Streamlining the Dealer Financing with FinTech Automation

To thrive in the emerging supply chain ecosystem, it’s time we rethink the traditional value chain through a multifaceted lens. This includes not only sales, origination, servicing, and asset disposition but also integrating a comprehensive financing angle.

By embedding financing throughout the value chain, organisations can unlock synergies, optimise resource allocation, and drive sustainable growth.

Automated financing solutions for corporates and their dealer and distribution networks not only boost liquidity but also mitigate risks, enhance cash flow management, and promote flexibility, allowing for greater scalability throughout the supply chain ecosystem.

Recent market analyses reveal a remarkable surge in supply chain financing activities in India, with key players like ICICI Bank, HDFC Bank, Axis Bank, and the State Bank of India witnessing a notable uptick of 50–100% in their supply chain business volumes. This spike highlights the growing recognition of financing as a strategic lever for fortifying supply chain resilience and enhancing operational efficiency.

Designed to help businesses access financing options for inventory and equipment purchases, dealer financing plays a critical role in ensuring the smooth flow of goods and funds in a supply chain.

With the addressable supply chain financing market in India estimated to be about INR 60,000 crore, let’s take a closer look at how automation in dealer financing is an indispensable imperative to enhance dealer liquidity.

The role of dealer financing in the broader spectrum of supply chain finance

Dealer financing is a type of financing that is set in motion by an anchor corporate for its network of dealers or distributors to increase their inventory holding capacity.

Unlock timely financing for your network of dealers and distributorsThrough dealer financing, businesses can secure the working capital needed to invest in essential equipment, broaden their product offerings, and capitalise on growth opportunities.

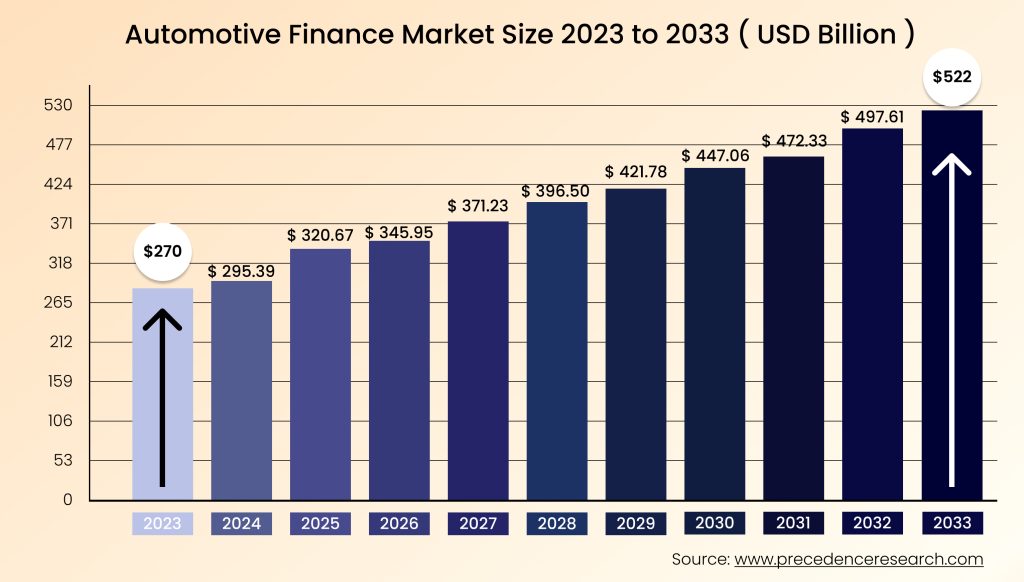

Dealer financing is typically prominent in the case of automobile financing. It supports the operations of the dealership and aids in purchasing inventory from manufacturers, as well as managing cash flow and working capital.

Talking about the significance of dealer financing in the automobile industry—it's interesting to note that dealer financing is an integral part of Maruti Suzuki's strategic blueprint, particularly in Tier-2 and Tier-3 markets across India. Over the past twelve months, the automotive giant has collaborated with seven financial institutions to bolster its extensive network of over 4,000 sales outlets nationwide.

Now Imagine all of this happening on a single multi-faceted platform powered by fintech to make dealer financing more seamless.

Having said that, dealer financing goes beyond the automotive industry. Today, industries such as manufacturing, agriculture, and construction heavily rely on dealer financing to sustain their supply chains and facilitate large-scale transactions. Whether it's purchasing machinery or stocking inventory—dealer financing ensures the sustained viability of business operations.

FinTechs are leading the charge in automating dealer financing

As per a recent report, close to 60% of surveyed businesses indicated that supply chain disruptions have resulted in revenue losses of 15% or more. Supply chain financing is undoubtedly vital to ensuring uninterrupted operations and cash flow management for businesses.

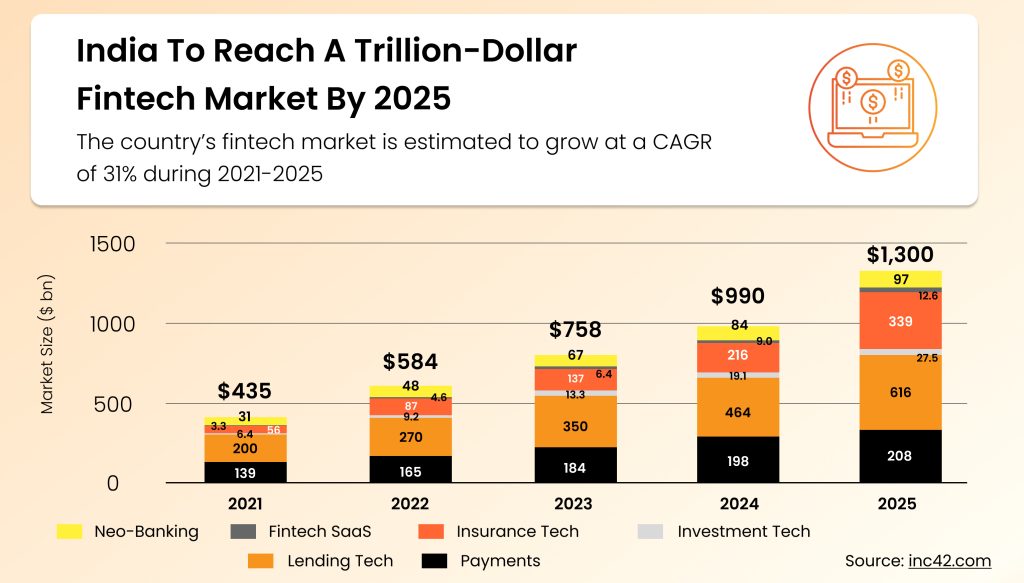

This is where FinTechs come into play. They have made a significant mark in the supply chain financing industry by digitising the interaction between entities and offering innovative pathways for the network of dealers and distributors to access timely financing.

FinTechs have been revolutionising the financial services industry as we know it. They have stepped up to cater to a significant unmet credit need by leveraging emerging technological innovations. This dynamic sector has produced technological innovations that have shaped a generation, each seemingly more game-changing than the last.

There’s no denying that these new-age entrants are well-equipped with cutting-edge digital solutions in terms of onboarding, underwriting, and credit scoring. They are developing innovative solutions tailored to address the pain points of traditional dealer financing programs.

FinTechs facilitate end-to-end digital onboarding for both anchor corporates and their dealers. They provide a distinct advantage in dealer financing by offering superior scalability, particularly evident in their capability to onboard a larger number of dealers onto their platform under multi-bank configurable programs which can easily accommodate a growing number of dealers, especially as corporates expand their businesses. Moreover, FinTechs offer reduced Turnaround Time (TAT) by enabling anchor corporates to bring their preferred banking partners onto the platform quickly. They simplify and speed up multi-bank integrations, allowing corporates to access their preferred banking options with ease.

Taking digital measures to address dealer financing needs

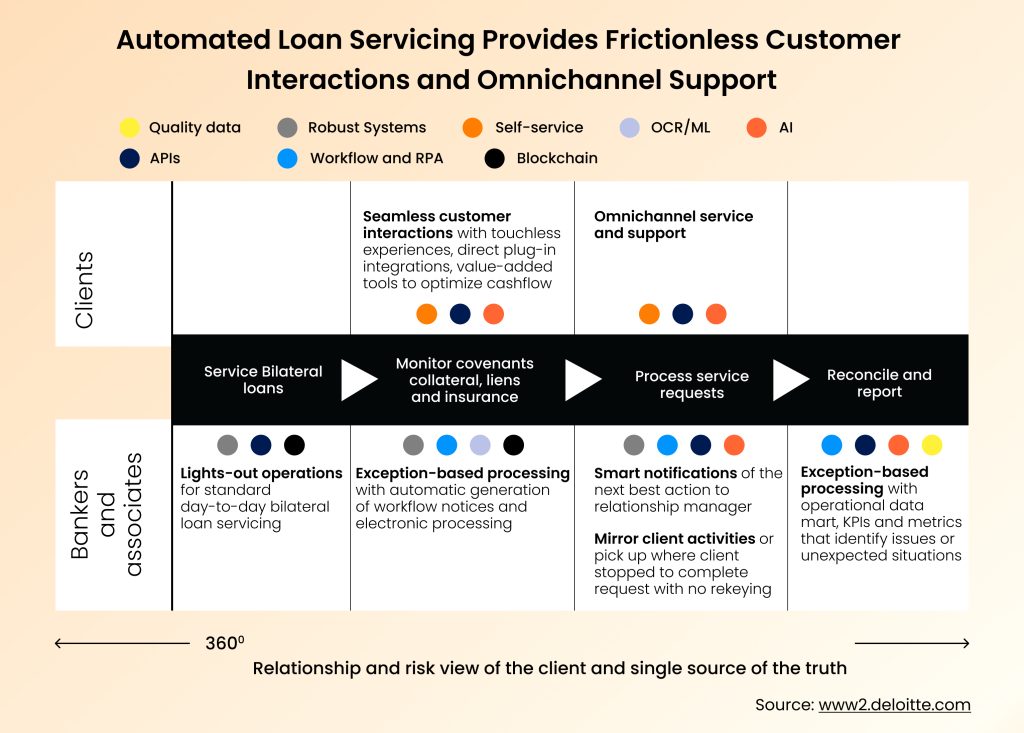

FinTech companies leverage automation, data analytics, and artificial intelligence to redefine how dealer financing is carried out.

Real-time data insights empower FinTech lenders to make informed decisions, mitigate risks, and customise financing solutions to meet the unique needs of corporate anchors and their network of dealers. Moreover, automated payment systems ensure timely disbursements of funds, in turn strengthening trade relations with dealers and distributors.

For instance, let's consider this scenario: a manufacturing company's dealer, preparing to restock inventory for upcoming peak seasons, seeks financing from a FinTech. Following an assessment of the dealer's creditworthiness, the FinTech routes the requirements to a financier, who then checks and disburses funds for inventory purchases. This allows the dealer to acquire inventory without immediate full payment, instead opting for gradual payments facilitated by the FinTech. As the dealer sells products and generates revenue, they can allocate the proceeds towards repayments, ensuring seamless operations and expansion.

Scale up your operations with dealer financingInnovative technologies empower new-age FinTechs to deliver a multitude of advantages in dealer financing, such as:

- Digital onboarding of anchor corporates and dealers

- Seamless automation and integration with corporate ERP systems

- Ability to modify financing terms as needed

- Flexibility for dealers to pay lenders anytime prior to the due date

- Automatic replenishment of limits after every payment is made

- Detailed MIS reports are generated for enhanced insights and decision-making

Fortifying dealer resilience with timely financing solutions

The integration of technology into dealer financing operations led by FinTechs has catalysed a paradigm shift, enabling banks and financial institutions to better serve their corporate clients and networks of dealers and distributors.

Leveraging automation, FinTechs are now at the forefront of expediting transactions and enhancing financial agility for dealers, ensuring they can effectively tide over the complexities they face in supply chain networks. By digitising workflows, FinTech platforms like CredAble expedite credit assessments, streamline documentation processes, and facilitate seamless transactions between financiers, corporates, and dealers. CredAble’s distributor financing platform, backed by multiple leading financial institutions, accelerates dealers' chances of loan approval. Through this digital platform, CredAble provides dealers with extended payment terms and addresses the requirements of corporates seeking faster receivables.

Think Working Capital… Think CredAble!