volumes in both consumer and commercial segments but also opening new competitive battlefronts through innovative propositions such as embedding credit solutions at the point of sale.

No-Code Development Platforms (NCDPs) and low-code platforms have entered the scene to redefine application development. The no-code or low-code platforms help FinTechs quickly prototype and deploy new applications and features without extensive manual coding.

These platforms often feature graphical user interfaces and configurations (e.g., drag-and-drop functionality) that allow even non-technical users (let's say a business analyst or product manager in a FinTech) to participate in application development.

In this article, we will take a closer look at the FinTech low-code revolution that has intensified in recent years and how it is likely to change the bank’s underwriting landscape in the near future.

Low-code platforms: The new centrepiece for FinTech innovations

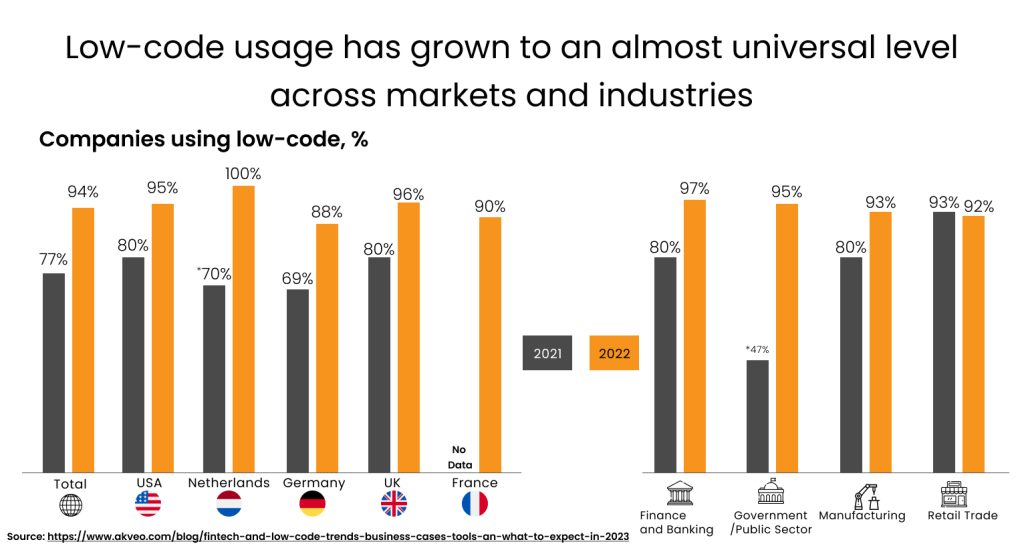

As projected by Gartner, by the end of this year, the adoption of no-code and low-code development is expected to account for 65% of total application development efforts.

Low-code technology has risen to fame as the fastest and most cost-effective way for organisations to accelerate their development timelines.

Low-code development is the ideal solution for FinTechs that are seeking to create integrated applications from the ground up with pre-existing management software and databases.

With low-code platforms, FinTechs can tackle mission-critical projects with ease and code 20 times faster without reinventing the wheel.

FinTechs can incorporate AI-driven functionalities to augment the entire Software Development Lifecycle (SDLC), making it nearly 10x more efficient.

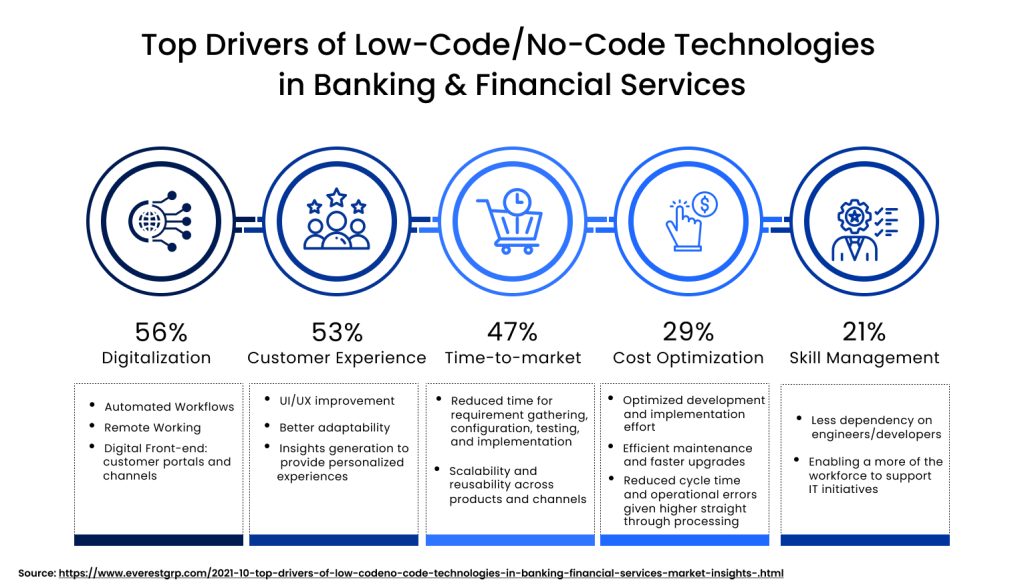

While low-code technology has a multitude of benefits to offer, its most popular ones are that it:

- Speeds up deployment and ensures a faster time to market, not to mention the ability to iterate quickly on user feedback

- Reduces costs as it lowers the dependence on specialised technical expertise

- Increases developer productivity, giving them the freedom to focus more on business logic rather than boilerplate coding

- Democratises software development, opening up new possibilities for citizen developers who do not have coding skills to create anything they desire with just a drag-and-drop interface

- Simplifies integration by offering pre-built connectors to popular systems

- Expedites digitalisation efforts and enhances customer experiences through faster deployment of innovative features and streamlined processes

Prime among these benefits is that low-code solutions are designed to scale with business needs. They often handle infrastructure and maintenance tasks behind the scenes. In turn, they enable FInTechs to speed up innovation by allowing developers to easily create proofs-of-concept for more sophisticated software development tasks requiring high-level skills.

Banks are leveraging FinTech low-code solutions to improve underwriting efficiency

Low-code development platforms have the capacity to free up critical R&D resources, allowing them to undertake multiple projects simultaneously. This strategic advantage equips traditional financial institutions to compete effectively amid the ongoing disruption in the financial industry landscape.

Moreover, low-code solutions provide room for more innovation and flexibility in risk assessment.

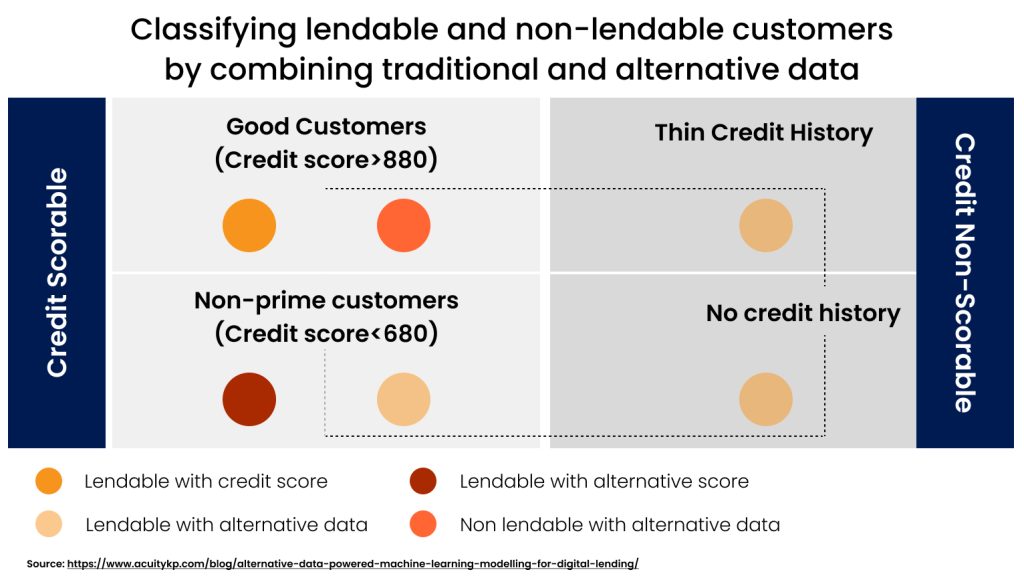

Banks are increasingly turning to FinTech low-code solutions to reimagine their underwriting processes, aiming to enhance efficiency and agility in assessing creditworthiness and managing risk.

By leveraging these innovative platforms, banks can create tailored lending processes, streamlining traditionally complex underwriting workflows, optimising decision-making, and ultimately improving the customer experience.

Low-code platforms empower banks to create custom underwriting applications with minimal manual coding, reducing development time significantly. This agility enables banks to adapt quickly to changing market conditions and regulatory requirements, ensuring that underwriting practices remain robust and compliant. Additionally, by harnessing advanced analytics and automation capabilities, banks can better assess credit risks and manage loan portfolios effectively.

Automate your Underwriting Process Now with Low CodeThe low-code revolution in FinTech boosts bank underwriting innovation

Banks today have the opportunity to stay ahead with intelligent banking operations and reimagine lending operations with new digital capabilities.

With the FinTech low-code platform, banks can create loan programmes based on categories like personal loans, business loans, and supply chain financing, with advanced flexibility in defining programme details. Traditional financial institutions can build any loan programmes customisable to their needs and customer expectations, as well as add new features or make tweaks on the go.

FinTech low-code platforms facilitate seamless integration with existing banking systems and data sources. By offering pre-built connectors to popular third-party systems and APIs, these platforms simplify the process of accessing and analysing vast amounts of customer data essential for underwriting decisions. This integration capability not only improves data accuracy but also enhances underwriters' ability to make informed lending decisions quickly.

CredAble's intelligent, low-code loan origination system allows clients to configure the borrower’s journey. It’s designed to orchestrate the optimal combination of technology and human ingenuity, offering next-gen modularity and allowing banks to select modules, customise forms, and configure workflows according to their specific requirements.

Think Working Capital… Think CredAble!