Leapfrogging Digital Transformation: What’s Driving Digital Adoption Among MSMEs?

Amid globalisation and technological advances, businesses of all sizes around the world are tapping into digital technologies to enhance their competitiveness and resilience.

India has pulled ahead in the digitisation journey when compared to its peers across the world. The country’s robust Digital Public Infrastructure (DPI) framework is boosting socio-economic development and making news on a global stage. Currently, DPI is empowering 97% of the country’s population—incentivising entrepreneurship, and advancing competition in key sectors like the Micro, Small, and Medium Enterprises (MSMEs).

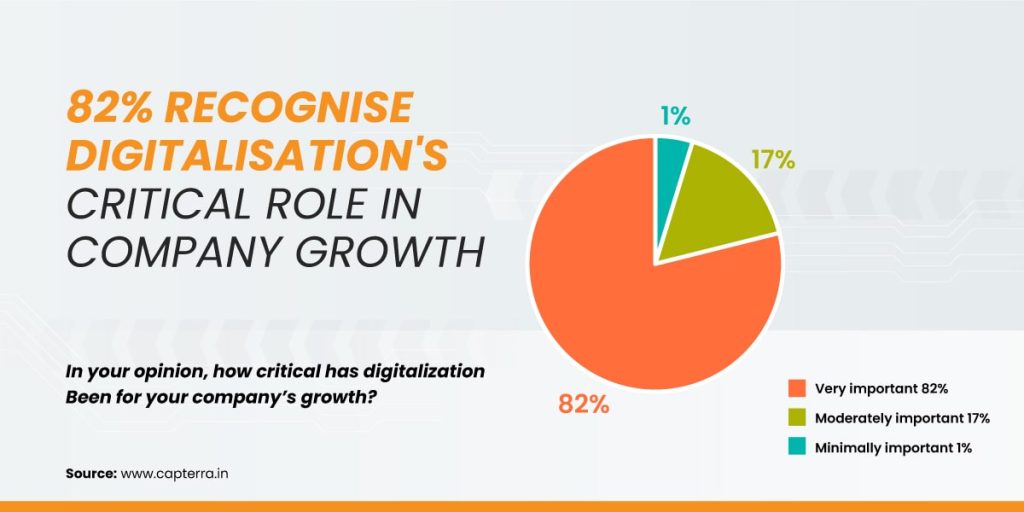

For years now, limited digitisation and strained access to capital have remained pressing issues requiring systematic attention to drive the MSME sector towards development. However, it's worth noting that the recent wave of digitisation has significantly contributed to enabling the growth and advancement of MSMEs in the country.

MSMEs have been keen towards increasing their digital footprint, to instill transparency and accountability. As per a report by RedSeer, of the 64 million MSMEs operating in India, an estimated 12%, or approximately 7.7 million, have achieved digital maturity.

Assessing the MSME digital maturity levels

A digital infrastructure designed for agility, growth, and value will aid MSMEs in gaining competitive advantage across multiple performance indicators, including time to market, cost efficiency, revenue growth, and customer satisfaction.

Vi Businesses recently conducted a study analysing nearly 1 Lakh MSME respondents across 16 industries on their digital growth story. As per the findings of the study—founder and business owner participation in digital transformation, technology-enabled tracking of business operations, and active adoption of technologies are some of the top characteristics displayed by MSMEs with high levels of digital maturity.

Here are a few more key insights into the digital maturity status of MSMEs in India:

- Over 64% of MSMEs in the Information Technology (IT) and Information Technology Enabled Services (ITes) Sector have digital maturity of over 50%.

- Sectors like Logistics, Media, and Manufacturing within the MSME domain rank higher on the Digital Maturity Index.

- Four technology areas that are driving MSMEs to become more digitally mature are Collaboration & Productivity, Cloud, Security, and IoT.

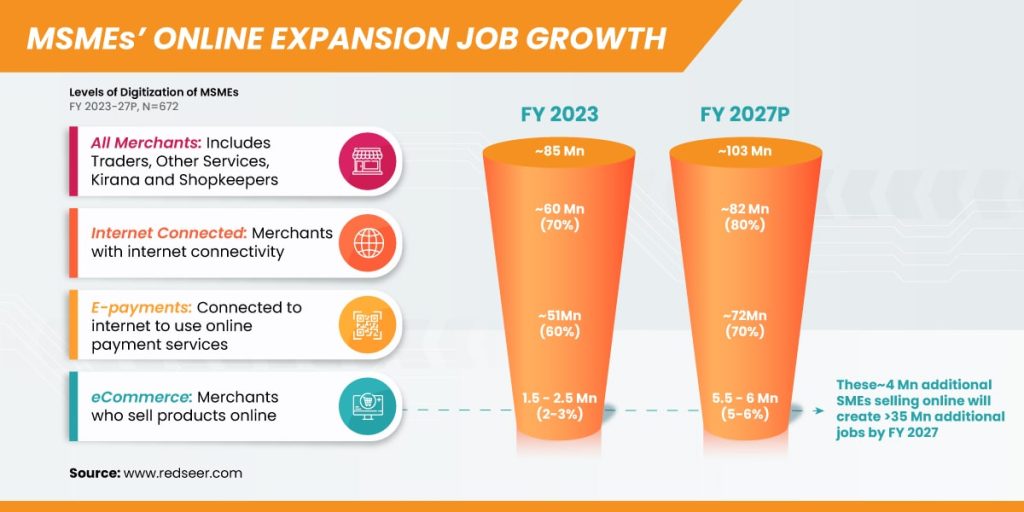

MSME sellers are increasingly taking their business online to tap into new value chains. While 70% of the 85 million MSME sellers in India have internet connectivity, 60% of them are now using online payments.

A new generation of digitally-savvy MSMEs are here

Post the pandemic, MSMEs have been more open to adopting digital solutions. A study by Google and KPMG states that small businesses backed by digital solutions enjoy twice the revenue growth compared to their offline counterparts. MSMEs that have integrated with E-commerce platforms, experienced a 65% increase in turnover and around 54% reported an increase in their profits.

The explosive growth in digital infrastructure coupled with the UPI-led migration to digital payments, not to mention the pandemic-accelerated shift in customer preferences, and disruptive innovations from the FinTech industry have led to accelerated digitisation in the MSME sector.

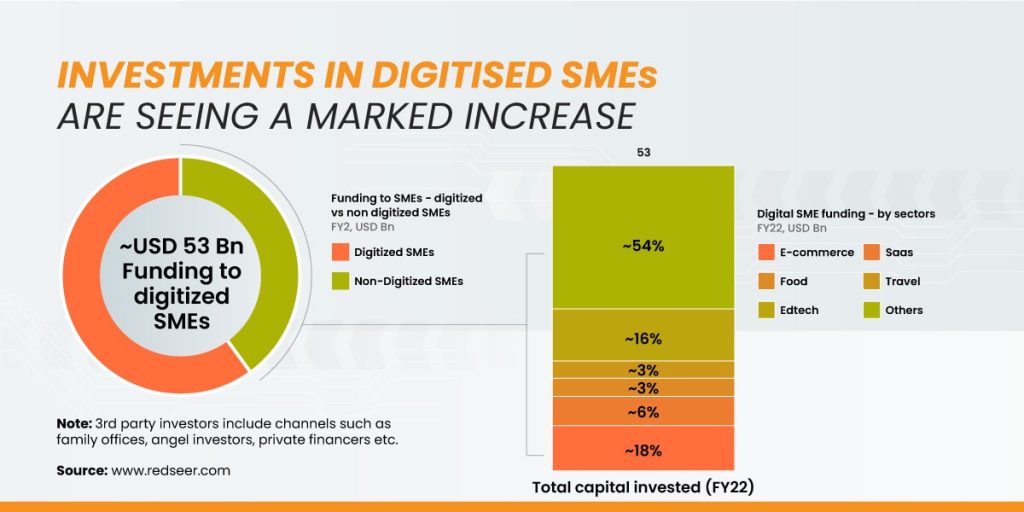

With all this in the backdrop, a notable development has been the growing interest of investors in digitised small businesses. Reports confirm that digitised SMEs attracted 40% of the share of invested capital in FY 22. E-commerce accounted for approximately 65% of the digitised SME investment, a figure projected to increase to around 75% over the next five years.

By embracing digitisation, the MSMEs have undergone systemic developments in the past couple of years, evidently altering how they conduct day-to-day operations, manage finances, and monitor cash flow.

MSMEs now use a comprehensive suite of business growth tools to gain greater visibility over their business and make informed financial decisions.

Towards inclusive finance: Digital lending initiatives for MSMEs

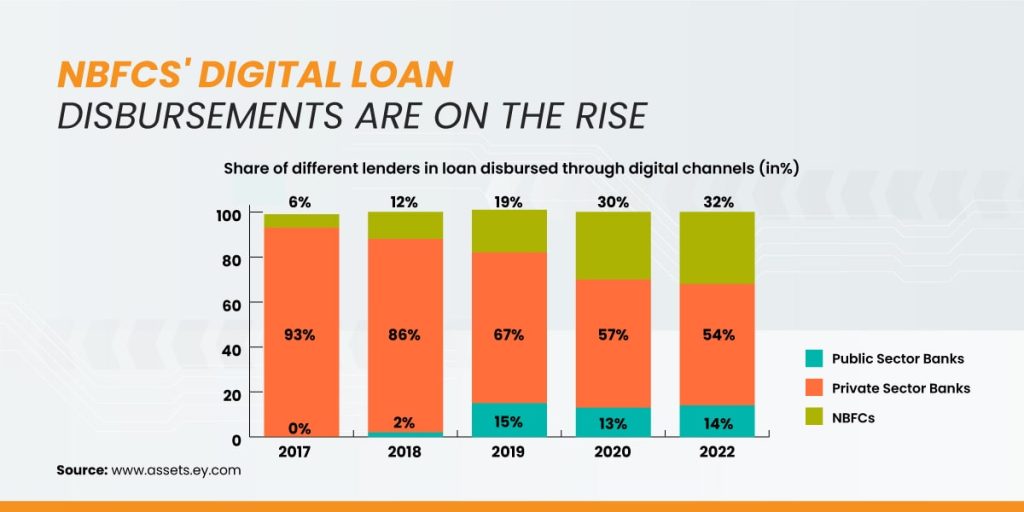

With the improved digital literacy among MSMEs, there's a growing receptivity towards tailored digital financing solutions offered by NBFCs and FinTech companies. Across the MSME credit value chain, digital advancements are driving change from sourcing to servicing and collections, mitigating challenges faced by MSME borrowers.

Close to 70% of small businesses require funds in the form of working capital. With MSMEs making the switch to digital solutions to survive, the age-old problem of procuring working capital is now being addressed by tech-based supply chain financing solutions.

Know more about working capital solutionsMoreover, the maturing India Stack, along with a strong foundation of API-based data availability, has transformed the MSME credit value chain. The RBI-licensed new financial entities such as the Account Aggregator and Open Credit Enablement Network (OCEN), have the power to revolutionise the digital lending ecosystem by allowing lenders and loan service providers to interact with one another and make informed decisions.

This has also ushered in a 2x growth in online loan disbursements. MSME digital lending is further expected to increase ten-fold to reach INR 6–7 lakh crore (USD 80–100 billion) in annual disbursements.

A watershed moment for MSMEs in India

With 67% of credit demand being unaddressed, MSMEs need to continue leveraging technological advancements and new-age financial solutions for long-term success in the digital economy.

Among the many boons of the increased adoption of digital solutions by MSMEs is that by migrating their activities online, they produce a traceable digital trail of financial transactions, making it easier for FinTech lenders to make data-backed decisions while lending to MSMEs.

FinTech lenders are using data-backed underwriting tools and cash flow-based assessments to offer Buy Now, Pay Later (BNPL) solutions and sachet-sized loans to meet the MSMEs’ demand for short-term capital.

Digital adoption among MSMEs is opening up more avenues for FinTechs like CredAble to step in and cater to the micro-transaction needs of the rapidly expanding sector of MSMEs and plug the growing credit gap.

MSMEs have doubled in strength in the past two years. By providing access to timely and affordable credit, CredAble is playing a key role in achieving India’s vision of transitioning towards a less cash, more diverse, and financially inclusive digital economy.

Think Working Capital… Think CredAble!