Financial Innovation in the Digital Age: The Growth of Embedded Finance in Southeast Asia

We’re living in a brave new digital world where significant advances in Artificial Intelligence (AI), Metaverse, and Web3 are stitching the physical and virtual spheres in unprecedented ways. The arrival of digital identities has unleashed never-before-seen convenience, resulting in greater efficiency and offering a strong defense mechanism against fraud.

Given this meteoric surge in digital capabilities, players in the financial services space are turning their attention to new product and service developments.

As the digital revolution gains global momentum, a new reality is dawning in the Far East…

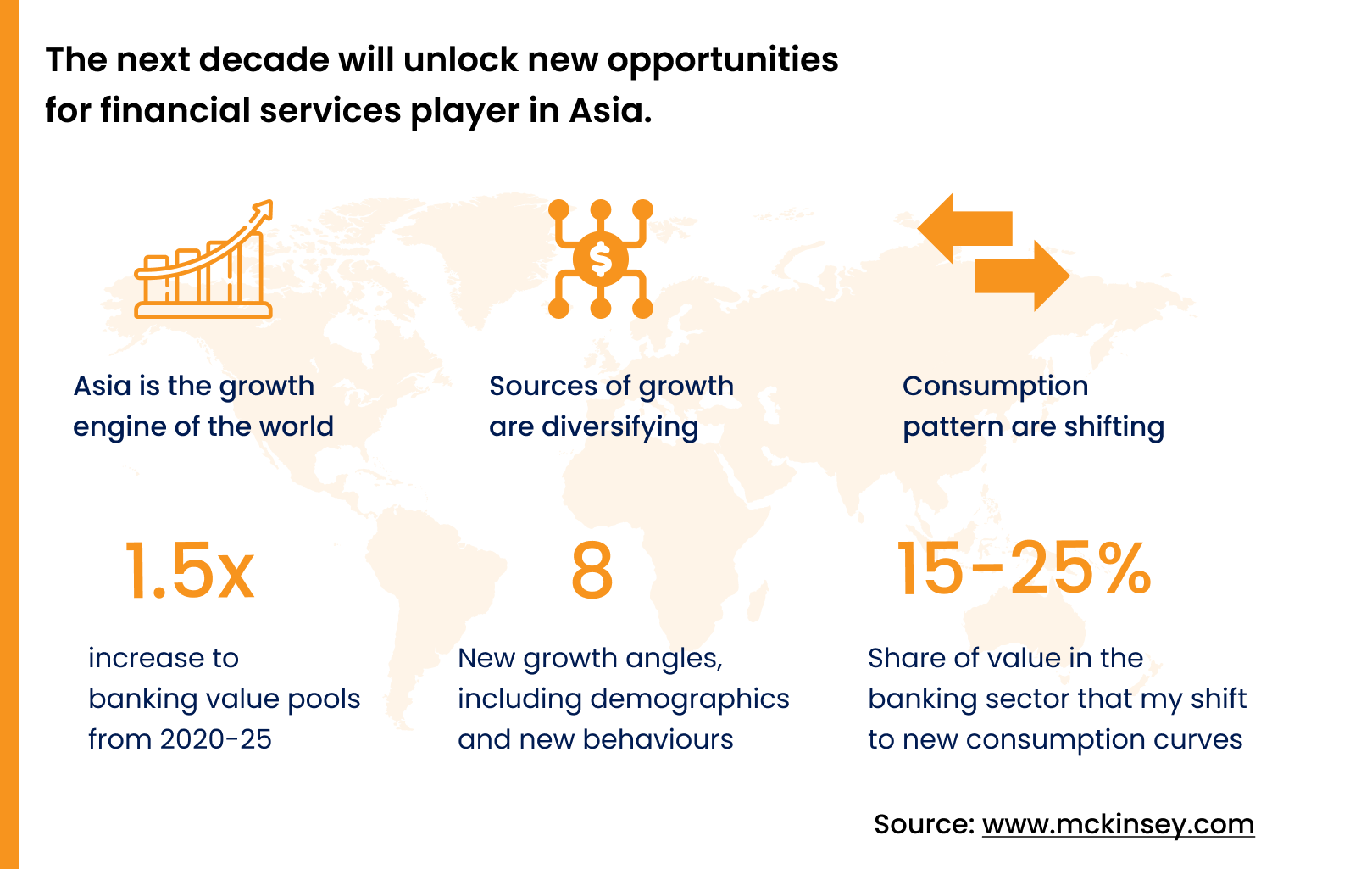

Home to an estimated 400 million internet users, Southeast Asia is building on the potential of ground-breaking digital technologies and fast-tracking innovation. Furthermore, as we approach the end of this year, it's projected that a colossal three billion individuals, making up 70% of Asia's total population, will join the ranks of the consuming class. With increasing income levels and en route to becoming the world’s consumption engine, consumers in this region are increasingly demanding more sophisticated financial solutions.

Setting the stage for Embedded Finance

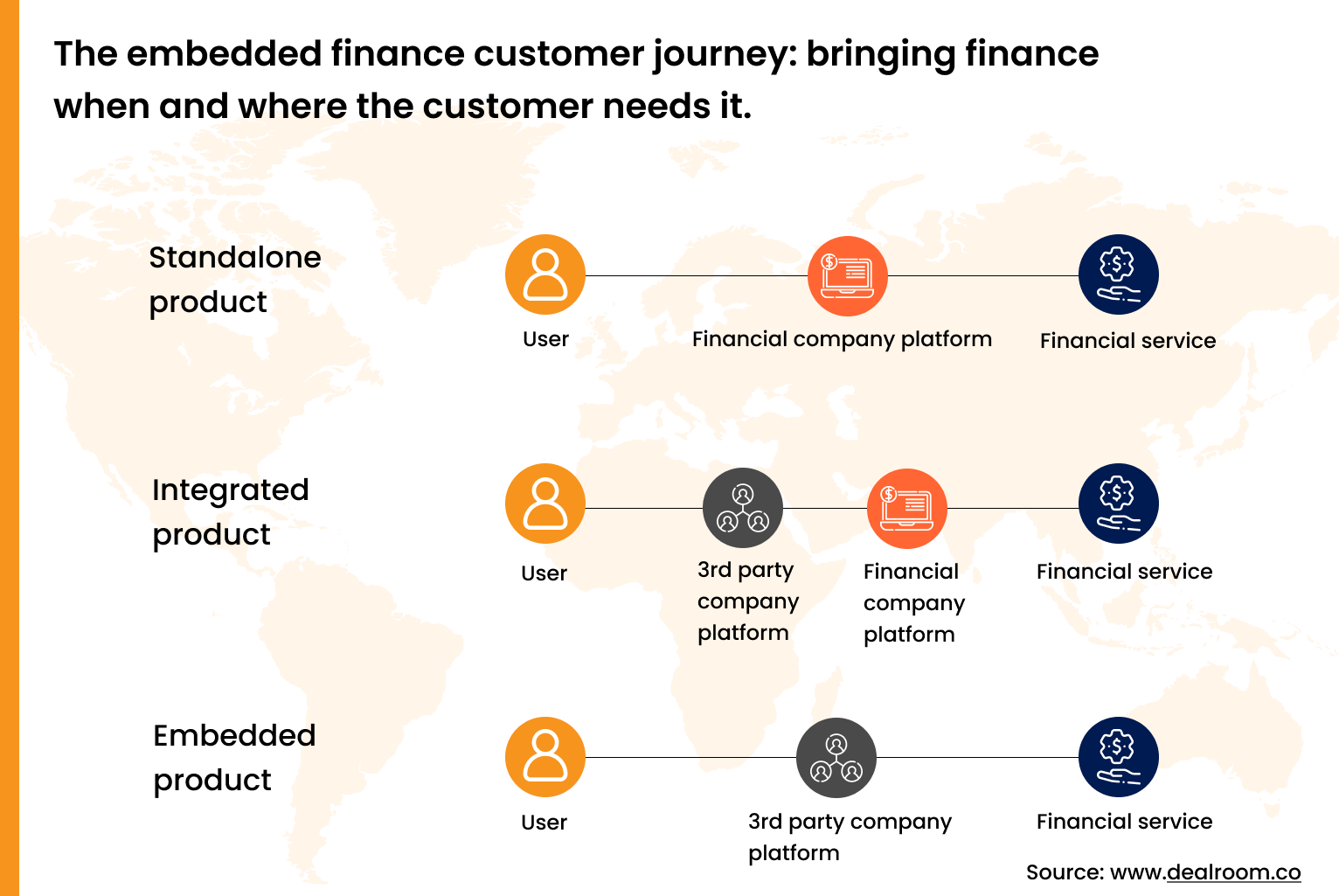

In today’s ‘experience age’, customers are demanding that financial products and services be built into their daily activities and made available as a part of the bigger digital bundle of services.

The rapidly expanding population of tech-savvy individuals and businesses in Southeast Asia is also notably the most receptive towards new-age FinTechs and innovative ways of consuming financial services.

Tapping into this region’s unmissable digital maturity—financial institutions and non-financial companies are leveraging next-generation technology to create new distribution models and find better ways to promote financial inclusion.

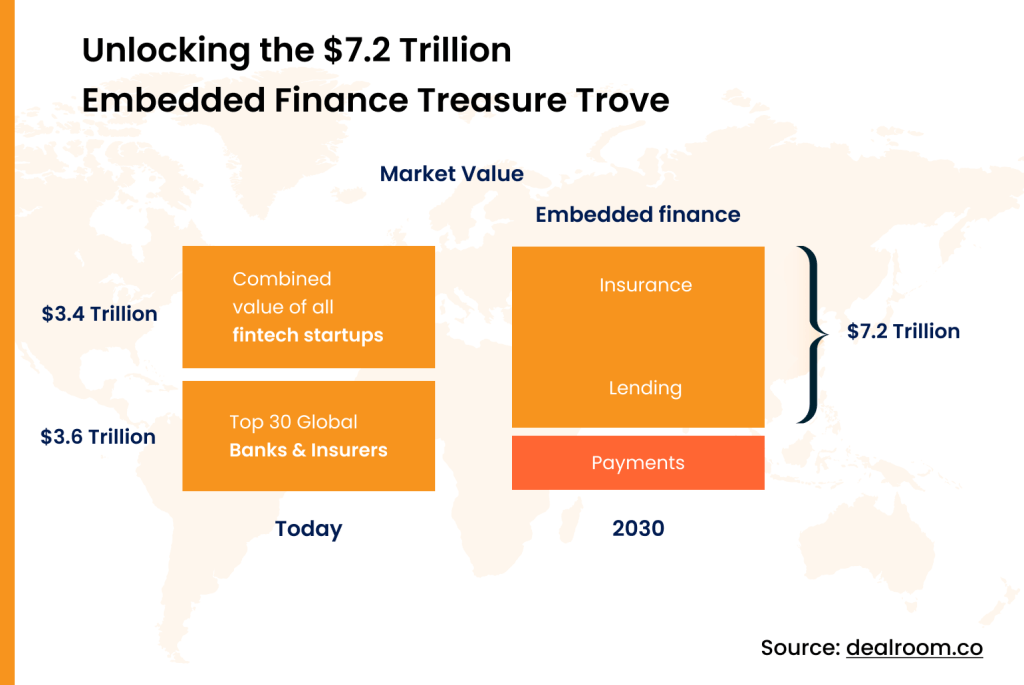

All this has led to the exponential growth of embedded financial solutions. Projected to reach a value of $7.2 trillion by 2030, embedded finance solutions are heralding a transformative era, forever changing customer interactions with financial institutions across Southeast Asia.

What sets Southeast Asia apart is its vibrant 'super app' culture. These apps redefine convenience by integrating E-commerce, food delivery, ride-hailing, and other entertainment services such as online gaming, into a single platform—providing an all-in-one mobile experience. The rise of this robust digital ecosystem has further enabled the advancement of embedded finance solutions.

In a subtle but powerful manner, embedded finance has seamlessly woven itself into the daily routines of these users, effortlessly integrating financial services within the apps and platforms they rely on. From the convenience of shopping on E-commerce marketplaces to the ease of hailing a taxi, embedded finance quietly orchestrates frictionless transactions, spearheading a revolution in Southeast Asia's financial landscape.

Embedded finance is charting a new financial frontier in Southeast Asia

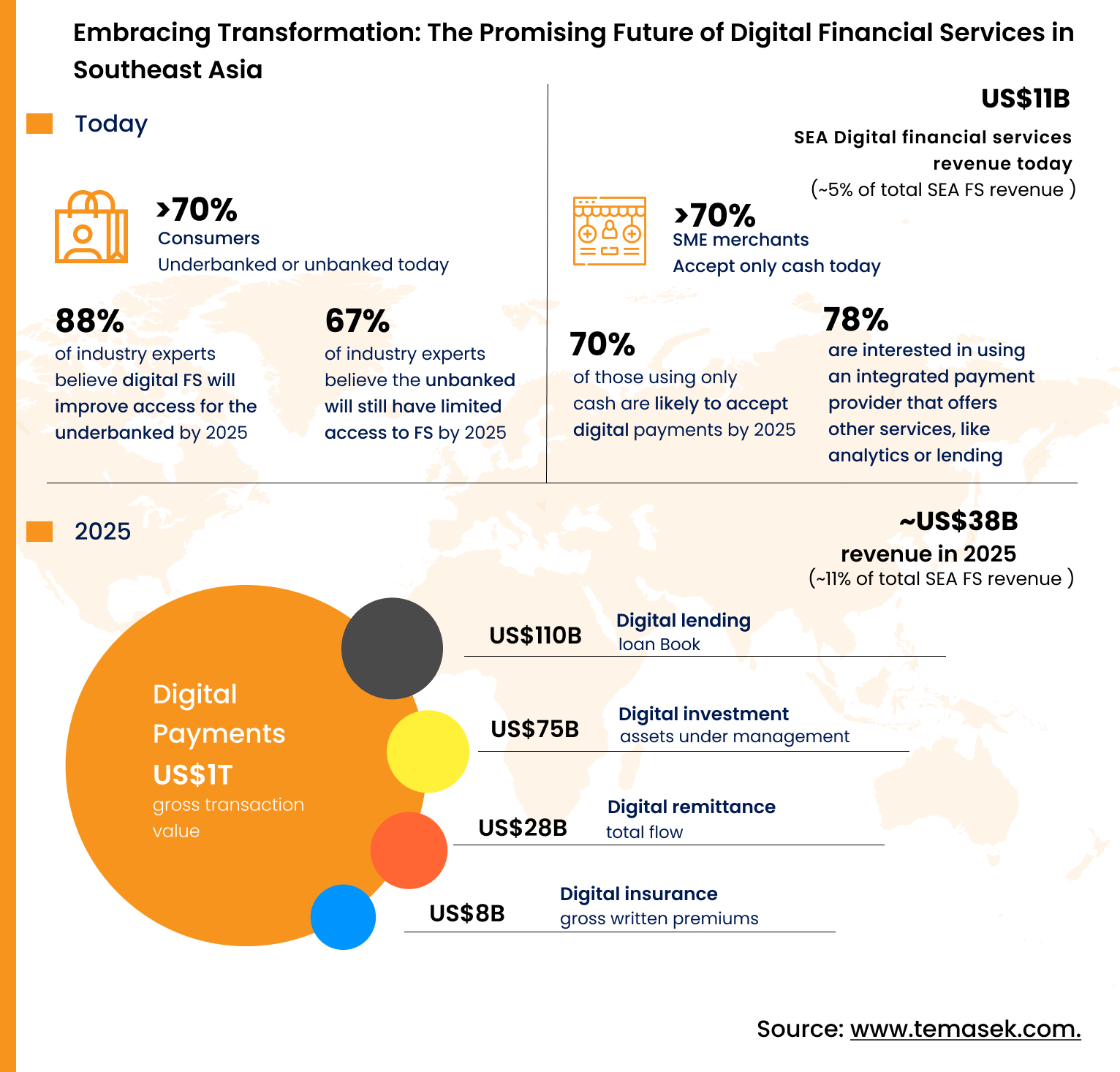

As of today, an alarming 70% or more of the population in Southeast Asia experience limited access to financial services. Add to that, a significant number of Small and Medium-sized Enterprises (SMEs) contend with substantial gaps in funding.

By effortlessly merging financial solutions into non-financial platforms, embedded finance removes access barriers and reduces the cost-to-serve through digital platforms.

● Win-win for all

Embedded finance takes on a distinct role in empowering both traditional banks and non-financial enterprises to seamlessly deliver frictionless customer experiences and unlock innovative revenue sources. Moreover, by embedding finance into the non-financial ecosystems—companies today have the liberty to offer flexible payment options along with sachet-sized loans and insurance products at the point of purchase. This makes transactions for end users an

enriching experience. Financial service providers need to tread this frontier cautiously and work together to navigate regulatory and integration obstacles. This way, they can ensure a smooth and secure embedded finance journey for customers and maintain the stability of the financial ecosystem.

● Deepens the roots of financial inclusion

Finance components can now be smoothly merged into customers’ digital journeys—making it more feasible for financial service providers to extend offerings such as digital wallets to often underserved segments. Embedded finance extends digital payment convenience to unbanked individuals accustomed to cash transactions. Accessible via ubiquitous non-financial digital platforms, or 'super apps,' these inclusive payment solutions are key to fostering financial participation throughout Southeast Asia. The phenomenal growth of embedded finance products is promoting financial inclusion in emerging Southeast Asian markets like Indonesia, the Philippines, and Vietnam, where significant barriers hinder access to essential financial services individuals and small businesses.

The synergy between Embedded Finance and BaaS

Embedded finance and Banking as a Service (BaaS) are closely connected. Both aim to offer customisable financial solutions in a quick and cost-effective way, across digital platforms.

In a nutshell, BaaS enables the integration of embedded finance. Through the use of APIs, BaaS providers enable non-financial companies to embed modular banking solutions into their digital interfaces.

By leveraging open API platforms and customisable front-end and back-end capabilities, FinTechs and financial institutions are powering the rise of embedded finance. Consequently, Southeast Asia is stepping into an era of convenience and accessibility previously unimaginable for this region. The embedded finance sector in Singapore is projected to achieve a 33.7% annual growth, reaching a total of US$1,161.7 million this year. Companies in Southeast Asia that are transitioning to BaaS are also anticipated to experience a global annual growth rate exceeding 70% in the coming three years.

Embedded value propositions are on the rise

Embedded finance opens up a multitude of opportunities that extend across the entire financial landscape. For instance, retailers storing customers' credit and debit card details in their apps enable effortless one-click payments. In Southeast Asia, embedded finance has made significant strides where homegrown unicorns like Gojek have extended their offerings from ride-hailing into the domain of financial services.

Owing to the region's young population, accelerated digital maturity, dynamic FinTech ecosystem, and the general openness of customers to alternative ways of engaging with financial services—embedded finance holds great potential in the Southeast Asian markets. Partnerships with FinTech firms, like CredAble, that deliver global capabilities through an API-centric, low-code/no-code BaaS tech suite, prove to be exceptionally advantageous in this context. As a tech enabler, CredAble plays a pivotal role in delivering the infrastructure and advanced functionalities necessary for the integration of embedded finance solutions. This support enables leading financial institutions to venture into new markets and revamp their core operations by offering seamlessly interoperable financial services through third-party platforms.

Think Working Capital… Think CredAble!